Apple Stock Forecast: Should You Buy AAPL At Current Prices? One Analyst Sees $254 Potential

Table of Contents

Current Apple Stock Performance (AAPL Stock Analysis)

Recent Financial Results and Future Earnings Expectations

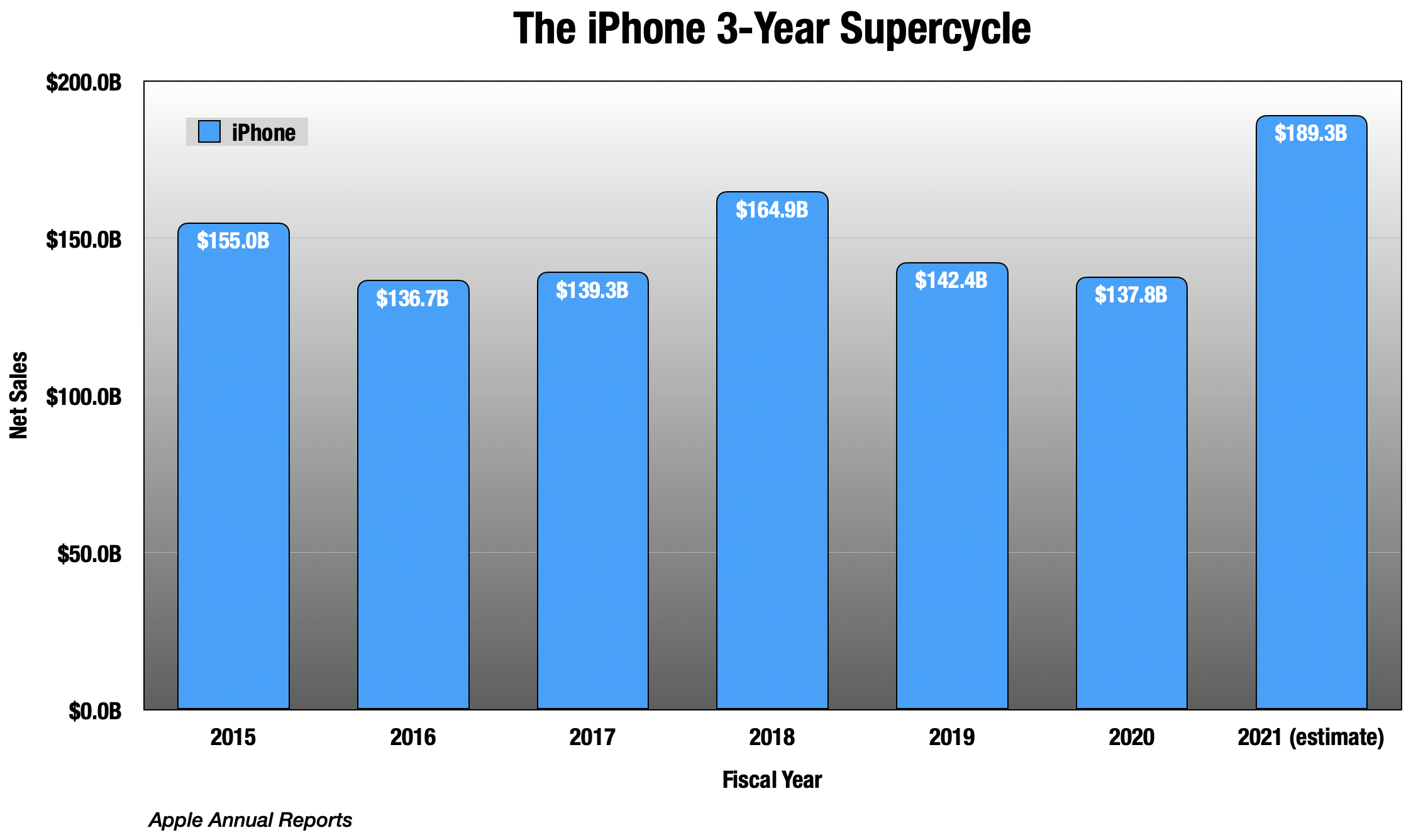

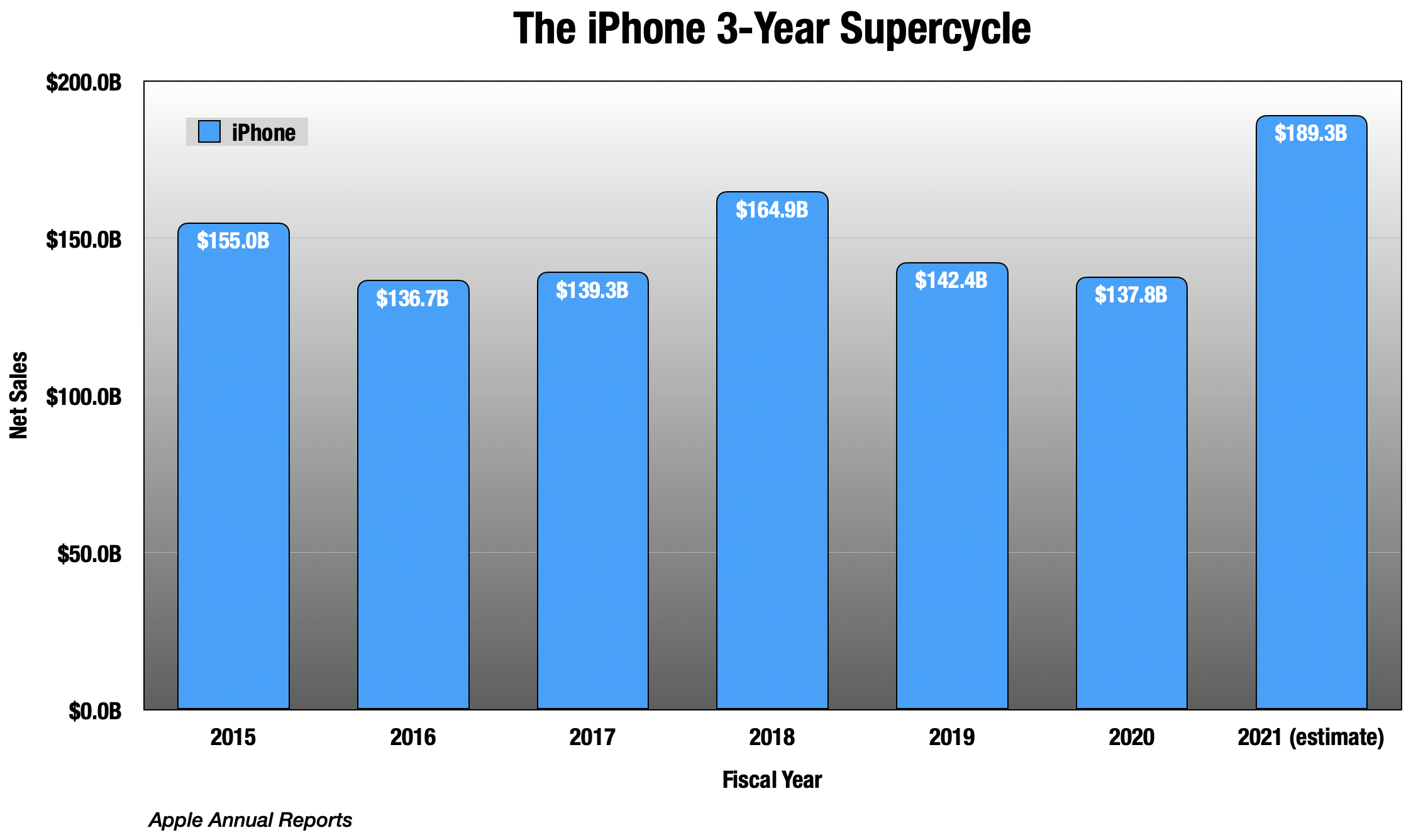

Apple's recent quarterly earnings reports have offered a mixed bag. While revenue growth remains strong, driven by robust iPhone sales and a growing services segment, profit margins have faced some pressure. Key performance indicators (KPIs) like average selling prices (ASPs) and user engagement are closely watched for clues about future performance. Reputable financial analysts offer varied projections for future earnings, with some suggesting continued growth while others express caution about potential economic headwinds.

- Q[Insert Quarter] 2024 Earnings: Revenue of $[Insert Revenue], EPS of $[Insert EPS]

- Projected Revenue Growth (Next Year): [Insert Percentage Range]%

- Analyst Consensus EPS Growth (Next Year): [Insert Percentage Range]%

Market Sentiment and Investor Confidence

The overall market sentiment plays a significant role in AAPL's price fluctuations. Currently, [describe overall market sentiment – bullish, bearish, neutral]. Investor confidence in Apple remains relatively high, but concerns exist regarding [mention specific concerns like global economic slowdown, competition, etc.]. Significant news events, such as new product launches (like the iPhone 15) or regulatory changes, can significantly impact investor sentiment and the stock price.

- Social Media Sentiment: [Summarize overall sentiment from relevant social media platforms.]

- Short Interest: [Percentage of shares shorted – indicate if it's high or low and the implication.]

- Recent News Impact: [Describe the impact of a recent significant news event on AAPL's stock price.]

Technical Analysis of AAPL Stock Chart

A technical analysis of the AAPL stock chart reveals [describe current trend – upward, downward, sideways]. Key technical indicators like moving averages (e.g., 50-day and 200-day), Relative Strength Index (RSI), and support and resistance levels provide valuable insights. [Describe chart patterns – e.g., head and shoulders, double top/bottom]. This analysis suggests potential price targets, but remember that technical analysis is not foolproof.

- 50-Day Moving Average: $[Insert Price]

- 200-Day Moving Average: $[Insert Price]

- RSI: [Insert Value – indicate if overbought or oversold]

- Support Level: $[Insert Price]

- Resistance Level: $[Insert Price]

The $254 AAPL Price Target: Is it Realistic?

Analyst Predictions and Rationale

One prominent analyst has predicted a $254 price target for AAPL, citing [mention the analyst's name and firm, if possible]. Their reasoning is based on [explain the analyst's rationale – e.g., strong future product pipeline, expansion into new markets, etc.]. However, this prediction is not universally shared. Other analysts offer more conservative forecasts, with the consensus estimate typically ranging between $[Insert Lower Bound] and $[Insert Upper Bound].

- Analyst's Key Arguments:

- [List bullet points summarizing the key arguments supporting the $254 price target.]

- Comparison to Consensus Estimates: [Explain how the $254 target compares to other analyst predictions.]

Potential Risks and Challenges

Reaching the $254 price target is not without risks. Potential downsides include a global economic downturn impacting consumer spending, increased competition from Android devices, and supply chain disruptions. Furthermore, the price target's sensitivity to various market conditions (e.g., interest rate hikes) needs careful consideration.

- Key Risks:

- Economic recession

- Increased competition

- Supply chain issues

- Regulatory hurdles

Should You Buy AAPL Stock Now? Investment Strategy Considerations

Weighing the Pros and Cons

Considering the analysis above, investing in AAPL presents both advantages and disadvantages. On the positive side, Apple's strong brand, loyal customer base, and diversified revenue streams are compelling. However, potential risks, including economic uncertainty and competitive pressures, must be weighed against the potential for significant returns. Diversification is crucial for any investment portfolio.

- Pros: Strong brand, diversified revenue streams, innovation potential.

- Cons: Economic uncertainty, competition, valuation concerns.

Risk Tolerance and Investment Timeline

Your investment decision should align with your risk tolerance and investment timeline. AAPL is generally considered suitable for long-term investors with a higher risk tolerance, but short-term investors should proceed with caution due to market volatility. Always conduct thorough due diligence before making any investment decisions.

- Long-term investors: Potential for significant growth over several years.

- Short-term investors: Higher risk due to price fluctuations.

Conclusion: Apple Stock Forecast – Your Next Steps

Our analysis of the Apple stock forecast (AAPL) reveals a complex picture. While the $254 price target represents a potentially lucrative opportunity, it's essential to recognize the significant risks involved. The current market conditions and Apple's future performance will ultimately determine whether this ambitious target is realized. Therefore, further research into AAPL's financial statements, competitive landscape, and overall market trends is crucial before making any investment decisions. Develop your own Apple stock forecast based on your personal risk tolerance and investment goals, and remember to always consult with a qualified financial advisor before investing. Learn more about Apple stock investment strategies to build a robust and informed approach to your portfolio.

Featured Posts

-

Rome Masters Zheng Through To Last 16 After Frech Win

May 25, 2025

Rome Masters Zheng Through To Last 16 After Frech Win

May 25, 2025 -

Officially Opened Ferraris First Service Centre In Bengaluru

May 25, 2025

Officially Opened Ferraris First Service Centre In Bengaluru

May 25, 2025 -

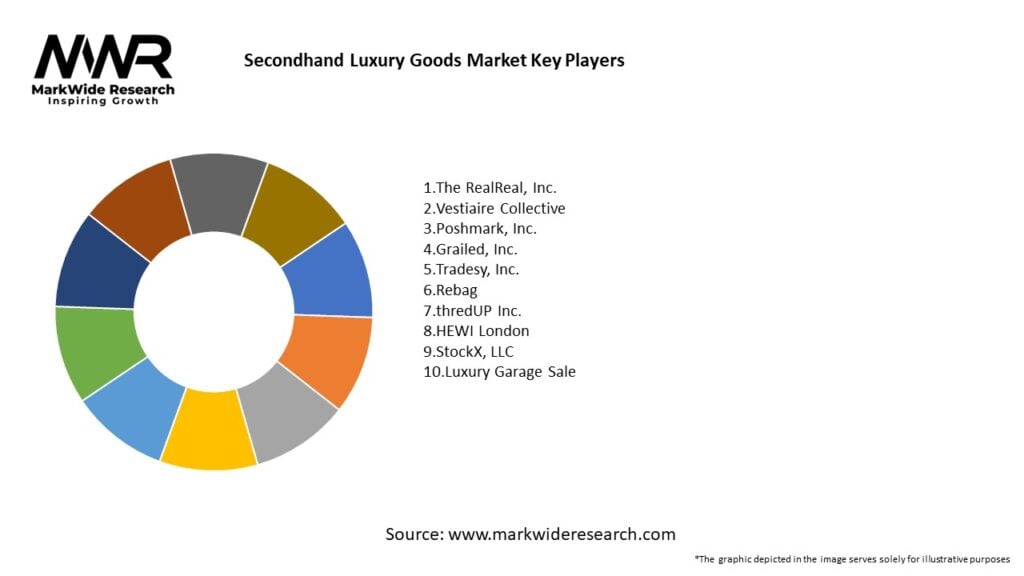

Paris Faces Economic Headwinds Luxury Goods Market Decline

May 25, 2025

Paris Faces Economic Headwinds Luxury Goods Market Decline

May 25, 2025 -

Urgent Flood Advisory Severe Storms Hitting Miami Valley

May 25, 2025

Urgent Flood Advisory Severe Storms Hitting Miami Valley

May 25, 2025 -

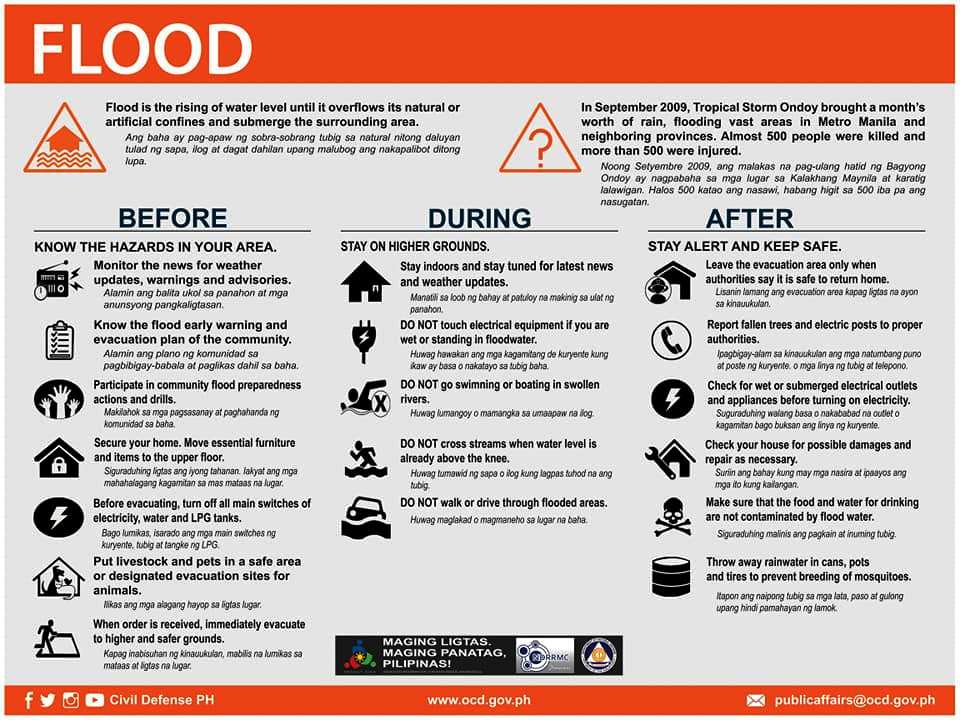

Staying Safe During Flash Floods A Guide To Flood Warnings And Preparedness

May 25, 2025

Staying Safe During Flash Floods A Guide To Flood Warnings And Preparedness

May 25, 2025