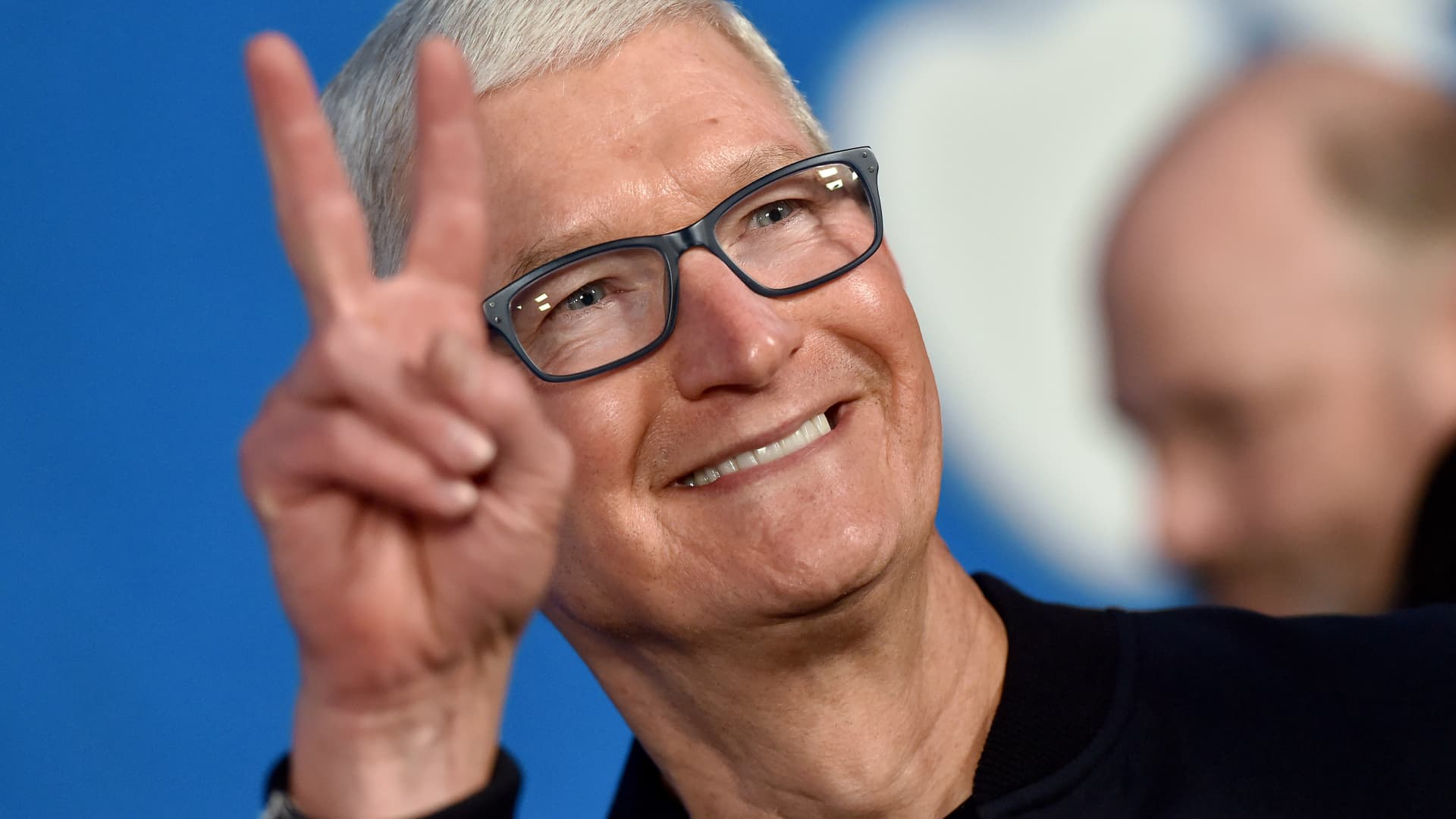

Apple Stock Price Drops On $900 Million Tariff Projection From Tim Cook

Table of Contents

Tim Cook's Tariff Projection and its Impact on Apple's Financial Outlook

Tim Cook's statement revealed that Apple anticipates a substantial $900 million negative impact on its financial performance due to recently implemented tariffs. This projection significantly impacts Apple's financial outlook and underscores the escalating costs associated with the ongoing trade disputes.

- Specific Products Affected: The tariffs primarily target Apple products manufactured in China, including:

- iPhones

- AirPods

- Apple Watches

- MacBooks (certain models)

- Impact on Profit Margins and Revenue: The $900 million represents a considerable dent in Apple's overall revenue, potentially impacting profit margins and investor confidence. Analysts predict a decrease in quarterly earnings, leading to a reassessment of Apple's financial projections.

- Short-Term and Long-Term Implications: In the short term, we can expect continued volatility in the Apple Stock Price. Long-term, the impact depends on several factors, including the duration of the tariffs, Apple's ability to mitigate the effects, and the overall resolution of trade tensions.

- Supply Chain Disruption: The tariffs disrupt Apple's complex global supply chain, primarily affecting manufacturing and distribution processes based in China. This could lead to production delays and increased costs, further pressuring the Apple Stock Price. Countries like Vietnam and India are being considered for diversification, but such shifts require significant investment and time.

Market Reaction to the News: Apple Stock Price Volatility and Investor Sentiment

The immediate market reaction to Cook's announcement was a sharp decline in Apple's stock price. The percentage drop varied throughout the day, but initial reports indicated a significant decrease, impacting the overall Apple Stock Price. This volatility reflects investor concern about the company's ability to navigate these trade challenges.

- Investor Sentiment and Analyst Reactions: Investor sentiment shifted dramatically, with many expressing concern over the long-term implications of the tariffs. Analyst reactions were mixed, with some suggesting a "buy the dip" strategy, while others expressed caution, advising investors to monitor the situation closely. Several analysts lowered their price targets for Apple Stock.

- Stock Price Volatility: Apple's stock price exhibited significant volatility in the hours and days following the announcement, fluctuating as investors digested the news and reassessed their investment strategies. This volatility is likely to continue until there's greater clarity on the future of the tariffs.

- Broader Market Implications: The drop in Apple's stock price had a ripple effect on other tech stocks, reflecting a broader concern about the impact of tariffs on the technology sector. The interconnected nature of the global tech industry means that the struggles of one giant like Apple often influence its competitors.

- Investor Strategies: Some investors may view the price drop as a buying opportunity ("buying the dip"), while others might adopt a wait-and-see approach. It is crucial for investors to assess their individual risk tolerance and investment goals before making any decisions regarding their Apple Stock holdings.

Long-Term Implications of Tariffs on Apple and the Tech Industry

The potential for future tariff increases and their cumulative effect on Apple represents a significant long-term risk. The ongoing trade war introduces considerable uncertainty, impacting future financial projections and investor confidence regarding Apple Stock.

- Mitigating Tariff Impacts: Apple could attempt to mitigate the impact of tariffs through several strategies, including:

- Shifting production to countries outside of China.

- Absorbing some of the increased costs.

- Increasing product prices to offset the tariff burden.

- Implications for the Tech Industry: Apple's situation highlights the broader challenges facing the tech industry, which is heavily reliant on global supply chains. The escalating trade tensions could lead to increased costs and reduced competitiveness for many tech companies.

- Political Implications: The ongoing trade war has significant political implications, influencing international relations and impacting businesses globally. The situation underlines the increasing interdependence of the global economy and the risks associated with trade protectionism.

- Consumer Alternatives: Consumers may seek alternatives if Apple significantly raises its prices to offset the tariffs. This could lead to a shift in market share within the tech industry and pressure Apple to find other solutions to navigate this difficult situation.

Conclusion

Tim Cook's projection of a $900 million tariff impact on Apple's finances has led to a significant drop in the Apple Stock Price, triggering concerns about the company's future profitability and the broader implications for the tech industry. The market reacted swiftly, demonstrating the sensitivity of investor sentiment to trade policy uncertainty. The long-term implications remain unclear, but Apple faces challenges in mitigating the effects of tariffs and maintaining its market position. To stay informed about the evolving situation regarding Apple stock price and tariffs, keep an eye on the Apple Stock Price for further developments and consider your investment strategy accordingly. Understanding the impact of tariffs on Apple Stock is crucial for informed investment decisions. Stay informed about further developments by following our updates on [Link to website/news source].

Featured Posts

-

The Complete Soundtrack For Picture This Prime Video Rom Com

May 24, 2025

The Complete Soundtrack For Picture This Prime Video Rom Com

May 24, 2025 -

Kyle Vs Teddi A Heated Confrontation Over Dog Walking

May 24, 2025

Kyle Vs Teddi A Heated Confrontation Over Dog Walking

May 24, 2025 -

Global Healthcare Transformation The Philips Future Health Index 2025 Report On Ai

May 24, 2025

Global Healthcare Transformation The Philips Future Health Index 2025 Report On Ai

May 24, 2025 -

Amsterdam City Faces Lawsuit From Residents Due To Tik Tok Crowds At Local Snack Bar

May 24, 2025

Amsterdam City Faces Lawsuit From Residents Due To Tik Tok Crowds At Local Snack Bar

May 24, 2025 -

Can Jordan Bardella Lead The Opposition To Victory In France

May 24, 2025

Can Jordan Bardella Lead The Opposition To Victory In France

May 24, 2025