Apple Stock Sell-Off: Tim Cook's Tariff Projection Hits Hard

Table of Contents

Tim Cook's Tariff Warnings and their Market Impact

Tim Cook's statements regarding the negative impact of tariffs on Apple's product pricing and profitability were blunt. He warned of significant cost increases stemming from the ongoing trade disputes, particularly between the US and China, where a large portion of Apple's manufacturing takes place. Following this announcement, the market reacted swiftly and negatively. Apple's stock price experienced a sharp decline, with a percentage drop of [Insert Actual Percentage Drop Here]% within [Insert Timeframe, e.g., a single trading day]. Trading volume also surged, indicating heightened investor activity and anxiety.

- Impact on iPhone production costs: Increased tariffs directly translate to higher manufacturing costs for iPhones and other Apple products, squeezing profit margins.

- Effect on Apple's global supply chain: The complex global supply chain, relying on numerous suppliers across multiple countries, becomes significantly more vulnerable and expensive to manage under a trade war scenario.

- Potential price increases for consumers: Apple may be forced to pass some, or all, of these increased costs onto consumers, potentially impacting sales volume and demand. This price increase could exacerbate the already slowing iPhone sales.

- Investor confidence shaken: Cook's warnings, combined with the already present market anxieties, significantly eroded investor confidence in Apple's short-term prospects.

Analyzing the Underlying Factors Contributing to the Apple Stock Sell-Off

While Tim Cook's tariff warnings were a significant catalyst for the Apple stock sell-off, other underlying factors contributed to the decline. The slowing growth in iPhone sales, particularly in key markets, is a major concern. This sluggishness is compounded by increasing competition in the smartphone market, primarily from Android manufacturers offering comparable features at lower price points.

- Saturation of the smartphone market: The global smartphone market is approaching saturation, meaning fewer consumers are upgrading their devices as frequently.

- Rising competition from Android manufacturers: Android manufacturers, particularly in the mid-range and budget segments, continue to innovate and gain market share.

- Concerns about future iPhone innovation: Some analysts and investors are expressing concerns about the pace of iPhone innovation, questioning whether Apple can maintain its competitive edge.

- Global economic slowdown impacting consumer spending: A global economic slowdown is impacting consumer discretionary spending, and higher-priced electronics like iPhones are often the first items to be cut from budgets.

Strategies for Investors Amidst the Apple Stock Sell-Off

The Apple stock sell-off presents a challenging situation for investors. The decision to hold, sell, or buy Apple stock hinges on individual investment goals, risk tolerance, and time horizon. However, there are a few crucial considerations for making informed decisions.

- Hold, sell, or buy – a nuanced perspective: Holding onto Apple shares might be a viable strategy for long-term investors with a high risk tolerance. Selling might be appropriate for investors seeking immediate capital preservation. Buying during a sell-off can be a lucrative opportunity for those with a long-term perspective, but requires careful analysis.

- Diversification strategies to mitigate risk: Diversifying one's investment portfolio across different asset classes and sectors helps to mitigate the risk associated with any single stock's volatility.

- Importance of long-term investment planning: Long-term investment plans, focused on long-term growth potential, can help ride out market fluctuations like this Apple stock sell-off.

- Monitoring economic indicators and news related to tariffs: Closely following news related to trade negotiations and economic indicators can help investors assess potential risks and opportunities.

The Role of Geopolitical Uncertainty

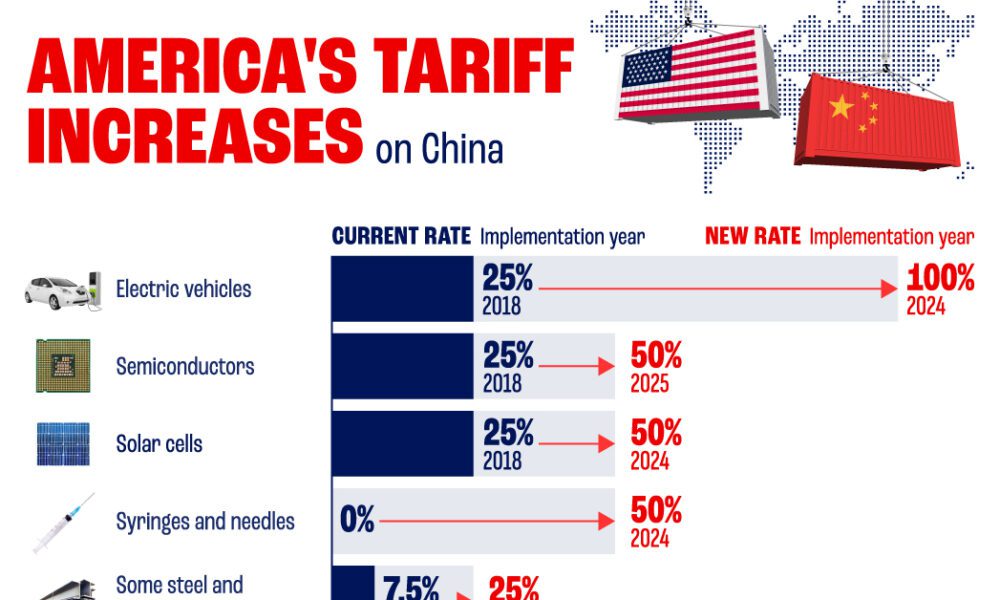

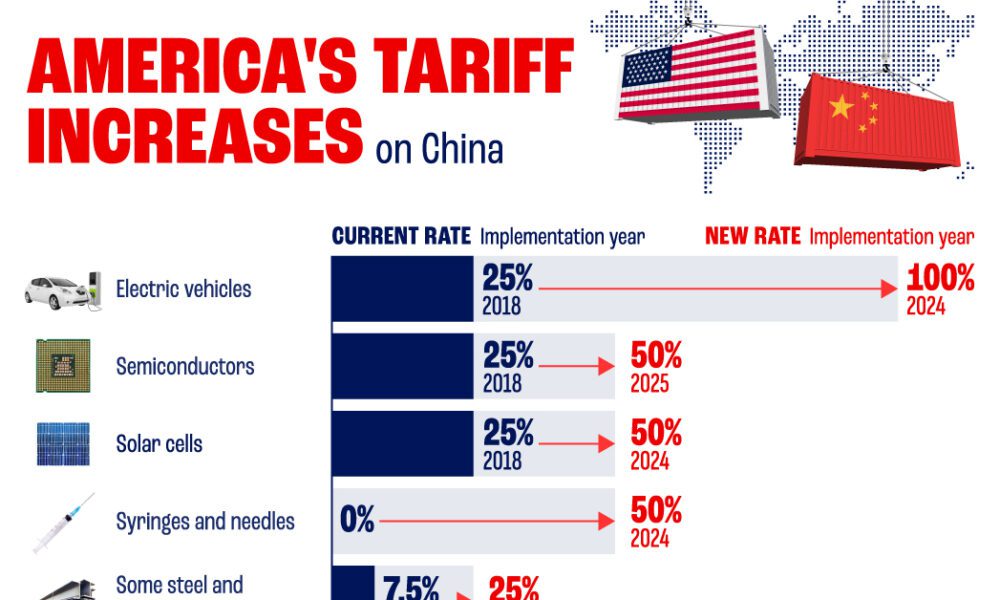

The broader impact of US-China trade relations on Apple cannot be overstated. The uncertainty created by shifting trade policies presents a significant challenge for the company's long-term planning and profitability.

- Impact on manufacturing locations: Apple may need to consider shifting manufacturing to other regions, which involves significant logistical challenges and costs.

- Potential for further tariff increases: The possibility of further tariff increases remains a significant threat, potentially compounding the negative impact on Apple’s profitability.

- Uncertainty surrounding future trade agreements: The unpredictable nature of international trade negotiations creates an environment of uncertainty, making strategic planning and investment decisions more difficult.

Conclusion

The recent Apple stock sell-off, primarily triggered by Tim Cook's tariff projections, underscores the significant interconnectedness of global trade and the tech industry's vulnerability to geopolitical instability. Beyond the immediate impact of tariffs, slowing iPhone sales and intensified competition add layers of complexity to the challenges facing Apple. This Apple stock sell-off serves as a stark reminder of the volatility inherent in the global market.

Call to Action: Understanding the nuances of this Apple stock sell-off is essential for making informed investment decisions. Stay informed about further developments regarding tariffs, Apple's strategic responses, and overall market trends to effectively navigate this volatile market and make sound judgments concerning your Apple stock portfolio. Continue to monitor news related to the Apple stock sell-off and related factors for strategic long-term planning.

Featured Posts

-

Les Gens Dici Histoire Traditions Et Societe

May 25, 2025

Les Gens Dici Histoire Traditions Et Societe

May 25, 2025 -

Solving The Disappearance Methods And Techniques For Investigation

May 25, 2025

Solving The Disappearance Methods And Techniques For Investigation

May 25, 2025 -

Struggling Canada Post Faces Customer Loss Amidst Strike Threat

May 25, 2025

Struggling Canada Post Faces Customer Loss Amidst Strike Threat

May 25, 2025 -

Jenson Button And The 2009 Brawn A Historic Reunion

May 25, 2025

Jenson Button And The 2009 Brawn A Historic Reunion

May 25, 2025 -

Sses Revised Spending Plan A 3 Billion Reduction

May 25, 2025

Sses Revised Spending Plan A 3 Billion Reduction

May 25, 2025