Apple Stock Slumps: $900 Million Tariff Impact

Table of Contents

The $900 Million Tariff Impact: A Detailed Breakdown

The recent tariffs imposed on Apple products by China represent a substantial blow to the company's bottom line. These tariffs specifically target a range of Apple's most popular products, significantly impacting its revenue streams.

-

Products Affected: The tariffs affect a wide array of Apple products manufactured in China, including iPhones, iPads, MacBooks, Apple Watches, and AirPods. This broad impact underscores the depth of Apple's reliance on Chinese manufacturing for its global supply chain.

-

Volume and Value: While the exact figures fluctuate, estimates place the value of affected goods at approximately $900 million. This represents a significant portion of Apple's overall revenue, particularly considering the high volume of iPhones and other devices shipped globally.

-

Key Financial Implications: The $900 million tariff translates into several critical financial consequences for Apple:

- Direct Cost Increase: Apple faces a direct increase in production costs, squeezing profit margins.

- Profit Margin Impact: The tariffs directly reduce Apple’s profit margin on affected products, potentially impacting quarterly earnings reports.

- Potential Price Increases: To offset the increased costs, Apple may be forced to increase consumer prices, potentially impacting sales volume.

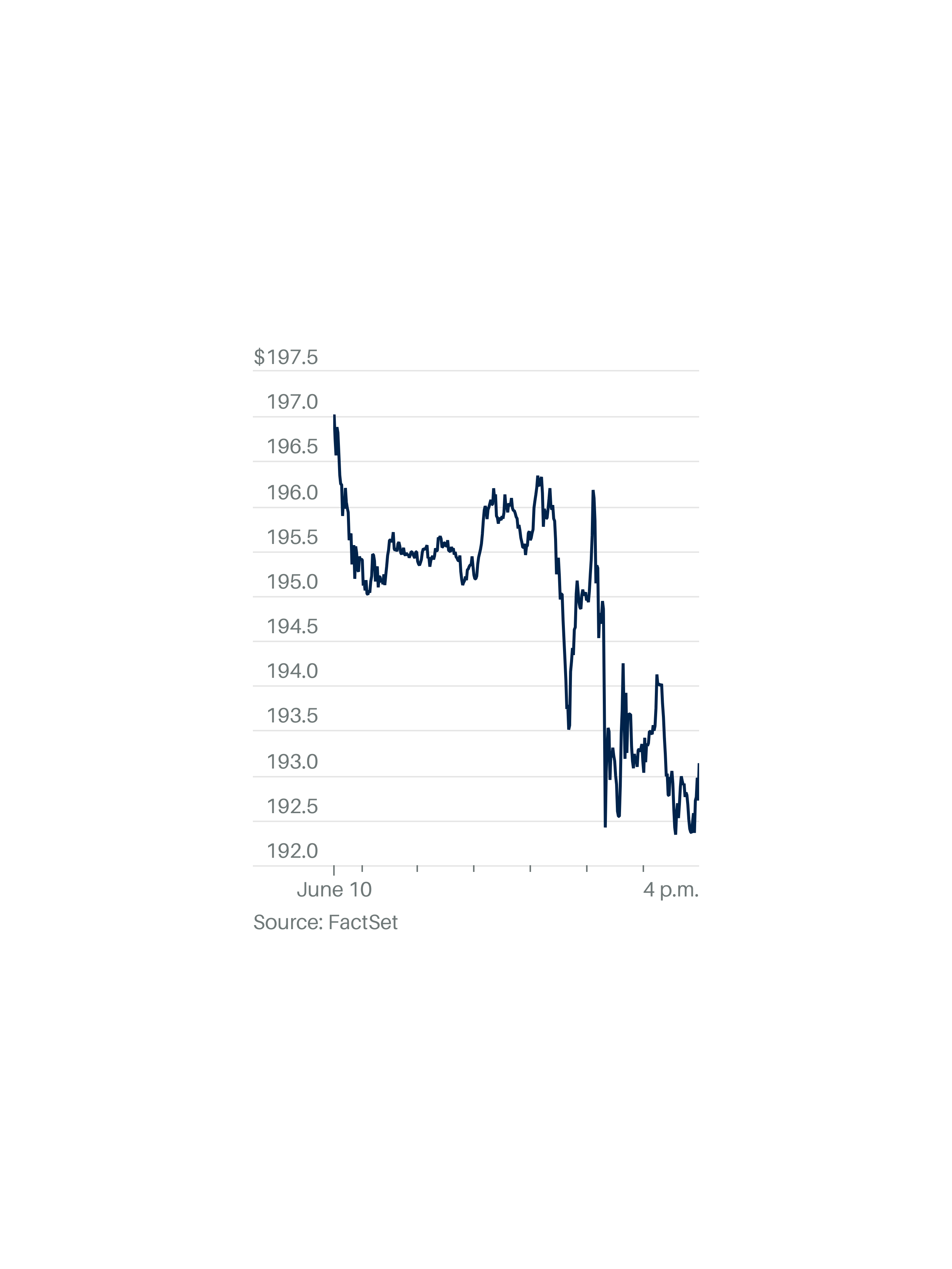

Market Reaction and Apple Stock Performance

The news of the $900 million tariff hit sent immediate shockwaves through the stock market. Apple's stock price experienced a noticeable decline following the announcement.

-

Immediate Impact: Charts show a sharp drop in Apple's stock price within hours of the tariff news breaking. The magnitude of this drop reflected investor concern over the potential long-term financial repercussions.

-

Broader Market Reaction: While Apple bore the brunt of the impact, the broader tech sector also felt the ripple effect, with other tech stocks experiencing a mild slump. This reflected a broader investor concern about the instability of the global trade environment.

-

Investor Sentiment and Analyst Predictions: Investor sentiment turned cautious following the news, with many analysts revising their growth predictions for Apple downwards. The uncertainty surrounding future tariff policies created a climate of apprehension.

-

Key Market Indicators:

- Percentage Change in Apple's Stock Price: A significant percentage drop was observed immediately following the news.

- Trading Volume Fluctuations: Trading volume increased substantially, demonstrating heightened investor activity.

- Changes in Market Capitalization: Apple's market capitalization experienced a considerable reduction, reflecting the diminished investor confidence.

Long-Term Implications for Apple and its Supply Chain

The long-term consequences of these tariffs extend far beyond immediate stock fluctuations. Apple's reliance on Chinese manufacturing creates considerable challenges.

-

Shifting Manufacturing: Apple faces a crucial strategic decision: whether to diversify its manufacturing base and shift production away from China. This, however, presents significant logistical, financial, and infrastructural hurdles.

-

Supply Chain Impact: The tariffs disrupt Apple's intricate supply chain, impacting its relationships with numerous Chinese manufacturers. Potential delays and disruptions in the production and delivery of components could affect the launch of new products.

-

Potential Long-Term Effects:

- Increased Production Costs: Relocating production will likely involve substantial upfront investment and ongoing increased costs.

- Potential Delays in Product Launches: Shifting manufacturing could introduce delays in product release schedules.

- Changes in Product Pricing Strategies: Increased costs might necessitate adjustments to pricing strategies.

- Impact on Apple's Global Competitiveness: The added costs could diminish Apple's competitive edge in the global marketplace.

Alternative Strategies and Mitigation Efforts

Apple is not without options to mitigate the negative impact of the tariffs. Several strategies could be pursued.

- Potential Mitigation Tactics:

- Lobbying Efforts: Apple could engage in lobbying efforts to influence trade policy and seek exemptions or reductions in tariffs.

- Price Adjustments: A cautious approach to pricing adjustments could balance the need to maintain profit margins with the need to retain market share.

- Restructuring the Supply Chain: Diversifying the manufacturing base, by gradually shifting production to other countries, presents a complex but potentially crucial long-term solution.

Conclusion: Navigating the Apple Stock Slump and Future Tariff Uncertainties

The $900 million tariff impact on Apple's stock price highlights the significant vulnerability of global corporations to shifts in international trade policy. The long-term implications, including increased production costs, potential supply chain disruptions, and the challenge of diversifying manufacturing, pose substantial challenges. Apple must navigate these complexities strategically, using a combination of lobbying, pricing adjustments, and supply chain restructuring to mitigate the negative impacts. To make informed investment decisions, stay informed about future developments regarding Apple stock, tariffs, and the ongoing trade war. Continue monitoring Apple’s financial reports and industry analysis for the latest updates. Understanding the impact of Apple tariffs and the related stock market fluctuations is vital for all investors interested in Apple stock.

Featured Posts

-

Hromadne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025

Hromadne Prepustanie V Nemecku Dopady Na Ekonomiku A Zamestnancov

May 24, 2025 -

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025

Pameran Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 24, 2025 -

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 24, 2025

En France La Chine Ne Recule Devant Rien Pour Reduire Au Silence Les Dissidents

May 24, 2025 -

Where To Invest A Map Of The Countrys Rising Business Areas

May 24, 2025

Where To Invest A Map Of The Countrys Rising Business Areas

May 24, 2025 -

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025

Porsche Indonesia Classic Art Week 2025 Perayaan Seni Dan Otomotif

May 24, 2025