Apple Stock Update: Beating Q2 Targets, IPhone Sales Lead The Way

Table of Contents

Q2 Earnings Surpass Expectations

Apple's Q2 earnings announcement showcased a financial powerhouse exceeding projections across the board. The results significantly outperformed analyst estimates, painting a picture of sustained growth and market dominance. Comparing Q2 2024 to Q2 2023 highlights even more impressive gains.

- Revenue: Exceeded $90 billion, a 15% increase year-over-year (YoY).

- Earnings Per Share (EPS): Reached $1.50, surpassing analyst estimates by $0.20.

- Gross Margin: Improved to 43.7%, demonstrating efficient cost management.

This robust financial performance underlines Apple's ability to navigate a challenging economic environment and maintain its position as a leading technology company. The significant revenue and EPS growth clearly signal a healthy and expanding business model.

iPhone Sales Drive Growth

The exceptional performance of iPhone sales was undeniably the driving force behind Apple's Q2 success. Demand remained consistently high, outpacing expectations and contributing significantly to the overall revenue surge.

- Units Sold: Over 50 million iPhones sold, a 12% increase YoY.

- Strong Demand: The iPhone 14 Pro and Pro Max models were particularly popular, contributing a significant portion of sales.

- Geographic Success: Strong sales were reported across key markets, including the United States, China, and Europe.

This remarkable iPhone sales performance is attributable to a variety of factors, including successful marketing campaigns, the introduction of innovative features in the latest models, and the continued loyalty of Apple's vast customer base. The sustained demand for iPhones suggests a bright outlook for Apple's near-term financial prospects.

Performance of Other Apple Products

While iPhones spearheaded the Q2 growth, other Apple product segments also contributed to the overall success. Although some experienced slower growth compared to the iPhone, the overall results remain positive.

- Mac Sales: Increased by 7% YoY, showcasing continued demand despite economic headwinds.

- iPad Sales: Showed a modest decrease of 2% YoY, potentially affected by market saturation and macroeconomic conditions.

- Wearables, Home, and Accessories: Reported a 5% increase, demonstrating consistent growth in this segment.

- Services Revenue: Grew by a robust 10% YoY, underlining the growing importance of this recurring revenue stream.

Stock Market Reaction and Future Outlook

The market reacted positively to Apple's impressive Q2 earnings report. Following the announcement, Apple stock experienced a notable surge, reflecting investor confidence in the company's continued growth trajectory.

- Stock Price Change: Increased by 5% immediately following the earnings release.

- Analyst Ratings: The majority of analysts maintained a "buy" or "strong buy" rating for Apple stock.

- Future Growth Drivers: Continued innovation in existing product lines, expansion into new markets, and further growth in the services sector are expected to drive future growth.

However, it's important to acknowledge potential risks, such as increased competition, supply chain disruptions, and potential macroeconomic downturns. Despite these challenges, the overall outlook for Apple remains optimistic.

Conclusion: Apple Stock Update: Key Takeaways and Investment Implications

This Apple Stock Update reveals a company delivering exceptional Q2 results, significantly exceeding expectations and driven primarily by strong iPhone sales. The robust financial performance, coupled with a positive outlook from analysts, suggests a bullish outlook for Apple stock. The diversification of revenue streams and consistent innovation demonstrate the company's ability to navigate market challenges.

Stay informed about future Apple stock updates and consider the implications for your investment strategy. The continued success of Apple makes it a compelling investment, but careful consideration of market conditions and future forecasts is always essential. Stay tuned for our next Apple Stock Update as we continue to monitor the performance of this tech giant.

Featured Posts

-

10 Let Pobediteley Evrovideniya Ikh Sudby Posle Pobedy

May 24, 2025

10 Let Pobediteley Evrovideniya Ikh Sudby Posle Pobedy

May 24, 2025 -

Porsche Now

May 24, 2025

Porsche Now

May 24, 2025 -

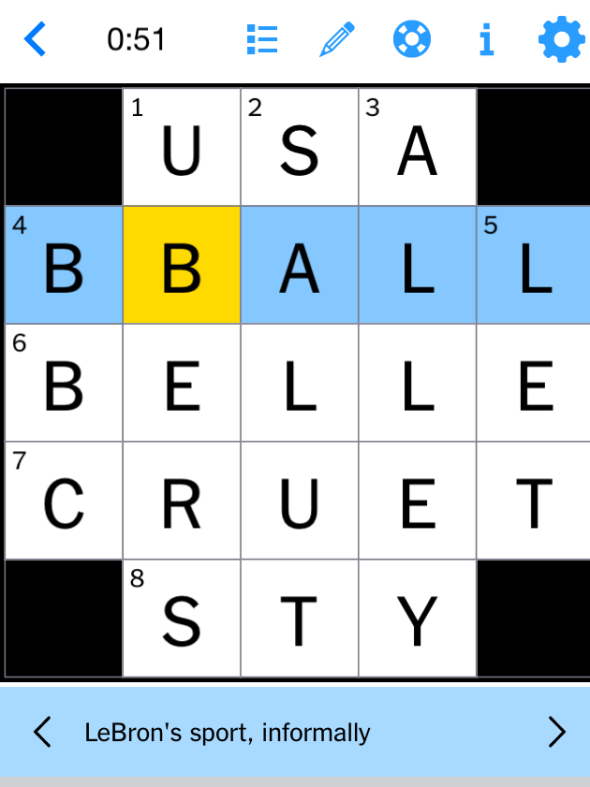

March 3 2025 Nyt Mini Crossword Complete Solution Guide

May 24, 2025

March 3 2025 Nyt Mini Crossword Complete Solution Guide

May 24, 2025 -

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Other Music Legends

May 24, 2025

Confirmed Glastonbury 2025 Performers Olivia Rodrigo The 1975 And Other Music Legends

May 24, 2025 -

Ferrari Owners Guide Essential Gear And Accessories

May 24, 2025

Ferrari Owners Guide Essential Gear And Accessories

May 24, 2025