Apple Vs. Trump Tariffs: Will Buffett's Top Tech Stock Crack?

Table of Contents

The Impact of Tariffs on Apple's Supply Chain:

H2: Disrupted Supply Chains and Increased Production Costs:

Apple's extensive reliance on Chinese manufacturing for the production of iPhones, iPads, and other devices made it particularly vulnerable to the tariffs. These tariffs directly increased the cost of importing components and finished goods, creating a ripple effect throughout Apple's operations.

- Increased cost of iPhones and other Apple products: Higher import costs meant Apple faced the difficult choice of absorbing these increased expenses or passing them on to consumers through higher prices.

- Potential for reduced profit margins: The increased cost of production inevitably squeezed profit margins, impacting Apple's bottom line.

- Pressure to relocate manufacturing outside of China: To mitigate the impact of tariffs, Apple faced increasing pressure to diversify its manufacturing base and relocate production to countries with more favorable trade agreements.

H2: Shifting Global Production Strategies:

In response to the trade war, Apple began exploring and implementing strategies to diversify its manufacturing footprint. This involved shifting some production to countries like India and Vietnam, a significant undertaking fraught with challenges.

- Increased logistical complexities: Relocating manufacturing is a complex and time-consuming process, requiring substantial investment in new facilities, infrastructure, and workforce training.

- Potential initial disruptions to production: Shifting production inevitably led to potential temporary disruptions in supply chains, potentially impacting product availability and sales.

- Investment in new manufacturing facilities in other countries (India, Vietnam, etc.): This diversification strategy required significant capital investment and long-term commitment from Apple.

Consumer Demand and Market Reaction to Tariffs:

H2: Impact on Consumer Spending:

The increased prices resulting from the tariffs had a direct impact on consumer spending. Consumers faced the choice of paying more for Apple products or opting for cheaper alternatives.

- Reduced consumer demand due to higher prices: Increased prices could lead to a decrease in consumer demand, especially in price-sensitive markets.

- Potential for a shift to cheaper alternatives: Consumers might switch to competing brands offering similar products at lower prices.

- Impact on the overall tech market: The impact of tariffs extended beyond Apple, affecting the entire tech market and investor confidence in the sector.

H2: Stock Market Volatility and Investor Sentiment:

The trade war and the imposition of tariffs significantly impacted investor sentiment and created volatility in Apple's stock price. Any news related to trade policy changes caused immediate reactions in the market.

- Short-term stock price fluctuations: Apple's stock price experienced short-term fluctuations directly correlated with developments in the trade war.

- Long-term impact on investor confidence: The uncertainty created by the trade war could have negatively impacted investor confidence in the long run.

- Comparison to other tech stocks' reactions to similar trade policies: Analyzing the reactions of other tech companies to similar trade policies provided valuable context to understand the overall impact on the tech sector.

Buffett's Perspective and Apple's Resilience:

H2: Warren Buffett's Long-Term Investment Strategy:

Warren Buffett's investment philosophy emphasizes long-term value creation. His significant investment in Apple reflects his belief in the company's long-term prospects. The tariffs, while presenting challenges, were unlikely to derail his long-term strategy.

- Buffett's confidence in Apple's brand strength: Buffett recognized Apple's strong brand, loyal customer base, and resilient ecosystem as key factors contributing to its long-term success.

- Apple's strong ecosystem and loyal customer base: The strength of Apple's ecosystem and the loyalty of its customers provided a cushion against the impact of price increases.

- Diversification of Buffett's portfolio: Buffett's portfolio diversification minimized the overall risk associated with any single investment, including Apple.

H2: Apple's Overall Financial Strength and Diversification:

Despite the challenges posed by the tariffs, Apple's strong financial health and diversification strategies helped the company weather the storm.

- Strong cash reserves and profitability: Apple's substantial cash reserves and consistent profitability provided a buffer against the negative impact of tariffs.

- Growth in services revenue: The growing revenue stream from Apple's services segment helped offset potential losses in product sales.

- Expansion into new markets and product categories: Apple's strategic expansion into new markets and product categories reduced its dependence on any single product or region.

Conclusion: The Future of Apple Amidst Trade Tensions

The "Apple vs. Trump Tariffs" conflict highlighted the complexities of global trade and its impact on even the most successful companies. While the tariffs presented significant challenges, Apple's financial strength, brand loyalty, and diversification strategies ultimately helped mitigate the negative effects. While short-term stock fluctuations occurred, the long-term impact was less severe than initially feared. The question of whether Buffett's investment would "crack" proved ultimately negative.

However, the experience underscores the importance of understanding the intricacies of global trade policies and their potential impact on businesses and the global economy. Stay informed about future developments concerning "Apple vs. Trump Tariffs" and similar trade disputes to stay ahead of the curve in understanding the dynamic interplay between global trade and the tech industry. Further research into the shifting dynamics of global manufacturing and the strategies companies employ to mitigate trade risks is strongly recommended. Understanding the complexities of "Apple vs. Trump Tariffs" remains crucial for navigating the evolving landscape of international trade.

Escape To The Country Choosing The Right Rural Location For You

Escape To The Country Choosing The Right Rural Location For You

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

Waarom Stijgt De Aex Terwijl De Amerikaanse Beurs Daalt

Is Open Ai Acquiring Jony Ives Ai Hardware Startup

Is Open Ai Acquiring Jony Ives Ai Hardware Startup

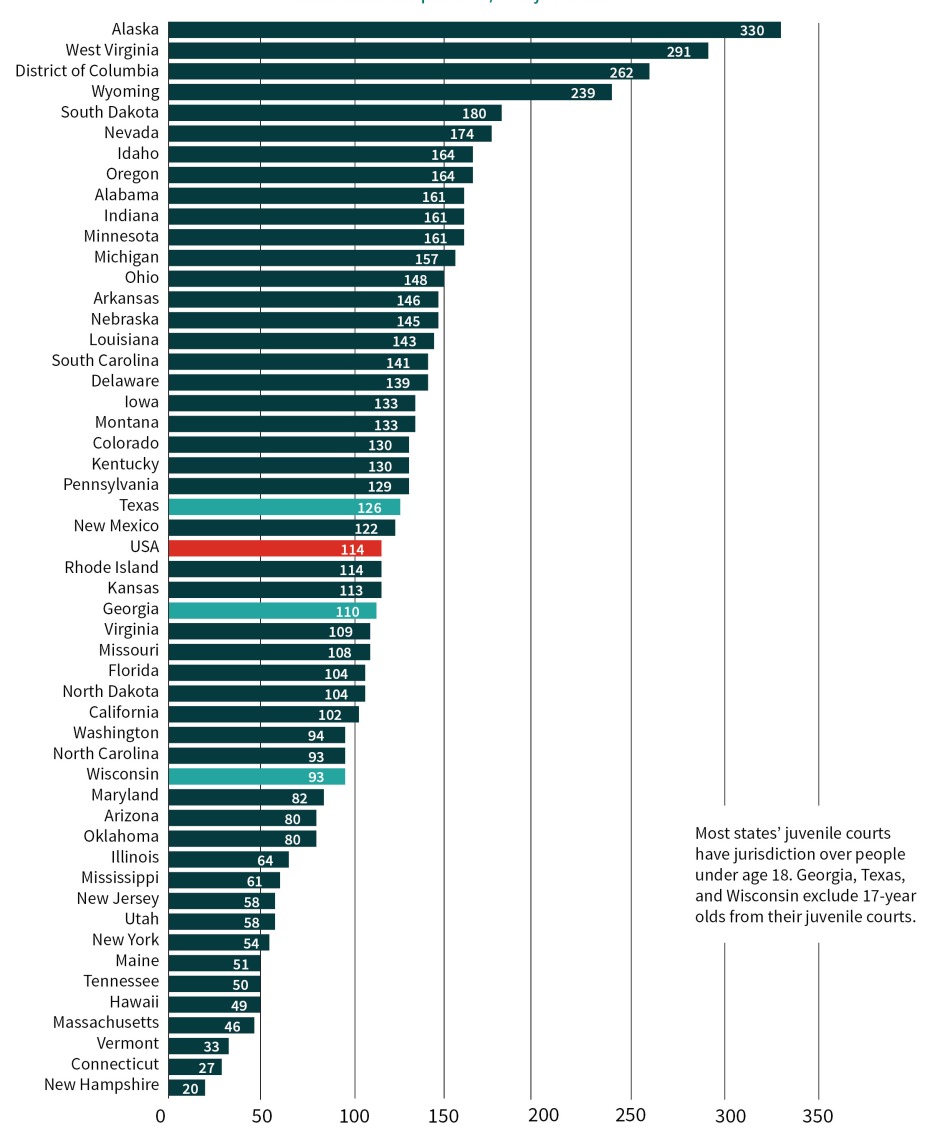

Frances Juvenile Justice System Proposed Changes To Sentencing

Frances Juvenile Justice System Proposed Changes To Sentencing

Museum Funding In Jeopardy Examining The Impact Of Trumps Budget

Museum Funding In Jeopardy Examining The Impact Of Trumps Budget