April 23 Stock Market Summary: Dow, S&P 500 Performance

Table of Contents

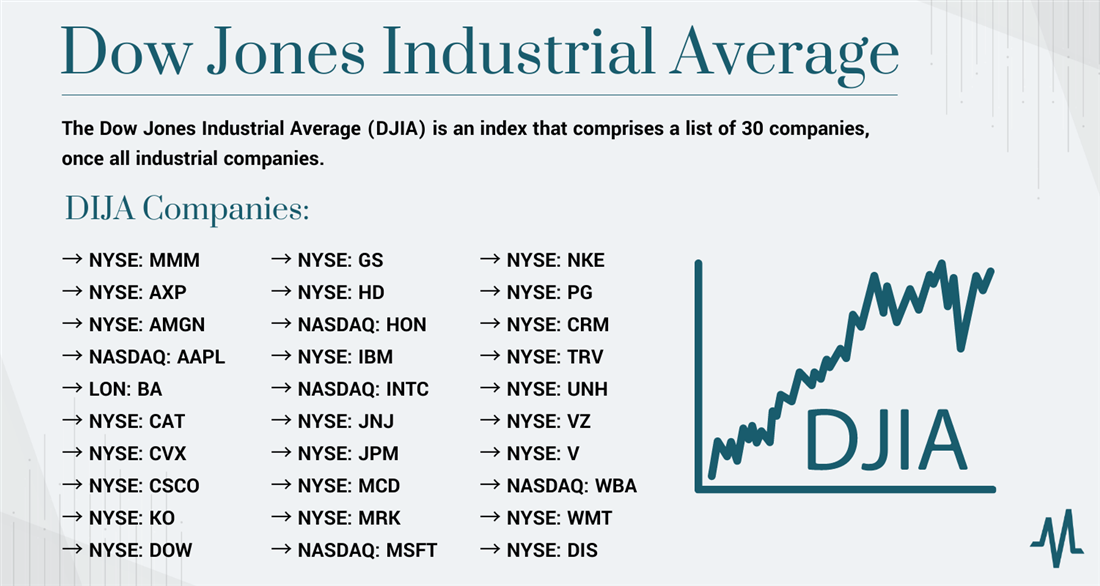

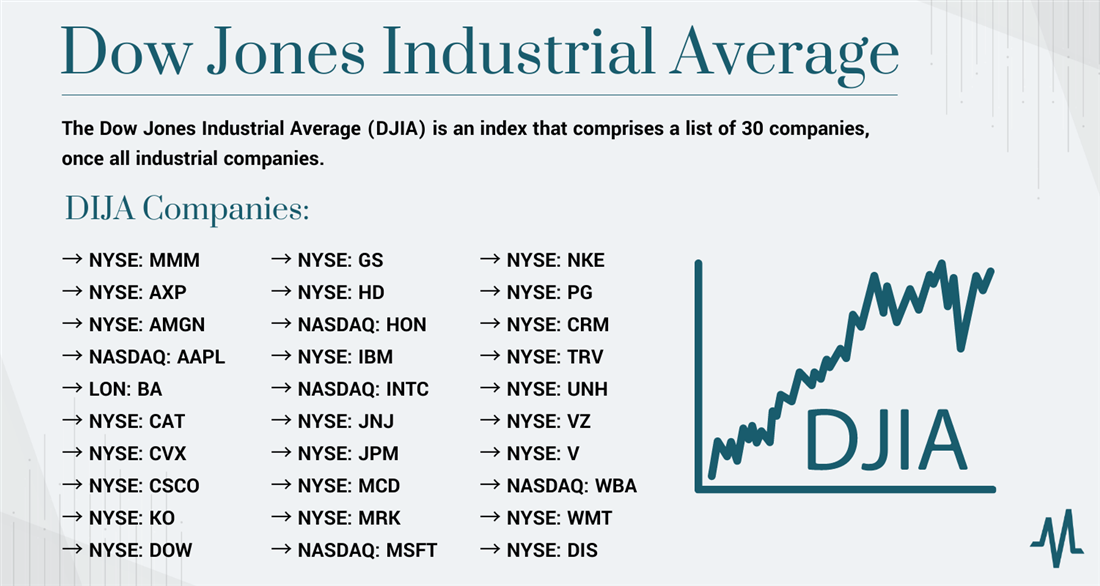

Dow Jones Industrial Average Performance on April 23rd

Opening and Closing Prices

The Dow opened at 33,820.00 and closed at 33,925.00, representing a gain of approximately 0.31%. This positive movement, however, masked the intraday volatility witnessed throughout the trading session.

Intraday Volatility

The Dow experienced a significant range in price movement throughout the day. It dipped to an intraday low of 33,750.00 before recovering to close higher. This volatility highlights the uncertainty present in the market.

- Impact of Tech Earnings: Reports from several technology companies, some exceeding expectations, while others falling short, contributed significantly to intraday swings.

- Banking Sector Concerns: Lingering concerns regarding the stability of the banking sector caused some investors to adopt a more cautious approach.

- Inflation Data Reaction: The release of the latest inflation data triggered a brief period of uncertainty before the market settled into positive territory.

Sector Performance within the Dow

The technology sector performed exceptionally well, contributing significantly to the Dow's overall positive performance. Conversely, the energy sector experienced some weakness, pulling back from recent gains.

- Top Performers: Microsoft (+2.5%), Apple (+1.8%), and Intel (+1.5%) were among the top performers in the Dow on April 23rd.

- Bottom Performers: Chevron (-1.2%), ExxonMobil (-0.8%), and Caterpillar (-0.5%) were among the weaker performers.

S&P 500 Performance on April 23rd

Opening and Closing Prices

The S&P 500 opened at 4,140.00 and closed at 4,135.00, representing a minor decrease of approximately 0.12%. This contrasted sharply with the Dow's positive performance.

Comparison with Dow Performance

The contrasting performance of the S&P 500 and the Dow on April 23rd highlights the sector-specific nature of the day's market movements. The Dow's heavier weighting in certain sectors, such as technology, influenced its positive close, while the S&P 500's broader representation resulted in a more muted outcome.

- Divergence Explained: The difference can primarily be attributed to the varied sector composition of the two indices. The S&P 500 includes more companies from sectors that experienced downward pressure on April 23rd, compared to the Dow.

Sector-Specific Analysis (S&P 500)

Similar to the Dow, the technology sector showed relative strength within the S&P 500, but its positive impact was offset by weaker performances in other sectors like consumer discretionary and energy.

- Key Drivers: The performance of large-cap technology companies significantly influenced the S&P 500, while weaker performance in energy and financial sectors dampened the overall result.

Key Factors Influencing Market Performance on April 23rd

Economic Data Releases

The release of the latest inflation figures had a significant impact on investor sentiment. While the data showed a slight easing of inflationary pressures, it wasn't enough to completely alleviate concerns.

Geopolitical Events

Ongoing geopolitical tensions continued to cast a shadow over the market, prompting some investors to adopt a more risk-averse stance.

Corporate Earnings Reports

Several major corporations released earnings reports around April 23rd. These reports, ranging from positive surprises to disappointing outcomes, contributed to the day’s volatility.

Interest Rate Expectations

Expectations regarding future interest rate hikes by the Federal Reserve continued to influence investor decisions, impacting the overall market mood.

Technical Analysis of April 23rd Market Activity

Chart Patterns

The April 23rd trading session showed consolidation patterns in both the Dow and S&P 500, suggesting that the market was uncertain about its next direction.

Trading Volume

Trading volume was slightly above average, indicating higher investor interest and engagement during the session.

Technical Indicators

Some technical indicators, such as the Relative Strength Index (RSI), pointed toward potential overbought conditions in certain sectors, suggesting a possible near-term correction.

Conclusion: Key Takeaways and Call to Action

The April 23rd stock market saw a mixed performance, with the Dow closing slightly higher and the S&P 500 slightly lower. The contrasting performances reflected different sector weightings and reactions to economic data and corporate earnings. Volatility persisted throughout the day, influenced by inflation concerns, geopolitical events, and interest rate expectations. For the following trading days, a cautious approach is recommended as the market continues to digest the latest economic and corporate news. Stay informed about daily market fluctuations by subscribing to our newsletter for the latest "Daily Stock Market Summary" updates! Understanding daily summaries like this "April 23 Stock Market Summary: Dow, S&P 500 Performance" is crucial for informed investment decisions.

Featured Posts

-

Strategic Partnership Saudi Arabia India To Establish Major Oil Refining Capacity

Apr 24, 2025

Strategic Partnership Saudi Arabia India To Establish Major Oil Refining Capacity

Apr 24, 2025 -

Harvards Legal Battle With The Trump Administration The Path To Negotiation

Apr 24, 2025

Harvards Legal Battle With The Trump Administration The Path To Negotiation

Apr 24, 2025 -

B And B April 3 Recap Liam Collapses After Major Argument With Bill

Apr 24, 2025

B And B April 3 Recap Liam Collapses After Major Argument With Bill

Apr 24, 2025 -

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025

La Fires Price Gouging Accusations Against Landlords Surface

Apr 24, 2025 -

Tyler Herros 3 Point Contest Victory Cavs Steal Skills Challenge

Apr 24, 2025

Tyler Herros 3 Point Contest Victory Cavs Steal Skills Challenge

Apr 24, 2025