April Outlook Update: Recent Developments And Forecasts

Table of Contents

Macroeconomic Developments Shaping the April Outlook

Several key global economic indicators are shaping the April outlook. GDP growth rates vary significantly across nations, with some experiencing robust expansion while others grapple with slower growth or even contraction. Inflation rates remain a major concern globally, impacting consumer spending and central bank policies. Unemployment figures, while generally positive in many developed economies, still present challenges in certain sectors.

Geopolitical events continue to exert considerable influence. Ongoing conflicts and trade disputes create uncertainty and disrupt supply chains, impacting the April outlook negatively. For example, the ongoing conflict in Ukraine continues to affect energy prices and global food security, adding to inflationary pressures. Recent economic news and data releases, such as the latest CPI and PPI figures, provide crucial insights into these trends.

- Global Economy: The global economy shows signs of a slowdown in certain regions, with rising interest rates dampening growth in some sectors.

- GDP Growth: Varied GDP growth across regions; some experiencing robust growth while others face stagnation.

- Inflation: Persistent inflationary pressures in many countries, impacting consumer spending and business investments.

- Unemployment Rate: Relatively low unemployment in many developed economies, but sector-specific challenges remain.

- Geopolitical Risks: Ongoing geopolitical uncertainties contribute significantly to market volatility and economic uncertainty.

Inflation Trends and Their Implications for April

Inflation remains a key factor shaping the April outlook. Analyzing inflation data, including CPI (Consumer Price Index) and PPI (Producer Price Index), is crucial for understanding its trajectory. High inflation erodes purchasing power, impacting consumer spending and investment decisions. Businesses face increased costs, potentially leading to price increases and reduced profit margins.

Central banks are responding to inflation through monetary policy adjustments, primarily through interest rate hikes. These policies aim to curb inflation but also risk slowing economic growth. The effectiveness of these measures will significantly influence the April outlook.

- Inflation Rate: Persistently high inflation in many regions despite central bank efforts.

- CPI/PPI: Tracking CPI and PPI provides vital information on price changes for consumer and producer goods.

- Consumer Spending: Inflation's impact on consumer spending is closely monitored; reduced spending could signal an economic downturn.

- Monetary Policy: Central banks' response to inflation will be critical for shaping the April outlook and beyond.

- Interest Rates: Rising interest rates aim to curb inflation, but may also slow economic growth.

Supply Chain Dynamics and April Projections

Global supply chains continue to experience disruptions, though the severity is easing in some areas. Bottlenecks and logistical challenges persist, affecting production, manufacturing, and delivery times. This directly impacts businesses' ability to meet demand and maintain profitability. The April outlook will be significantly influenced by the degree to which supply chain disruptions improve or worsen.

Factors such as port congestion, labor shortages, and geopolitical instability contribute to ongoing challenges. Improvements in certain areas, however, offer a glimpse of potential recovery. Monitoring the efficiency of global trade and logistics will be crucial for accurate April projections.

- Supply Chain: Ongoing challenges, although some easing is observed in specific areas.

- Logistics: Logistical bottlenecks continue to impact delivery times and increase costs.

- Manufacturing: Production disruptions caused by supply chain issues are still affecting numerous sectors.

- Global Trade: The flow of goods across borders is gradually recovering but faces ongoing hurdles.

- Disruptions/Bottlenecks: While easing in some regions, disruptions remain a significant factor.

Market Forecasts for April: Key Sectors and Trends

Market forecasts for April indicate varied performance across different sectors. The technology sector, driven by ongoing innovation and investment, is expected to show moderate growth. The energy sector, however, faces uncertainty due to fluctuating prices and geopolitical factors. The financial sector's performance will depend largely on interest rate movements and investor sentiment.

Consumer confidence and investor sentiment are key drivers of market performance. Positive sentiment generally translates to increased investment and economic activity, while negative sentiment can lead to market downturns. Careful monitoring of these indicators is essential for understanding the April outlook.

- Market Forecast: Varied predictions across sectors, reflecting different growth potentials and challenges.

- Sector Performance: Individual sectors show diverse performance based on specific market drivers.

- Stock Market: Stock market performance is influenced by a complex interplay of factors, including economic data, company earnings, and investor sentiment.

- Investor Sentiment: Positive investor sentiment boosts market performance, while negative sentiment can lead to volatility.

- Economic Growth: Economic growth projections directly influence market forecasts for various sectors.

- Industry Trends: Emerging industry trends and technological advancements also shape market forecasts.

Technology Sector Outlook for April

The technology sector continues to be a dynamic area, driven by rapid innovation and substantial investments. Advancements in areas such as artificial intelligence, cloud computing, and cybersecurity are fueling growth. Key players in software, hardware, and digital transformation are expected to perform reasonably well in April, but competition remains intense.

The impact of technology on other sectors is also notable. Digital transformation is reshaping industries, creating new opportunities and challenges. The April outlook for the technology sector will be largely dependent on continued innovation, successful product launches, and investor confidence.

- Tech Sector: Steady growth expected, driven by continued innovation and investment.

- Innovation: Technological breakthroughs will continue to shape the sector's growth trajectory.

- Technology Investment: High levels of investment are expected to fuel further growth and innovation.

- Software/Hardware: Both software and hardware segments are poised for continued growth.

- Digital Transformation: The impact of digital transformation on other industries is significant and will continue to be a major driver of growth for the tech sector.

Energy Sector Outlook for April

The energy sector faces considerable uncertainty in April, primarily driven by fluctuating energy prices and geopolitical events. Oil and gas prices remain volatile, influenced by supply disruptions, geopolitical tensions, and the ongoing energy transition towards renewable sources. The role of renewable energy in shaping the April outlook is increasingly significant, as investments in solar, wind, and other renewable sources continue to grow.

The geopolitical landscape plays a significant role in the energy sector. Conflicts and sanctions can drastically affect energy supplies and prices, creating volatility and uncertainty. Careful monitoring of these factors is crucial for understanding the April energy sector outlook.

- Energy Prices: Volatile energy prices continue to impact the sector's performance.

- Oil/Gas: Supply chain disruptions and geopolitical factors continue to influence oil and gas prices.

- Renewable Energy: Growth in renewable energy is reshaping the energy landscape.

- Energy Transition: The transition towards renewable energy sources is ongoing and influencing energy market dynamics.

- Geopolitical Factors: Geopolitical instability significantly impacts energy supplies and prices.

Risks and Uncertainties Affecting the April Outlook

Several risks and uncertainties could significantly affect the April outlook. Unexpected economic shocks, such as a sudden recession or a major financial crisis, could trigger market volatility and negatively impact economic growth. Policy changes, particularly regarding monetary policy or trade regulations, could also create uncertainty and disrupt markets.

Geopolitical risks remain a significant concern. Escalation of conflicts or unforeseen international events could lead to market instability and negatively impact global trade. Assessing the likelihood and potential impact of these risks is crucial for making informed decisions and developing appropriate mitigation strategies.

- Risk Assessment: Careful evaluation of potential risks is vital for navigating the current economic climate.

- Economic Uncertainty: Uncertain economic conditions add to the complexity of making predictions.

- Market Volatility: Market fluctuations driven by various factors add to uncertainty.

- Geopolitical Risks: Geopolitical instability poses significant threats to the global economy.

- Policy Uncertainty: Changes in economic policies can introduce uncertainty into market forecasts.

Conclusion: Staying Ahead with the April Outlook Update

This April outlook update highlights significant macroeconomic developments, including persistent inflation, ongoing supply chain challenges, and geopolitical uncertainties. Market forecasts suggest varied performance across sectors, with some experiencing growth while others face headwinds. Identifying and mitigating potential risks is crucial for navigating the complexities of the current economic climate.

Staying informed about current economic and market conditions is essential for making informed decisions. Regularly checking for updates and further analysis of the April outlook is crucial. Subscribe to our newsletter or follow our social media channels for ongoing updates and deeper dives into economic forecasts and market trends. Stay informed on the April outlook and future developments.

Featured Posts

-

While Sinner Soared Alcaraz And Zverev Stalled

May 28, 2025

While Sinner Soared Alcaraz And Zverev Stalled

May 28, 2025 -

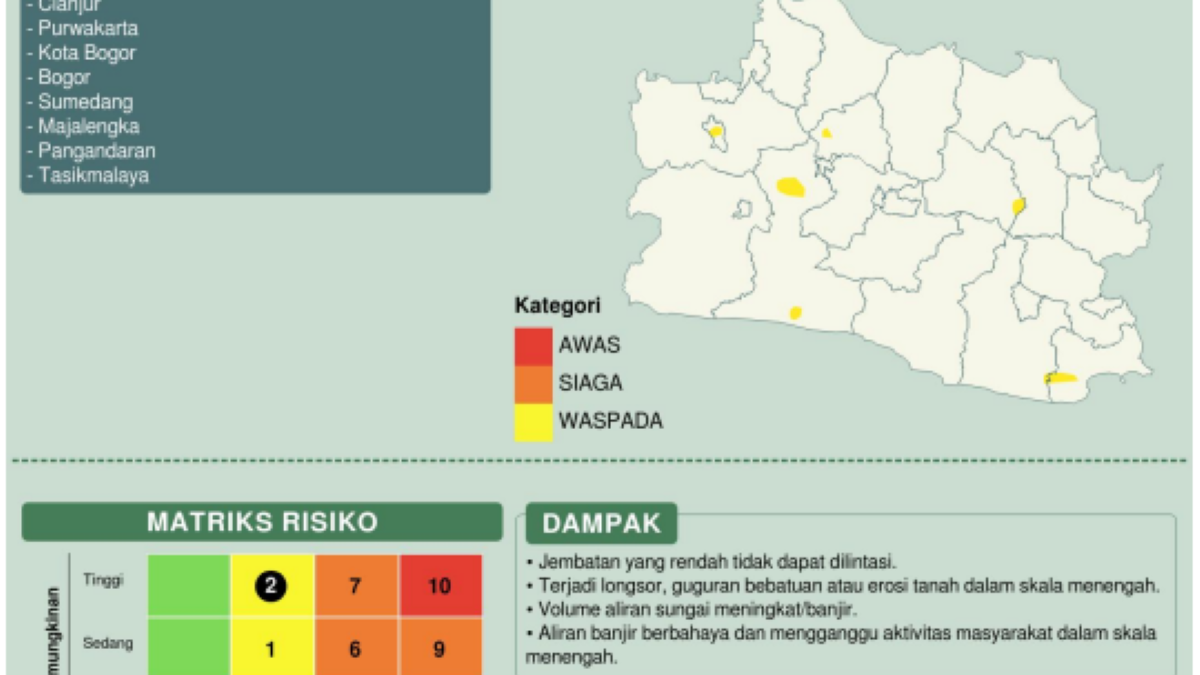

Ramalan Cuaca Jabar Besok Waspada Hujan Hingga Petang

May 28, 2025

Ramalan Cuaca Jabar Besok Waspada Hujan Hingga Petang

May 28, 2025 -

Samsung Galaxy S25 256 Go Caracteristiques Techniques Et Performances

May 28, 2025

Samsung Galaxy S25 256 Go Caracteristiques Techniques Et Performances

May 28, 2025 -

Bts Featurette The Making Of The Phoenician Scheme World

May 28, 2025

Bts Featurette The Making Of The Phoenician Scheme World

May 28, 2025 -

Kanye West Spotted With Bianca Censori Doppelganger Is This His New Relationship

May 28, 2025

Kanye West Spotted With Bianca Censori Doppelganger Is This His New Relationship

May 28, 2025