Are High Stock Market Valuations A Cause For Concern? BofA Says No.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's argument against immediate concern regarding high stock market valuations rests on several key pillars. They believe current prices are justifiable, considering several macroeconomic factors and corporate performance indicators. Their analysis suggests that the current elevated valuations are not necessarily unsustainable or indicative of an imminent crash.

-

Low Interest Rates: Sustained low interest rates significantly impact stock valuations. Lower borrowing costs encourage companies to invest and expand, boosting earnings and making equities more attractive relative to bonds. This supportive interest rate environment contributes to higher price-to-earnings ratios (P/E) without necessarily signaling overvaluation.

-

Strong Corporate Earnings: BofA points to strong corporate earnings as a key justification for current stock prices. Many companies have reported healthy profits, demonstrating resilience and fueling investor confidence. This positive earnings outlook supports the current valuation levels.

-

Positive Economic Outlook: A generally positive economic outlook, albeit with some uncertainties, influences investor sentiment. The expectation of continued economic growth underpins investor confidence and willingness to pay higher prices for stocks.

-

Supporting Metrics: BofA's analysis likely incorporates various metrics, such as forward-looking earnings estimates and adjusted P/E ratios, to contextualize current valuations. These detailed analyses help them to temper concerns about the potential for a significant market correction.

Understanding the Current Market Landscape: Factors Contributing to High Valuations

Several macroeconomic factors contribute to the current landscape of high stock market valuations. These factors interplay in complex ways, shaping investor behavior and ultimately influencing prices.

-

Government Stimulus Packages: The substantial government stimulus packages implemented globally in response to the pandemic injected significant liquidity into the market, boosting asset prices, including stocks.

-

Technological Advancements: Rapid technological advancements, especially in sectors like technology and biotechnology, have fueled the growth of many companies, further contributing to higher valuations, particularly for growth stocks.

-

Global Economic Recovery: The ongoing global economic recovery post-pandemic, although uneven, contributes to a generally positive investor sentiment. This recovery fuels demand for equities and supports higher prices.

-

Shifting Investor Preferences: Investor preferences are dynamic. The current market has witnessed a shift towards growth stocks, which tend to command higher valuations due to expectations of substantial future growth, while value stocks have seen comparatively less attention.

Potential Risks and Cautions: Acknowledging the Concerns

While BofA's analysis offers a reassuring perspective, it's crucial to acknowledge the potential downsides and risks associated with high stock market valuations. A balanced approach requires considering both the positive and negative factors.

-

Valuation Bubbles and Corrections: The possibility of valuation bubbles forming in specific sectors or the broader market remains a legitimate concern. High valuations can make markets susceptible to corrections, where prices fall sharply.

-

Inflationary Pressures: Rising inflation erodes the purchasing power of money, impacting corporate earnings and potentially leading to a reassessment of stock valuations. Inflationary pressures can dampen investor sentiment.

-

Geopolitical Uncertainties: Geopolitical uncertainties and conflicts introduce volatility into the market, affecting investor confidence and potentially leading to sudden price fluctuations. Geopolitical risk remains a significant factor.

-

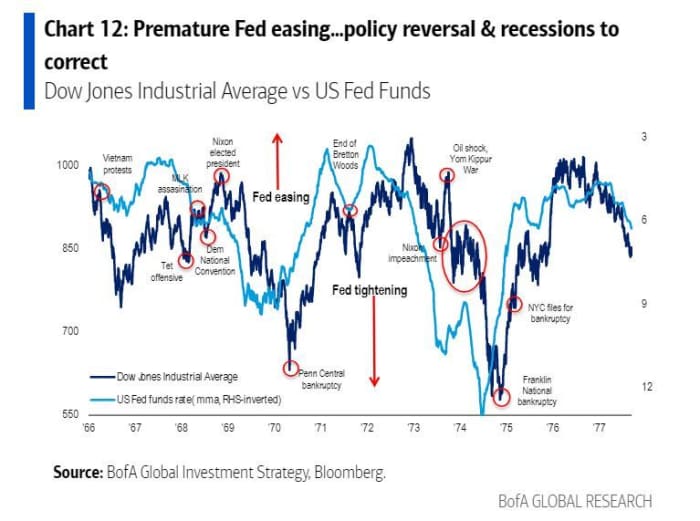

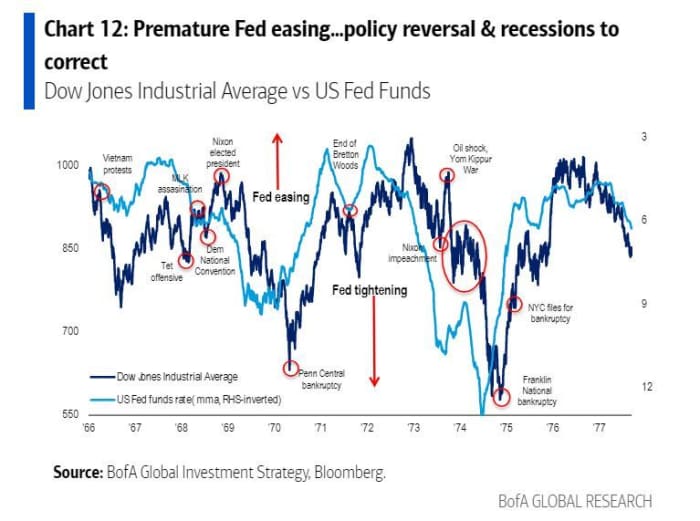

Rising Interest Rates: A future increase in interest rates, a move often employed to combat inflation, could negatively impact stock valuations by increasing borrowing costs for companies and making bonds a more attractive investment option.

Balancing Risk and Reward: A Long-Term Perspective

Navigating high stock market valuations requires a long-term investment strategy. Focusing solely on short-term market fluctuations can be detrimental.

-

Long-Term Investing: A long-term perspective helps to weather market volatility and benefit from the long-term growth potential of the market. While short-term corrections are possible, long-term trends often prevail.

-

Portfolio Diversification: Diversifying your investment portfolio across different asset classes and sectors reduces overall risk. This diversification helps mitigate losses from any sector-specific correction.

-

Risk Management: Implementing robust risk management strategies, including setting stop-loss orders and regularly reviewing your portfolio, is crucial. This proactive approach helps protect your investments from substantial losses.

Conclusion: Navigating High Stock Market Valuations – A Balanced Approach

BofA's argument against immediate panic over high stock market valuations is supported by several factors, including low interest rates, strong corporate earnings, and a generally positive economic outlook. However, acknowledging the potential risks, such as valuation bubbles, inflation, geopolitical uncertainty, and the potential impact of rising interest rates, is equally important.

Ultimately, navigating high stock market valuations requires a balanced approach. While BofA's analysis offers a reassuring perspective, it's crucial to conduct thorough research, diversify your portfolio, manage your risk effectively, and adopt a long-term investment strategy. Understanding the nuances of high stock market valuations is crucial for making informed investment decisions. Don't hesitate to seek professional financial advice to help you develop a personalized investment strategy tailored to your risk tolerance and financial goals.

Featured Posts

-

Understanding Pasifika Sipoti April 4th

May 01, 2025

Understanding Pasifika Sipoti April 4th

May 01, 2025 -

Channel 4 Show Reveals Michael Sheens Debt And Net Worth Impact

May 01, 2025

Channel 4 Show Reveals Michael Sheens Debt And Net Worth Impact

May 01, 2025 -

Dragons Den A Comprehensive Guide For Aspiring Entrepreneurs

May 01, 2025

Dragons Den A Comprehensive Guide For Aspiring Entrepreneurs

May 01, 2025 -

Dzilijan Anderson Zenstvenost U Retro Haljini

May 01, 2025

Dzilijan Anderson Zenstvenost U Retro Haljini

May 01, 2025 -

Kogi Train Breakdown Leaves Passengers Stranded

May 01, 2025

Kogi Train Breakdown Leaves Passengers Stranded

May 01, 2025