Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's analysts suggest that current high stock market valuations aren't necessarily a harbinger of an impending market crash. Their optimism stems from several key factors:

-

Low Interest Rates: Historically low interest rates significantly impact stock valuations. Lower rates make borrowing cheaper for companies, boosting investment and earnings. This, in turn, supports higher stock prices. BofA's research indicates a strong correlation between low interest rates and sustained market growth, even with elevated valuations.

-

Strong Corporate Earnings: Robust corporate earnings are another pillar supporting BofA's positive outlook. Many companies have reported strong profit growth, justifying, to some extent, the higher price-to-earnings (P/E) ratios. BofA analysts point to sustained growth in key sectors as evidence of this strength.

-

Technological Innovation: The ongoing wave of technological innovation fuels expectations of future growth. Companies leading in areas like artificial intelligence, cloud computing, and biotechnology are seen as having significant long-term potential, supporting higher valuations for the broader market. BofA highlights the disruptive potential of these technologies as a key driver of future earnings.

-

Global Economic Factors: While acknowledging global economic uncertainties, BofA’s assessment incorporates a relatively positive outlook on global macroeconomic conditions. Factors such as continued growth in emerging markets and ongoing government stimulus packages are cited as contributing to their optimistic forecast. However, BofA cautions that these factors are subject to change and require continuous monitoring.

Counterarguments and Potential Risks: Addressing Criticisms of BofA's Position

While BofA presents a compelling case, it's crucial to acknowledge potential counterarguments and risks associated with high stock market valuations.

-

Valuation Multiples: Critics argue that current P/E ratios and other valuation metrics are stretched, indicating the market might be overvalued. While strong earnings support higher valuations to some degree, the extent of the current multiples remains a point of contention. Some analysts believe that a correction is inevitable if earnings growth doesn't keep pace with price increases.

-

Market Bubbles: The possibility of a market bubble forming is a legitimate concern. History shows that periods of rapid price increases often end in sharp corrections. BofA acknowledges this risk but suggests that the current market environment differs from previous bubble periods due to the factors outlined above.

-

Inflationary Pressures: Rising inflation can erode corporate profits and negatively impact stock valuations. BofA's outlook incorporates potential inflationary pressures but suggests that current levels are manageable and unlikely to trigger a significant market downturn.

-

Geopolitical Risks: Global uncertainties and geopolitical risks, such as ongoing trade disputes and conflicts, could destabilize the market. These risks are acknowledged by BofA, but their assessment suggests that the current level of risk is within acceptable bounds.

Investing Strategies in a High-Valuation Environment: Advice for Investors

Navigating a high-valuation environment requires a thoughtful investment strategy. Here's some advice:

-

Diversification Strategies: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. This reduces your exposure to any single sector or market segment.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is essential. Short-term market fluctuations should be viewed within the context of your overall long-term financial goals. Trying to time the market is often unsuccessful.

-

Value Investing Approach: Despite high market valuations, opportunities to identify undervalued stocks still exist. A value investing approach, focusing on companies with strong fundamentals and reasonable valuations, can be a viable strategy.

-

Risk Management: Implementing effective risk management strategies, such as setting stop-loss orders and regularly reviewing your portfolio, is vital in any market environment, but particularly important during periods of high valuations.

Conclusion: High Stock Market Valuations: Weighing the Risks and Opportunities

BofA's optimistic outlook on high stock market valuations rests on factors such as low interest rates, strong corporate earnings, technological innovation, and a relatively positive view of global economic conditions. However, counterarguments highlighting valuation multiples, potential market bubbles, inflationary pressures, and geopolitical risks underscore the inherent uncertainties. Understanding high stock market valuations is crucial for making informed investment decisions. Continue your research to build a strategy that aligns with your financial objectives, keeping BofA's perspective in mind as one data point amongst many.

Featured Posts

-

Pne Ag Veroeffentlichung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025

Pne Ag Veroeffentlichung Nach Artikel 40 Absatz 1 Wp Hg

Apr 27, 2025 -

Pfc To Announce Fourth Dividend For Fy 25 On March 12 2025

Apr 27, 2025

Pfc To Announce Fourth Dividend For Fy 25 On March 12 2025

Apr 27, 2025 -

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025

Pegulas Comeback Victory Over Collins In Charleston

Apr 27, 2025 -

Ariana Grandes Transformation Professional Stylists And Artists At Work

Apr 27, 2025

Ariana Grandes Transformation Professional Stylists And Artists At Work

Apr 27, 2025 -

Alberto Ardila Olivares Logrando Tus Metas Con Garantia

Apr 27, 2025

Alberto Ardila Olivares Logrando Tus Metas Con Garantia

Apr 27, 2025

Latest Posts

-

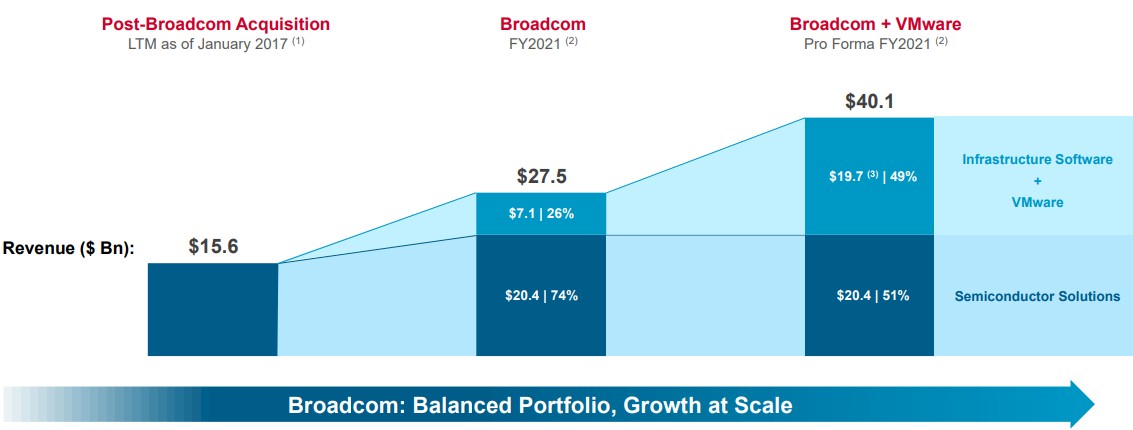

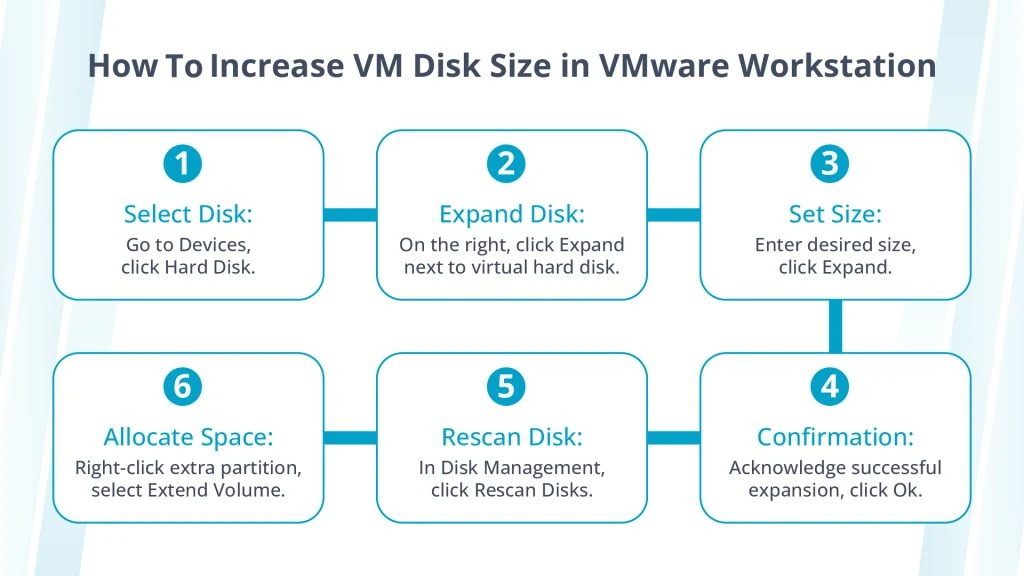

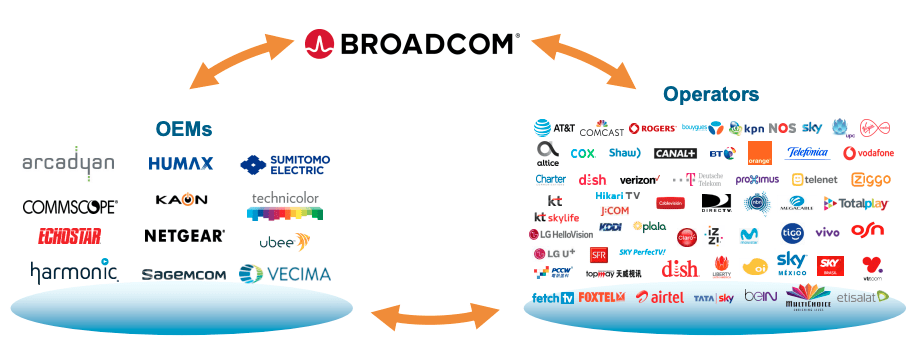

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025

The V Mware Price Shock At And T Highlights A 1 050 Increase From Broadcom

Apr 28, 2025 -

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025

Broadcoms V Mware Deal At And T Sounds Alarm Over Extreme Cost Increase

Apr 28, 2025 -

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025

Extreme Price Increase For V Mware At And Ts Reaction To Broadcoms Proposal

Apr 28, 2025 -

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Details Extreme Price Increase

Apr 28, 2025 -

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025

Broadcoms Proposed V Mware Price Hike At And T Reports A 1 050 Increase

Apr 28, 2025