Are High Stock Market Valuations A Concern? BofA's Analysis

Table of Contents

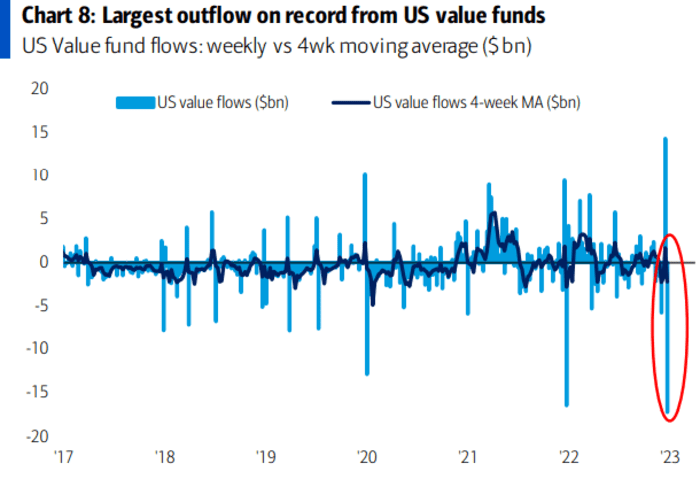

BofA's Key Findings on High Stock Market Valuations

Bank of America's analysis of high stock market valuations reveals a nuanced perspective. While acknowledging the elevated levels, they don't necessarily sound the alarm bells, but they do highlight specific areas of concern. Their assessment isn't a blanket statement of impending doom, but a call for cautious optimism and strategic adjustments.

-

BofA's valuation metrics: BofA employs various valuation metrics, including the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other forward-looking indicators. These metrics provide a comprehensive picture of market valuation relative to historical trends and projected earnings. They look at both current and future earnings expectations to provide a more robust assessment.

-

Overvalued sectors: BofA's analysis pinpoints specific sectors, such as certain technology stocks and some growth-focused companies, as potentially overvalued relative to their historical averages and projected future earnings. However, they also identify other sectors, often those considered more defensive, that appear more reasonably priced.

-

Market outlook: BofA's outlook isn't a simple prediction of a crash. Instead, they foresee a period of potential volatility, with the possibility of both further growth and market corrections. This highlights the importance of a robust and adaptable investment strategy. Their analysis suggests the need to carefully assess risk and to have a flexible approach to portfolio management.

Factors Contributing to High Stock Market Valuations

Several factors contribute to the current high stock market valuations. Understanding these factors is crucial for comprehending the market's overall health and potential risks.

-

Low interest rates: The prolonged period of low interest rates, a consequence of various monetary policies including quantitative easing, has significantly impacted discounted cash flow valuations. Lower discount rates inflate the present value of future earnings, leading to higher stock prices.

-

Strong corporate earnings growth: Robust corporate earnings growth in many sectors has supported higher price-to-earnings ratios. However, the sustainability of this growth is a key consideration in assessing the long-term value of stocks.

-

Monetary policy and quantitative easing: Central bank policies, such as quantitative easing, have injected significant liquidity into the financial system, helping to drive up asset prices across the board, including stocks. This artificial stimulus needs to be considered when analyzing valuations.

-

Investor sentiment and market psychology: Positive investor sentiment and a "fear of missing out" (FOMO) mentality can further fuel price increases, potentially pushing valuations beyond levels justified by fundamental analysis alone. Market psychology plays a significant, albeit often unpredictable, role in stock market performance.

Potential Risks Associated with High Stock Market Valuations

Investing in a highly valued market presents several potential risks. It's crucial to acknowledge these risks and develop strategies to mitigate them.

-

Vulnerability to negative economic news: High valuations increase the market's sensitivity to negative economic news or unexpected events. Even minor setbacks can trigger significant price corrections.

-

Potential for capital losses: A market downturn in a high-valuation environment could lead to substantial capital losses. Investors need to be prepared for potential volatility.

-

Impact on investor confidence: Negative news or a market correction can quickly erode investor confidence, potentially leading to a sell-off and further price declines.

-

Inflation risk: Sustained inflation can erode the real returns from investments, particularly in a high-valuation market where future growth may be less certain.

BofA's Recommendations and Investment Strategies

BofA's recommendations emphasize a cautious yet opportunistic approach, urging investors to adapt their strategies to the current market environment characterized by high stock market valuations.

-

Asset allocation: BofA advocates for a diversified asset allocation strategy. This means distributing investments across various asset classes, not just stocks, to reduce risk. This might involve increasing allocations to bonds or other less volatile assets.

-

Sector-specific strategies: They suggest favoring sectors deemed less overvalued and more resilient to potential economic headwinds. This could involve a shift from growth stocks to value stocks or defensive sectors.

-

Risk management: Managing risk is paramount. This involves carefully considering individual risk tolerance and employing strategies to limit potential losses, such as stop-loss orders or hedging techniques.

Diversification Strategies for a High-Valuation Market

Diversification is key to mitigating the risks associated with high stock market valuations. This involves spreading investments across a range of assets and geographies.

-

Geographic diversification: Investing in international markets can reduce reliance on any single economy and help to balance risk.

-

Sector diversification: Investing across different industry sectors helps to mitigate the impact of negative news affecting specific industries.

-

Asset class diversification: Including bonds, real estate, and other asset classes in the portfolio helps smooth returns over time.

-

Alternative investments: Consideration of alternative investments like hedge funds or private equity can provide diversification and potentially reduce correlation with traditional equity markets.

Conclusion

BofA's analysis of high stock market valuations highlights a complex picture. While the market has reached elevated levels, their findings don't necessarily signal an immediate crash. However, they emphasize the need for caution and a strategic approach. Their recommendations center on diversification, robust risk management, and a careful selection of investments, focusing on sectors with reasonable valuations and less exposure to potential market corrections. Understanding these high stock market valuations and their potential impact is crucial for making informed investment decisions. Learn more about BofA's detailed analysis and develop a robust investment strategy to navigate this market effectively. Remember to carefully consider your own risk tolerance and seek professional financial advice before making any investment decisions concerning high stock market valuations.

Arsenals Title Bid Souness Highlights Crucial Role

Arsenals Title Bid Souness Highlights Crucial Role

Ai Chip Exports Nvidia Ceo Seeks Policy Changes From Trump

Ai Chip Exports Nvidia Ceo Seeks Policy Changes From Trump

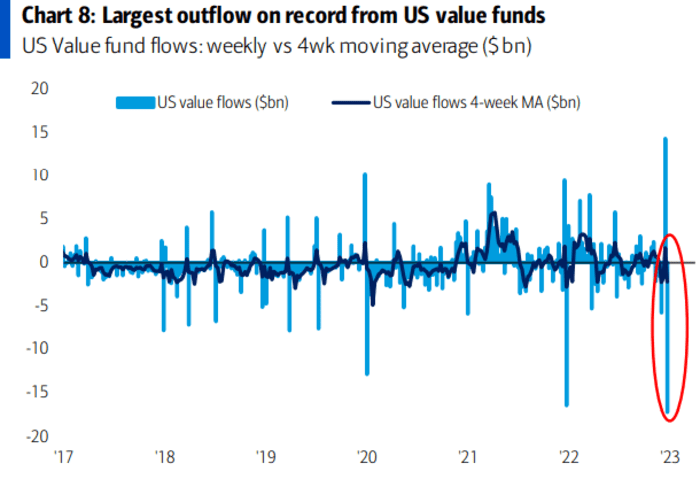

Decoding The 2024 Political Climate Examining Voter Turnout In Florida And Wisconsin

Decoding The 2024 Political Climate Examining Voter Turnout In Florida And Wisconsin

A Deep Dive Into South Koreas Housing Culture A Must See Exhibition

A Deep Dive Into South Koreas Housing Culture A Must See Exhibition

Channel 4s Million Pound Giveaway Christopher Stevens Critique

Channel 4s Million Pound Giveaway Christopher Stevens Critique