Are Republican Infighting And Policy Differences Dooming Trump's Tax Plan?

Table of Contents

Internal Republican Divisions: A Fractured Party

The Republican party, despite holding power, is far from monolithic on the issue of tax reform. Deep divisions exist between different factions, creating significant obstacles for the passage of Trump's ambitious tax plan. The tension primarily lies between fiscal conservatives, who prioritize lower government spending and balanced budgets, and those advocating for more expansive tax cuts, even if it means increasing the national debt.

- Conservative vs. moderate Republican approaches to tax reform: Conservatives often favor targeted tax cuts, focusing on specific areas deemed crucial for economic growth. Moderates, on the other hand, may be more inclined towards broader tax reductions, even if they lead to a larger budget deficit. This difference in philosophy creates a major hurdle in reaching a unified Republican position.

- Differing opinions on tax cuts for corporations vs. individuals: A significant point of contention revolves around the balance between corporate and individual tax cuts. Some Republicans prioritize incentivizing business investment through lower corporate taxes, while others advocate for greater tax relief for individuals and families. This internal debate has significantly hampered the negotiation process.

- The role of powerful lobbyists and their influence on individual Republican senators and representatives: Powerful lobbying groups representing various sectors of the economy exert considerable influence on individual Republican lawmakers. These groups often push for tax provisions that benefit their specific interests, further fragmenting the party's stance on Trump's tax plan.

- Examples of public statements and voting records showcasing intra-party disagreements: Numerous public statements by Republican senators and representatives reveal significant disagreements on key aspects of the plan. Voting records on related legislation also highlight the internal divisions and lack of a cohesive Republican strategy. These public displays of dissent weaken the plan's chances of passage.

Policy Differences and Competing Priorities

Beyond internal divisions, the passage of Trump's Tax Plan is complicated by competing policy goals. The plan's significant cost raises concerns about the national debt and clashes with other proposed legislative priorities. These competing demands for limited resources create significant legislative hurdles.

- The impact of the national debt on the feasibility of substantial tax cuts: The already substantial national debt makes implementing large-scale tax cuts politically challenging. Fiscal conservatives within the Republican party express deep concerns about increasing the debt further, putting pressure on the administration to scale back the proposed cuts or find alternative funding mechanisms.

- Conflicts with other proposed legislation (e.g., infrastructure spending, healthcare reform): Trump's administration also pushes for ambitious infrastructure spending and healthcare reform. These initiatives compete for the same limited pool of resources, making it harder to secure enough congressional support for the tax plan. Balancing these competing priorities requires difficult choices and compromises that are proving hard to achieve.

- The influence of budgetary constraints and the need for fiscal responsibility: Budgetary constraints force lawmakers to prioritize. Concerns about fiscal responsibility and long-term economic stability push some Republicans to oppose tax cuts that they believe are fiscally unsustainable. This creates a strong counter-narrative to the administration's arguments.

- Analysis of alternative policy proposals from within and outside the Republican party: Alternative tax proposals exist, offered by both Republican and Democrat lawmakers. These alternatives provide further complications and potentially more palatable solutions for some factions, further diluting support for Trump's specific plan.

The Role of Public Opinion and Media Scrutiny

Public opinion and media coverage play a crucial role in shaping the political landscape surrounding Trump's Tax Plan. Negative public perception and critical media narratives can significantly impact legislative momentum.

- Polling data reflecting public support or opposition to specific elements of the plan: Polling data shows mixed public support for various provisions of the plan. Certain aspects, such as corporate tax cuts, have faced significant public opposition, potentially influencing lawmakers’ decisions.

- The impact of media narratives framing the tax plan as beneficial or harmful: Media narratives significantly shape public opinion. Negative portrayals focusing on potential downsides, like increased inequality or the national debt, can damage public support and hurt the plan's chances. Conversely, positive narratives highlighting potential benefits can bolster support.

- Analysis of public discourse surrounding the plan's potential economic consequences: Public discourse focuses heavily on the potential economic consequences of the plan. Debate centers on whether the plan will stimulate economic growth or exacerbate existing inequalities. This public debate directly affects legislative action.

- How negative press coverage might be influencing public opinion and thereby, legislative momentum: Negative press coverage can erode public support, leading to pressure on lawmakers to reconsider or amend the plan. This pressure can significantly affect the plan's trajectory.

Conclusion

This article explored the significant challenges facing Trump's Tax Plan, highlighting the internal divisions within the Republican party, competing policy priorities, and the impact of public opinion and media scrutiny. The combination of these factors suggests that the plan's passage is far from guaranteed. The fate of Trump's Tax Plan hinges on overcoming these substantial obstacles. Continued monitoring of Republican infighting, policy debates, and public reaction will be crucial in determining the ultimate success or failure of this ambitious economic initiative. Stay informed on the latest developments regarding Trump's tax plan and its future. Understanding the ongoing dynamics surrounding this Republican tax plan is crucial for anyone interested in the future of the US economy.

Featured Posts

-

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025

Adidas Anthony Edwards 2 A First Look At The New Signature Shoe

Apr 29, 2025 -

Jeff Goldblums Honest Revelation One Thing He Never Experienced

Apr 29, 2025

Jeff Goldblums Honest Revelation One Thing He Never Experienced

Apr 29, 2025 -

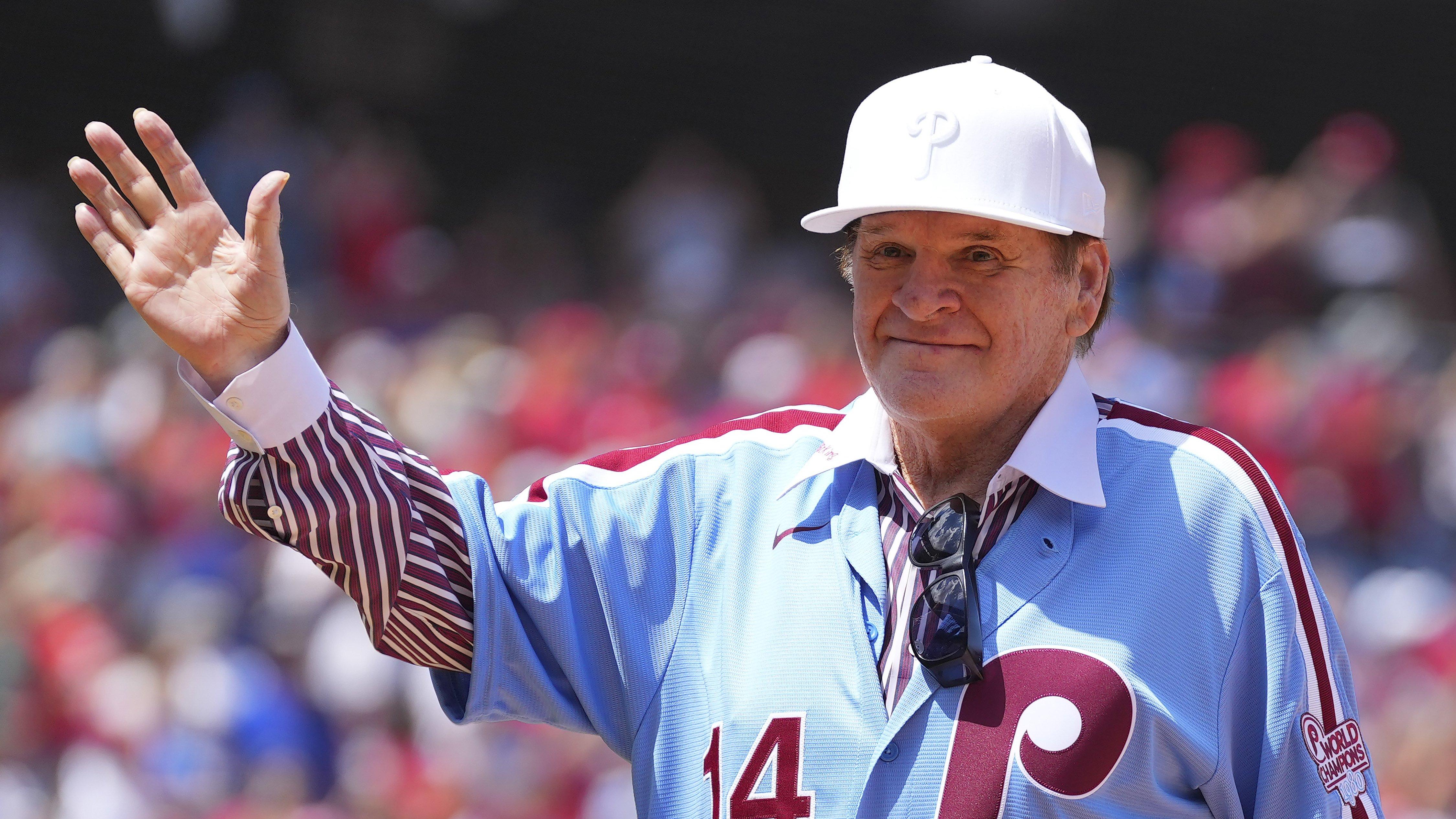

Report New Petition Seeks To Lift Pete Roses Ban

Apr 29, 2025

Report New Petition Seeks To Lift Pete Roses Ban

Apr 29, 2025 -

Post Trump Funding Cuts A Global Competition For American Scientific Talent

Apr 29, 2025

Post Trump Funding Cuts A Global Competition For American Scientific Talent

Apr 29, 2025 -

Unexpected Collaboration Ariana Grande And Jeff Goldblum On I Dont Know Why

Apr 29, 2025

Unexpected Collaboration Ariana Grande And Jeff Goldblum On I Dont Know Why

Apr 29, 2025