Assessing The Economic Impact Of Film Tax Credits In Minnesota

Table of Contents

Job Creation and Employment in the Minnesota Film Industry

Film tax credits directly impact job creation within the Minnesota film industry. Productions incentivized by these credits employ numerous individuals in diverse roles. This isn't limited to on-screen talent; it encompasses a wide range of positions, from highly skilled professionals to entry-level crew members.

- Increased employment in film production, post-production, and related services: Tax credits encourage larger productions, requiring more personnel across various departments, such as camera operation, sound engineering, editing, visual effects, and production management.

- Job creation across various skill levels: Opportunities exist for both experienced professionals and aspiring individuals entering the industry, fostering skills development and career growth within Minnesota.

- Potential for attracting skilled workers from other states: A thriving film industry, boosted by attractive tax incentives, can draw talent from across the country, contributing to the state's overall human capital.

- Data showcasing job growth figures related to film tax credits: While precise figures are difficult to isolate, studies comparing job growth in the film sector before and after the implementation of the tax credit program can shed light on its impact. (Further research into specific government reports and economic impact studies is needed here to provide concrete data.)

The types of jobs created are equally important. From gaffers and grips to makeup artists and caterers, the ripple effect extends beyond the core film crew to encompass numerous support services. Analyzing wages and salaries generated by these jobs provides a clearer picture of the program's contribution to the state's economy.

Revenue Generation and Economic Multiplier Effect

Film productions don't just create jobs; they inject significant capital into local economies. Money spent on location scouting, equipment rentals, hotel accommodations, catering, and other local services stimulates economic activity. This spending creates a multiplier effect, where the initial injection of funds generates further economic activity as businesses reinvest earnings and employees spend their wages.

- Increased spending in local businesses (hotels, restaurants, equipment rentals): Film crews often utilize local businesses for services and supplies, providing a direct boost to these entities.

- Revenue generated from tourism related to film production locations: Filming in iconic Minnesota locations can draw tourists seeking to visit filming sites, generating revenue for tourism-related businesses.

- Data showing the economic multiplier effect of film production spending: Economic modeling can demonstrate the extent to which initial film production spending amplifies overall economic activity.

- Examples of successful films that leveraged Minnesota's film tax credits and their resulting revenue impact: Highlighting specific cases where film productions directly benefited from the tax credits and subsequently generated significant revenue for the state is crucial for demonstrating the program's effectiveness.

Analyzing these revenue streams demonstrates the broader economic benefits beyond direct employment.

Return on Investment (ROI) of Minnesota's Film Tax Credit Program

Assessing the ROI of Minnesota's film tax credit program is complex and requires a careful cost-benefit analysis. Comparing the cost of the tax credits to the economic benefits generated – including job creation, revenue generation, and tourism – is essential for determining its overall effectiveness.

- Cost-benefit analysis of the program: This necessitates quantifying both the expenditure on tax credits and the resulting economic gains.

- Comparison of Minnesota's ROI with other states' film tax credit programs: Benchmarking against similar incentive programs in other states can provide valuable context and perspective.

- Discussion of the challenges in accurately measuring ROI: Accurately attributing economic gains solely to the tax credit program is challenging, as other factors influence economic growth.

- Analysis of long-term versus short-term economic effects: The program's long-term impact on industry development and job sustainability needs to be considered alongside immediate economic benefits.

Different methodologies exist for assessing ROI, each with its own limitations. A comprehensive analysis should consider multiple approaches to provide a robust evaluation.

Challenges and Limitations of Film Tax Credits in Minnesota

Despite the potential benefits, film tax credits in Minnesota face challenges. Concerns exist regarding potential fraud, the equitable distribution of benefits, and the opportunity cost of allocating funds to this specific initiative.

- Potential for misuse of tax credits: Mechanisms to prevent fraud and ensure accountability are crucial to maintain the program's integrity.

- Opportunity costs associated with allocating funds to film tax credits: Resources used for film tax credits could potentially be invested in other economic development programs.

- Argument for alternative strategies to attract film production: Exploring alternative methods to attract film production, such as infrastructure improvements or workforce training, should be considered.

- Analysis of the program's effectiveness in attracting high-budget productions: Determining whether the tax credits are effective in attracting the large-scale productions that generate the most significant economic impact is critical.

Addressing these challenges is crucial for optimizing the program's effectiveness and ensuring its long-term sustainability.

Conclusion: The Future of Film Tax Credits in Minnesota

The economic impact of Film Tax Credits in Minnesota presents a complex picture. While they demonstrably contribute to job creation and revenue generation, a thorough cost-benefit analysis is essential to determine their overall ROI and compare their effectiveness against alternative economic development strategies. Understanding both the positive and negative aspects – including potential drawbacks like fraud and opportunity costs – is vital for informed policymaking. The future of film production in Minnesota hinges on a careful evaluation of the effectiveness of these incentives and the ongoing need for them. We urge readers to engage in further research on this topic and contact their representatives to voice their opinions on the impact of Minnesota film tax credits and the future of film incentives in the state.

Featured Posts

-

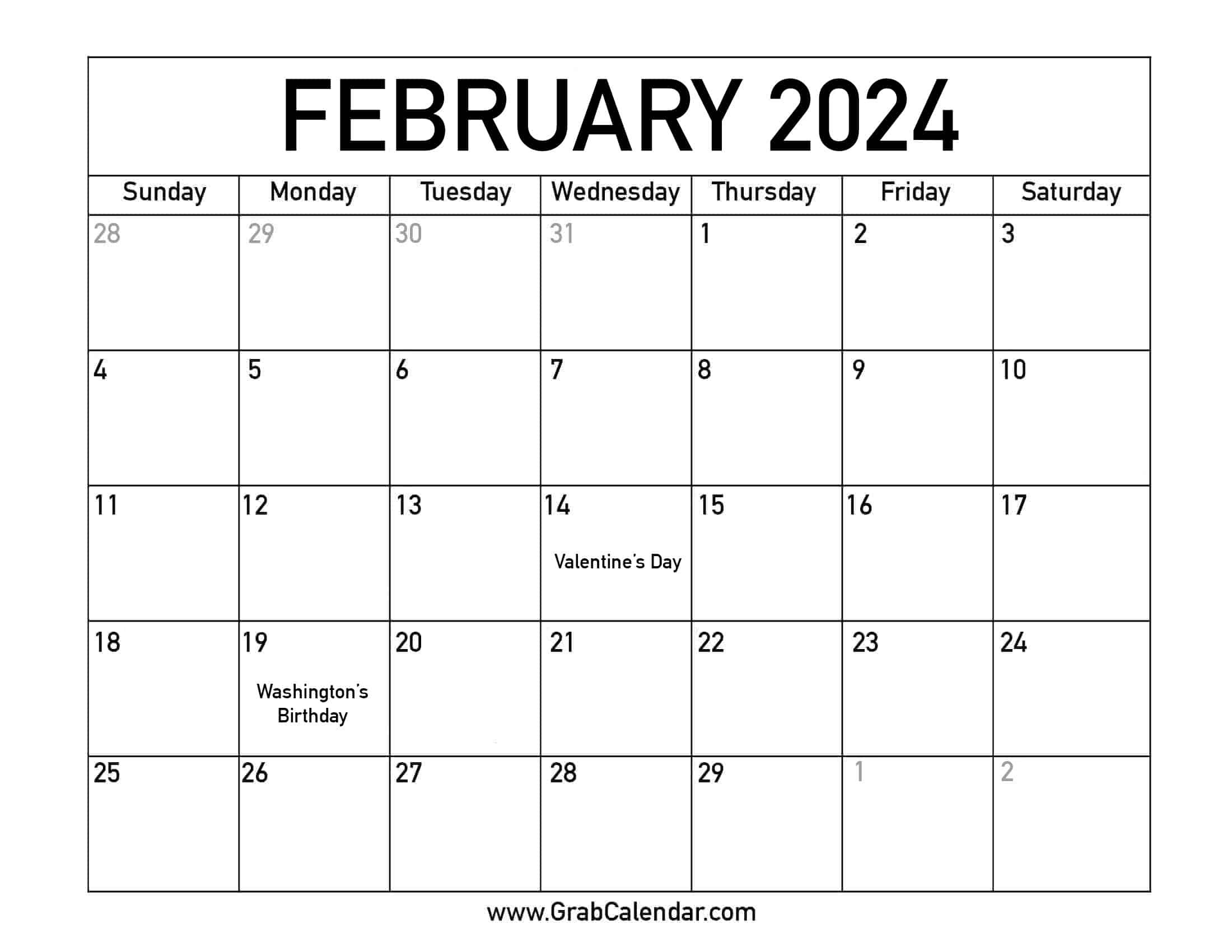

Reflecting On A Happy Day February 20 2025

Apr 29, 2025

Reflecting On A Happy Day February 20 2025

Apr 29, 2025 -

Pw Cs Withdrawal From Nine Sub Saharan African Countries A Detailed Analysis

Apr 29, 2025

Pw Cs Withdrawal From Nine Sub Saharan African Countries A Detailed Analysis

Apr 29, 2025 -

Alberto Ardila Olivares Y La Consistencia En El Marcador

Apr 29, 2025

Alberto Ardila Olivares Y La Consistencia En El Marcador

Apr 29, 2025 -

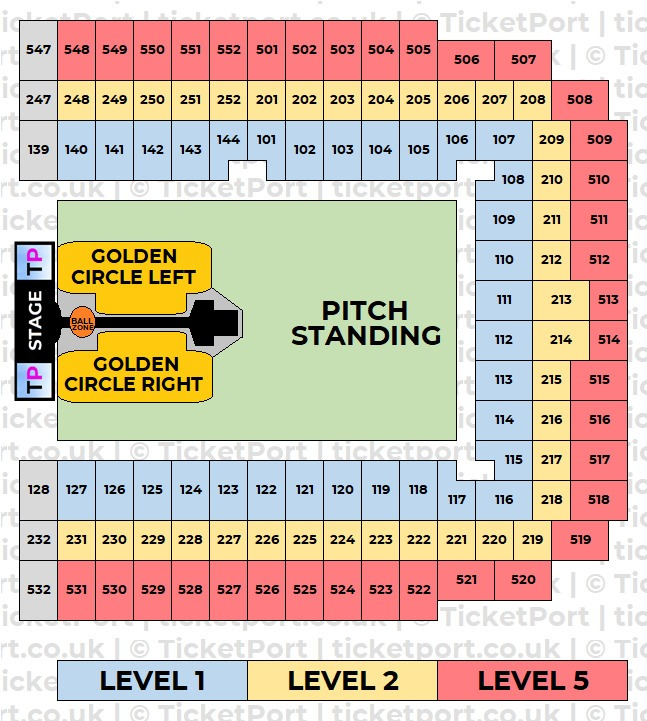

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham

Apr 29, 2025 -

Legal Battle Brewing Us Attorney Generals Stand Against Transgender Athletes In Mn

Apr 29, 2025

Legal Battle Brewing Us Attorney Generals Stand Against Transgender Athletes In Mn

Apr 29, 2025