Assessing The Scale Of The Current Bond Market Crisis

Table of Contents

Global Impact of the Bond Market Crisis

The interconnected nature of global financial markets means that a crisis originating in one region can quickly spread, creating a domino effect. The current Bond Market Crisis is no exception, impacting developed and emerging economies alike, with far-reaching consequences for various asset classes.

Impact on Developed Economies

Developed economies, such as the US and those within the EU, are not immune to the fallout from this Bond Market Crisis. The increased cost of borrowing for governments is severely limiting fiscal flexibility, potentially leading to reduced government spending on vital public services.

- Increased borrowing costs for governments: Higher interest rates translate directly into increased debt servicing costs for governments, leaving less money for essential public services and potentially hindering economic growth.

- Reduced fiscal flexibility: Governments face a difficult balancing act between managing debt levels and maintaining vital public services. This reduced flexibility can hamper economic recovery and potentially trigger further crises.

- Potential for sovereign debt crises: In some instances, the escalating debt burden could lead to sovereign debt crises, triggering a cascading effect throughout the global financial system.

Impact on Emerging Markets

Emerging markets are particularly vulnerable to the current Bond Market Crisis. Rising interest rates in developed nations often lead to capital flight from emerging markets as investors seek safer havens, resulting in currency depreciation and inflation.

- Currency depreciation: Capital flight weakens the local currency, making imports more expensive and fueling inflation.

- Inflation surges: Combined with currency depreciation, rising interest rates can lead to significant inflationary pressures, impacting living standards and potentially leading to social unrest.

- Potential debt defaults: Many emerging market countries have significant dollar-denominated debt, making them highly susceptible to rising interest rates and currency fluctuations, increasing the risk of sovereign debt defaults.

- Increased social unrest: The combination of economic hardship and currency devaluation can lead to social unrest and political instability.

Ripple Effects on Other Financial Markets

The Bond Market Crisis is not isolated; its effects ripple throughout other financial markets, creating a contagion effect.

- Market volatility: Uncertainty in the bond market spills over into stock markets, causing increased volatility and investor anxiety.

- Decreased investor confidence: The crisis erodes investor confidence across asset classes, leading to reduced investment and economic slowdown.

- Potential for a broader financial crisis: If the crisis deepens, it could potentially trigger a broader financial crisis, similar to the 2008 global financial crisis.

Identifying the Key Drivers of the Bond Market Crisis

Several factors have converged to create the current Bond Market Crisis. Understanding these underlying causes is crucial for assessing its severity and potential trajectory.

Rising Interest Rates

Central banks worldwide have aggressively raised interest rates to combat persistent inflation. This monetary tightening has had a profound impact on the bond market.

- Reduced demand for bonds: Higher interest rates make newly issued bonds more attractive, reducing the demand for existing bonds and pushing their prices down.

- Capital losses for bondholders: Falling bond prices translate into capital losses for bondholders, especially those holding long-term bonds.

- Increased borrowing costs for businesses: Higher interest rates increase borrowing costs for businesses, potentially hindering investment and economic growth.

Persistent Inflation

Stubbornly high inflation erodes the real return on bonds, making them less attractive to investors.

- Reduced purchasing power: Inflation reduces the purchasing power of future bond payments, diminishing their attractiveness.

- Increased uncertainty: High and unpredictable inflation increases uncertainty about future economic conditions, further dampening investor confidence in bonds.

- Downward pressure on bond prices: The combination of reduced demand and increased uncertainty puts downward pressure on bond prices.

Geopolitical Risks

Global political instability and geopolitical risks add to the uncertainty in the bond market, influencing investor sentiment and bond yields.

- Increased risk aversion: Geopolitical tensions increase risk aversion among investors, leading them to seek safer havens and reducing demand for riskier assets like bonds.

- Capital flight from risky assets: Investors may pull their money out of emerging markets and other risky assets, further exacerbating the crisis.

- Increased demand for safe-haven assets: Demand for safe-haven assets, such as US Treasury bonds, increases, potentially widening the yield spread between safe and risky bonds.

Assessing the Severity and Potential Outcomes of the Bond Market Crisis

The current Bond Market Crisis presents a range of potential outcomes, from a relatively mild correction to a full-blown financial crisis. Several factors will determine the severity.

Mild Correction vs. Full-Blown Crisis

The ultimate outcome will depend on several crucial factors:

- Policy responses: The effectiveness of government and central bank interventions will play a crucial role in determining the crisis's severity.

- Market liquidity: Sufficient market liquidity is essential for orderly trading and preventing panic selling. A lack of liquidity could amplify the crisis.

- Investor sentiment: Investor confidence is a key determinant of market stability. A sharp decline in investor confidence could trigger a rapid deterioration of the situation.

Potential Mitigation Strategies

Governments and central banks have several options to mitigate the Bond Market Crisis:

- Interest rate adjustments: Central banks may adjust interest rate policies to balance inflation control with the need to support economic growth.

- Quantitative easing: Central banks might resort to quantitative easing (QE) to inject liquidity into the market and lower long-term interest rates.

- Fiscal stimulus packages: Governments may implement fiscal stimulus packages to boost economic activity and support businesses.

- Regulatory reforms: Regulatory reforms aimed at strengthening the financial system and preventing future crises could be introduced.

Conclusion

The current Bond Market Crisis presents a significant threat to the global economy, impacting developed and emerging markets alike. Rising interest rates, persistent inflation, and geopolitical risks are the primary drivers of this crisis. The potential outcomes range from a mild correction to a full-blown financial crisis, depending on policy responses, market liquidity, and investor sentiment. Understanding the nuances of this Bond Market Crisis is crucial for investors and policymakers alike. Staying informed about the latest developments and consulting with a financial professional to navigate this challenging landscape of Bond Market instability and turmoil is essential.

Featured Posts

-

Score Big Genuine Memorial Day Deals Worth Buying

May 28, 2025

Score Big Genuine Memorial Day Deals Worth Buying

May 28, 2025 -

The Impact Of The Dual Hollywood Strike On Film And Television Production

May 28, 2025

The Impact Of The Dual Hollywood Strike On Film And Television Production

May 28, 2025 -

Opposition Parties Slam Pvv Coalitions Rental Price Freeze

May 28, 2025

Opposition Parties Slam Pvv Coalitions Rental Price Freeze

May 28, 2025 -

Liverpools Transfer Plans Two Wingers On The Radar Salah Contract Key

May 28, 2025

Liverpools Transfer Plans Two Wingers On The Radar Salah Contract Key

May 28, 2025 -

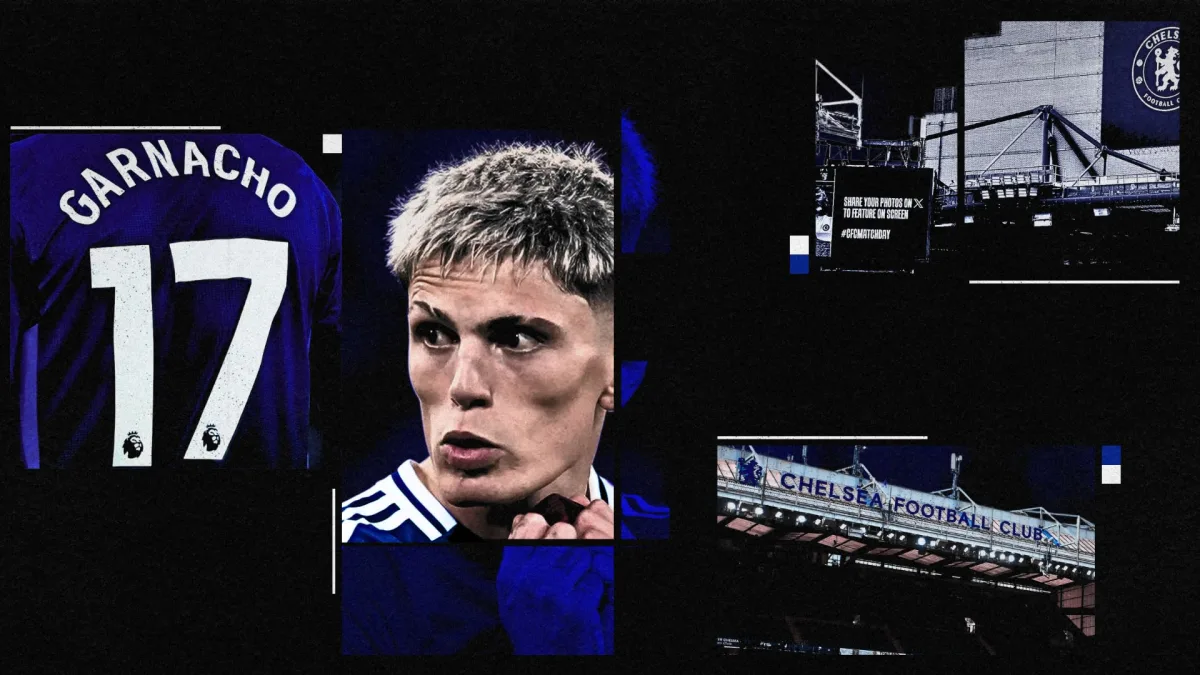

Chelsea Contacts Alejandro Garnacho Transfer Speculation Mounts

May 28, 2025

Chelsea Contacts Alejandro Garnacho Transfer Speculation Mounts

May 28, 2025