AT&T Sounds Alarm: Broadcom's VMware Deal To Increase Costs By 1,050%

Table of Contents

AT&T's Concerns and Projected Cost Increases

AT&T's alarm stems from its reliance on VMware's virtualization technologies. The company claims the Broadcom-VMware deal will drastically inflate its licensing fees and associated infrastructure costs. While AT&T hasn't publicly detailed its exact methodology for arriving at the 1050% figure, the concern centers around several key areas:

- Higher licensing fees for VMware software: The acquisition could lead to significantly increased licensing costs for AT&T's existing VMware deployments, impacting their operational budget.

- Increased network infrastructure costs: Integrating Broadcom's technologies with VMware's could necessitate substantial upgrades to AT&T's network infrastructure, further adding to expenses.

- Potential for reduced competition and market control: A combined Broadcom and VMware could lead to reduced competition, potentially granting them significant market power to dictate pricing.

- Impact on AT&T's overall budget and profitability: The cumulative effect of these increased costs could severely impact AT&T's profitability and potentially force price increases for consumers. This could trigger a domino effect across the entire telecom sector.

Broadcom's Response and Market Analysis

Broadcom has countered AT&T's claims, arguing that the acquisition will ultimately benefit customers through innovation and efficiencies. They emphasize the integration of their semiconductor and software technologies, promising enhanced performance and cost savings in the long run. However, independent analysts remain divided.

- Broadcom's justifications for the acquisition: Focus on synergistic benefits, improved product offerings, and expansion into new markets.

- Projected benefits for Broadcom and VMware customers: Claims of enhanced performance, improved security, and streamlined operations.

- Independent analyst opinions on the potential impact: Some analysts echo AT&T's concerns, while others express optimism about the potential for positive market effects.

- Examination of existing antitrust concerns: The merger is under intense regulatory scrutiny, with concerns about potential monopolistic practices and reduced competition.

Implications for Consumers and the Telecom Industry

The potential consequences for consumers are significant. Increased costs for telecom providers like AT&T will likely translate into higher prices for services like internet and phone plans. This impact will likely be felt most acutely by small businesses that rely on VMware infrastructure for their operations.

- Potential price hikes for internet and phone services: Consumers could face higher monthly bills for essential telecom services.

- Impact on small businesses relying on VMware infrastructure: Small and medium-sized enterprises could be disproportionately affected by increased VMware licensing and support costs.

- Possible changes in service offerings by telecom providers: Providers may respond by reducing service offerings or implementing data caps to mitigate the impact of increased costs.

- Long-term consequences for technological innovation: Reduced competition could stifle innovation in the telecom and broader technology sectors.

Regulatory Scrutiny and Potential Antitrust Issues

The Broadcom-VMware deal is under intense scrutiny from regulatory bodies worldwide, including the FTC in the US and the EU Commission. Concerns center on potential anti-competitive practices and the creation of a dominant player in the market.

- Potential for regulatory intervention or blocking of the merger: Regulatory bodies could impose conditions on the deal or even block it altogether.

- Timeline for regulatory approvals or rejections: The regulatory review process is ongoing, and the outcome remains uncertain.

- Impact of potential legal challenges: Legal challenges could further delay or even prevent the completion of the acquisition.

Conclusion: The Fallout from the Broadcom-VMware Deal: Understanding the Cost Implications

AT&T's projection of a 1050% cost increase due to the Broadcom-VMware acquisition is a serious warning sign for the telecom industry. The potential consequences are far-reaching, affecting consumers through higher prices and impacting businesses through increased operational costs. The regulatory scrutiny and potential antitrust issues add further complexity to the situation. Further research is needed to fully understand the long-term implications of this merger. Stay informed about developments related to the Broadcom-VMware acquisition and its effect on telecom costs to protect your interests.

Featured Posts

-

Sabrina Carpenter Fortnite Skin Confirmed Date And Time

May 02, 2025

Sabrina Carpenter Fortnite Skin Confirmed Date And Time

May 02, 2025 -

Christina Aguileras Latest Photoshoot A Controversy Over Digital Alterations

May 02, 2025

Christina Aguileras Latest Photoshoot A Controversy Over Digital Alterations

May 02, 2025 -

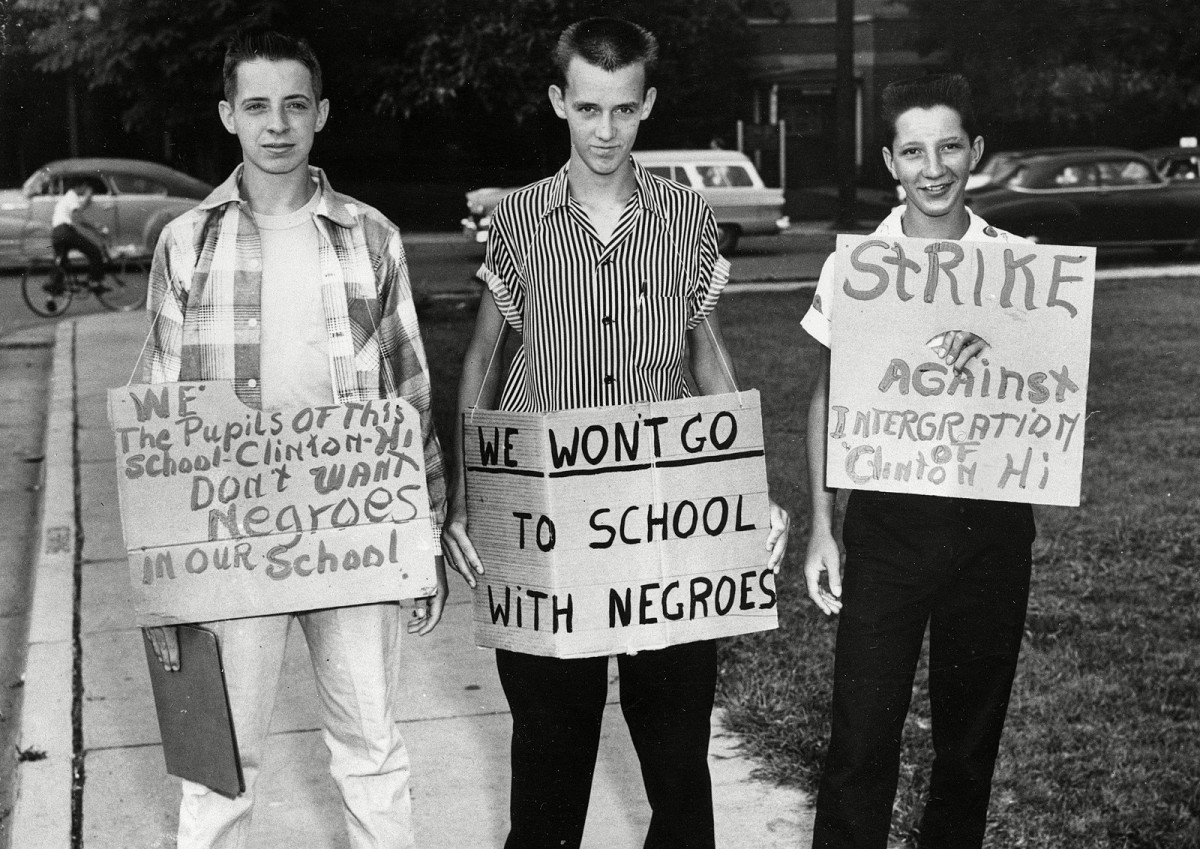

School Desegregation The End Of An Era Analysis Of Dojs Decision

May 02, 2025

School Desegregation The End Of An Era Analysis Of Dojs Decision

May 02, 2025 -

Kampen Dagvaardt Enexis Probleem Met Stroomnetaansluiting Leidt Tot Kort Geding

May 02, 2025

Kampen Dagvaardt Enexis Probleem Met Stroomnetaansluiting Leidt Tot Kort Geding

May 02, 2025 -

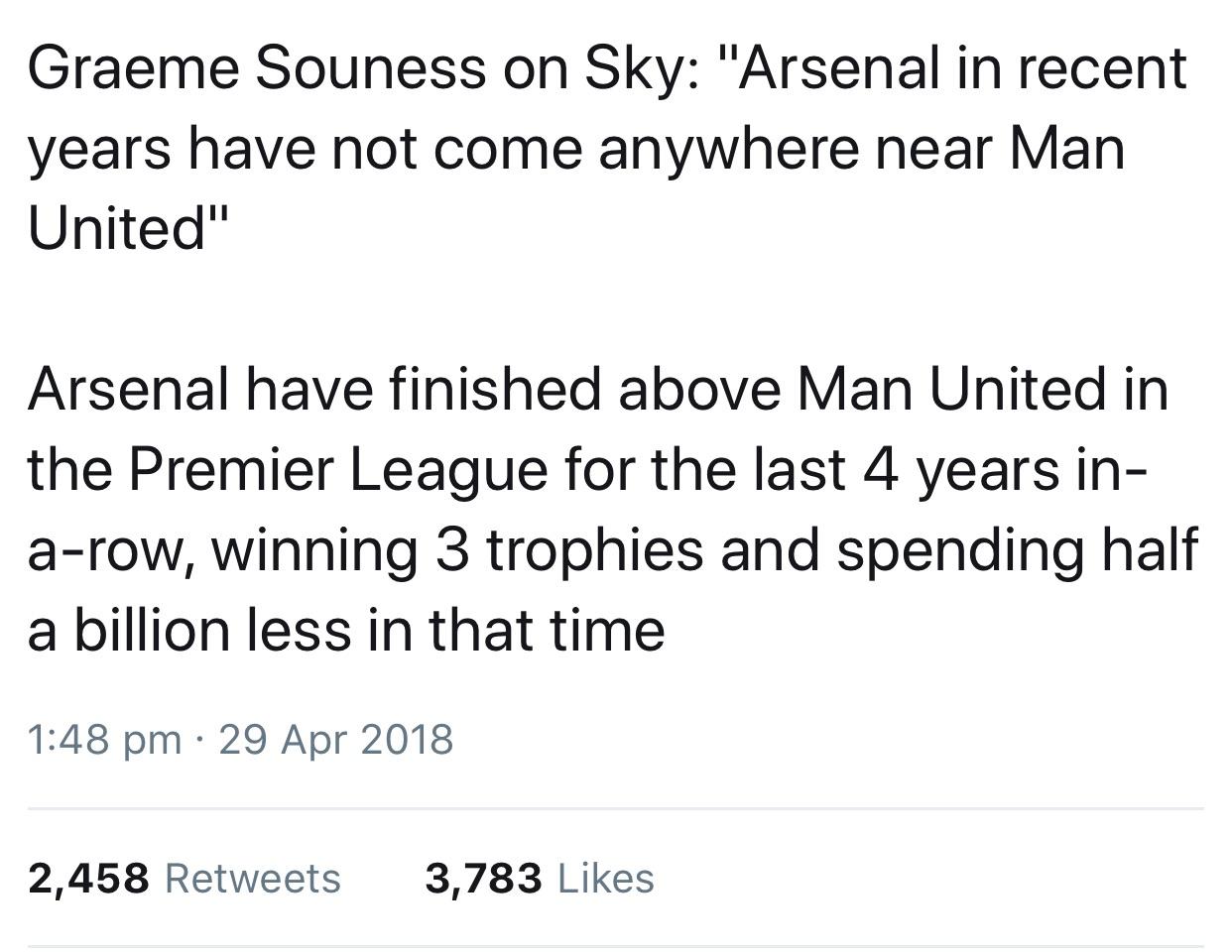

Graeme Souness The Arsenal Costly Role Revealed

May 02, 2025

Graeme Souness The Arsenal Costly Role Revealed

May 02, 2025