Attracting Canadian Private Investment: CAAT Pension Plan's Active Approach

Table of Contents

CAAT's Diversified Investment Portfolio in Canada

CAAT doesn't rely on a single asset class for its Canadian investment portfolio. Instead, it employs a strategic asset allocation across various sectors of the Canadian private market, mitigating risk and maximizing returns. This diversification strategy is a cornerstone of their success in attracting Canadian private investment.

- Significant holdings in Canadian private equity: CAAT has substantial investments in diverse private equity opportunities, including promising technology startups and crucial infrastructure projects. This broad approach allows them to capitalize on growth across various economic sectors.

- Substantial investments in Canadian real estate: Their portfolio includes a mix of residential and commercial real estate, providing a stable and relatively predictable income stream while also benefiting from long-term property value appreciation. This contributes significantly to their overall Canadian investment strategy.

- Exposure to Canadian infrastructure projects: CAAT actively invests in projects vital to Canada's future, such as renewable energy initiatives and transportation networks. These investments provide both financial returns and contribute to the country's sustainable development.

- Strategic partnerships with Canadian private investment firms: CAAT doesn't operate in isolation. They cultivate strategic alliances with established Canadian private investment firms, leveraging their expertise and networks to identify and secure top-tier investment opportunities.

Active Management and Due Diligence

CAAT's success in attracting Canadian private investment isn't accidental. It's a direct result of their commitment to active investment management and a rigorous due diligence process. This proactive approach allows them to identify and mitigate risks while maximizing the potential for strong returns.

- In-house expertise in various asset classes: CAAT employs specialized teams with deep expertise in private equity, real estate, infrastructure, and other asset classes relevant to the Canadian market. This ensures comprehensive analysis of every potential investment.

- Robust due diligence framework for evaluating risks and opportunities: Their comprehensive due diligence process involves thorough financial modeling, risk assessment, and market analysis. No stone is left unturned in their pursuit of secure and profitable Canadian investment opportunities.

- Regular portfolio reviews and performance analysis: CAAT consistently monitors its investments, conducting regular reviews and performance analyses. This allows for timely adjustments to the portfolio based on market conditions and emerging trends.

- Proactive engagement with portfolio companies: CAAT doesn't simply invest and walk away. They actively engage with portfolio companies, providing strategic guidance and support to enhance performance and drive value creation.

Strategic Partnerships and Deal Sourcing

Access to high-quality investment opportunities is crucial for success in the competitive Canadian private investment market. CAAT excels in this area through its strategic partnerships and robust deal-sourcing capabilities.

- Collaboration with established private equity firms: CAAT's network of partnerships with leading Canadian private equity firms provides access to exclusive deal flow, giving them a significant advantage over other investors.

- Networking with key industry players and advisors: They maintain strong relationships with key industry experts and advisors, providing invaluable insights and early access to promising investment prospects. This extensive Canadian investment network is a key differentiator.

- Participation in industry conferences and events: CAAT actively participates in industry conferences and events, fostering relationships and expanding their network. This enhances their deal-sourcing capabilities and keeps them abreast of emerging trends.

- Development of strong relationships with government agencies: Building strong relationships with relevant government agencies provides access to information and opportunities related to public-private partnerships and other government-backed initiatives within the Canadian private investment sector.

Focus on ESG (Environmental, Social, and Governance) Factors

CAAT integrates ESG considerations into its investment process, aligning its investment strategy with its responsible investment goals. This commitment to sustainable investing attracts investors who share their values and contributes to the long-term sustainability of their portfolio.

- Incorporation of ESG factors in due diligence: ESG factors are explicitly considered during the due diligence process, ensuring that investments align with CAAT’s values and contribute positively to society and the environment.

- Engagement with portfolio companies on ESG performance: CAAT actively engages with portfolio companies to encourage and monitor their ESG performance. This approach aims to drive positive change within the companies they invest in.

- Investment in companies with strong ESG profiles: CAAT prioritizes investments in companies demonstrating strong ESG performance, reflecting their commitment to responsible and sustainable investment practices in the Canadian market.

- Reporting on ESG performance to stakeholders: CAAT transparently reports on its ESG performance to stakeholders, demonstrating their accountability and commitment to responsible investing.

Conclusion

CAAT Pension Plan's success in attracting Canadian private investment is a testament to its well-defined and effectively implemented strategy. Their diversified portfolio, active management approach, strategic partnerships, and strong focus on ESG factors create a winning combination. This proactive strategy not only secures strong returns but also contributes to the sustainable growth of the Canadian economy.

Learn more about successful strategies for attracting Canadian private investment by examining CAAT's approach and adapting key elements to your own investment strategy. Consider diversifying your portfolio across various Canadian asset classes and employing a rigorous due diligence process, incorporating ESG factors, to secure strong and responsible returns in the dynamic Canadian private investment market. Investing in Canadian private markets requires a proactive, well-informed approach—learn from the best.

Featured Posts

-

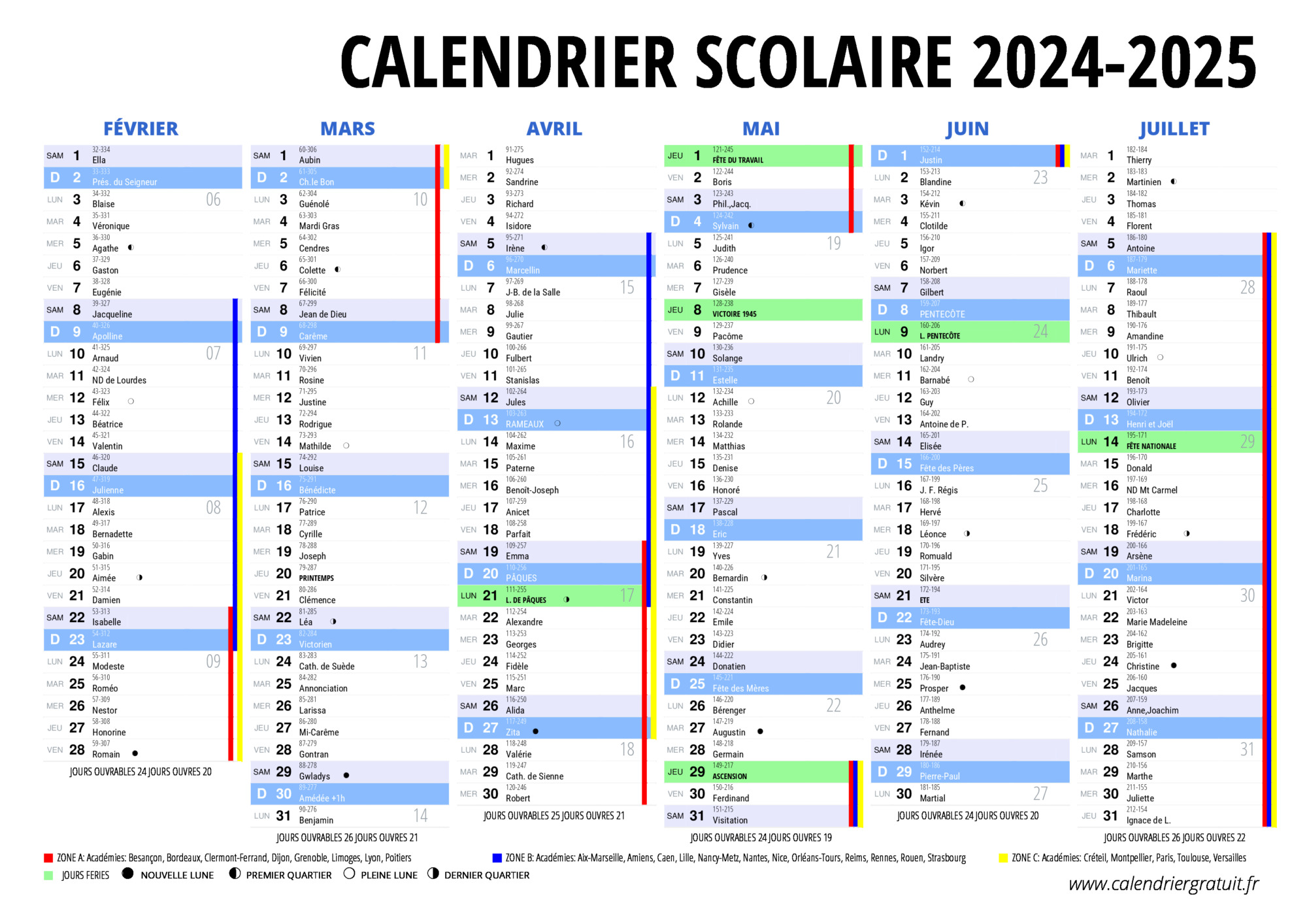

Planification Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025

Planification Vacances Scolaires 2025 Federation Wallonie Bruxelles

Apr 23, 2025 -

Jangan Lewatkan Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025

Jangan Lewatkan Program Tv Spesial Ramadan 2025 Untuk Menemani Buka Dan Sahur

Apr 23, 2025 -

Yankees Record Breaking Night Judges Triple And Teams 9 Home Runs

Apr 23, 2025

Yankees Record Breaking Night Judges Triple And Teams 9 Home Runs

Apr 23, 2025 -

Nestor Cortes Strong Performance Leads Brewers To Victory Over Reds

Apr 23, 2025

Nestor Cortes Strong Performance Leads Brewers To Victory Over Reds

Apr 23, 2025 -

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Ramalan Dan Pertimbangan Primbon Jawa

Apr 23, 2025

Kecocokan Jodoh Weton Senin Legi Dan Rabu Pon Ramalan Dan Pertimbangan Primbon Jawa

Apr 23, 2025