Aussie Dollar Outperforms Kiwi: Option Traders' Insights

Table of Contents

Understanding the AUD/NZD Exchange Rate Dynamics

Recent Market Movements and Volatility

The AUD/NZD exchange rate has witnessed significant volatility in recent months, with the Australian dollar consistently outperforming its New Zealand counterpart. This sustained strength is evident in the charts below (insert relevant chart/graph illustrating AUD/NZD performance). Several factors contribute to this volatility, including:

- Interest Rate Differentials: Discrepancies between the Reserve Bank of Australia's (RBA) and the Reserve Bank of New Zealand's (RBNZ) monetary policy stances significantly impact the AUD/NZD exchange rate. Higher interest rates in Australia generally attract foreign investment, boosting demand for the AUD.

- Economic Data Releases: Key economic indicators, such as inflation figures, employment data, and GDP growth, released by both countries play a crucial role. Positive economic news for Australia and negative news for New Zealand can strengthen the AUD against the NZD. For example, stronger-than-expected inflation figures in Australia might lead to expectations of higher interest rates, benefiting the AUD.

Fundamental Factors Driving the Aussie Dollar's Strength

The Aussie dollar's robust performance stems from several fundamental factors:

- Stronger Australian Economy: Compared to New Zealand, Australia's economy often demonstrates greater resilience, leading to increased investor confidence and higher demand for the AUD.

- Higher Commodity Prices: Australia's economy heavily relies on commodity exports, making it highly sensitive to global commodity prices. Rising prices for resources like iron ore and coal benefit the Australian economy and strengthen the AUD.

- Monetary Policy Divergence: Differences in the monetary policy approaches of the RBA and the RBNZ directly influence the AUD/NZD exchange rate. A more hawkish stance by the RBA (suggesting higher interest rates) compared to a more dovish RBNZ (suggesting lower rates) strengthens the AUD.

Analyzing the New Zealand Dollar's Weakness

The underperformance of the New Zealand dollar is attributed to several factors:

- Economic Slowdown: New Zealand's economy has experienced a relative slowdown compared to Australia, impacting investor sentiment and weakening the NZD.

- Global Economic Uncertainty: New Zealand's export-oriented economy is highly sensitive to global economic conditions. Periods of global uncertainty tend to negatively impact the NZD.

- Interest Rate Expectations: Lower interest rate expectations in New Zealand compared to Australia decrease the attractiveness of the NZD to investors.

Option Traders' Perspectives on AUD/NZD

Implied Volatility and Option Pricing

Option prices in the AUD/NZD market reflect traders' expectations regarding future price volatility. Implied volatility, a key metric derived from option prices, indicates the market's assessment of future price swings. Higher implied volatility suggests greater uncertainty and usually results in higher option premiums. Analyzing the price of AUD/NZD options (both puts and calls), and studying the skew and term structure of volatility, offers valuable insights into market sentiment and expected future movements.

Popular Trading Strategies

Option traders employ various strategies in the AUD/NZD market based on their outlook:

- Straddles: This strategy involves simultaneously buying a call and a put option with the same strike price and expiration date, profiting from significant price movements in either direction.

- Strangles: Similar to a straddle but with different strike prices (one call and one put option with different strike prices), this strategy is less expensive but requires a larger price movement to be profitable.

- Bull/Bear Spreads: These strategies involve buying and selling options to profit from a specific directional movement (bullish or bearish) in the AUD/NZD exchange rate, limiting risk while maximizing potential profit within a defined range.

Risk Management Considerations

Effective risk management is paramount in option trading. Strategies to mitigate potential losses include:

- Stop-Loss Orders: These orders automatically close a position when the price reaches a predetermined level, limiting potential losses.

- Position Sizing: Carefully determining the appropriate size of each trade relative to the overall trading capital is essential for managing risk.

Future Outlook for the AUD/NZD

Expert Predictions and Market Sentiment

Expert opinions and market sentiment regarding the AUD/NZD's future trajectory vary. (Insert summaries of forecasts from reputable sources). News events and economic data releases constantly influence market perception.

Potential Catalysts for Change

Several upcoming events could significantly impact the AUD/NZD exchange rate:

- Upcoming Economic Data Releases: Key economic indicators from both Australia and New Zealand can trigger significant price movements.

- Central Bank Announcements: Announcements by the RBA and the RBNZ regarding interest rate decisions or monetary policy shifts are major catalysts for AUD/NZD volatility.

- Geopolitical Events: Global geopolitical events can influence investor sentiment and consequently affect the AUD/NZD exchange rate.

Conclusion: Capitalizing on the Aussie Dollar's Outperformance

The Aussie dollar's current strength against the Kiwi reflects a confluence of fundamental and technical factors, as observed by option traders. Understanding these factors, including interest rate differentials, economic data, and market sentiment, is crucial for navigating this dynamic market. Remember that thorough research and robust risk management strategies are paramount for success in forex trading, particularly when dealing with options. Stay informed about future movements in the Aussie dollar and kiwi exchange rate and leverage these insights to develop a successful AUD/NZD trading strategy. Learn more about forex option trading today!

Featured Posts

-

Post Engagement Rihanna Shines In Cherry Red Heels And Cool Confidence

May 06, 2025

Post Engagement Rihanna Shines In Cherry Red Heels And Cool Confidence

May 06, 2025 -

The Ross Family Dynasty Tracee Ellis Ross And Her Hollywood Heritage

May 06, 2025

The Ross Family Dynasty Tracee Ellis Ross And Her Hollywood Heritage

May 06, 2025 -

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

May 06, 2025

Technical Glitch Forces Blue Origin To Postpone Rocket Launch

May 06, 2025 -

Get Sabrina Carpenters Dance Moves In Fortnite

May 06, 2025

Get Sabrina Carpenters Dance Moves In Fortnite

May 06, 2025 -

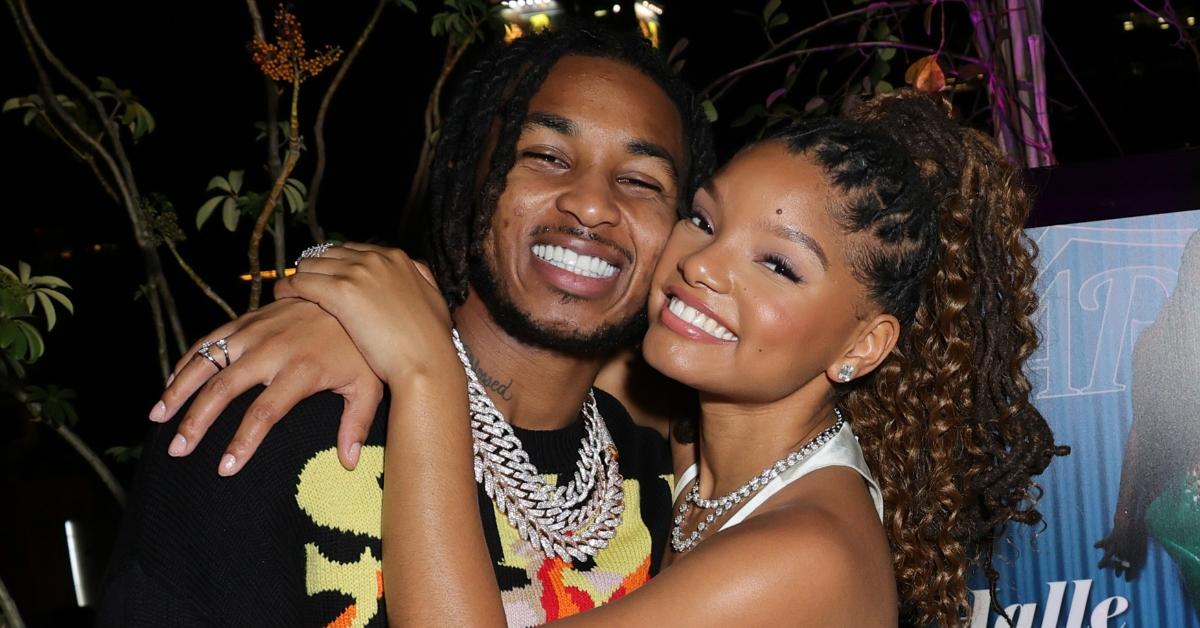

Controversy Surrounding Ddgs New Diss Track Against Halle Bailey

May 06, 2025

Controversy Surrounding Ddgs New Diss Track Against Halle Bailey

May 06, 2025