Avoid Unforced Errors: Warren Buffett's Leadership Strategies For Success

Table of Contents

H2: Long-Term Vision & Patient Investment

Warren Buffett's legendary success isn't built on overnight gains; it's a testament to his unwavering commitment to long-term value creation. Unlike many who chase fleeting market trends, Buffett champions a patient investment approach, prioritizing fundamental analysis and intrinsic value over short-term market fluctuations.

H3: Resisting Short-Term Pressures

- Focus on fundamental analysis: Buffett meticulously analyzes the underlying strengths and potential of a company, disregarding short-term market noise. He looks for businesses with strong competitive advantages and durable economic moats.

- Prioritizing long-term value: His investment horizon spans decades, enabling him to weather market storms and capitalize on long-term growth opportunities. Short-term gains are secondary to sustainable, long-term value.

- Delayed gratification: Buffett's philosophy embodies the principle of delayed gratification, preferring to wait for the right opportunity rather than rushing into ill-considered decisions. This patience is a cornerstone of his investment strategy and his leadership style.

H3: Understanding Your Circle of Competence

Buffett famously advocates for focusing on areas where one possesses genuine expertise. This concept, often referred to as one's "circle of competence," emphasizes the importance of specialization and the dangers of overextension.

- Stick to what you know: Buffett's investments predominantly lie within industries he understands thoroughly, minimizing the risk of making uninformed decisions.

- Avoiding unfamiliar territories: He's consistently avoided ventures outside his area of expertise, recognizing the inherent risks of operating in unfamiliar landscapes.

- The power of saying "no": Knowing what you don't know is as crucial as knowing what you do know. Buffett is adept at recognizing and avoiding ventures beyond his comprehension.

H2: The Power of Integrity and Ethical Decision-Making

Warren Buffett's reputation for integrity is as valuable as his investment acumen. His ethical approach permeates every aspect of Berkshire Hathaway's operations, fostering trust and minimizing reputational risks, a key component of effective leadership strategies.

H3: Building Trust and Reputation

- Transparency and honesty: Buffett's commitment to transparency ensures open communication with stakeholders, building lasting trust and fostering strong relationships.

- Aversion to deceptive practices: He operates with unwavering ethical standards, rejecting short cuts and prioritizing long-term reputation over short-term gains.

- Ethical conduct as a competitive advantage: Building a reputation for integrity provides a significant competitive advantage, attracting top talent and securing loyalty from investors and partners.

H3: Surrounding Yourself with Talented Individuals

Buffett emphasizes the importance of assembling a high-performing team, recognizing that effective leadership involves delegating tasks to competent individuals. He doesn't try to do everything himself.

- Talent acquisition: Berkshire Hathaway's success stems from its ability to attract and retain top-tier talent, empowering individuals to contribute their unique expertise.

- Empowering employees: Buffett fosters a culture of trust and empowerment, enabling his team to make informed decisions and take ownership of their work.

- The value of teamwork: His leadership style emphasizes collaborative efforts, harnessing the collective intelligence and diverse perspectives of his team.

H2: Meticulous Research and Data-Driven Decisions

Buffett's success is deeply rooted in his meticulous research process and his commitment to making data-driven decisions, a cornerstone of his leadership strategies. He doesn't rely on gut feelings; he relies on facts.

H3: Fundamental Analysis and Value Investing

- Due diligence: He rigorously researches potential investments, poring over financial statements and understanding the company's business model before making a commitment.

- Focus on intrinsic value: Buffett identifies companies that are undervalued relative to their intrinsic worth, focusing on long-term growth potential.

- Long-term investment horizon: Patience and a long-term perspective allow him to weather short-term market volatility and realize the full potential of his investments.

H3: Risk Assessment and Mitigation

- Proactive risk management: Buffett actively identifies and assesses potential risks, developing mitigation strategies to minimize exposure to unforeseen challenges.

- Diversification: While focusing on long-term value, he also practices diversification, spreading investments across various industries and sectors to manage overall portfolio risk.

- Contingency planning: Berkshire Hathaway maintains robust contingency plans, enabling the company to adapt to changing circumstances and overcome unexpected hurdles.

3. Conclusion

Warren Buffett's remarkable success isn't a matter of luck; it's the direct result of applying consistent and effective leadership strategies. His emphasis on long-term vision, unwavering integrity, and meticulous research form the pillars of his approach, minimizing costly errors and creating sustainable growth. By incorporating elements of Warren Buffett's leadership strategies into your own approach, you can significantly reduce unforced errors and pave the way for sustainable success. Embrace the principles of patience, ethical conduct, and data-driven decision-making to unlock your own potential for lasting achievement and build a legacy of success.

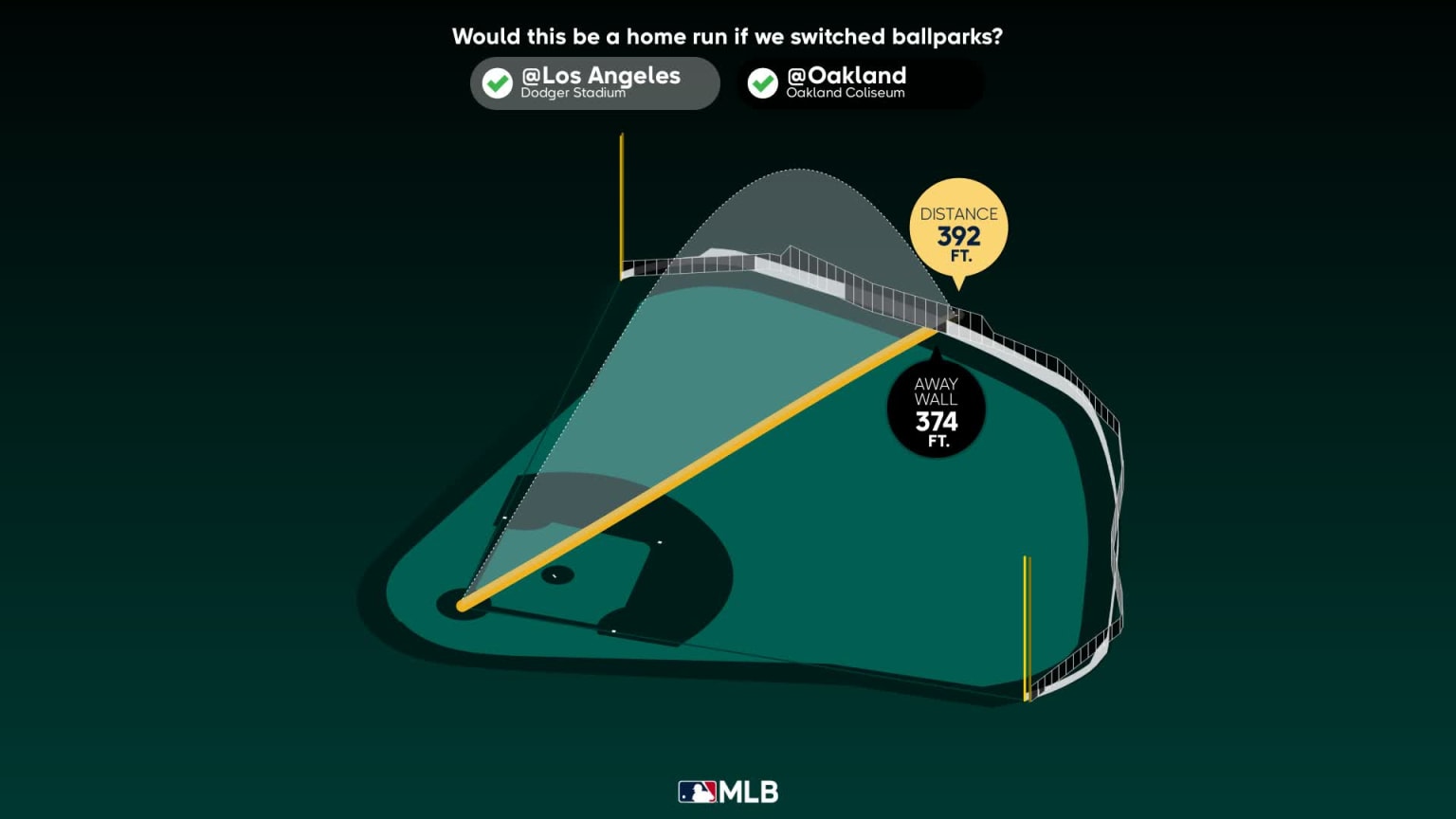

Athletics Defeat Mariners Behind Langeliers Home Run

Athletics Defeat Mariners Behind Langeliers Home Run

Steelers Face Losing George Pickens Before 2026 Insider Report

Steelers Face Losing George Pickens Before 2026 Insider Report

Nowa Ksiazka O Konklawe Premiera W Warszawie

Nowa Ksiazka O Konklawe Premiera W Warszawie

March 14th Nba Game Cavaliers Vs Grizzlies Injury Report And Analysis

March 14th Nba Game Cavaliers Vs Grizzlies Injury Report And Analysis

Federal Investigation Crook Made Millions From Office365 Breach

Federal Investigation Crook Made Millions From Office365 Breach