Bajaj Twins Drag On Indian Stock Market: Sensex, Nifty 50 End Unchanged

Table of Contents

Bajaj Auto's Performance and its Market Impact

Bajaj Auto, a significant component of the Sensex and Nifty 50, reported disappointing financial results for the quarter. The company's sales figures fell short of analyst predictions, primarily due to [cite specific reasons, e.g., weaker-than-expected two-wheeler sales, increased competition, supply chain disruptions]. Profit margins also experienced a contraction, further dampening investor enthusiasm. This decline directly impacted the overall market indices. Bajaj Auto's considerable weight within these indices means even a slight dip in its stock price can have a ripple effect, contributing significantly to the overall stagnation.

- Sales figures: Reported a [percentage]% decrease in two-wheeler sales compared to the previous quarter.

- Profit margin: Contracted by [percentage]%, driven by [mention specific factors like increased raw material costs].

- Index impact: Bajaj Auto's decline contributed to an estimated [percentage]% downward pressure on the Sensex and Nifty 50.

- Sector headwinds: The overall two-wheeler segment faced challenges due to [mention relevant factors like increased fuel prices, economic slowdown].

Bajaj Finance's Influence on Market Sentiment

Bajaj Finance, another heavyweight in the market, also exhibited weaker-than-expected performance. While the company remains a strong player in the financial sector, several factors contributed to its stock price decline. [Mention specific factors, e.g., rising interest rates impacting loan demand, potential regulatory changes affecting lending practices]. The subdued performance of Bajaj Finance further dampened investor confidence, contributing to the overall market inertia. The correlation between Bajaj Finance's performance and overall market sentiment is strong, with any negative news impacting investor confidence across the board.

- Key financial metrics: [Mention specific metrics like net interest margins, asset quality, loan growth].

- Macro-economic impact: Rising interest rates and inflation negatively impacted consumer spending and loan demand.

- Analyst predictions: Several analysts revised their ratings for Bajaj Finance, citing concerns about [mention specific concerns].

Overall Market Reaction and Investor Sentiment

The underperformance of the Bajaj twins resulted in a muted market reaction, characterized by low trading volumes and cautious investor sentiment. While some sectors showed resilience, the overall market mood was one of uncertainty. Global factors also played a role, with [mention specific global events like geopolitical instability or international market fluctuations] influencing investor decisions. Comparing this situation to past market downturns reveals [mention similarities and differences].

- Trading volumes: Sensex and Nifty 50 experienced [percentage]% lower trading volumes compared to the previous session.

- Expert opinions: Market analysts expressed concerns about the short-term outlook, citing the Bajaj twins' performance and broader economic uncertainties.

- Comparison to previous downturns: [Explain similarities and differences to previous market corrections].

Alternative Explanations for Market Stagnation

While the Bajaj twins played a significant role, other factors also contributed to the market's stagnation. Global market trends, including [mention specific global factors], influenced investor sentiment. Economic indicators, such as [mention relevant data points like inflation figures or GDP growth forecasts], also played a part. Additionally, news related to other significant companies or sectors might have contributed to the overall market neutrality.

- Global factors: [Mention specific international events or economic indicators that influenced the Indian market].

- Other corporate news: News regarding [mention other significant corporate events] could have had a subtle impact on market sentiment.

- Economic data points: [Mention relevant economic data that influenced market behavior].

Conclusion: Bajaj Twins and the Indian Stock Market – A Cautious Outlook

The unchanged closing of the Sensex and Nifty 50 can be largely attributed to the disappointing performance of the Bajaj twins, Bajaj Auto and Bajaj Finance. Their underperformance, coupled with global uncertainties and other economic factors, resulted in a cautious market response and low trading volumes. The short-term outlook remains uncertain, with the performance of the Bajaj twins and broader economic indicators continuing to influence market sentiment. Staying informed about the performance of the "Bajaj Twins" and other key market indicators is crucial for making informed investment decisions. We recommend further research into the latest financial reports of Bajaj Auto and Bajaj Finance, as well as continuous monitoring of Indian stock market analysis to navigate this dynamic environment effectively.

Featured Posts

-

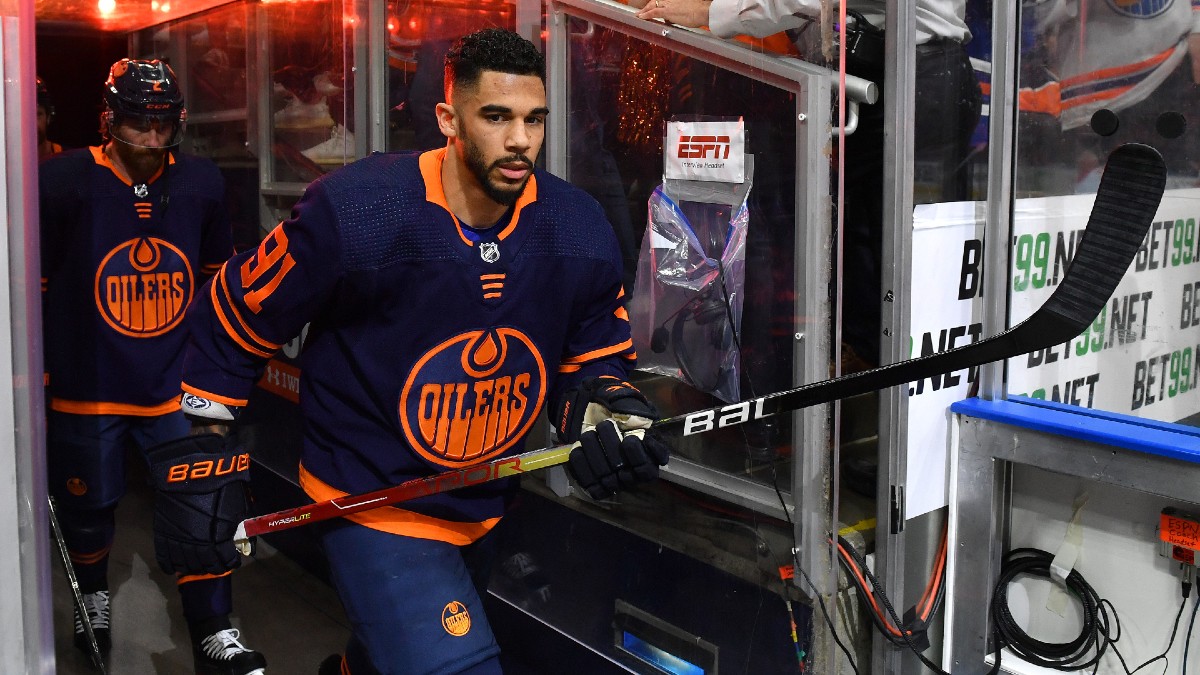

Betting On The Oilers Kings Series Expert Predictions And Odds Breakdown

May 09, 2025

Betting On The Oilers Kings Series Expert Predictions And Odds Breakdown

May 09, 2025 -

Charges Filed Against Woman Claiming To Be Madeleine Mc Cann Stalking Allegations

May 09, 2025

Charges Filed Against Woman Claiming To Be Madeleine Mc Cann Stalking Allegations

May 09, 2025 -

Uk Visa Restrictions Report On Potential Nationality Limits

May 09, 2025

Uk Visa Restrictions Report On Potential Nationality Limits

May 09, 2025 -

Macron Confirms France And Poland To Sign Friendship Treaty In Month

May 09, 2025

Macron Confirms France And Poland To Sign Friendship Treaty In Month

May 09, 2025 -

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Employees

May 09, 2025

Serious Data Breach Nottingham Attack Victim Records Accessed By 90 Nhs Employees

May 09, 2025