Bank Of Canada Rate Cut Odds Diminish On Strong Retail Sales

Table of Contents

Robust Retail Sales Fuel Rate Hike Speculation

A recent surge in retail sales has fueled speculation about a potential rate hike instead of a cut. This unexpected jump signifies robust consumer spending and points towards a healthier-than-expected economic climate. The implications are significant for the Bank of Canada's monetary policy decisions.

- Retail sales increased by 2.5% in July (example percentage – replace with actual data when available), exceeding analysts' predictions.

- Key sectors driving this growth include automobiles, durable goods, and furniture, indicating strong consumer confidence.

- This robust spending translates to increased economic activity and growth, putting upward pressure on inflation.

Strong retail sales are a clear indicator of consumer confidence and economic resilience. This makes a Bank of Canada rate cut less likely, as the central bank aims to manage inflationary pressures without triggering an economic downturn. The current economic strength reduces the urgency for stimulating the economy through interest rate reductions. Concerns about overheating are now becoming more prominent in the discussion around future interest rate decisions.

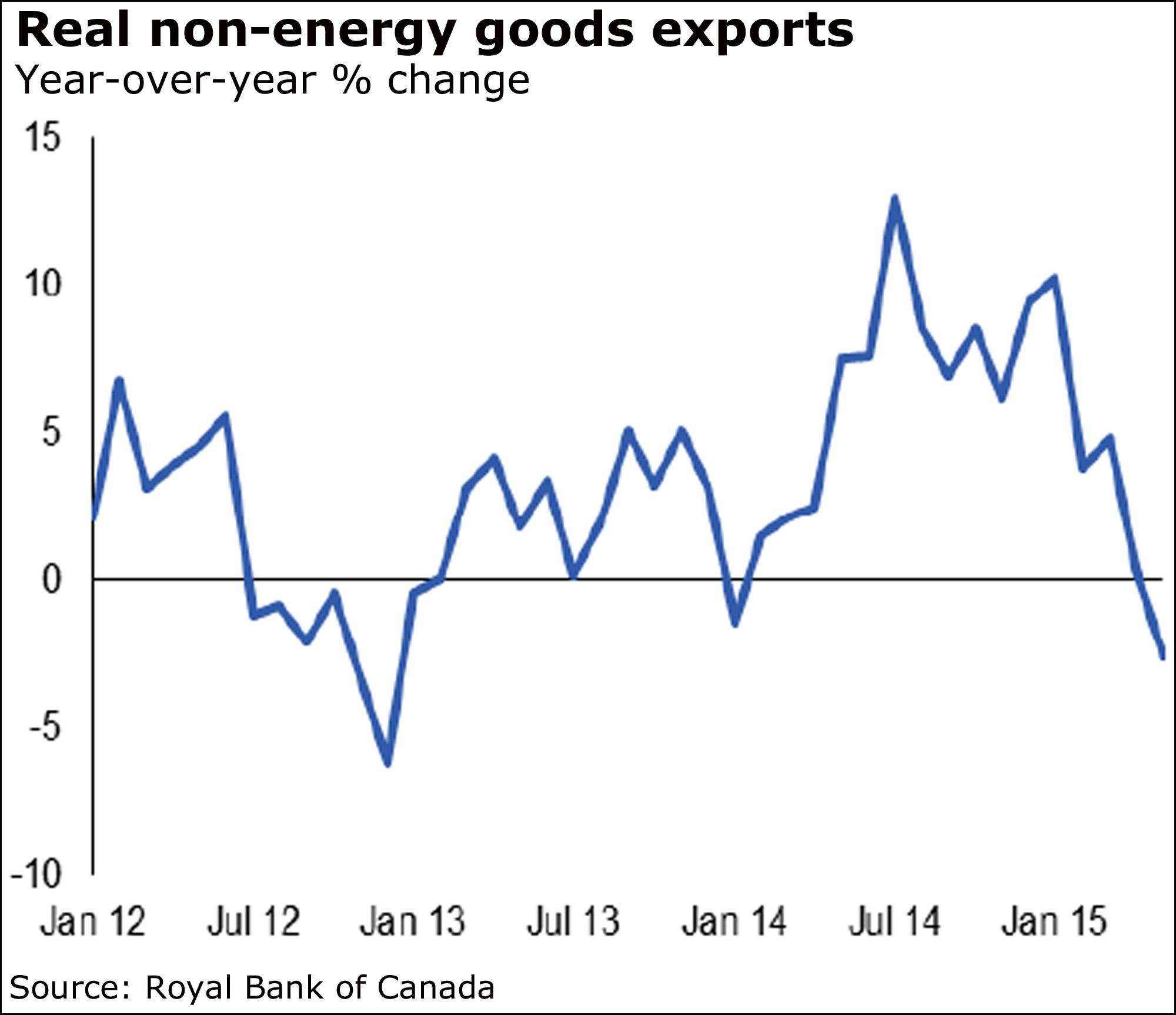

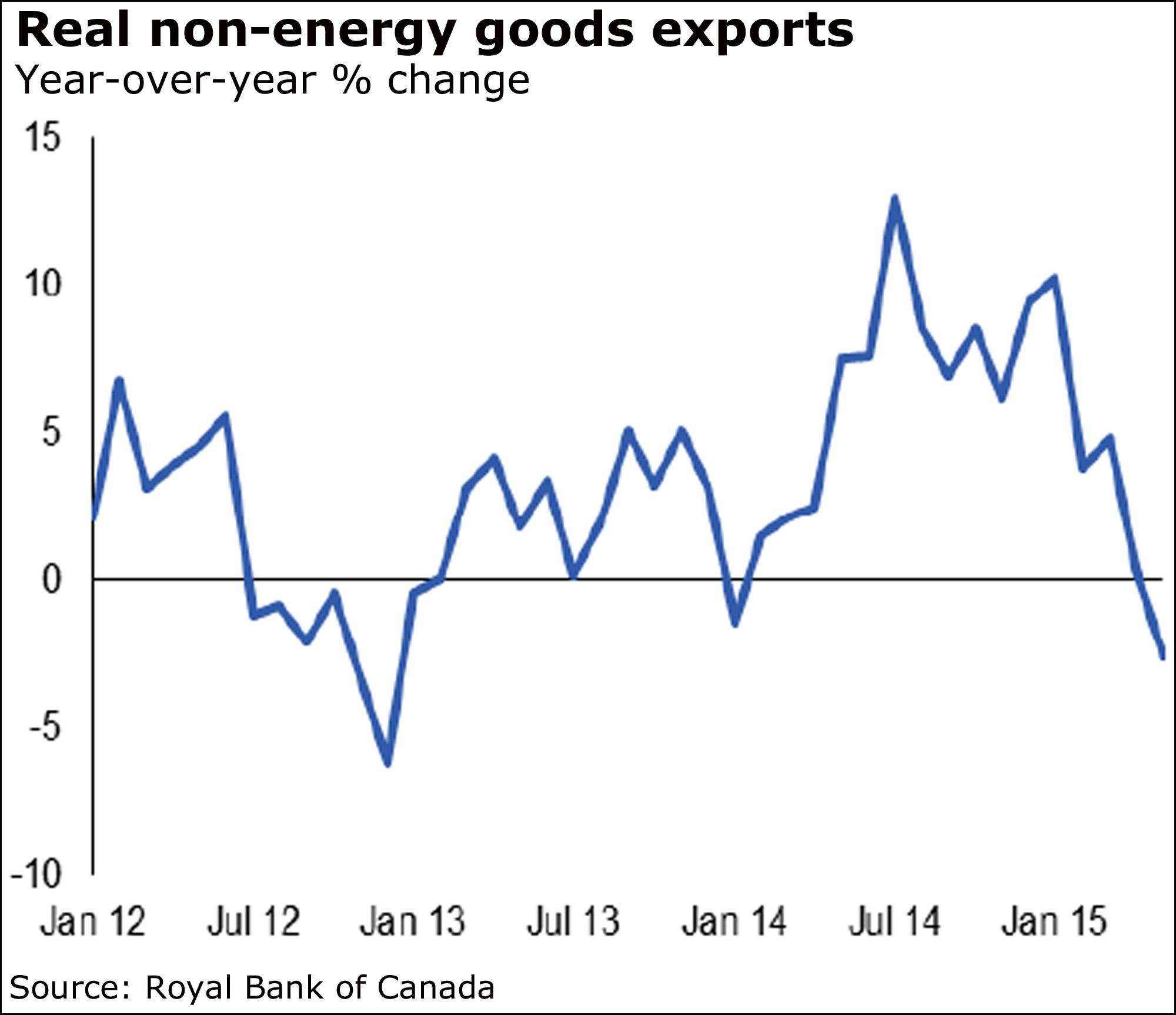

Inflation Remains a Key Concern for the Bank of Canada

Persistent inflationary pressures remain a major concern for the Bank of Canada, significantly impacting its monetary policy decisions. While recent data shows some signs of moderation, inflation remains above the central bank's target range.

- The current inflation rate is [Insert Current Inflation Rate] (replace with actual data), significantly higher than the Bank of Canada's target of 2%.

- Core inflation, which excludes more volatile components like energy and food, also remains elevated.

- Contributing factors to persistent inflation include ongoing supply chain disruptions, elevated energy prices, and strong consumer demand.

Given these inflationary pressures, the likelihood of a Bank of Canada rate cut diminishes considerably. The Bank of Canada's primary mandate is to maintain price stability, and reducing interest rates in the face of persistent inflation would contradict this goal. The central bank is likely to prioritize inflation control, even at the potential cost of slower economic growth.

Impact on Bond Yields and the Canadian Dollar

Diminished expectations of a Bank of Canada rate cut have had a noticeable impact on bond yields and the Canadian dollar. The shift in market sentiment has directly affected these key financial indicators.

- Bond yields have increased following the release of the strong retail sales data.

- This reflects the inverse relationship between bond yields and interest rates: as interest rates are expected to remain higher or even rise, bond yields increase to reflect this.

- The Canadian dollar has shown signs of strengthening against other major currencies, indicating increased investor confidence in the Canadian economy.

These changes reflect investor sentiment and their expectations regarding future monetary policy. The market is now pricing in a lower probability of a rate cut, resulting in adjustments to bond yields and the exchange rate. This reinforces the view that a Bank of Canada rate cut is becoming increasingly less probable in the near term.

Alternative Monetary Policy Tools

If a Bank of Canada rate cut is deemed inappropriate, the central bank has other tools at its disposal to manage the economy. These include:

- Quantitative easing (QE): This involves the Bank of Canada purchasing government bonds to increase the money supply and lower long-term interest rates.

- Forward guidance: This involves the Bank of Canada communicating its intentions regarding future monetary policy to influence market expectations.

Conclusion

Several key factors contribute to the significantly diminished likelihood of a Bank of Canada rate cut. Strong retail sales figures demonstrate economic resilience, while persistent inflation pressures necessitate a cautious approach to monetary policy. These factors have impacted bond yields and the Canadian dollar, reflecting the shift in market sentiment. Understanding the nuances of Bank of Canada rate cut predictions is crucial for navigating the Canadian economic climate.

Call to Action: Stay informed about the evolving economic landscape and the Bank of Canada's monetary policy decisions. Regularly check for updates on Bank of Canada rate cut odds and related economic news to make informed financial decisions. Monitoring the situation closely will allow you to better understand the potential impact on your investments and financial planning. Stay ahead of the curve by consistently seeking updated information on the Bank of Canada’s future interest rate decisions and their implications.

Featured Posts

-

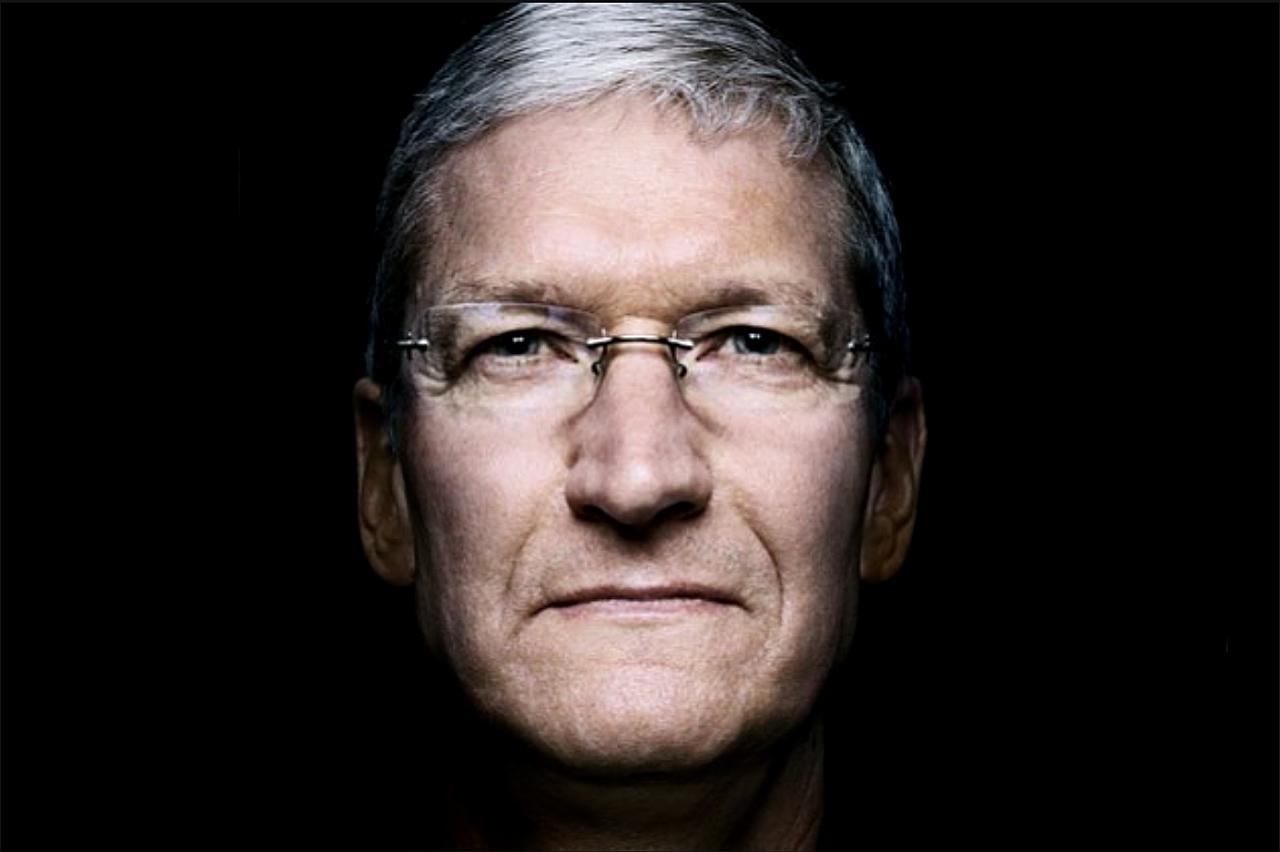

Apples Ceo Faces Headwinds Examining Tim Cooks Recent Struggles

May 25, 2025

Apples Ceo Faces Headwinds Examining Tim Cooks Recent Struggles

May 25, 2025 -

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

George L Russell Jr S Death Loss Of A Legal And Civil Rights Leader In Maryland

May 25, 2025

George L Russell Jr S Death Loss Of A Legal And Civil Rights Leader In Maryland

May 25, 2025 -

Chinas Zheng Qinwen Claims Semifinal Spot At Italian Open Beats Sabalenka

May 25, 2025

Chinas Zheng Qinwen Claims Semifinal Spot At Italian Open Beats Sabalenka

May 25, 2025 -

The Architects Lament How Virtue Signaling Threatens The Profession

May 25, 2025

The Architects Lament How Virtue Signaling Threatens The Profession

May 25, 2025