Bank Of Canada Rate Cuts: Economists Predict Renewed Action Amidst Tariff Job Losses

Table of Contents

Rising Unemployment and the Impact of Tariffs

The direct correlation between rising tariffs and job losses in key Canadian sectors is undeniable. The tariff impact on jobs is becoming increasingly severe, pushing the Canadian unemployment rate higher and raising concerns about the risk of an economic recession. Increased import costs, a direct result of tariffs, are reducing the competitiveness of Canadian businesses on the global stage.

- Increased import costs due to tariffs leading to reduced competitiveness: Businesses find it harder to compete with cheaper imports, leading to decreased sales and profitability.

- Layoffs and production cuts in sectors heavily reliant on trade: Industries such as manufacturing and agriculture, heavily reliant on international trade, are experiencing significant layoffs and production cuts.

- Rising consumer prices eroding purchasing power: Tariffs translate to higher prices for consumers, reducing their disposable income and impacting overall consumer spending.

- Negative impact on business investment and confidence: Uncertainty surrounding trade policies is discouraging investment and dampening business confidence, leading to further economic slowdown.

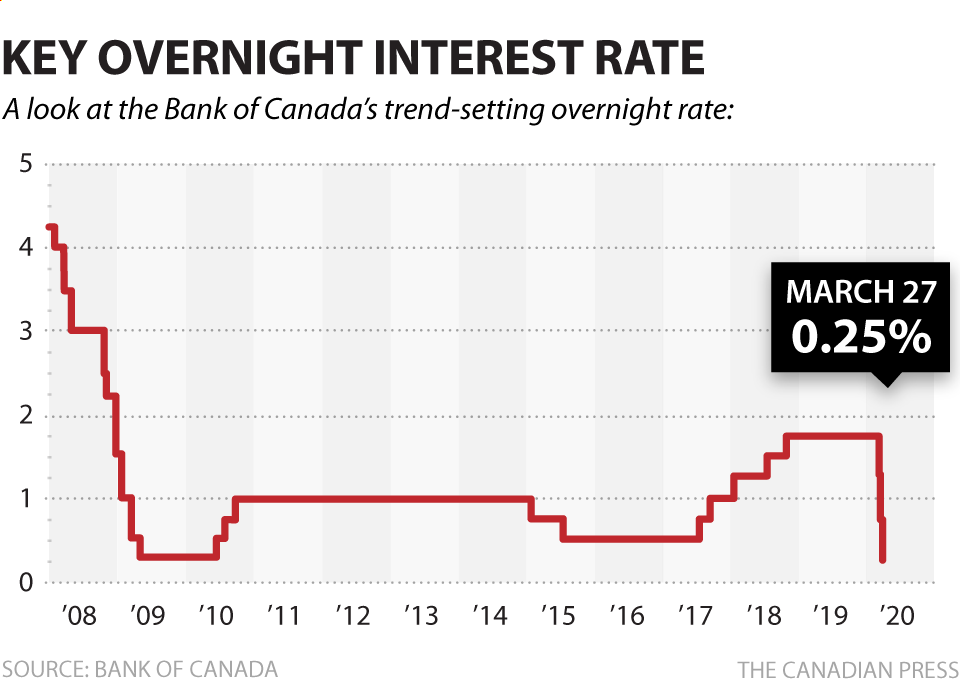

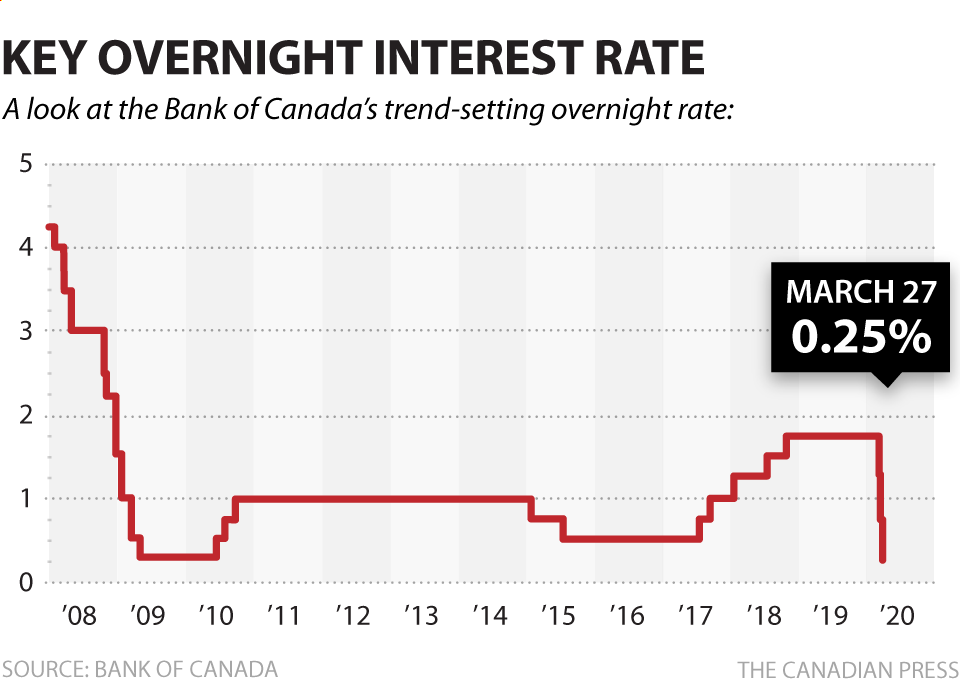

Weakening Economic Indicators Pointing to Rate Cuts

Recent economic indicators paint a concerning picture, strongly suggesting a need for intervention by the Bank of Canada. Slower-than-expected GDP growth, decreasing consumer confidence, and inflation remaining below the Bank of Canada's target range all point towards a potential economic slowdown or even recession. The Bank of Canada's monetary policy is under intense scrutiny as it seeks to navigate this challenging economic landscape.

- Slower-than-expected GDP growth in Q3 2023: Preliminary data suggests a significant slowdown in economic growth during the third quarter of 2023.

- Decreasing consumer confidence impacting spending: Worries about job security and rising prices are leading consumers to reduce spending, further weakening economic activity.

- Inflation remaining below the Bank of Canada's target range: Persistent low inflation signals a lack of robust economic growth and justifies the need for stimulative measures.

- Potential for an economic slowdown or recession: The confluence of these factors increases the likelihood of an economic slowdown or even a recession in the near future.

Economists' Predictions and Potential Rate Cut Scenarios

Leading economists are increasingly predicting further Bank of Canada rate cuts. While there's a consensus that further monetary easing is needed, opinions diverge on the magnitude and timing of these cuts. Many predict a 25 basis point cut by the end of the year, but some anticipate more aggressive action if the economic situation deteriorates further. The effectiveness of such rate cuts in stimulating the economy remains a subject of debate. The Bank of Canada might also employ alternative monetary policy tools, like quantitative easing, depending on the economic outlook.

- Consensus forecasts for a 25 basis point cut by December 2023: This is a widely held view among economists, reflecting a cautious approach to monetary policy.

- Diverging opinions on the need for further cuts beyond December 2023: Some economists believe further cuts may be necessary, while others advocate for a wait-and-see approach.

- Analysis of the potential effectiveness of rate cuts in stimulating the economy: The effectiveness of rate cuts depends on various factors, including consumer and business confidence.

- Discussion of alternative monetary policy tools the Bank of Canada might employ: Quantitative easing or other unconventional methods could be considered if rate cuts prove insufficient.

Potential Consequences of Further Bank of Canada Rate Cuts

Further interest rate cuts will have both positive and negative consequences. While lower borrowing costs could incentivize business investment and consumer spending, potentially leading to a resurgence in the housing market, there are also risks. Aggressive rate cuts could fuel inflation, impacting the value of the Canadian dollar. A careful balancing act is required.

- Lower borrowing costs incentivizing business investment and consumer spending: Reduced interest rates can make borrowing cheaper, encouraging businesses to invest and consumers to spend.

- Potential for a resurgence in the housing market: Lower mortgage rates could stimulate demand in the housing sector.

- Risks of increased inflation if rate cuts are too aggressive: Excessive monetary easing can lead to higher inflation, eroding purchasing power.

- Possible impact on the Canadian dollar exchange rate: Lower interest rates can make the Canadian dollar less attractive to foreign investors, potentially leading to depreciation.

Conclusion

The Canadian economy is facing significant challenges due to tariff-related job losses and weakening economic indicators. Economists widely predict further Bank of Canada rate cuts to stimulate growth, but the magnitude and timing remain uncertain. These cuts have the potential to boost economic activity but also carry risks, particularly regarding inflation and the Canadian dollar. Understanding the implications of Bank of Canada rate cuts is crucial for both businesses and individuals. Stay informed about future announcements regarding Bank of Canada rate cuts to effectively manage your financial planning and navigate this complex economic landscape. Regularly checking for updates on Bank of Canada monetary policy decisions and economic forecasts will help you make informed financial decisions.

Featured Posts

-

Blowout Win Propels Celtics To Division Title

May 12, 2025

Blowout Win Propels Celtics To Division Title

May 12, 2025 -

Who Is Manon Fiorot Understanding The Ufc Contenders Journey To Gold

May 12, 2025

Who Is Manon Fiorot Understanding The Ufc Contenders Journey To Gold

May 12, 2025 -

Johnson Family Shares Sweet Easter Video Featuring Their Son

May 12, 2025

Johnson Family Shares Sweet Easter Video Featuring Their Son

May 12, 2025 -

St Petersburg Gp Mc Laughlin Grabs Pole Position

May 12, 2025

St Petersburg Gp Mc Laughlin Grabs Pole Position

May 12, 2025 -

Controverse Dals Ines Reg Eliminee Natasha St Pier Epargnee Est Ce Equitable

May 12, 2025

Controverse Dals Ines Reg Eliminee Natasha St Pier Epargnee Est Ce Equitable

May 12, 2025