Bank Of Canada Rate Cuts Imminent? Analysis Of Tariff-Related Job Losses

Table of Contents

The Impact of Tariffs on Canadian Employment

The impact of tariffs on Canadian employment is significant and multifaceted. Job losses are not uniformly distributed, with specific sectors bearing the brunt of the economic fallout.

Sector-Specific Job Losses

Tariffs have disproportionately affected certain sectors of the Canadian economy. The manufacturing and agricultural sectors, in particular, have experienced substantial job losses.

- Manufacturing: The automotive sector, a cornerstone of Canadian manufacturing, has seen significant production cuts and layoffs due to increased import costs stemming from tariffs. For example, Ford Canada announced the elimination of hundreds of jobs at its Oakville plant in 2023, directly attributable to reduced production caused by tariff increases.

- Agriculture: Canadian farmers, facing higher tariffs on their exports to key trading partners, have seen decreased demand for their products. This has led to reduced farm incomes, farm closures, and subsequent job losses across the agricultural value chain. Dairy farmers in Ontario, for example, have reported significant financial difficulties due to reduced exports.

- Other Sectors: The ripple effect extends beyond these primary sectors. Transportation and logistics companies, reliant on the movement of goods, have also experienced job losses as trade volumes have decreased. The impact of “tariff impact on manufacturing jobs” and "agricultural job losses Canada" is undeniable.

The Ripple Effect on the Canadian Economy

The job losses in specific sectors have a broader impact, creating a ripple effect throughout the Canadian economy.

- Reduced Consumer Spending: Job losses translate to decreased consumer spending, as individuals have less disposable income. This reduced demand affects businesses across various sectors, further impacting employment.

- Decreased Business Investment: Uncertainty about the future economic climate discourages business investment, leading to slower economic growth and potentially further job losses. The resulting "Canadian economic slowdown" can be attributed in part to the negative effects of tariffs and reduced business confidence.

Inflationary Pressures and the Bank of Canada's Mandate

Tariffs contribute to inflationary pressures, directly impacting the Bank of Canada's mandate to control inflation and maintain stable economic growth.

Tariffs and Inflation

Tariffs increase the cost of imported goods and services, leading to higher prices for consumers.

- Increased Import Costs: Tariffs directly increase the price of imported goods, impacting everything from consumer electronics to food products. This directly affects the "CPI Canada" and increases the "cost of living Canada."

- Impact on CPI: The rising prices of imported goods are reflected in the Consumer Price Index (CPI), contributing to overall inflation. This rise in the "Canadian inflation rate" can significantly impact consumer purchasing power.

The Bank of Canada's Response

The Bank of Canada's primary mandate is to maintain price stability and foster sustainable economic growth. In response to high inflation or economic slowdowns, the Bank might consider rate cuts to stimulate economic activity.

- Mechanics of Interest Rate Cuts: Lowering interest rates makes borrowing cheaper for businesses and consumers, encouraging investment and spending. This, in turn, stimulates economic growth and job creation.

- Potential Impact: Interest rate cuts can help mitigate the negative effects of tariffs by encouraging borrowing and investment, potentially offsetting the job losses caused by the "Canadian trade war impact". The effectiveness of "interest rate manipulation" in this context, however, depends on several other economic factors.

Alternative Economic Indicators and Their Implications

Beyond employment and inflation, other economic indicators offer further insight into the potential for Bank of Canada rate cuts.

GDP Growth and Unemployment Rates

Analyzing the Canadian GDP growth and unemployment rate provides a broader perspective on the health of the Canadian economy.

- GDP Growth: A slowdown in GDP growth, indicating reduced overall economic activity, strengthens the case for intervention by the Bank of Canada. Statistics Canada publishes regular updates on "Canadian GDP growth," offering critical data for analysis.

- Unemployment Rate: A rising "Canadian unemployment rate," particularly in sectors affected by tariffs, provides further evidence of the need for stimulating economic activity.

Business Confidence and Investment

Business confidence and investment levels are crucial indicators of future economic activity.

- Business Confidence Surveys: Surveys measuring business sentiment provide valuable insight into investment plans and expectations for future growth. Lower levels of "business confidence Canada" suggest a need for government intervention to boost investor optimism.

- Foreign Investment: Reduced "foreign investment Canada" further indicates a lack of confidence in the Canadian economy and may necessitate a policy shift to boost investor confidence. The "Canadian economic outlook" is largely dependent on these factors.

Conclusion: Bank of Canada Rate Cuts – A Necessary Response?

The analysis presented demonstrates a clear link between tariffs, subsequent job losses, and the potential for inflationary pressures. These factors, coupled with slowing GDP growth and reduced business confidence, suggest a strong case for the Bank of Canada to consider rate cuts to stimulate the economy and mitigate the negative impact of tariff-related job losses. The likelihood of Bank of Canada interest rate cuts hinges on the continued economic fallout from tariffs and the severity of the resulting economic slowdown. However, there are uncertainties. The effectiveness of rate cuts depends on various factors, including consumer and business confidence. To stay informed about the evolving situation and the Bank of Canada's policy decisions related to Bank of Canada rate cuts, it's crucial to follow the Bank of Canada's website and reputable economic news sources for updates on Canadian monetary policy and its potential impact on the Canadian economy. Staying informed about Bank of Canada interest rate cuts is critical for navigating this period of economic uncertainty.

Featured Posts

-

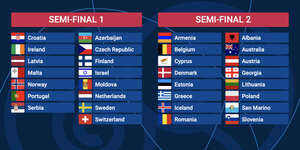

Eurovision 2025 Semi Final And Final Dates Announced

May 14, 2025

Eurovision 2025 Semi Final And Final Dates Announced

May 14, 2025 -

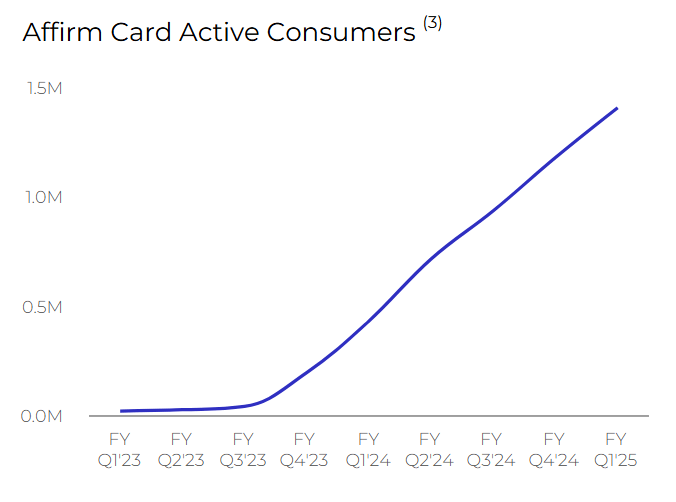

The Impact Of Trump Tariffs On Fintech Ipos An Analysis Of Affirm Holdings Afrm

May 14, 2025

The Impact Of Trump Tariffs On Fintech Ipos An Analysis Of Affirm Holdings Afrm

May 14, 2025 -

Dokovicev Put Do Vrha Prevazilazenje Federerove Dominacije

May 14, 2025

Dokovicev Put Do Vrha Prevazilazenje Federerove Dominacije

May 14, 2025 -

Experience Chocolate Heaven Lindt Opens In Central London

May 14, 2025

Experience Chocolate Heaven Lindt Opens In Central London

May 14, 2025 -

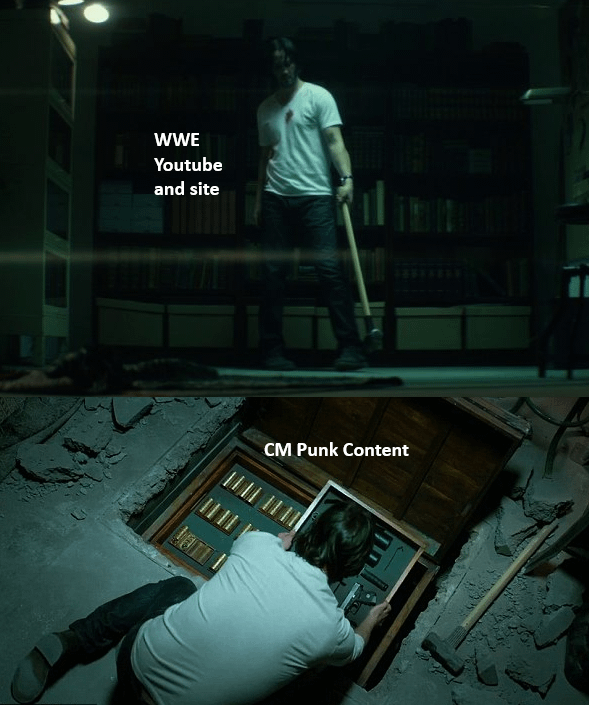

Wwe Wrestle Mania Iii Livestream Event Details From Wwe Vault

May 14, 2025

Wwe Wrestle Mania Iii Livestream Event Details From Wwe Vault

May 14, 2025