Bank Of Canada Rate Pause: Expert Analysis From FP Video

Table of Contents

Understanding the Bank of Canada's Rate Pause Decision

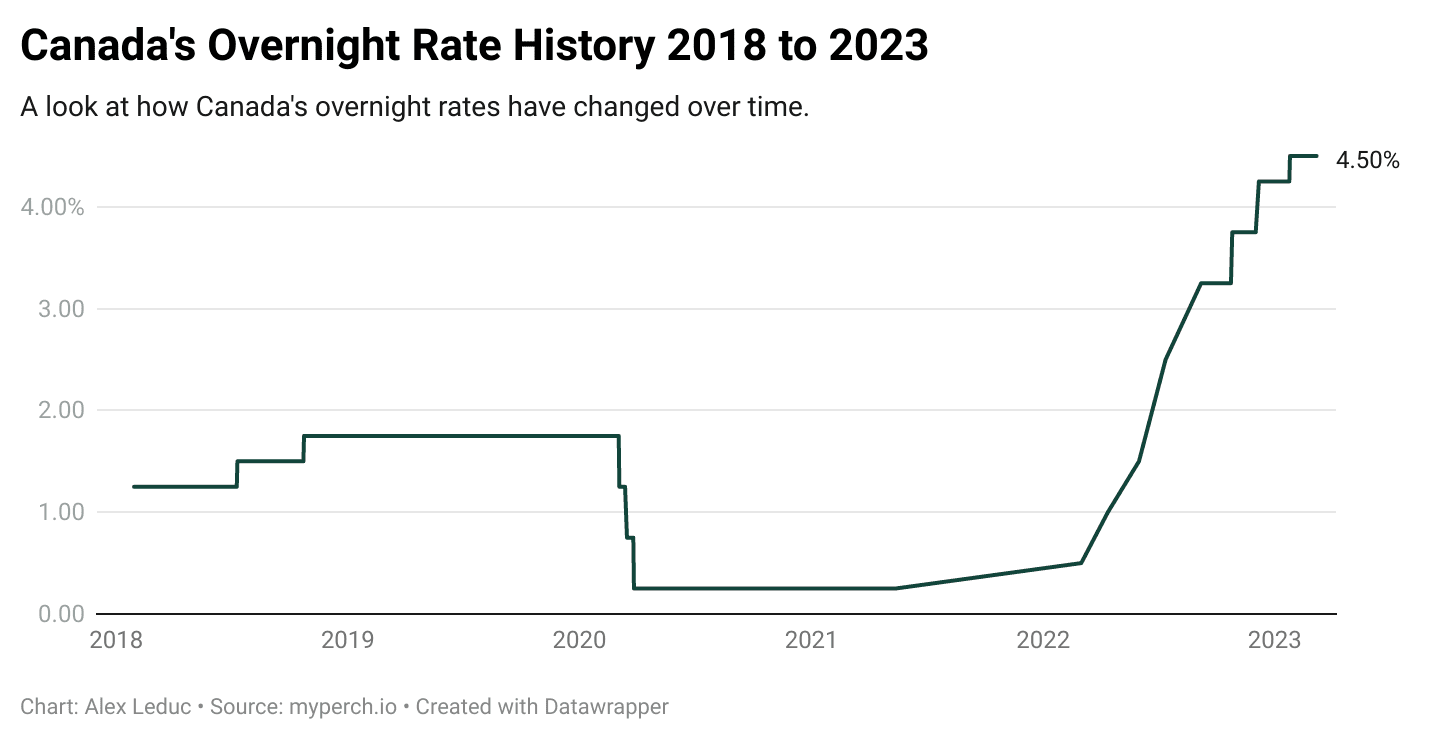

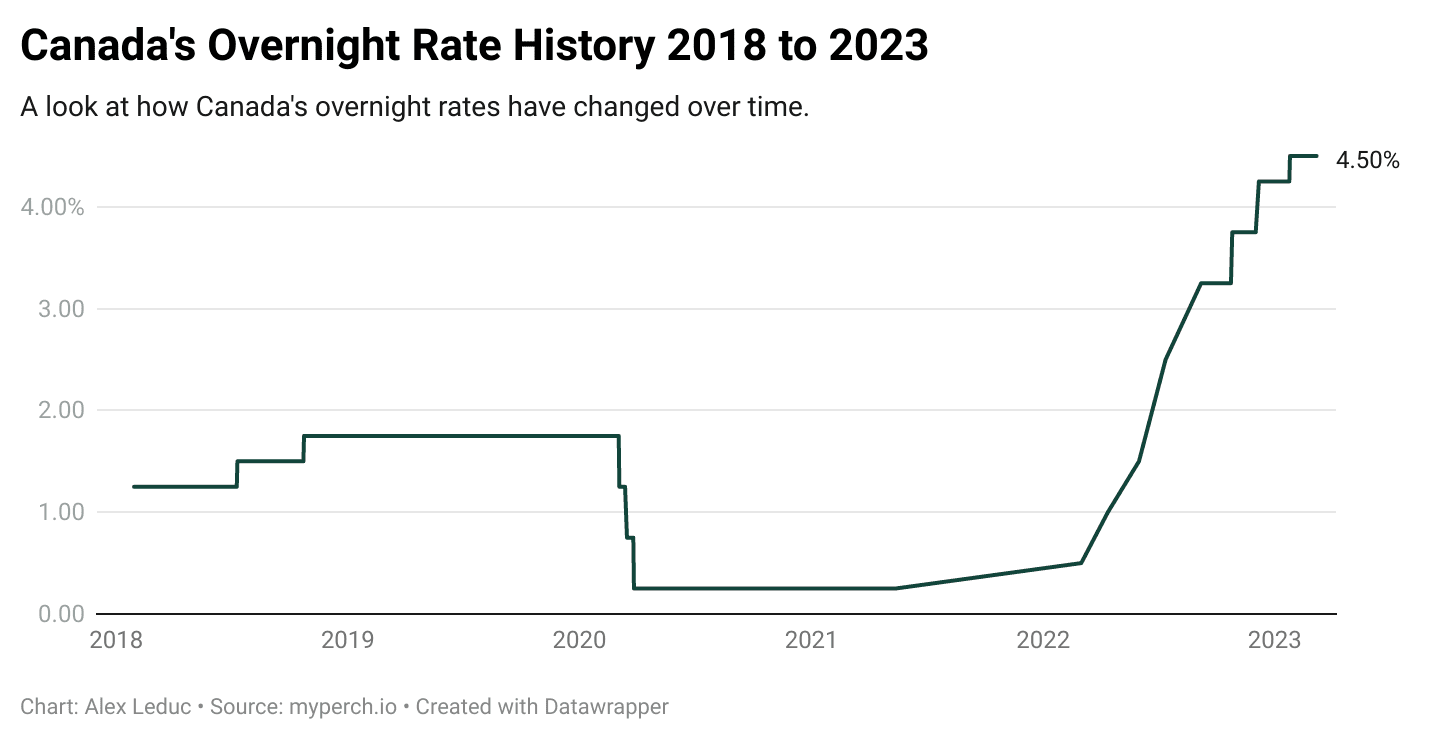

The Bank of Canada's decision to pause interest rate increases is multifaceted and hinges on several key economic indicators.

Inflationary Pressures and Economic Growth

Canada's inflation rate, while showing signs of cooling, remains a significant concern for the Bank of Canada. The central bank's primary mandate is to maintain price stability.

- Recent Inflation Data: While inflation has decreased from its peak, it still surpasses the Bank of Canada's target of 2%. Recent data shows a fluctuating inflation rate, requiring careful monitoring.

- Interest Rates and Inflation: Higher interest rates typically curb inflation by reducing borrowing and spending, thereby cooling down demand. The Bank of Canada's previous rate hikes aimed to achieve this.

- GDP Growth and its Impact: GDP growth, while slowing, remains relatively positive. This suggests that the economy is not in immediate danger of recession, allowing the Bank of Canada to pause and assess the impact of previous rate hikes.

Keyword integration: Inflation rate Canada, GDP growth Canada, monetary policy Bank of Canada, Canadian inflation.

Global Economic Uncertainty

The Bank of Canada's decision is not made in isolation. Global economic factors significantly influence its monetary policy decisions.

- Global Inflation: High inflation is a global phenomenon, impacting supply chains and commodity prices worldwide. This creates uncertainty and challenges for central banks globally.

- Recession Risks: The possibility of a global recession looms, particularly in major economies. This risk necessitates a cautious approach by the Bank of Canada.

- Geopolitical Events: Geopolitical instability, such as the ongoing war in Ukraine, creates further uncertainty and volatility in global markets, affecting Canada's economy.

Keyword integration: Global recession, geopolitical risks, international monetary policy, global economic uncertainty.

Expert Opinions from FP Video

FP Video provides in-depth analysis from leading economists offering valuable perspectives on the Bank of Canada's rate pause.

Short-Term Outlook for Interest Rates

FP Video's experts express diverse views on the short-term trajectory of interest rates.

- Potential Rate Hikes or Further Pauses: Some experts predict further rate hikes in the coming months, citing persistent inflationary pressures. Others anticipate a prolonged pause, allowing the economy to absorb the impact of previous increases.

- Expert Quotes (Example): “[Insert a quote from the FP Video analysis regarding short-term interest rate predictions]” This provides context and authority to the analysis.

Keyword integration: Interest rate forecast Canada, Bank of Canada predictions, Canadian interest rates.

Long-Term Implications for the Canadian Economy

The long-term effects of the rate pause on the Canadian economy are complex and depend on several factors.

- Impact on Housing Market: The pause could provide some relief to the housing market, potentially stabilizing prices or preventing further significant declines. However, high borrowing costs may continue to impact affordability.

- Consumer Spending: Consumer confidence and spending are likely to be impacted by the ongoing uncertainty. Lower interest rates might stimulate spending, but high inflation may constrain it.

- Business Investment: Businesses may adjust their investment plans based on interest rate movements and economic forecasts. Lower rates can encourage investment, but uncertainty might lead to caution.

Keyword integration: Canadian housing market, consumer confidence, business investment Canada, Canadian economy forecast.

How the Bank of Canada Rate Pause Affects You

Understanding the implications of the Bank of Canada's rate pause is crucial for personal and business financial planning.

Managing Your Finances in a Time of Uncertainty

The current economic climate requires a strategic approach to personal finance.

- Mortgage Payments: Homeowners with variable-rate mortgages may see some relief from further rate increases, while those with fixed-rate mortgages will remain unaffected.

- Savings Strategies: Consider the impact of inflation on your savings. Diversification and strategic investment planning are key.

- Investment Decisions: Maintain a diversified investment portfolio, considering risk tolerance and long-term financial goals.

Keyword integration: Personal finance Canada, mortgage rates Canada, investment strategies Canada, Canadian savings rates.

Impact on Businesses and Investment Decisions

The rate pause has significant implications for businesses and investors.

- Business Loans: Businesses considering taking out loans may find borrowing costs slightly eased, although overall rates remain high.

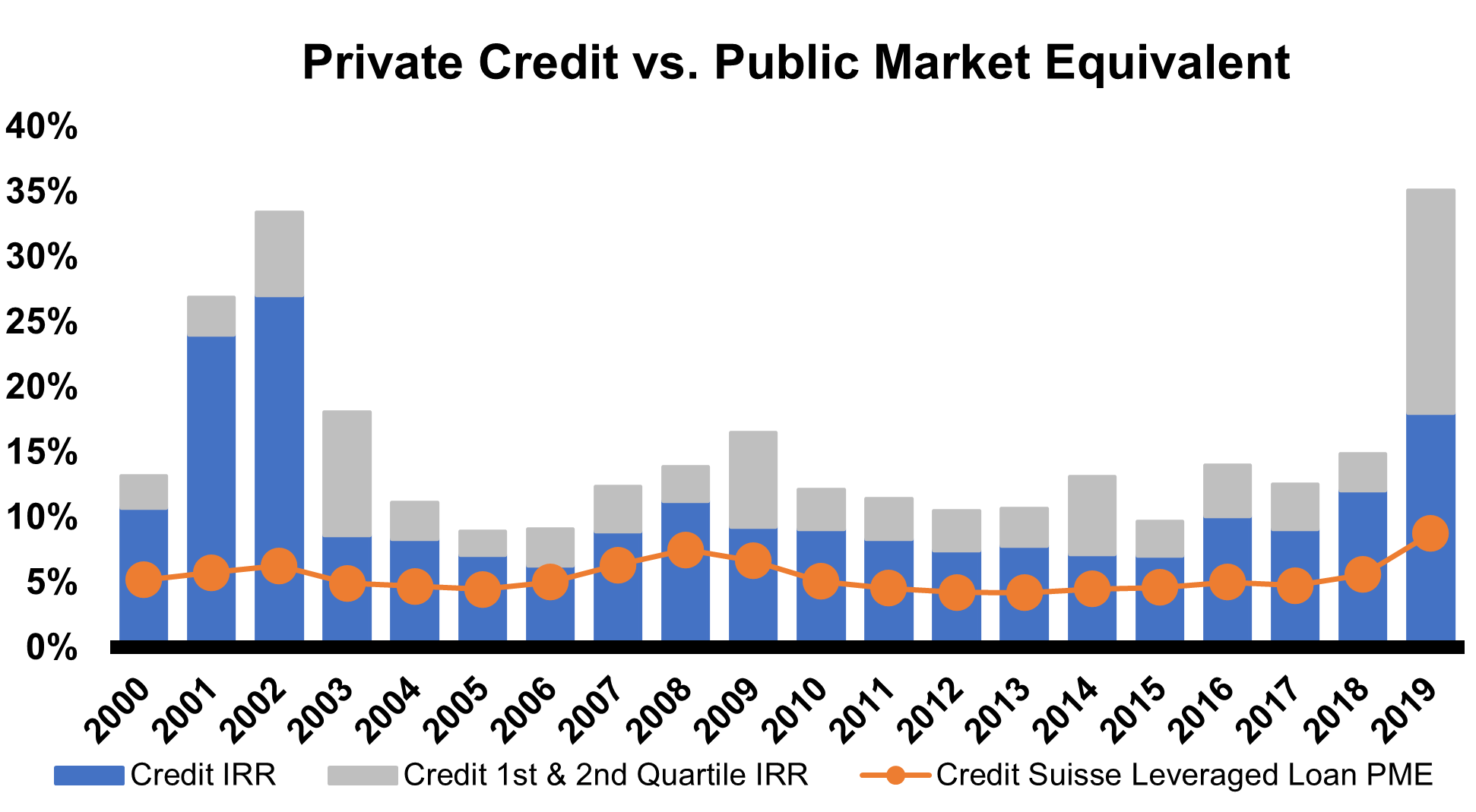

- Investment Opportunities: The pause creates both opportunities and challenges for investment. Thorough due diligence and risk assessment are crucial.

- Business Growth: Business growth will depend on several factors including consumer spending, access to capital and global economic conditions.

Keyword integration: Business loans Canada, investment opportunities Canada, economic growth Canada, Canadian business investment.

Conclusion

The Bank of Canada's decision to pause interest rate hikes is a significant development with far-reaching consequences. While the pause offers some short-term relief, the ongoing uncertainty surrounding inflation and global economic conditions requires careful navigation. FP Video's expert analysis provides critical insights into potential future rate adjustments and their impact on various sectors. Understanding the ramifications of the Bank of Canada rate pause is vital for individuals and businesses alike to make informed financial decisions. Stay informed by watching the full FP Video analysis on the Bank of Canada rate pause and regularly checking our website for updates. Mastering the implications of the Bank of Canada rate pause is crucial to effectively navigating the present economic climate.

Featured Posts

-

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 22, 2025

Land Your Dream Private Credit Job 5 Crucial Dos And Don Ts

Apr 22, 2025 -

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 22, 2025

Zuckerberg And Trump A New Era For Facebook And Politics

Apr 22, 2025 -

Rallies And Protests Against Trump A National Perspective

Apr 22, 2025

Rallies And Protests Against Trump A National Perspective

Apr 22, 2025 -

Fsus Post Shooting Class Resumption Plan A Controversial Decision

Apr 22, 2025

Fsus Post Shooting Class Resumption Plan A Controversial Decision

Apr 22, 2025 -

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 22, 2025

T Mobile To Pay 16 Million For Data Breaches Spanning Three Years

Apr 22, 2025