BBAI Stock: Deep Dive Into The 17.87% Drop And Future Outlook

Table of Contents

Analyzing the 17.87% Drop in BBAI Stock Price

The dramatic drop in BBAI stock price triggered immediate concerns among investors. Let's dissect the contributing factors:

Market Sentiment and Investor Reaction

The sharp decline in BBAI share price significantly impacted investor confidence, leading to increased volatility and decreased trading volume in the short term. This negative sentiment was amplified by:

- Negative news coverage: Any negative press releases or articles concerning BBAI's operations or financial performance could have influenced investor perception.

- Analyst downgrades: Negative rating changes from financial analysts can significantly impact market sentiment and lead to sell-offs.

- General market trends: Broader market downturns often exacerbate negative reactions to company-specific news. A bearish market makes investors more risk-averse, potentially leading to heavier selling pressure on stocks like BBAI.

Data regarding trading volume changes and price fluctuations during and after the drop is crucial in understanding the immediate market reaction. Analyzing this data will paint a clearer picture of investor behavior and confidence levels.

Financial Performance and Earnings Reports

A thorough examination of BBAI's recent financial performance and earnings reports is crucial to understanding the stock price decline. Key financial metrics to consider include:

- Revenue: Analysis of recent revenue figures compared to previous quarters and years helps determine if revenue growth has slowed or reversed.

- Earnings: Examining earnings per share (EPS) and comparing it to expectations provides insight into the company's profitability.

- Debt: A high debt-to-equity ratio can signal financial instability and concern investors.

Visual representations of this data, such as charts and graphs comparing BBAI's performance to industry benchmarks, will improve understanding. Any discrepancies between the company's performance and market expectations need to be carefully analyzed.

Company-Specific News and Events

Significant events impacting BBAI, both internal and external, can dramatically affect the BBAI share price. These events might include:

- Contract wins or losses: Large contracts are crucial for BBAI's revenue stream; significant losses could lead to investor concern.

- Lawsuits or regulatory actions: Legal battles or regulatory issues can create uncertainty and negatively affect investor confidence.

- Management changes: Changes in leadership can signal instability and impact market perception.

Linking to relevant news articles and official company filings will provide readers with verifiable information and enhance the article's credibility.

Factors Contributing to the BBAI Stock Decline

Several factors beyond immediate company news likely contributed to the BBAI stock decline:

Macroeconomic Conditions

The broader economic environment plays a significant role. Factors such as:

- Interest rate hikes: Increased interest rates make borrowing more expensive, potentially slowing business growth and reducing investment in technology stocks.

- Inflation: High inflation can erode consumer spending and affect company profitability.

- Recession fears: Concerns about an impending recession make investors more cautious and likely to sell off riskier assets, including technology stocks like BBAI.

Competitive Landscape

The AI and data analytics sector is intensely competitive. BBAI faces challenges from:

- Established players: Large, well-funded companies with significant market share pose a substantial competitive threat.

- New entrants: Innovative startups can disrupt the market with new technologies or business models.

- Market share analysis: Understanding BBAI's market share relative to competitors provides insights into its competitive positioning.

Technological Challenges and Innovation

The pace of technological advancement in AI is rapid. BBAI's success depends on:

- Technological innovation: The company's ability to innovate and adapt to emerging technologies is vital for maintaining a competitive edge.

- Research and development: Adequate investment in R&D is crucial for staying ahead of the competition.

- Integration capabilities: The ability to smoothly integrate its solutions with existing client systems is a key factor for success.

Future Outlook and Potential for BBAI Stock Recovery

Despite the recent downturn, several factors could contribute to a BBAI stock recovery:

Growth Prospects and Market Opportunities

BBAI's future growth hinges on its ability to capitalize on market opportunities:

- New contracts and partnerships: Securing new contracts and strategic partnerships can boost revenue and investor confidence.

- Expansion into new markets: Expanding into untapped markets can drive growth and diversification.

- Development of new products and services: Innovative new offerings can increase BBAI's competitive advantage.

Management Strategies and Initiatives

BBAI's management team plays a crucial role in navigating the challenges and driving future growth through:

- Cost-cutting measures: Improving efficiency and reducing costs can strengthen the company's financial position.

- New product launches: Introducing innovative products can boost revenue and market share.

- Strategic acquisitions: Acquiring complementary companies can accelerate growth and expand BBAI's capabilities.

Analyst Forecasts and Predictions

A balanced view of analyst predictions provides further context. Summarizing various analyst ratings and price targets will offer investors a range of potential outcomes. It is crucial to remember that analyst predictions are not guarantees of future performance.

Conclusion: Investing in BBAI Stock: Weighing the Risks and Rewards

The 17.87% drop in BBAI stock highlights the volatility inherent in the technology sector. While the company faces challenges, opportunities for growth and recovery also exist. Factors like macroeconomic conditions, competitive pressures, and BBAI's internal strategies all play a role in determining the future trajectory of the BBAI share price. Before making any investment decisions regarding BBAI stock or BigBear.ai stock, it's crucial to conduct thorough due diligence, carefully weigh the risks and rewards, and consider diversification within your investment portfolio. Remember, this analysis is for informational purposes only and should not be considered financial advice.

Featured Posts

-

Robin Roberts Gma Family Announcement A New Addition

May 20, 2025

Robin Roberts Gma Family Announcement A New Addition

May 20, 2025 -

Uk Taxpayers Locked Out Major Hmrc Website Outage

May 20, 2025

Uk Taxpayers Locked Out Major Hmrc Website Outage

May 20, 2025 -

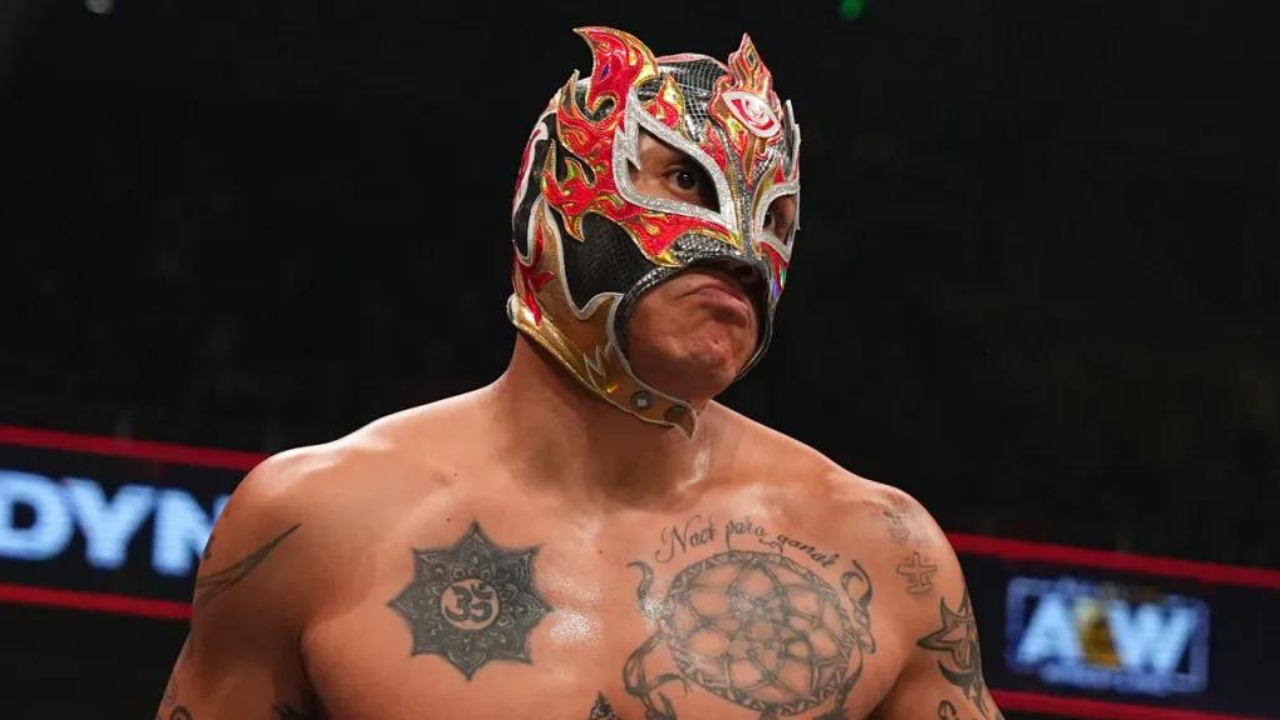

Wwe Smack Down Rey Fenixs New Ring Name And Debut Date

May 20, 2025

Wwe Smack Down Rey Fenixs New Ring Name And Debut Date

May 20, 2025 -

Jutarnji List Sve Zvijezde Na Premijeri Pogledajte Tko Je Bio Tamo

May 20, 2025

Jutarnji List Sve Zvijezde Na Premijeri Pogledajte Tko Je Bio Tamo

May 20, 2025 -

Germanys Nations League Triumph 5 4 Aggregate Victory Over Italy Secures Final Four Spot

May 20, 2025

Germanys Nations League Triumph 5 4 Aggregate Victory Over Italy Secures Final Four Spot

May 20, 2025