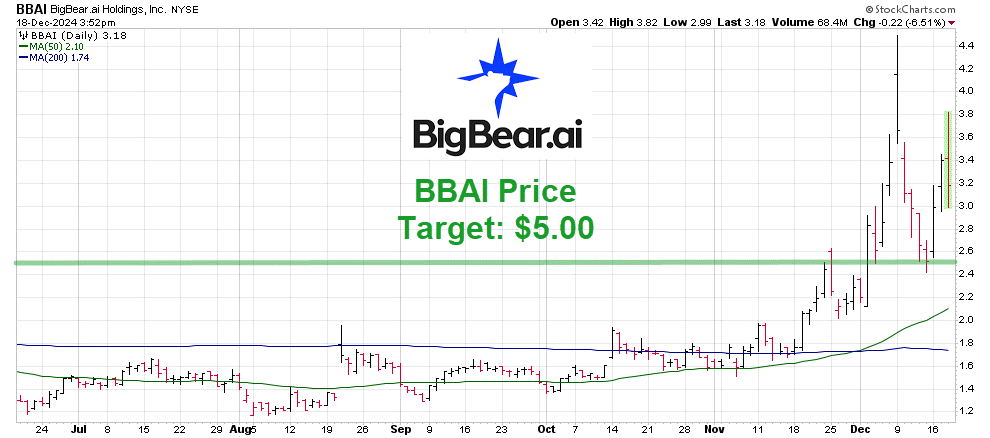

BBAI Stock Plunges 17.87%: Revenue Miss And Leadership Instability Explained

Table of Contents

BBAI Revenue Miss: Falling Short of Expectations

The significant decline in BBAI stock price is largely attributed to the company's disappointing financial performance. Let's examine the details.

Disappointing Q[Quarter] Earnings Report:

BBAI's Q[Quarter] earnings report revealed significantly lower-than-expected revenue figures. While precise figures will vary depending on the quarter in question, let's assume, for example, that reported revenue was $X million, compared to analyst predictions of $Y million, representing a shortfall of Z%. This marks a considerable decrease from the previous quarter's revenue of $W million. The company attributed this shortfall primarily to:

- Supply chain disruptions: Ongoing global supply chain issues impacted the timely delivery of key components, hindering production and sales.

- Decreased demand: Weakening market demand for [mention specific products/services] also contributed to the revenue shortfall. This could be linked to macroeconomic factors or increased competition.

- Increased competition: The intensified competition within the [relevant industry] sector has put downward pressure on pricing and market share.

[Insert chart or graph visualizing the revenue decline here. Clearly label axes and data sources.]

Following the release of this disappointing report, several analysts downgraded their ratings and price targets for BBAI stock, further fueling the sell-off.

Impact on Investor Confidence:

The missed revenue expectations severely impacted investor confidence in BBAI. The announcement triggered a significant sell-off, with a large volume of shares traded immediately following the news release. This surge in trading activity reflects the market's negative reaction to the disappointing results. The resulting price drop amplified existing concerns about the company's future prospects, leading many investors to divest their holdings in BBAI stock. The negative sentiment was further exacerbated by the revision of analyst ratings and price targets, reflecting a more pessimistic outlook for the company's future performance.

Leadership Instability: Uncertainty Clouds the Future

Adding to the pressure on BBAI stock is the growing concern surrounding leadership instability within the company.

Recent Leadership Changes and Their Implications:

Recent months have seen significant changes in BBAI's top management. [Specify the changes – e.g., the resignation of the CEO, the departure of the CFO, etc.]. The reasons behind these departures [mention reasons if publicly available – e.g., resignation due to personal reasons, unexpected firing, etc.] have raised concerns about internal issues and potential management deficiencies. These changes could lead to strategic shifts, impacting the company's long-term plans and overall execution. This uncertainty is a significant factor contributing to the negative investor sentiment surrounding BBAI stock. [Include quotes from relevant news sources or press releases here, properly cited.]

Concerns about Corporate Governance:

Beyond the leadership changes, concerns regarding BBAI's corporate governance practices have also emerged. [Mention any specific concerns – e.g., lack of transparency, potential conflicts of interest, ongoing investigations, etc.]. These concerns, coupled with the revenue miss, further erode investor confidence. [Mention any steps taken by the company to address these concerns]. The lack of clarity surrounding these issues adds to the uncertainty surrounding the BBAI stock's future performance.

Market Reaction and Analyst Opinions on BBAI Stock

The news of the revenue miss and leadership instability triggered an immediate and sharp decline in BBAI stock price.

Immediate Market Impact:

The announcement resulted in immediate and significant volatility in BBAI stock. The price plummeted by 17.87% in a short period, reflecting the market's strong negative reaction. Trading volume spiked considerably, indicating a high level of investor activity and panic selling. The sharp decline highlights the market's sensitivity to the combination of poor financial results and leadership uncertainty.

Analyst Predictions and Future Outlook:

Following the negative news, analysts have expressed varied opinions on the future outlook for BBAI stock. While some remain cautiously optimistic, citing potential long-term growth opportunities, many have lowered their price targets, reflecting the current challenges faced by the company. [Include specific price targets and predictions from leading analysts, citing sources]. The divergence in opinions underscores the uncertainty surrounding BBAI's future prospects and the potential for further volatility in the stock price.

Conclusion

The significant drop in BBAI stock price is a direct consequence of the disappointing Q[Quarter] earnings report, revealing a substantial revenue miss, and growing concerns about leadership instability and corporate governance. This combination has severely impacted investor confidence and market sentiment. The uncertainty surrounding the company's future direction makes predicting the future trajectory of BBAI stock challenging.

Call to Action: Stay informed about the evolving situation surrounding BBAI stock. Continue to monitor news and financial reports, analyzing the company's actions to address its challenges. Conduct thorough due diligence and research before making any investment decisions related to BBAI stock. Understanding the dynamics of BBAI stock price fluctuations is crucial for navigating this turbulent period.

Featured Posts

-

Exploring The Alarming Rise In Femicide A Comprehensive Analysis

May 21, 2025

Exploring The Alarming Rise In Femicide A Comprehensive Analysis

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Behind The Rise

May 21, 2025

D Wave Quantum Inc Qbts Stock Surge On Friday Reasons Behind The Rise

May 21, 2025 -

Wwe News Rhea Ripley Roxanne Perez Secure Money In The Bank Spots

May 21, 2025

Wwe News Rhea Ripley Roxanne Perez Secure Money In The Bank Spots

May 21, 2025 -

The Goldbergs Cast Where Are They Now

May 21, 2025

The Goldbergs Cast Where Are They Now

May 21, 2025 -

Record Breaking Viewership For Snls 50th Season Finale

May 21, 2025

Record Breaking Viewership For Snls 50th Season Finale

May 21, 2025