BBAI Stock Takes A Hit Following Below-Expectations Q1 Report

Table of Contents

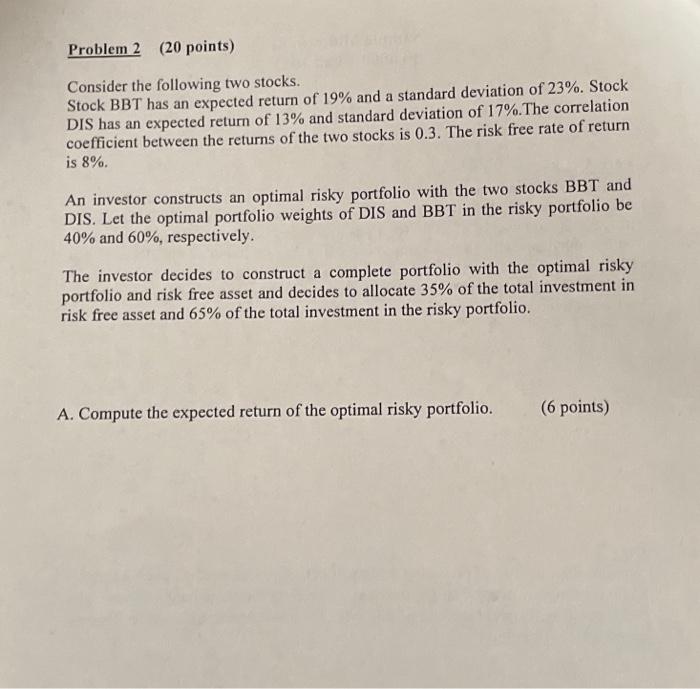

BBAI Q1 Earnings Miss Expectations: A Detailed Breakdown

BBAI's Q1 2024 financial performance significantly missed analyst projections, raising serious concerns among investors. The company's revenue and earnings per share (EPS) figures fell considerably short of expectations, indicating a substantial underperformance compared to both the previous quarter and market forecasts. This poor financial performance casts a shadow on the BBAI investment outlook.

- Revenue: BBAI reported Q1 revenue of [Insert Actual Revenue Figure Here], significantly lower than the projected [Insert Analyst Projection Figure Here]. This represents a [Insert Percentage] decrease compared to Q4 2023's revenue of [Insert Q4 2023 Revenue Figure Here].

- EPS: Earnings per share came in at [Insert Actual EPS Figure Here], dramatically below the anticipated [Insert Analyst Projection Figure Here]. This marks a considerable drop from the [Insert Q4 2023 EPS Figure Here] reported in the previous quarter.

- Key Metrics: Other key performance indicators, such as sales growth and operating margins, also showed significant weakness, highlighting broader issues within the company's operations. Specific details regarding these metrics were not disclosed in the initial report, fueling further uncertainty.

- Management Explanation: BBAI management attributed the disappointing results to [Insert Management's Explanation Here – e.g., increased competition, macroeconomic headwinds in China, delays in product launches]. However, the lack of concrete specifics has left investors seeking more clarity.

Impact on BBAI Stock Price and Investor Sentiment

The immediate impact of the disappointing Q1 report was a sharp decline in BBAI's stock price. The BBAI stock price volatility was substantial, with [Insert Percentage Change] decrease observed immediately following the release of the earnings report. This triggered a surge in trading volume as investors reacted to the news.

- Stock Price Change: BBAI stock experienced a [Insert Percentage] drop in its share price within [Timeframe] of the Q1 report release.

- Trading Volume: Trading volume spiked significantly, indicating heightened investor activity and uncertainty surrounding the future of the BBAI investment.

- Analyst Ratings: Several analysts downgraded their ratings and price targets for BBAI stock, reflecting a more pessimistic outlook for the company's short-term prospects.

- Short Interest: The increased short interest suggests that some investors are betting against BBAI's future performance, further adding to the negative sentiment surrounding the stock.

Analyzing the Reasons Behind BBAI's Underperformance

Several factors likely contributed to BBAI's disappointing Q1 performance. The company faces stiff competition in the rapidly evolving AI market, and the challenging macroeconomic environment in China, including its slowing economy, has undoubtedly played a significant role.

- Competition: Intense competition from established players and emerging startups in the AI sector has put pressure on BBAI's market share and profitability.

- Market Challenges: The overall AI market is experiencing some headwinds, with concerns about growth slowing in some sectors. This broader market trend has impacted BBAI's performance.

- Technological Advancements: While BBAI is investing in technological advancements, the pace of innovation might not be keeping up with the demands of the rapidly changing AI landscape.

- Geopolitical Factors: Geopolitical tensions and regulatory changes in China could also be contributing factors impacting BBAI's operations and investor confidence.

Future Outlook and Potential Implications for BBAI Investors

The Q1 results paint a concerning picture for BBAI's short-term prospects. However, the long-term outlook depends significantly on the company's ability to address the challenges it faces and capitalize on emerging opportunities within the AI sector.

- Revised Guidance: BBAI's revised guidance for the remainder of the year will be a critical indicator of its future performance.

- Growth Catalysts: Potential catalysts for future growth include new product launches, strategic partnerships, and successful expansion into new markets.

- Investment Risks: Investing in BBAI stock carries significant risks, given the current uncertainty surrounding the company's performance and the volatile nature of the AI market.

- Investor Recommendations: Investors should carefully assess the risks before making any investment decisions. Consulting with a financial advisor is strongly recommended.

Conclusion

The disappointing Q1 earnings report has dealt a significant blow to BBAI stock, highlighting the challenges the company faces in a competitive and evolving market. Understanding the factors contributing to this decline is crucial for investors considering BBAI as an investment. While the long-term potential of BBAI remains to be seen, the short-term outlook appears uncertain. Before investing in BBAI stock, carefully consider the risks and rewards, and conduct thorough due diligence. Stay informed about the latest developments in BBAI stock and make informed decisions based on your own thorough due diligence. Before investing in BBAI stock, consider the risks and rewards carefully and consult with a financial advisor.

Featured Posts

-

Radostnaya Novost Dzhennifer Lourens Snova Mama

May 20, 2025

Radostnaya Novost Dzhennifer Lourens Snova Mama

May 20, 2025 -

Michael Schumachers Unsuccessful Comeback The Role Of Unheeded Red Bull Advice

May 20, 2025

Michael Schumachers Unsuccessful Comeback The Role Of Unheeded Red Bull Advice

May 20, 2025 -

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025

Texas House Bill Aims To Restrict Minors Social Media Access

May 20, 2025 -

April 25 2025 New York Times Crossword Answers

May 20, 2025

April 25 2025 New York Times Crossword Answers

May 20, 2025 -

Femicide Causes Statistics And Prevention Strategies

May 20, 2025

Femicide Causes Statistics And Prevention Strategies

May 20, 2025