Before The Semiconductor Boom: An Examination Of Leveraged ETF Activity

Table of Contents

Understanding Leveraged ETFs in the Semiconductor Industry

Leveraged exchange-traded funds (LETFs) are investment vehicles designed to deliver magnified returns compared to the underlying index they track. In the semiconductor industry, popular LETFs like the Invesco PHLX Semiconductor Sector Index ETF (SOXX) and the VanEck Semiconductor ETF (SMH) offer leveraged versions, often providing 2x or 3x exposure. This means a 10% increase in the underlying index could theoretically result in a 20% or 30% gain with a 2x or 3x LETF, respectively. However, the reverse is equally true: a 10% drop in the underlying index could lead to a 20% or 30% loss.

- Definition of leveraged ETFs and their purpose: LETFs aim to provide daily leveraged returns mirroring a specific index. They use derivatives and other financial instruments to achieve this magnification.

- Examples of semiconductor-focused LETFs: Besides SOXX and SMH, several other LETFs offer leveraged exposure to the semiconductor sector. Researching these options is crucial for diversification.

- Explanation of leverage ratios and their effect on daily returns: A 2x LETF aims for double the daily return of the underlying index, while a 3x LETF aims for triple the daily return. This daily compounding is key to understanding the potential for significant gains and losses.

- Risks of using LETFs, including volatility decay and compounding effects: Volatility decay is a significant risk. Over longer periods, daily rebalancing can lead to returns that deviate substantially from the intended multiple of the underlying index. The daily compounding of gains and losses can dramatically amplify results.

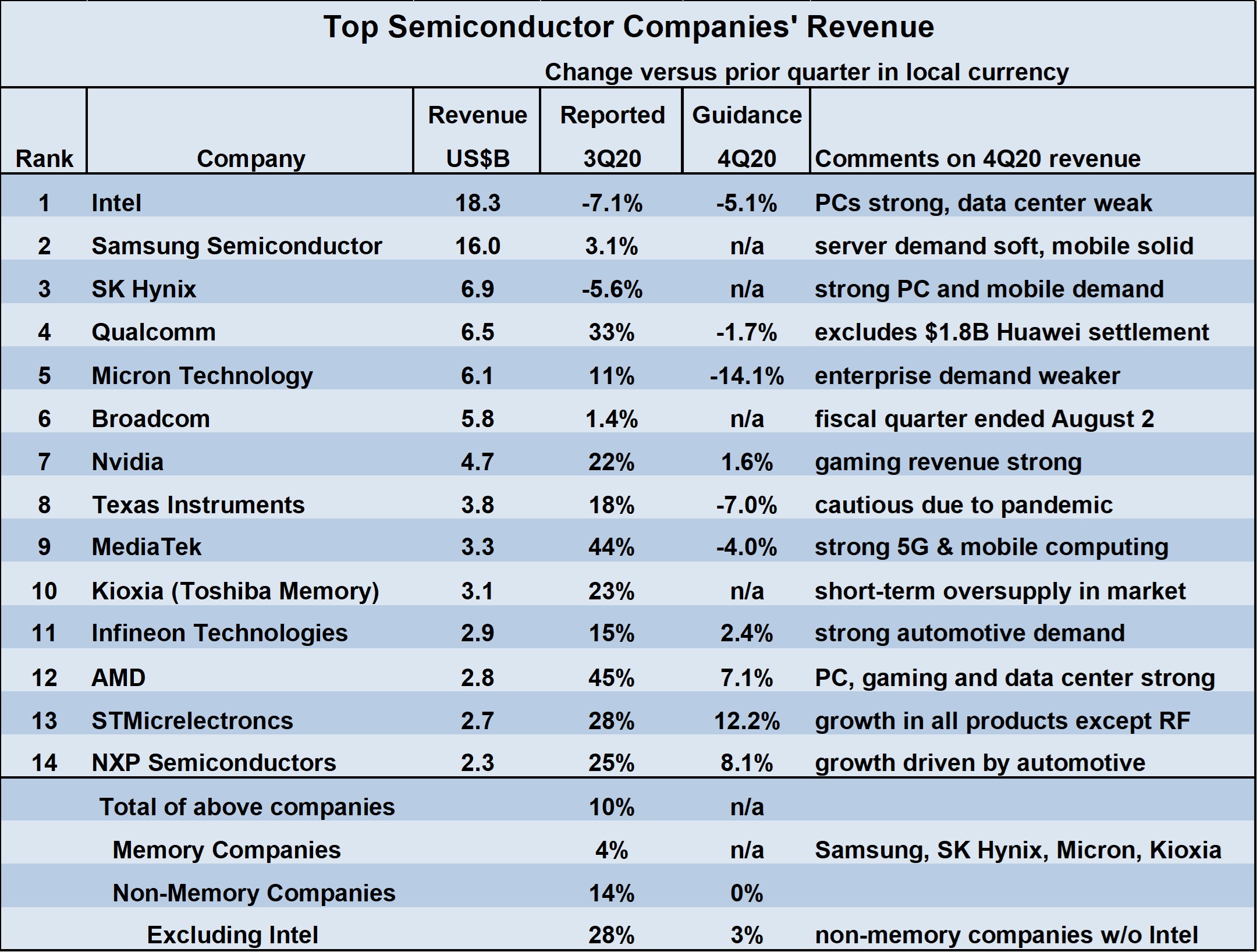

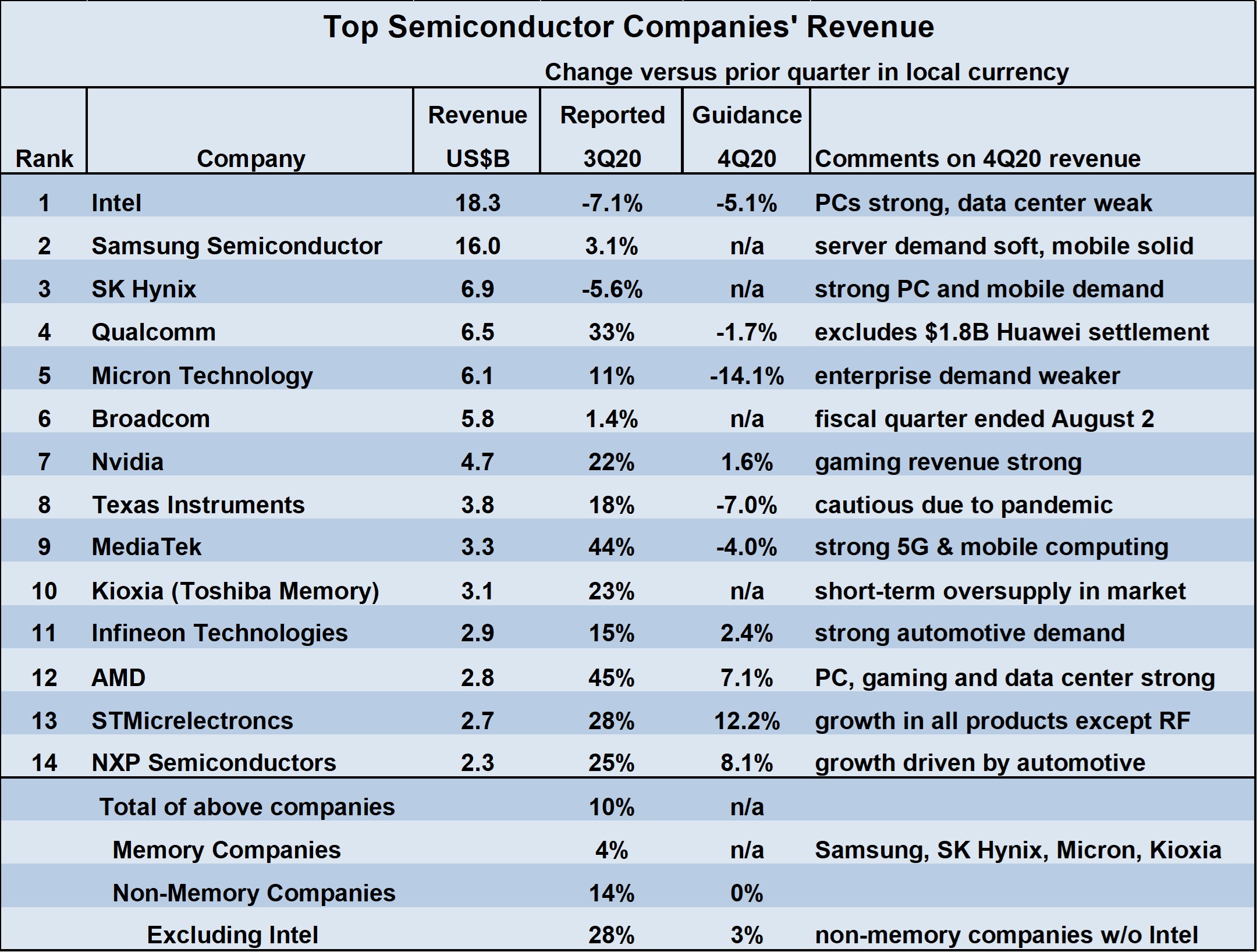

Pre-Boom ETF Activity: A Data-Driven Analysis

Analyzing pre-boom trading volume and investor sentiment in semiconductor LETFs reveals valuable insights. Before the recent surge, many semiconductor LETFs experienced periods of lower trading volume compared to the post-boom surge. This suggests a more cautious approach by investors in the pre-boom period. While precise data requires access to historical trading records, a general observation is that returns mirrored the underlying index, albeit magnified, showing limited major deviations.

- Charts illustrating trading volume of specific semiconductor LETFs before the boom: (Insert relevant charts and graphs here, sourced from reputable financial data providers). These visuals would clearly demonstrate the volume differences.

- Analysis of price movements and returns during this period: This section requires a detailed analysis of the price movement of specific LETFs against the price movements of the underlying indexes. Highlighting periods of significant divergence is crucial.

- Mention of any notable news or events that affected LETF activity: Any geopolitical events, regulatory changes, or significant company announcements impacting the semiconductor industry should be mentioned.

- Comparison of LETF performance against the underlying index: A direct comparison will illustrate the amplification effect of leverage and any deviations due to volatility decay.

Investor Behavior and Sentiment Analysis

Understanding investor behavior leading up to the semiconductor boom is vital. While definitive data on investor sentiment before the boom is difficult to obtain in a universally agreed-upon way, anecdotal evidence and news reports could indicate a more cautious or less speculative environment. Analyst reports during this period might show a range of opinions, possibly reflecting a less uniformly bullish outlook compared to the later boom period.

- Analysis of investor sentiment data (e.g., surveys, social media sentiment): While precise pre-boom sentiment data is challenging to compile comprehensively, qualitative analysis of news articles and financial publications can provide insights.

- Mention of key analyst reports and predictions: Referencing reputable financial analysis firms and their projections during this pre-boom period provides valuable context.

- Discussion of potential speculative bubbles or market manipulation: A thoughtful discussion of the potential for speculative bubbles or market manipulation is necessary for a complete analysis, but requires significant evidence.

Implications for Future Investment Strategies

The pre-boom period offers valuable lessons for future semiconductor LETF investments. Understanding the amplified risks associated with leverage, even in seemingly stable markets, is paramount. Diversification beyond semiconductor LETFs and careful risk management are crucial.

- Strategies for mitigating risk when using LETFs: This includes diversification, careful position sizing, and potentially employing stop-loss orders.

- Importance of understanding the underlying asset and market conditions: Thorough research on the semiconductor industry, including technological advancements, supply chain dynamics, and regulatory changes is essential.

- Advice on portfolio diversification: Diversifying investments across multiple asset classes helps mitigate the risk associated with concentrating in volatile sectors.

- Recommendations for appropriate risk tolerance levels: Investors should only use LETFs if their risk tolerance is high, and they fully understand the potential for significant losses.

Conclusion: Leveraged ETF Activity and the Semiconductor Market

Analyzing pre-boom leveraged ETF activity in the semiconductor market reveals valuable insights into the risks and potential rewards of this investment strategy. The amplification effect of leverage, highlighted by the pre-boom data analysis, underscores the importance of thorough research and careful risk management. Remember, while LETFs can magnify gains, they can also exponentially increase losses. Before investing in semiconductor LETFs, or any leveraged ETFs, conduct thorough due diligence, consider your risk tolerance, and perhaps seek professional financial advice. Further exploration into "semiconductor ETF investing," "leveraged ETF risks," and "semiconductor market analysis" will enhance your understanding and inform your investment decisions.

Featured Posts

-

Tempah Byd Ev Di Mas 2025 And Dapatkan Kredit Cas Rm 800 9 15 Mei Nikmati Konsert Rentak Elektrik

May 13, 2025

Tempah Byd Ev Di Mas 2025 And Dapatkan Kredit Cas Rm 800 9 15 Mei Nikmati Konsert Rentak Elektrik

May 13, 2025 -

Manila Schools Closed Due To Heat Wave Bangkok Post Report

May 13, 2025

Manila Schools Closed Due To Heat Wave Bangkok Post Report

May 13, 2025 -

Will Renewed Trump Tariffs Cripple Europe Analyzing The Economic Impact

May 13, 2025

Will Renewed Trump Tariffs Cripple Europe Analyzing The Economic Impact

May 13, 2025 -

Bar Roma Toronto What To Expect At This Popular Spot

May 13, 2025

Bar Roma Toronto What To Expect At This Popular Spot

May 13, 2025 -

Ugroza Terakta Arest Stalkera Presledovavshego Semyu Skarlett Yokhansson

May 13, 2025

Ugroza Terakta Arest Stalkera Presledovavshego Semyu Skarlett Yokhansson

May 13, 2025