Beijing's Trade War Pain: Hiding Economic Weakness From America

Table of Contents

Manipulating Economic Data: A Closer Look at China's Statistics

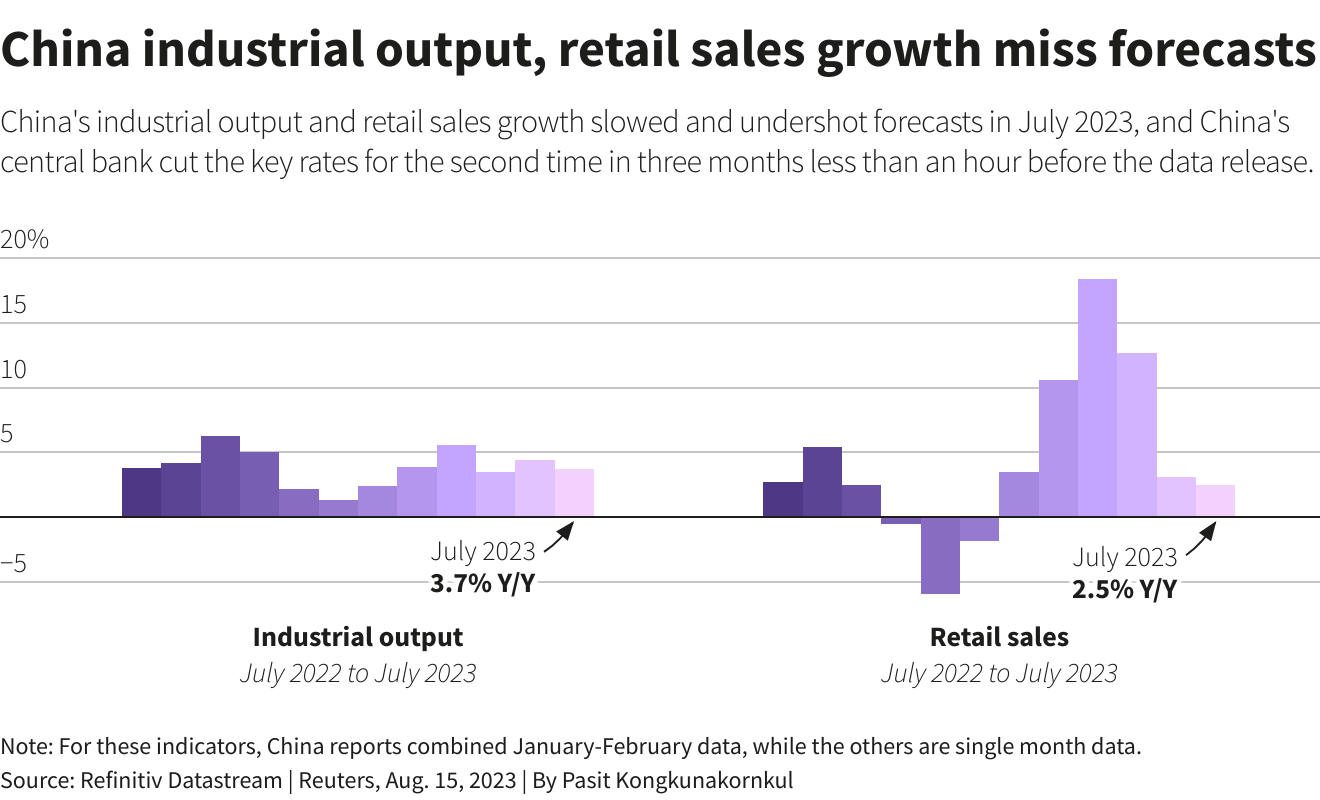

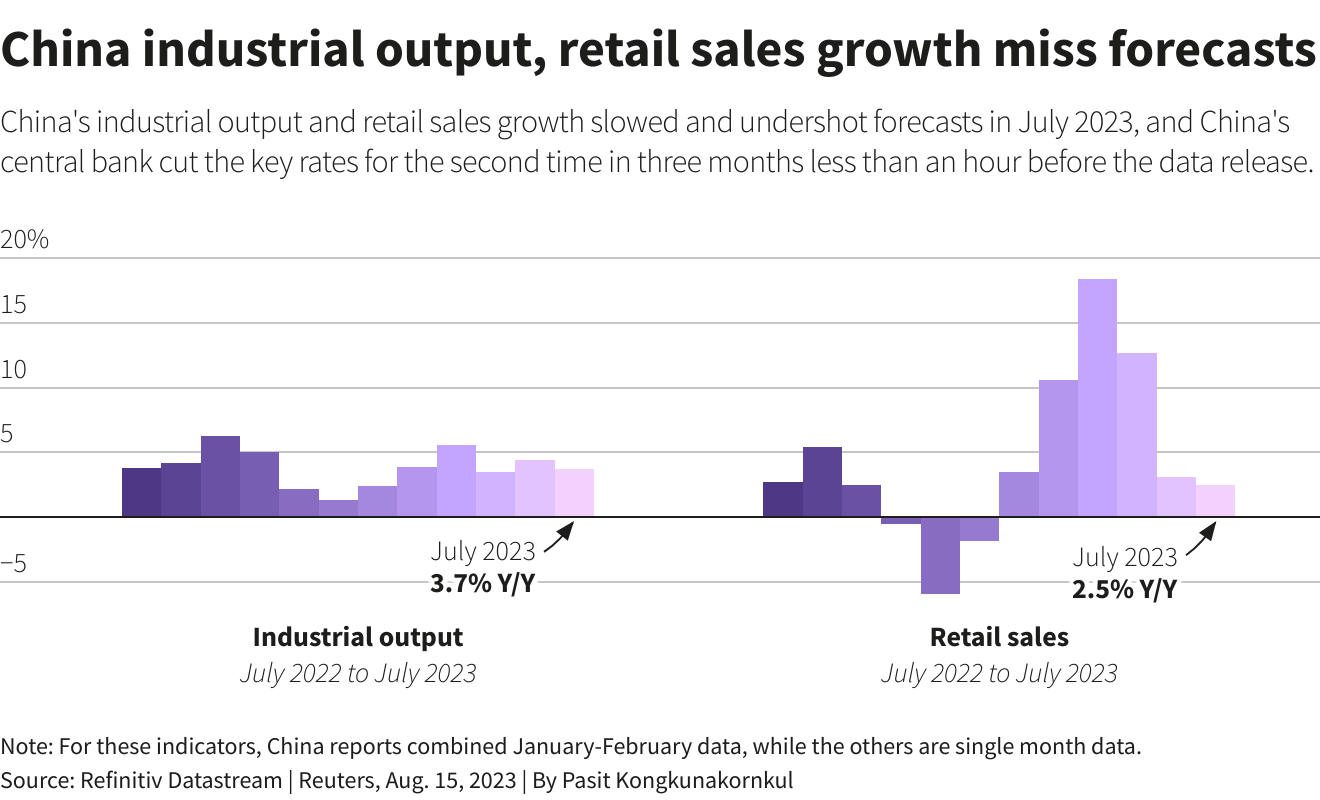

China's economic data, often cited as a key indicator of global economic health, has come under increasing scrutiny. The question remains: how reliable are these figures, especially in the wake of the US-China trade war?

Inflated GDP Figures: A Closer Examination

One significant area of concern revolves around China's reported GDP growth. While official figures consistently portray robust expansion, independent analyses often paint a less optimistic picture. These discrepancies raise serious questions about the methodologies employed and the potential for manipulation.

- Inconsistencies: Comparisons between reported GDP growth and other economic indicators, such as industrial output and consumer spending data, frequently reveal significant disparities. A booming industrial sector doesn't always translate into equally strong consumer spending, suggesting a potential disconnect.

- Shadow Banking: The significant role of China's shadow banking sector, a largely unregulated financial system, makes accurate GDP calculations exceptionally challenging. The opaque nature of these activities makes it difficult to assess their true impact on the overall economy.

- Data Gaps: A lack of granular data and transparency surrounding specific economic sectors further complicates independent verification of the official GDP figures. This lack of detailed information makes it challenging for economists to conduct thorough analyses and draw reliable conclusions.

Keywords: China GDP, economic data manipulation, shadow banking, unreliable economic indicators, GDP growth, China economic statistics.

Underreporting Unemployment: The Hukou System and Hidden Unemployment

Another critical area where China's economic reality might be masked is unemployment. The official unemployment rate consistently remains low, but this figure may not reflect the full picture.

- Hukou System: China's Hukou system, a household registration system, significantly impacts the accuracy of unemployment statistics. Migrant workers, often excluded from official statistics, frequently experience underemployment or unemployment.

- Underemployment: Many individuals are classified as employed even if they are working part-time or in low-paying jobs, concealing the true extent of underemployment within the Chinese economy.

- Anecdotal Evidence: Anecdotal evidence from various sources, including news reports and social media, often suggests higher levels of unemployment than official statistics indicate. These alternative data sources offer valuable insights that complement official figures.

Keywords: China unemployment, Hukou system, underemployment, hidden unemployment, labor market statistics, China job market.

Strategic Use of State-Owned Enterprises (SOEs) to Mask Economic Stress

The significant role of State-Owned Enterprises (SOEs) in the Chinese economy provides another potential avenue for masking economic weakness.

SOE Debt and Bailouts: A Crutch for the Economy?

The increasing debt burden of SOEs and the government's repeated interventions through bailouts are significant concerns. These actions might be masking underlying structural issues within the broader economy.

- Examples of Bailouts: Numerous instances of substantial government bailouts for financially distressed SOEs demonstrate the government's willingness to prop up failing businesses, potentially preventing a more accurate reflection of market forces.

- Financial Implications: The scale of these bailouts poses a considerable financial risk for the Chinese government, potentially leading to long-term financial instability and increased public debt.

- Systemic Risk: The continued reliance on bailouts to support struggling SOEs creates a moral hazard, potentially fostering further risk-taking and ultimately increasing systemic financial instability.

Keywords: State-owned enterprises, SOE debt, China's debt crisis, financial instability, government bailouts, SOE reform.

Suppressed Private Sector Growth: Stifling Innovation?

While SOEs receive significant government support, the private sector's struggles may be intentionally downplayed.

- Private Sector Difficulties: The trade war significantly impacted many Chinese private sector companies, leading to job losses and business closures. The government's response to these challenges has not always been transparent or supportive.

- Favoritism Towards SOEs: Government policies often seem to favor SOEs over private enterprises, hindering the growth and innovation of the private sector. This imbalance creates an uneven playing field and stifles competition.

- Long-Term Consequences: The suppression of private sector growth could have severe long-term consequences for China's economic dynamism and its ability to maintain sustainable economic expansion.

Keywords: China private sector, economic slowdown, suppression of private enterprise, regulatory hurdles, private enterprise in China.

Opacity and Lack of Transparency in Financial Reporting

The opacity surrounding China's economic data adds another layer to the puzzle.

Limited Access to Information: A Barrier to Accurate Analysis

International analysts face significant challenges in obtaining reliable economic data from China.

- Data Restrictions: Restrictions on data access, coupled with inconsistent data reporting standards, make independent verification of official figures incredibly difficult.

- Verification Challenges: The lack of transparent accounting practices and limited audit access make it challenging to verify the accuracy and reliability of financial reporting from Chinese companies.

- Implications for Global Investors: This lack of transparency poses significant risks for global investors who rely on accurate economic data to make informed investment decisions.

Keywords: Data transparency, information asymmetry, financial reporting, China economic transparency, foreign investment, China financial data.

The Role of Censorship and Propaganda: Shaping the Narrative

The Chinese government's control over information and its use of propaganda further complicate efforts to assess the true state of the Chinese economy.

- Censorship of Negative News: Negative economic news is often censored, preventing a complete and accurate picture of the economic challenges facing China.

- Propaganda and Positive Portrayals: The government uses propaganda to maintain a narrative of economic strength and stability, even when facing significant challenges.

- Impact on International Trust: This lack of transparency and control over the narrative undermine international trust and confidence in China's economic data and overall stability.

Keywords: China censorship, propaganda, media control, economic narrative, public opinion, China information control.

Conclusion: Unmasking the Reality of Beijing's Trade War Pain

This article has explored various ways in which China might be concealing the true extent of its economic vulnerability following the trade war with the US. From manipulating economic data to leveraging SOEs and controlling information flow, the evidence suggests a concerted effort to present a more positive image than reality warrants. The lack of transparency poses significant risks for global investors and highlights the importance of critical analysis of official Chinese economic statistics. Understanding the nuances of Beijing's economic strategy is crucial for navigating the complexities of global trade and investment. Further research into the hidden realities behind China's economic performance is necessary to accurately assess the true impact of the trade war and the long-term implications for the global economy. Continue to explore the issue of Beijing's trade war pain to gain a more complete and nuanced understanding of this critical issue.

Featured Posts

-

Intervention De Macron Risque De Militarisation De L Aide A Gaza Par Israel

May 03, 2025

Intervention De Macron Risque De Militarisation De L Aide A Gaza Par Israel

May 03, 2025 -

Gabon Macron Annonce La Fin De La Francafrique Quelles Implications Pour L Afrique

May 03, 2025

Gabon Macron Annonce La Fin De La Francafrique Quelles Implications Pour L Afrique

May 03, 2025 -

Local Elections 2024 Assessing The Reform Partys Prospects Under Farage

May 03, 2025

Local Elections 2024 Assessing The Reform Partys Prospects Under Farage

May 03, 2025 -

New Keller Williams Affiliate Joins Arkansas Market

May 03, 2025

New Keller Williams Affiliate Joins Arkansas Market

May 03, 2025 -

Daisy May Coopers Engagement To Anthony Huggins Details Revealed

May 03, 2025

Daisy May Coopers Engagement To Anthony Huggins Details Revealed

May 03, 2025