Belgium's Merchant Market: Securing Finance For A 270MWh BESS Project

Table of Contents

Understanding the Belgian Merchant Market for Energy Storage

The Belgian electricity market operates within a liberalized framework, presenting both opportunities and complexities for BESS project developers. The merchant market, in particular, relies on competitive pricing and flexible trading mechanisms. Successful BESS projects must capitalize on diverse revenue streams to ensure profitability and attract investors. These revenue streams include:

- Arbitrage Opportunities: BESS can buy energy at low prices and sell it at peak demand times, profiting from price fluctuations throughout the day. This requires sophisticated forecasting models and a deep understanding of the Belgian energy price dynamics.

- Frequency Regulation and Ancillary Services: BESS can provide essential ancillary services to Elia, the Belgian transmission system operator, by quickly responding to fluctuations in grid frequency and maintaining system stability. These services are remunerated through contracts and contribute significantly to project revenue.

- Capacity Market Participation: Belgium's capacity market mechanisms incentivize the provision of reserve power capacity. BESS projects can participate, securing payments for their ability to deliver power during periods of high demand or grid emergencies.

- Power Purchase Agreements (PPAs) with Industrial Customers: Direct PPAs with industrial consumers offer a stable and predictable revenue stream, mitigating the volatility associated with wholesale electricity markets. These agreements can be structured to meet specific customer needs, such as peak shaving or backup power supply.

- Demand-Side Management: BESS can optimize energy consumption by responding to real-time demand signals, potentially reducing energy costs for both industrial and residential consumers.

Key Financial Considerations for a 270MWh BESS Project

Securing funding for a 270MWh BESS project requires a meticulous financial strategy. The scale of the project necessitates a comprehensive understanding of the associated costs and potential returns. Key financial aspects include:

- Estimating CAPEX and OPEX: Accurate estimation of capital expenditure (CAPEX), including battery technology, installation, and grid connection costs, is critical. Operational expenditure (OPEX), encompassing maintenance, insurance, and personnel costs, must also be carefully projected.

- Exploring Funding Options: A blended financing approach may be optimal, combining debt financing (bank loans, green bonds) with equity financing (private investors, venture capital). The specific mix will depend on project risk profile and investor appetite. Government incentives and grants available in Belgium for renewable energy and energy storage projects should also be considered.

- Developing a Robust Financial Model: A detailed financial model demonstrating a strong return on investment (ROI) is crucial to attract investors. The model should incorporate various scenarios and risk assessments to build investor confidence.

- Due Diligence and Risk Assessment: Thorough due diligence, including technical, environmental, and regulatory assessments, is paramount. Identifying and mitigating potential risks, such as technology failure, regulatory changes, or market volatility, is essential for securing financing.

Navigating the Regulatory Landscape in Belgium for BESS Projects

The regulatory landscape in Belgium significantly impacts the feasibility and financing of BESS projects. Understanding the regulatory requirements and navigating the permitting process are crucial for project success. Key regulatory considerations include:

- Grid Connection Requirements: Securing grid connection approval from Elia involves a rigorous process, requiring detailed technical specifications and compliance with relevant grid codes. Understanding the grid connection timelines and associated costs is essential for accurate project planning.

- Permitting and Licensing: Various permits and licenses are required at the local, regional, and national levels. Navigating this complex process requires expertise in Belgian regulatory frameworks and environmental regulations.

- Regulatory Compliance: Strict adherence to grid codes, safety standards, and environmental regulations is mandatory. Non-compliance can result in delays, penalties, and even project failure.

- Government Incentives: Belgium offers various government incentives and support programs for renewable energy and energy storage projects, potentially reducing project costs and enhancing financial viability. Understanding and leveraging these incentives is crucial for securing project financing.

Strategic Partnerships and Risk Mitigation for Successful Financing

Strategic partnerships can significantly enhance the attractiveness of a BESS project to investors. Risk mitigation strategies are also vital for securing favorable financing terms. Key strategies include:

- Securing Long-Term Offtake Agreements: Long-term PPAs with credible offtakers reduce revenue uncertainty and increase investor confidence.

- Partnering with Experienced Developers and Investors: Collaborating with experienced players in the energy storage sector provides access to expertise, networks, and potentially co-financing.

- Utilizing Risk Mitigation Strategies: Insurance policies can cover specific risks, such as equipment failure or regulatory changes. Hedging strategies can mitigate price volatility in the electricity market.

- Exploring Partnerships with Specialized Financial Institutions: Partnering with financial institutions experienced in renewable energy and infrastructure financing can simplify the funding process and secure favorable financing terms.

Conclusion

Securing finance for a 270MWh BESS project in Belgium's merchant market requires a multifaceted approach. A deep understanding of the market dynamics, including various revenue streams and potential risks, is crucial. Navigating the regulatory landscape and securing strategic partnerships are equally important for project success. By carefully planning the financial strategy, developing a robust business case, and mitigating potential risks, developers can unlock the significant opportunities presented by Belgium's growing BESS market. Invest in Belgium's growing BESS market today! Contact us to learn more about securing finance for your BESS project in Belgium.

Featured Posts

-

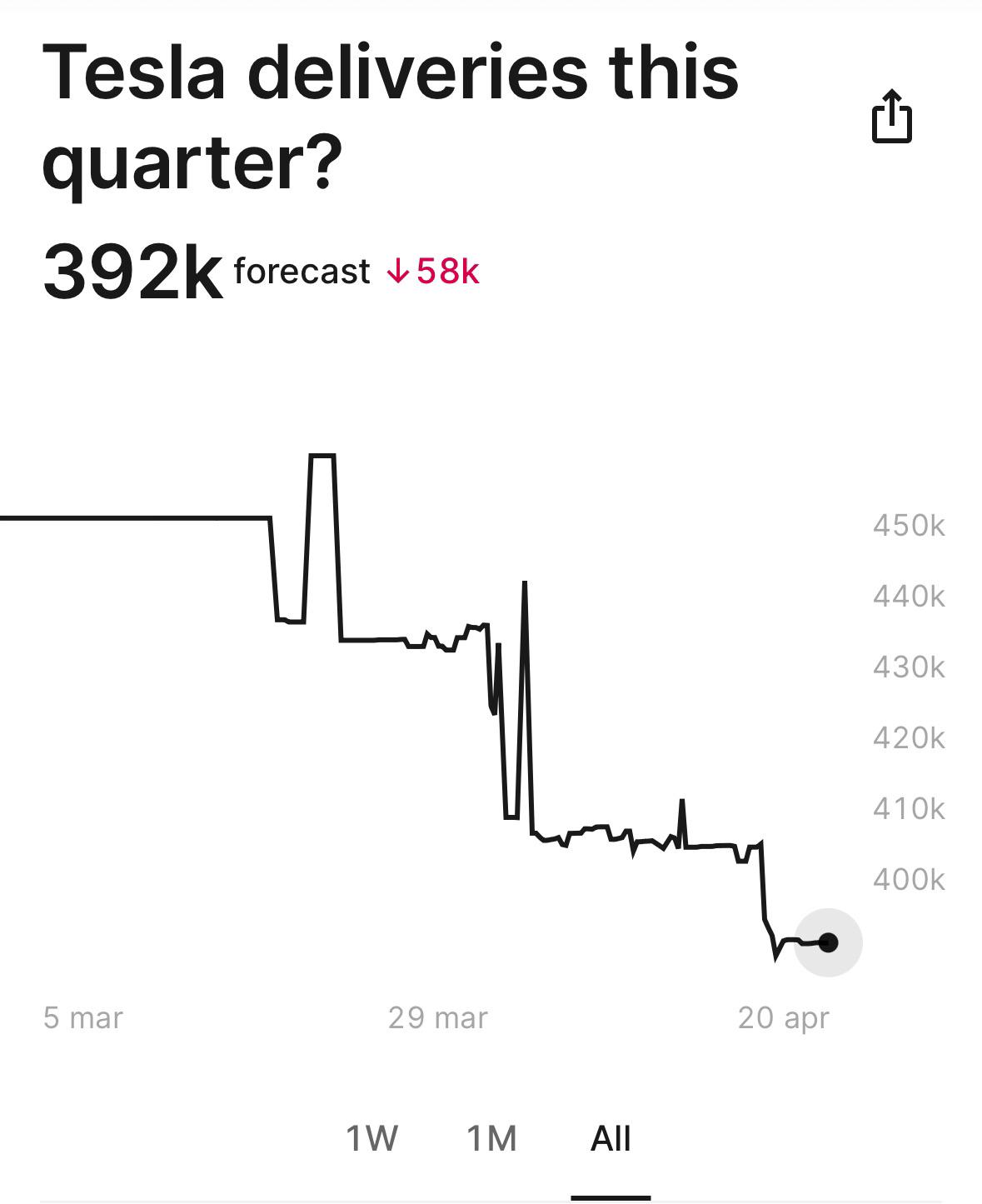

Tesla Ceo Search Exclusive Update On Elon Musks Succession

May 03, 2025

Tesla Ceo Search Exclusive Update On Elon Musks Succession

May 03, 2025 -

This Country Practical Tips For Your Trip

May 03, 2025

This Country Practical Tips For Your Trip

May 03, 2025 -

Amant Alastthmar Baljbht Alwtnyt Tkshf En Syasatha Alaqtsadyt

May 03, 2025

Amant Alastthmar Baljbht Alwtnyt Tkshf En Syasatha Alaqtsadyt

May 03, 2025 -

Fortnite Chapter 6 Season 3 Are The Servers Down

May 03, 2025

Fortnite Chapter 6 Season 3 Are The Servers Down

May 03, 2025 -

Justice Department Ends Louisiana School Desegregation Order A New Chapter

May 03, 2025

Justice Department Ends Louisiana School Desegregation Order A New Chapter

May 03, 2025