Berkshire Hathaway's Stake Boosts Japan Trading House Stock Prices

Table of Contents

Berkshire Hathaway's Investment Strategy and its Rationale

Berkshire Hathaway, renowned for its long-term value investing approach under Warren Buffett's leadership, typically targets companies with strong fundamentals, durable competitive advantages, and consistent profitability. Their investments are characterized by a "buy-and-hold" strategy, focusing on building long-term value rather than short-term gains. However, the recent foray into Japanese trading houses represents a notable shift, raising several intriguing questions about Berkshire's rationale.

Why Japanese trading houses? Several factors likely contributed to this decision:

- Long-term investment horizon: Berkshire's strategy aligns perfectly with the long-term outlook of these established trading houses.

- Focus on undervalued companies: While these companies might not be considered "undervalued" in the traditional sense, Berkshire may see opportunities for growth and value appreciation not fully reflected in current market valuations.

- Diversification of portfolio: The investment diversifies Berkshire's holdings geographically and sectorally, reducing overall portfolio risk.

- Potential for significant returns: The trading houses offer exposure to diverse global commodities and markets, promising substantial returns over the long term.

- Strategic partnership opportunities: Beyond simple investment, Berkshire might seek strategic partnerships with these companies, leveraging their global networks and expertise.

Impact on Japanese Trading House Stock Prices

The immediate impact of Berkshire Hathaway's investment on the stock prices of the targeted Japanese trading houses was dramatic. Following the announcement, we witnessed a significant and sustained price increase across the board. This surge reflects the positive market sentiment triggered by Berkshire's endorsement.

- Significant price increase post-announcement: Stock prices experienced double-digit percentage increases in many cases, highlighting investor confidence in Berkshire's investment acumen.

- Increased trading volume: The news spurred a significant increase in trading volume, indicating heightened market interest and activity.

- Positive investor sentiment: The investment signaled a vote of confidence in the long-term prospects of the Japanese trading houses and the broader Japanese economy.

- Potential for further price appreciation: Many analysts predict further price appreciation given Berkshire's long-term holding strategy and the potential for synergistic growth.

- Comparison with previous market performance: The post-investment performance contrasts sharply with the relatively subdued performance of these stocks in the period leading up to Berkshire's involvement.

Individual Stock Performance Analysis (Itochu, Mitsubishi, etc.)

While all five trading houses saw substantial gains, the specific performance varied. For example, Itochu Corp. experienced a [insert percentage]% increase, while Mitsubishi Corp. saw a [insert percentage]% rise. These differences could be attributed to several factors, including individual company performance, sector-specific dynamics, and varying market sensitivities. A detailed analysis of each company's financial performance and market positioning is necessary for a complete understanding of their individual stock price movements.

- Individual stock price changes: Detailed data on the percentage change for each company should be included here.

- Company-specific factors influencing stock prices: Analysis of individual company performance and market position is needed.

- Comparative analysis of stock performance: A comparative analysis of the stock performance of all five companies should be presented.

Implications for the Broader Japanese Market

Berkshire Hathaway's investment carries significant implications for the broader Japanese market, extending beyond the direct impact on the five trading houses.

- Increased foreign investor interest in Japan: The investment signals renewed confidence in the Japanese market, encouraging further foreign investment.

- Boost to investor confidence: The move acts as a powerful endorsement of the Japanese economy, boosting overall investor confidence.

- Potential for further investment in Japanese companies: This investment could trigger a wave of similar investments from other foreign investors.

- Long-term economic benefits for Japan: Increased investment and economic activity could contribute to sustained economic growth in Japan.

Future Outlook and Predictions

The long-term outlook for the Japanese trading houses and the broader market remains positive, given Berkshire Hathaway's continued involvement and the overall economic recovery. However, several uncertainties exist.

- Potential for continued stock price growth: The potential for continued growth depends on several factors, including global economic conditions and individual company performance.

- Risks associated with global economic conditions: Global economic downturns or geopolitical instability could negatively impact the performance of these companies.

- Long-term investment potential: Despite potential short-term volatility, the long-term investment potential remains strong, considering the stable and diversified nature of the trading houses' businesses.

Conclusion: Berkshire Hathaway's Investment: A Catalyst for Japanese Trading House Growth?

Berkshire Hathaway's investment in Japanese trading houses has undeniably created a significant surge in their stock prices, demonstrating the considerable market impact of this decision. The investment signals a renewed confidence in the long-term prospects of these companies and the broader Japanese economy, promising potential for long-term growth and significant returns. This investment serves as a catalyst, potentially attracting further foreign investment and bolstering investor confidence. Stay tuned for further updates on how Berkshire Hathaway's strategic investments continue to shape the future of Japanese trading houses and the broader market. Follow our analysis of Berkshire Hathaway's impact on Japanese trading house stock prices for continued insights.

Featured Posts

-

Arsenali Nen Hetim Te Uefa S Per Ndeshjen Kunder Psg Detaje Te Reja

May 08, 2025

Arsenali Nen Hetim Te Uefa S Per Ndeshjen Kunder Psg Detaje Te Reja

May 08, 2025 -

Andor Season 2 Could Rebels Characters Appear A Timeline Analysis

May 08, 2025

Andor Season 2 Could Rebels Characters Appear A Timeline Analysis

May 08, 2025 -

Analiza E Ndeshjes Se Psg Fitore Minimaliste

May 08, 2025

Analiza E Ndeshjes Se Psg Fitore Minimaliste

May 08, 2025 -

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025

Ethereum Network Sees Significant Increase In Address Activity

May 08, 2025 -

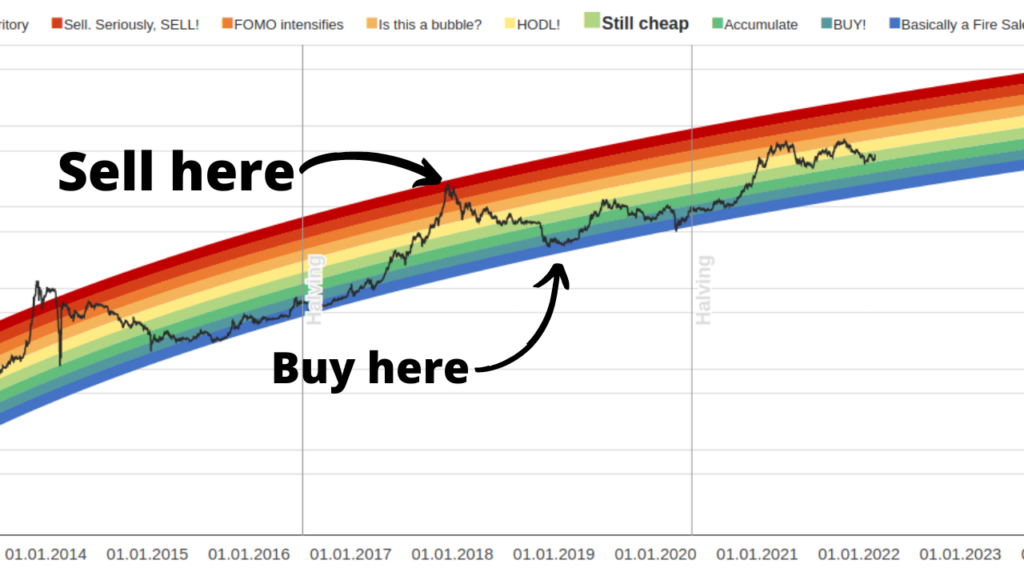

Six Month Trend Reversal Bitcoin Buying Volume Outpaces Selling On Binance

May 08, 2025

Six Month Trend Reversal Bitcoin Buying Volume Outpaces Selling On Binance

May 08, 2025