Best Personal Loans For Bad Credit: Guaranteed Approval? Direct Lenders Up To $5000

Table of Contents

Understanding Personal Loans for Bad Credit

Obtaining a personal loan with bad credit presents unique challenges. A low credit score signals higher risk to lenders, resulting in less favorable loan terms. This typically translates to higher interest rates, smaller loan amounts, and more stringent eligibility requirements. What constitutes "bad credit"? Generally, a FICO score below 670 is considered bad, with scores below 580 indicating significantly impaired credit.

- Higher Interest Rates: Expect to pay a significantly higher annual percentage rate (APR) compared to borrowers with good credit. This is the lender's way of compensating for the increased risk.

- Smaller Loan Amounts: Lenders may offer smaller loan amounts to mitigate their risk. Getting a loan of $5000 with bad credit might require a strong application and might have stricter terms.

- More Stringent Requirements: Lenders will scrutinize your application more closely, demanding more comprehensive documentation of income, employment history, and debt.

- Potential for Loan Origination Fees: Be aware that some lenders charge fees for processing your loan application, adding to the overall cost.

Debunking the Myth of "Guaranteed Approval"

Let's be clear: no reputable lender can guarantee loan approval. Any advertisement promising "guaranteed approval" is a major red flag and often a sign of a predatory lender. Lenders assess risk based on several factors:

-

Credit Score: This is the most crucial factor. A higher score significantly improves your chances.

-

Debt-to-Income Ratio (DTI): This ratio compares your monthly debt payments to your gross monthly income. A lower DTI indicates better financial health.

-

Employment History and Income Stability: Lenders want to see evidence of consistent income to ensure you can repay the loan.

-

"Guaranteed Approval" ads often lead to predatory lenders: These lenders often charge exorbitant fees and interest rates.

-

Focus on lenders with transparent application processes: Look for clear terms and conditions and easy-to-understand fees.

-

Be wary of upfront fees for guaranteed approvals: Legitimate lenders don't require upfront payments to consider your application.

Pre-qualification vs. Application

Pre-qualification involves providing basic information to receive an estimate of your loan terms without a formal credit check. This allows you to compare offers from different lenders before committing to a full application, which involves a hard credit inquiry that can slightly lower your credit score. Pre-qualification is a safer, less impactful first step.

Finding Reputable Direct Lenders

Direct lenders provide loans directly to borrowers without involving intermediaries like brokers. This offers several advantages: clearer terms, simplified processes, and often more competitive rates. Finding trustworthy direct lenders requires diligence:

-

Check reviews: Read online reviews from previous borrowers to gauge the lender's reputation for fairness and customer service.

-

Verify licensing: Ensure the lender is properly licensed and operates legally in your state.

-

Compare interest rates and fees from multiple lenders: Don't settle for the first offer you receive. Shop around and compare.

-

Read the fine print carefully before signing any loan agreement: Understand all terms and conditions before committing.

-

Look for lenders specializing in loans for bad credit: These lenders understand the unique challenges and may offer more tailored solutions.

Online Lenders vs. Traditional Banks

Online lenders often offer faster processing times and more convenient application processes. However, traditional banks may provide more personalized service and potentially lower interest rates if you qualify. Carefully weigh the pros and cons of each before making a decision.

Factors Affecting Loan Approval and Interest Rates

Your credit score plays a dominant role, but other factors also influence your loan approval and interest rate:

-

Credit Score: A higher credit score significantly increases your chances of approval and results in lower interest rates.

-

Debt-to-Income Ratio: A lower DTI demonstrates your ability to manage debt effectively.

-

Employment History and Income Stability: Consistent employment and a stable income stream are critical factors.

-

Improve credit score before applying (paying bills on time, reducing debt): Take steps to improve your creditworthiness before applying for a loan.

-

Provide accurate and complete information on your application: Errors or omissions can lead to delays or rejection.

-

Consider securing a co-signer to improve approval chances: A co-signer with good credit can strengthen your application.

Alternatives to Personal Loans for Bad Credit

If you struggle to secure a personal loan, consider these alternatives:

-

Secured loans: These loans require collateral (like a car or savings account), reducing the lender's risk and potentially resulting in better terms.

-

Credit unions: Credit unions often offer more lenient lending criteria and lower interest rates than traditional banks.

-

Payday loans: These are short-term, high-interest loans. Use them cautiously, as they can easily trap you in a cycle of debt.

-

Explore all options before committing to a loan: Compare interest rates, fees, and repayment terms carefully.

-

Consider the long-term implications of each option: A seemingly small loan can have significant long-term financial consequences.

-

Seek financial advice if needed: A financial advisor can help you navigate your options and develop a sound financial plan.

Conclusion

Securing a personal loan with bad credit requires careful research and a realistic understanding of your options. While "guaranteed approval" is a myth, responsible direct lenders can offer solutions up to $5000. Start your search for the best personal loan for your bad credit situation today. Compare lenders carefully and choose a reputable direct lender that fits your needs. Don't let bad credit stop you from accessing the financial support you need. Remember to research and compare options before committing to any personal loan, especially those for bad credit.

Featured Posts

-

Yoan Moncadas Blast Fuels Angels Fifth Straight Victory

May 28, 2025

Yoan Moncadas Blast Fuels Angels Fifth Straight Victory

May 28, 2025 -

Teylr Suift Khyu Dzhakman I Skandalt Nova Informatsiya Za Bleyk Layvli I Dzhstin Baldoni

May 28, 2025

Teylr Suift Khyu Dzhakman I Skandalt Nova Informatsiya Za Bleyk Layvli I Dzhstin Baldoni

May 28, 2025 -

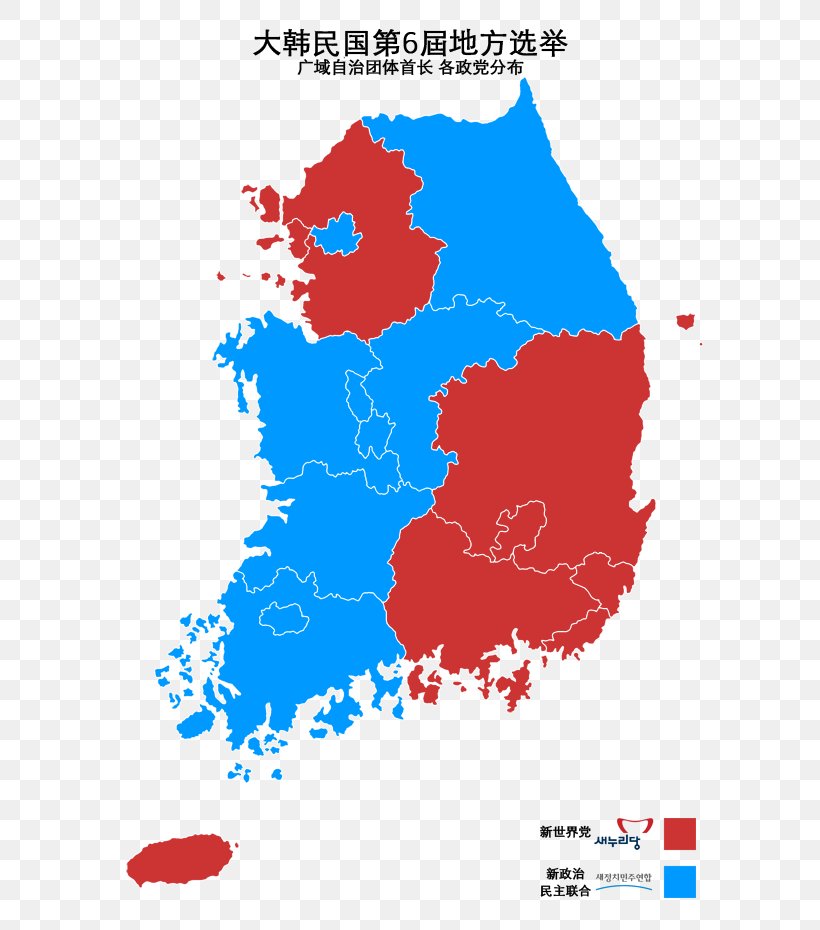

The 2024 South Korean Presidential Election Who Are The Leading Contenders

May 28, 2025

The 2024 South Korean Presidential Election Who Are The Leading Contenders

May 28, 2025 -

Dari Satu Kursi Dpr Ke Perubahan Rencana Kantor Nas Dem Bali

May 28, 2025

Dari Satu Kursi Dpr Ke Perubahan Rencana Kantor Nas Dem Bali

May 28, 2025 -

French Open Draw Sinner In Favorable Top Half

May 28, 2025

French Open Draw Sinner In Favorable Top Half

May 28, 2025