Best Tribal Loans For Bad Credit: Direct Lender Guaranteed Approval?

Table of Contents

Understanding Tribal Loans and Their Advantages

What are Tribal Loans?

Tribal loans are short-term loans offered by lenders associated with Native American tribes. These lenders operate under the principle of tribal sovereign immunity, a legal doctrine that grants tribes a degree of autonomy from state and federal regulations. This can lead to different lending practices compared to traditional banks or credit unions. It's crucial to understand that not all tribal lenders are the same, and responsible research is paramount.

Advantages of Tribal Loans for Borrowers with Bad Credit:

- Higher Approval Rates: Tribal lenders often have less stringent credit requirements than traditional institutions. This can translate to a higher likelihood of approval for individuals with poor credit scores, although this is not guaranteed.

- Faster Processing Times: Many tribal lenders boast quicker application and approval processes compared to banks, meaning you could receive funds faster. However, the speed varies significantly among lenders.

- Less Stringent Credit Checks: While a credit check is usually still performed, the emphasis may be less on your credit score and more on your income and ability to repay.

- Flexible Repayment Options: Some tribal lenders offer more flexible repayment terms than traditional lenders, though this is not universally the case and terms should be carefully reviewed.

Disadvantages and Potential Risks:

- Higher Interest Rates: Expect significantly higher interest rates compared to conventional loans. This is a common characteristic of short-term, high-risk loans.

- Potential for Aggressive Collection Practices: While reputable lenders operate ethically, some unscrupulous lenders may engage in aggressive collection tactics. Always thoroughly research any lender before borrowing.

- Misconceptions and Scams: Be wary of lenders promising "guaranteed approval" without careful review of your application. These are often scams designed to take advantage of vulnerable borrowers.

Always remember responsible borrowing is key. Thoroughly research and compare lenders before committing to any loan.

Finding Reputable Direct Lenders for Tribal Loans

How to Identify Legitimate Lenders:

Avoid scams by checking the lender's legitimacy:

- Licensing and Registration: Confirm the lender is properly licensed and registered to operate in your state.

- Online Reviews: Read reviews from previous borrowers to gauge their experiences and identify potential red flags.

- Transparency in Fees and Terms: Ensure all fees and terms are clearly explained upfront, avoiding hidden charges. Look for lenders that readily provide detailed information about their lending practices.

The Importance of Comparing Loan Offers:

Before choosing a lender, compare:

- Annual Percentage Rate (APR): This reflects the total cost of the loan, including interest and fees. Choose the lowest APR you can qualify for.

- Fees: Compare origination fees, late payment fees, and any other applicable charges.

- Repayment Terms: Evaluate the length of the repayment period and the associated monthly payments to ensure they fit your budget.

Use reputable comparison websites to research lenders and their offers.

The "Guaranteed Approval" Myth:

No lender can genuinely guarantee loan approval, including tribal lenders. While they may have higher approval rates than traditional lenders, your application will still be assessed based on your financial situation. Beware of lenders making unrealistic promises.

Factors Affecting Tribal Loan Approval

Credit Score and History:

Your credit score and history still play a role, even with tribal lenders. A good credit history increases your chances of approval and may result in better loan terms. Factors like payment history, debt-to-income ratio, and past delinquencies are still considered.

Income and Employment Verification:

Stable income and employment verification are crucial. Lenders want assurance you can repay the loan. Be prepared to provide proof of income, such as pay stubs or tax returns.

Other Factors:

Other factors that influence approval include:

- Debt Levels: High levels of existing debt can reduce your approval chances.

- Existing Loan Obligations: Multiple outstanding loans might make it harder to qualify.

- Loan Amount: Requesting a larger loan amount increases the risk for the lender, potentially lowering your chances of approval.

Responsible Borrowing and Repayment Strategies

Creating a Repayment Plan:

Before applying, create a detailed repayment plan:

- Budgeting: Track your income and expenses to determine how much you can comfortably afford to repay each month.

- Prioritizing Debt: If you have other debts, prioritize repayment to reduce your overall debt load.

A realistic plan is crucial to avoid default.

Managing Debt and Avoiding Default:

Defaulting on a loan has serious consequences, including damage to your credit score and potential legal action. Always prioritize repayments and communicate with your lender if you encounter difficulties.

Seeking Financial Assistance:

If you're struggling with debt, seek help:

- Credit Counseling Services: These services can provide guidance on managing debt and creating a budget.

Don't hesitate to seek professional help to avoid financial hardship.

Conclusion

Tribal loans for bad credit offer a potential solution for those struggling to secure financing through traditional channels. However, it's crucial to understand both the advantages and disadvantages. Higher approval rates are possible, but higher interest rates are the norm. "Guaranteed approval" is a misleading promise. Prioritize finding a reputable direct lender, comparing loan offers thoroughly, and creating a realistic repayment plan. Remember, responsible borrowing is essential. Research carefully and compare offers from different best tribal loan options and choose the reliable tribal lenders that best suit your needs. Find the secured tribal loans for bad credit that work for you. Start your research today to find the best tribal loan for your specific situation.

Featured Posts

-

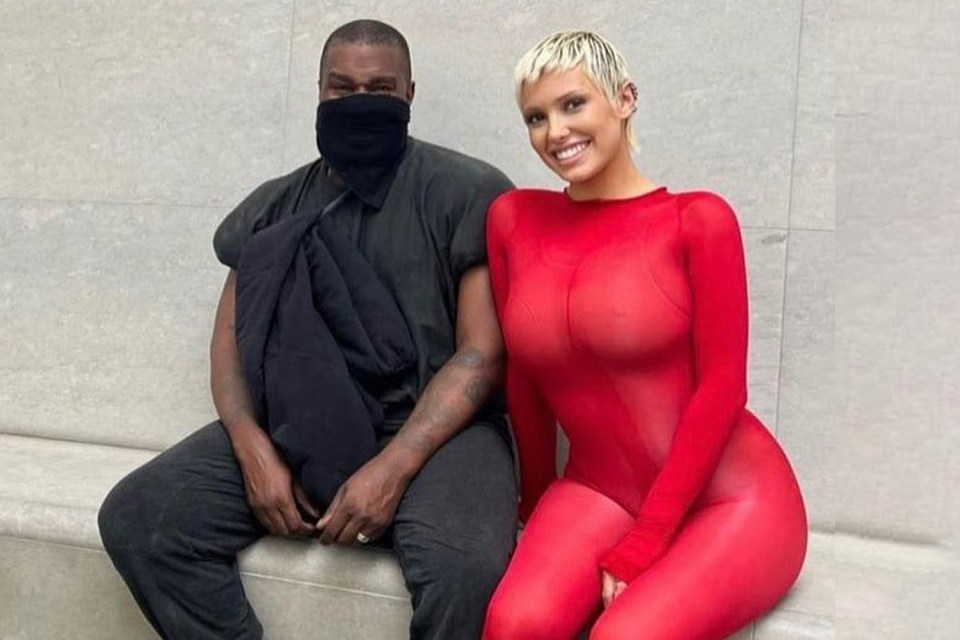

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025

Is This Bianca Censoris Twin Kanye West Seen With Striking Look Alike In Los Angeles

May 28, 2025 -

How To Watch The 2025 American Music Awards For Free Online

May 28, 2025

How To Watch The 2025 American Music Awards For Free Online

May 28, 2025 -

Angels And Dodgers Battle Through Shortstop Injuries

May 28, 2025

Angels And Dodgers Battle Through Shortstop Injuries

May 28, 2025 -

1 Million National Lottery Win Six Week Deadline Approaching

May 28, 2025

1 Million National Lottery Win Six Week Deadline Approaching

May 28, 2025 -

Is Rayan Cherki Headed To Old Trafford

May 28, 2025

Is Rayan Cherki Headed To Old Trafford

May 28, 2025