Best Tribal Loans For Bad Credit: Direct Lenders & Guaranteed Approval

Table of Contents

Understanding Tribal Loans and Direct Lenders

What are Tribal Loans?

Tribal loans are short-term loans offered by lending institutions owned and operated by Native American tribes. These loans operate under tribal sovereignty, meaning they are often subject to different regulations than traditional banks and other lenders. This jurisdictional difference is a key factor differentiating tribal lending from traditional lending practices. While this can offer advantages like potentially faster processing times, it also means these loans may come with higher interest rates than conventional options. It's vital to carefully examine the terms and conditions before proceeding.

- Jurisdictional Differences: The regulatory environment for tribal loans varies significantly depending on the tribe and location.

- Higher Interest Rates: Be aware that tribal loans often carry higher interest rates compared to traditional bank loans.

- Faster Processing Times: Compared to traditional banks, tribal lenders may offer faster loan processing and approval.

The Advantages of Direct Lenders

Opting for a direct lender when applying for a tribal loan eliminates the need for intermediaries, such as brokers. This direct approach offers several key advantages:

-

Transparency: Direct lenders offer greater transparency regarding fees, interest rates, and repayment terms. You know exactly what you're signing up for.

-

Improved Control: You have more control over the borrowing process and communication with the lender.

-

Potentially More Favorable Terms: Dealing directly can sometimes lead to more favorable terms and conditions than going through a broker who adds their own fees and markups.

-

Reduced Fees: Fewer intermediaries mean potentially lower overall fees.

-

Faster Processing: Direct applications can lead to faster processing times.

-

Improved Communication: Direct contact simplifies communication and allows for quicker resolution of any issues.

-

Easier Application Process: The application process is often streamlined when dealing directly with the lender.

Finding Reputable Direct Tribal Lenders

Navigating the tribal lending landscape requires diligence. To avoid scams and predatory lenders, take these crucial steps:

-

Verify Licenses and Accreditations: Check if the lender is properly licensed and accredited in the relevant jurisdiction.

-

Check Online Reviews: Thoroughly review customer feedback on independent review websites. Pay close attention to complaints about high fees, hidden charges, or aggressive collection practices.

-

Beware of Unrealistic Promises: Be wary of lenders who promise "guaranteed approval" without properly assessing your financial situation.

-

Look for Licenses and Accreditations: Confirm the lender's legitimacy through official channels.

-

Check Better Business Bureau Ratings: See what the Better Business Bureau has to say about the lender's reputation.

-

Read Customer Reviews on Independent Sites: Look for unbiased reviews on sites like Trustpilot or Yelp.

-

Compare Interest Rates and Fees: Don't settle for the first offer; compare rates and fees from multiple lenders.

Navigating "Guaranteed Approval" Claims

The Reality of Guaranteed Approval

The term "guaranteed approval" is often a marketing tactic used to attract borrowers with bad credit. In reality, no lender can truly guarantee loan approval. Your eligibility depends on various factors:

-

Credit Score: A higher credit score significantly increases your chances of approval.

-

Income: Lenders assess your income to determine your ability to repay the loan.

-

Debt-to-Income Ratio: A high debt-to-income ratio can negatively impact your approval odds.

-

Pre-qualification Doesn't Guarantee Approval: Pre-qualification is just a preliminary assessment; it doesn't guarantee final approval.

-

Lenders Assess Risk: Lenders carefully assess your risk profile before granting a loan.

-

Responsible Borrowing Practices are Crucial: Always borrow responsibly and only what you can afford to repay.

Improving Your Chances of Approval

While guaranteed approval is a myth, you can improve your odds by:

-

Dispute Errors on Your Credit Report: Check your credit report for inaccuracies and dispute any errors.

-

Pay Down Existing Debts: Reducing your debt-to-income ratio shows lenders you're managing your finances better.

-

Improve Your Credit Utilization Ratio: Keep your credit card balances low compared to your credit limit.

-

Build Positive Credit History: Make consistent on-time payments to build a better credit history.

-

Consider a Co-signer: A co-signer with good credit can significantly increase your approval chances.

-

Provide Accurate and Complete Application Information: Ensure all the information on your application is correct and complete to avoid delays.

Comparing Tribal Loans with Other Bad Credit Loan Options

Alternatives to Tribal Loans

Several alternatives exist for borrowers with bad credit:

-

Payday Loans: These short-term, high-interest loans are often considered a last resort due to their extremely high cost.

-

Personal Loans from Credit Unions: Credit unions may offer more favorable terms than banks for borrowers with bad credit.

-

Secured Loans: Secured loans require collateral, reducing the lender's risk and potentially leading to lower interest rates.

-

Payday Loans: High Interest: Payday loans typically charge exorbitant interest rates.

-

Credit Unions: Lower Rates: Credit unions sometimes offer more competitive rates compared to banks.

-

Secured Loans: Require Collateral: Secured loans necessitate collateral, like a car or home, to back the loan.

Choosing the Right Loan for Your Needs

Selecting the best loan requires careful consideration:

-

Assess Your Financial Needs: Determine the exact amount you need to borrow and the repayment period that suits your budget.

-

Compare Interest Rates and Fees: Compare the total cost of borrowing, including interest, fees, and other charges, from different lenders.

-

Understand Repayment Terms: Carefully review the repayment schedule and ensure you can comfortably afford the monthly payments.

-

Check for Hidden Fees: Be aware of any potential hidden fees or charges.

-

Read Reviews: Research the lender's reputation and read customer reviews before making a decision.

Conclusion:

Tribal loans can be a potential solution for individuals with bad credit seeking financial assistance. However, understanding the realities of "guaranteed approval," the importance of choosing a reputable direct lender, and comparing loan options is crucial. Remember to always borrow responsibly and carefully evaluate the terms and conditions before committing to any loan. Find the best tribal loans for your bad credit situation by researching reputable direct lenders today!

Featured Posts

-

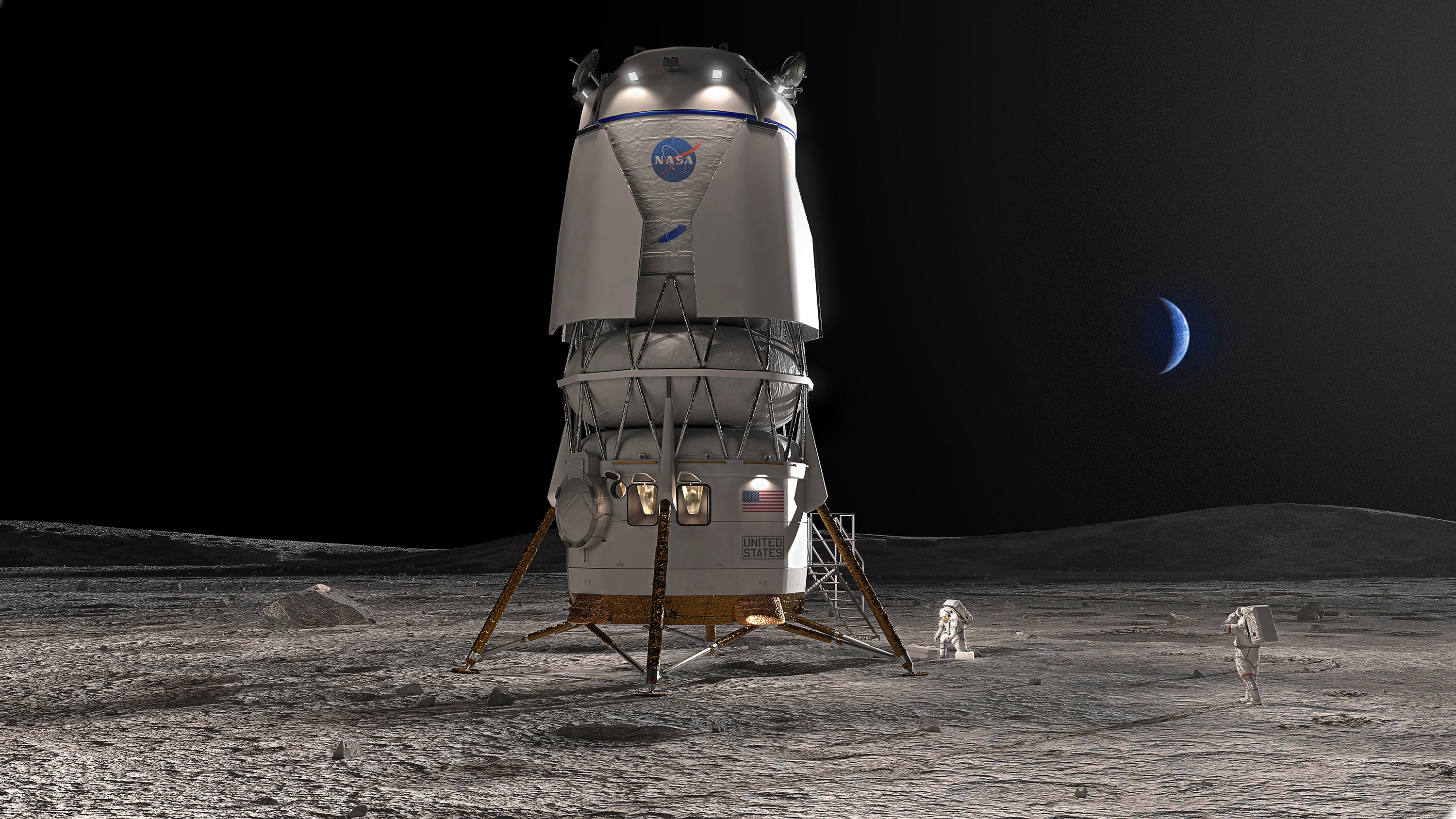

Blue Origin Rocket Launch Delayed Subsystem Malfunction Reported

May 28, 2025

Blue Origin Rocket Launch Delayed Subsystem Malfunction Reported

May 28, 2025 -

Housing Corporations To Sue Minister Over Rent Freeze

May 28, 2025

Housing Corporations To Sue Minister Over Rent Freeze

May 28, 2025 -

Sertijab 7 Pamen Polda Bali Dipimpin Kapolda Irjen Daniel Inilah Pesannya

May 28, 2025

Sertijab 7 Pamen Polda Bali Dipimpin Kapolda Irjen Daniel Inilah Pesannya

May 28, 2025 -

Seattles Rainy Weekend What To Expect

May 28, 2025

Seattles Rainy Weekend What To Expect

May 28, 2025 -

Bianca Censoris Divorce From Kanye West A Report On Her Difficulties

May 28, 2025

Bianca Censoris Divorce From Kanye West A Report On Her Difficulties

May 28, 2025