BigBear.ai (BBAI): Analyzing The Potential For Significant Stock Growth

Table of Contents

BigBear.ai's Core Business and Competitive Advantages

BigBear.ai delivers cutting-edge AI-powered solutions and data analytics services to both government and commercial clients. Their core offerings revolve around advanced algorithms that process and interpret vast datasets, enabling clients to make more informed decisions. BBAI's competitive advantage stems from a combination of factors:

-

Proprietary Technology: BigBear.ai possesses a strong intellectual property portfolio, including patented AI algorithms and specialized software, giving them a significant edge over competitors. This translates to a stronger moat and potentially higher profit margins compared to competitors lacking similar proprietary technology.

-

Sector Expertise: The company boasts deep expertise in mission-critical sectors such as defense, intelligence, and cybersecurity. This specialized knowledge allows them to tailor solutions to specific client needs, fostering strong and long-lasting customer relationships. This targeted approach minimizes competition in niche markets.

-

Strong Customer Relationships: BigBear.ai's proven track record and dedication to client success have cultivated strong relationships with key players in their target markets. These relationships provide a reliable revenue stream and opportunities for future growth.

-

Key Strengths in Detail:

- Advanced AI algorithms for data analysis and decision-making, enabling predictive modeling and real-time insights.

- Expertise in mission-critical applications for government and commercial clients, ensuring high-value service delivery.

- Strong intellectual property portfolio, protecting its innovative technologies and creating a sustainable competitive advantage.

- Strategic partnerships and collaborations, expanding its reach and capabilities.

Growth Drivers and Market Opportunities for BBAI Stock

Several key growth drivers position BBAI for significant expansion:

-

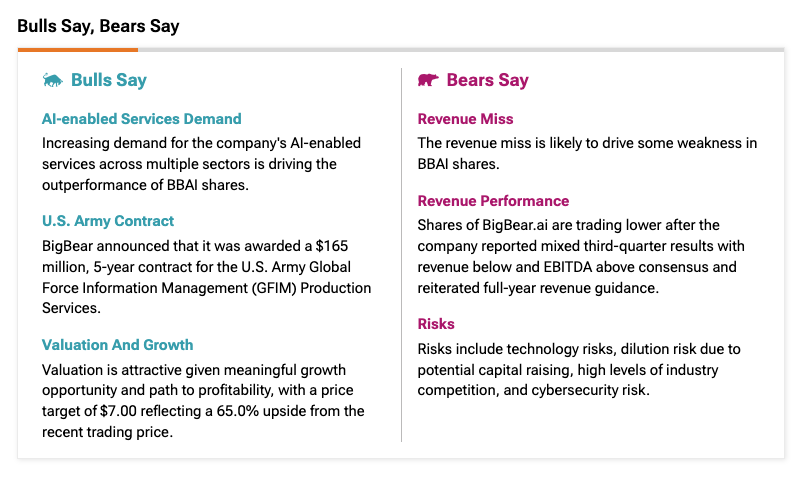

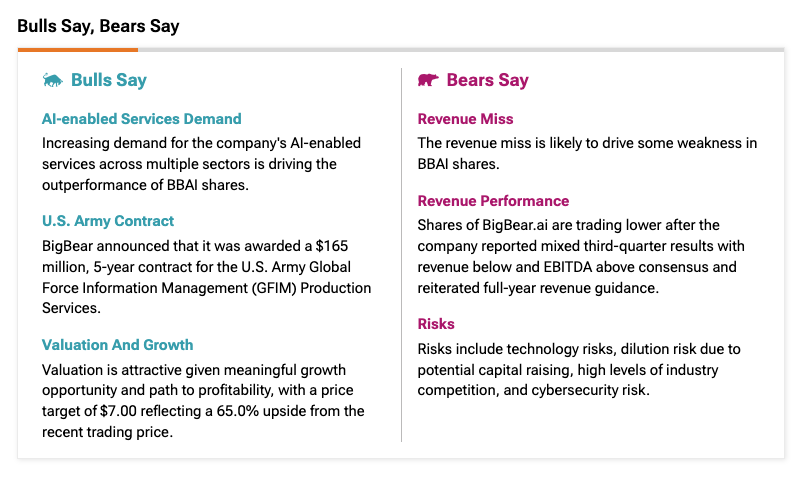

Booming AI Demand: The global demand for sophisticated AI solutions is rapidly accelerating across various industries. BigBear.ai is well-positioned to capitalize on this growth by providing advanced AI-driven solutions to a wide range of clients.

-

Market Expansion: BBAI is actively expanding into new markets, both geographically and sectorally. This diversification strategy reduces reliance on any single market and enhances overall growth potential. International expansion presents significant opportunities for BBAI stock growth.

-

Strategic Acquisitions: Strategic acquisitions can broaden BigBear.ai's capabilities and market reach, accelerating its growth trajectory. Acquisitions of complementary technologies or businesses can enhance its competitiveness and market presence.

-

Key Market Opportunities:

- Growing adoption of AI in various industries, creating a vast addressable market for BBAI's services.

- Government funding for AI and national security initiatives, providing significant opportunities in the public sector.

- Expansion into international markets, tapping into new customer bases and growth opportunities.

- Potential for strategic acquisitions to broaden capabilities and expand into new sectors.

Financial Performance and Valuation of BBAI

Analyzing BBAI's financial performance provides crucial insight into its investment potential. A thorough review of revenue growth, profitability, and cash flow, alongside a comparison of its valuation metrics (P/E ratio, market capitalization) with industry peers, is critical. While specific financial details are beyond the scope of this general overview, investors should carefully examine these elements through official financial reports and reputable financial analysis.

- Key Financial Considerations:

- Revenue growth trajectory and projections: Investors should review historical revenue growth and assess the plausibility of projected future growth.

- Profitability margins and potential for improvement: Analyzing profitability reveals the efficiency of BBAI's operations.

- Debt levels and financial stability: Assessing debt levels helps determine the company's financial health and risk.

- Comparison with competitor valuations: Comparing BBAI's valuation to industry peers provides context for its pricing.

Risks and Considerations for BBAI Stock

Investing in BBAI stock, like any investment, carries inherent risks:

-

Market Volatility: The stock market is inherently volatile, and BBAI stock price is subject to fluctuations influenced by broader market trends and company-specific news.

-

Competition: The AI market is becoming increasingly competitive, posing a risk to BBAI's market share. Strong competitors could limit BBAI's growth prospects.

-

Regulatory Changes: Government regulations impacting the AI and data analytics sectors could create hurdles for BBAI's operations.

-

Execution Risks: The success of BBAI's growth strategies depends on its ability to execute effectively. Failure to execute these strategies could negatively impact its performance.

-

Key Risks to Consider:

- Market fluctuations and their impact on stock price. Investors must account for market volatility.

- Competitive landscape and potential for market share erosion. A strong competitive analysis is vital.

- Regulatory risks and compliance challenges. Understanding the regulatory environment is crucial.

- Execution risks associated with growth strategies. Successful execution is critical for realizing growth.

Conclusion: Investing in BigBear.ai's Future Growth Potential

Investing in BigBear.ai presents a compelling opportunity, but careful consideration of both the potential rewards and associated risks is essential. BBAI's strong technological foundation, expertise in key sectors, and the burgeoning demand for AI solutions suggest significant growth potential. However, market volatility, competition, and regulatory changes pose challenges. A thorough due diligence process, including careful analysis of BBAI's financial performance, competitive landscape, and growth strategy, is paramount before making any investment decisions. This BigBear.ai stock analysis aims to provide a foundation for your own research. By conducting your own in-depth research and assessing your risk tolerance, you can develop a well-informed BigBear.ai investment strategy. Consider the BBAI long-term outlook and its potential for substantial returns before making your investment decisions. Remember, this is not financial advice; consult with a financial professional before investing in BigBear.ai (BBAI) stock.

Featured Posts

-

Llm Siri Apples Path To Enhanced Voice Assistant Performance

May 21, 2025

Llm Siri Apples Path To Enhanced Voice Assistant Performance

May 21, 2025 -

March 18 2025 Nyt Mini Crossword Complete Answers And Clues

May 21, 2025

March 18 2025 Nyt Mini Crossword Complete Answers And Clues

May 21, 2025 -

Vodacom Vod Reports Better Than Expected Earnings And Payout

May 21, 2025

Vodacom Vod Reports Better Than Expected Earnings And Payout

May 21, 2025 -

Abn Amro Opslag Alternatieven Voor Online Betalingen

May 21, 2025

Abn Amro Opslag Alternatieven Voor Online Betalingen

May 21, 2025 -

Impressive Mainz Victory Strengthens Top Four Claim

May 21, 2025

Impressive Mainz Victory Strengthens Top Four Claim

May 21, 2025