BigBear.ai (BBAI): Evaluating The Penny Stock's Long-Term Prospects

Table of Contents

BigBear.ai's Business Model and Revenue Streams

BigBear.ai offers AI-powered solutions to both government and commercial clients. Their core offerings include advanced analytics, data visualization, and predictive modeling, utilizing cutting-edge technologies to solve complex problems. This translates into several key revenue streams:

-

Government Contracts: A significant portion of BBAI's revenue comes from providing AI solutions to various government agencies. These contracts often involve national security and defense applications, providing a degree of stability but also subjecting the company to the intricacies of government procurement processes. Examples could include contracts for cybersecurity threat detection or intelligence analysis. Analyzing BigBear.ai revenue generated from these sources is crucial to understanding the company's financial health.

-

Commercial Partnerships: BBAI also collaborates with private sector companies, offering customized AI solutions tailored to specific industry needs. This diversification helps mitigate reliance on government contracts. Analyzing BBAI financial performance across these sectors can reveal the strength and sustainability of its business model.

-

Software Licensing: BigBear.ai licenses its proprietary software and algorithms to clients, creating a recurring revenue stream. This element reduces reliance on project-based income, increasing predictability in BigBear.ai revenue streams.

Analyzing historical and projected revenue growth is vital. While past performance is not indicative of future results, trends revealed by studying government contracts AI and other revenue sources help forecast future performance. Examining financial reports and analyst predictions provides valuable insights into BigBear.ai revenue and overall financial strength.

Competitive Landscape and Market Analysis

BigBear.ai operates in a competitive landscape filled with established players and agile startups in the AI and big data market. Key competitors include larger technology companies offering similar solutions. However, BBAI possesses several competitive advantages:

-

Unique Technology: BBAI boasts proprietary algorithms and technologies giving it a potential edge in specific niche markets.

-

Strong Partnerships: Strategic alliances with other technology providers and government organizations expand reach and capabilities.

-

Government Relationships: Established relationships with government agencies provide a strong foothold in a significant market segment.

The market for AI solutions is booming, showing substantial growth potential. Evaluating BigBear.ai competitors and analyzing BBAI market share within this expanding market is crucial to assessing the company's future prospects. Researching AI market analysis reports offers insights into the overall market size and growth rate, enabling a more accurate assessment of BBAI's potential for market penetration.

Financial Health and Valuation

A thorough analysis of BBAI's financial statements is necessary to understand its financial health. Key financial ratios to examine include:

-

Debt-to-Equity Ratio: Indicates the company's financial leverage and risk.

-

Current Ratio: Measures the company's ability to meet short-term obligations.

-

Profitability Metrics (Gross Margin, Operating Margin, Net Margin): Reveal the company's efficiency in generating profits.

Valuation metrics like the Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio need to be compared to industry averages and competitors. A high P/E ratio may indicate high growth expectations, but also increased risk. Examining BBAI stock valuation in this context is essential for a well-informed investment decision. Understanding penny stock risk associated with highly volatile stocks like BBAI is paramount. Analyzing factors like the dependence on government contracts, which can be subject to budgetary changes, contributes to a comprehensive BigBear.ai financial analysis.

Long-Term Growth Potential and Risks

BigBear.ai's long-term growth potential hinges on several factors:

-

Technological Advancements: Continued innovation in AI and big data technologies will be crucial for maintaining a competitive edge.

-

Market Expansion: Successfully entering new markets and expanding its client base will drive growth.

-

Successful Contract Acquisitions: Securing new and lucrative government and commercial contracts is essential for revenue growth.

However, several risks exist:

-

Increased Competition: Intense competition from larger, well-funded companies poses a significant threat.

-

Economic Downturns: Government spending cuts or reduced commercial demand can severely impact revenue.

-

Contract Failures: Failure to secure new contracts or delays in existing projects could negatively impact financial performance.

A balanced assessment of BBAI long-term prospects, considering both growth drivers and potential obstacles, is crucial. A successful penny stock investment strategy requires careful consideration of these factors. Thorough research into BigBear.ai growth potential should inform any investment decision.

Conclusion: Investing in BigBear.ai (BBAI): A Final Verdict

BigBear.ai (BBAI) operates in a dynamic and rapidly evolving market with significant growth potential. While it possesses competitive advantages and strong government relationships, its financial performance and dependence on government contracts present considerable risk. The company's future success hinges on its ability to innovate, secure new contracts, and navigate the complexities of the competitive AI landscape. Whether investing in BBAI aligns with your risk tolerance and investment goals requires careful consideration.

This analysis provides a starting point. Before making any investment decisions, conduct thorough due diligence, considering factors such as your personal risk tolerance and broader market conditions. Consider BBAI as part of a diversified portfolio and remember that responsible penny stock investing necessitates a well-informed and cautious approach. Further research into BigBear.ai investment opportunities and detailed BBAI stock analysis is strongly recommended before committing any capital.

Featured Posts

-

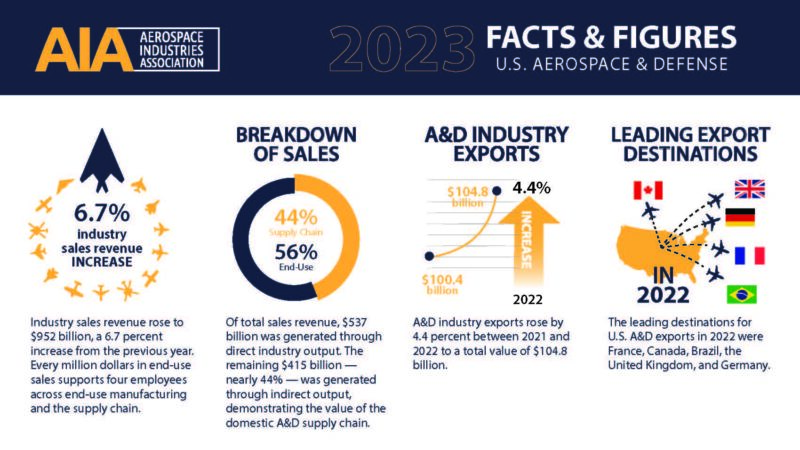

A Critical Examination Of Trumps Aerospace Deal Making Facts And Figures

May 20, 2025

A Critical Examination Of Trumps Aerospace Deal Making Facts And Figures

May 20, 2025 -

Huuhkajien Yllaetyskokoonpano Naein Suomi Aloittaa Ottelun

May 20, 2025

Huuhkajien Yllaetyskokoonpano Naein Suomi Aloittaa Ottelun

May 20, 2025 -

Dywan Almhasbt Ykshf En Mkhalfat Rdwd Afeal Alnwab Wkhtwathm Altalyt

May 20, 2025

Dywan Almhasbt Ykshf En Mkhalfat Rdwd Afeal Alnwab Wkhtwathm Altalyt

May 20, 2025 -

All The Answers Nyt Mini Crossword April 18 2025

May 20, 2025

All The Answers Nyt Mini Crossword April 18 2025

May 20, 2025 -

82 Ai

May 20, 2025

82 Ai

May 20, 2025