BigBear.ai (BBAI) Stock: Buy Rating Holds Amidst Defense Spending Growth

Table of Contents

BigBear.ai's Role in the Expanding Defense Sector

BigBear.ai is strategically positioned to capitalize on the growth within the defense sector. Their expertise in advanced technologies makes them a key player in modernizing military capabilities.

Government Contracts and Funding

BigBear.ai's success is significantly tied to its ability to secure lucrative government contracts. Recent wins demonstrate this capability:

- Contract X: Awarded a $XX million contract from the Department of Defense (DoD) for the development of [specific technology or service].

- Contract Y: Secured a $YY million contract with a major intelligence agency for [specific technology or service]. This demonstrates their capabilities within the intelligence community contracts.

- Contract Z: Awarded a smaller contract with the US Army for [specific technology or service], illustrating their diverse client base within the DoD.

These contracts, along with others, contribute significantly to BBAI revenue and showcase the company's growing presence within the defense technology landscape. The continued expansion of government spending on defense modernization represents a significant growth opportunity for BigBear.ai. The potential for future DoD contracts and intelligence community contracts remains substantial.

Technological Advantage and Competitive Landscape

BigBear.ai differentiates itself through its advanced technologies in AI, data analytics, and cybersecurity. This competitive advantage stems from:

- Proprietary AI algorithms: BigBear.ai utilizes cutting-edge AI algorithms for advanced data analysis, enabling faster and more accurate decision-making within the defense sector.

- Robust Data Analytics Platform: Their platform provides comprehensive data analytics capabilities, allowing for effective threat assessment and strategic planning.

- Next-Generation Cybersecurity Solutions: BigBear.ai offers innovative cybersecurity solutions designed to protect sensitive information and critical infrastructure within the defense ecosystem.

Compared to competitors, BigBear.ai's integrated approach, combining AI, data analytics, and cybersecurity, positions them uniquely to meet the complex needs of modern defense organizations. Their innovative solutions are setting them apart in the competitive defense technology market.

Analysis of the "Buy" Rating for BBAI Stock

The "buy" rating assigned to BBAI stock by various analysts is supported by several factors.

Financial Performance and Projections

BigBear.ai's recent financial performance provides some positive signals:

- Revenue Growth: The company has demonstrated consistent revenue growth over [specific period], indicating strong demand for its services.

- Earnings Reports: While profitability might still be developing, positive trends in earnings reports suggest potential for future growth.

- Analyst Price Targets: Several analysts have set price targets for BBAI stock significantly above its current trading price, further supporting the "buy" recommendation. (Note: Always cite the sources of these price targets.)

These financial indicators, along with positive projections from analysts, contribute to the optimistic outlook for BBAI stock.

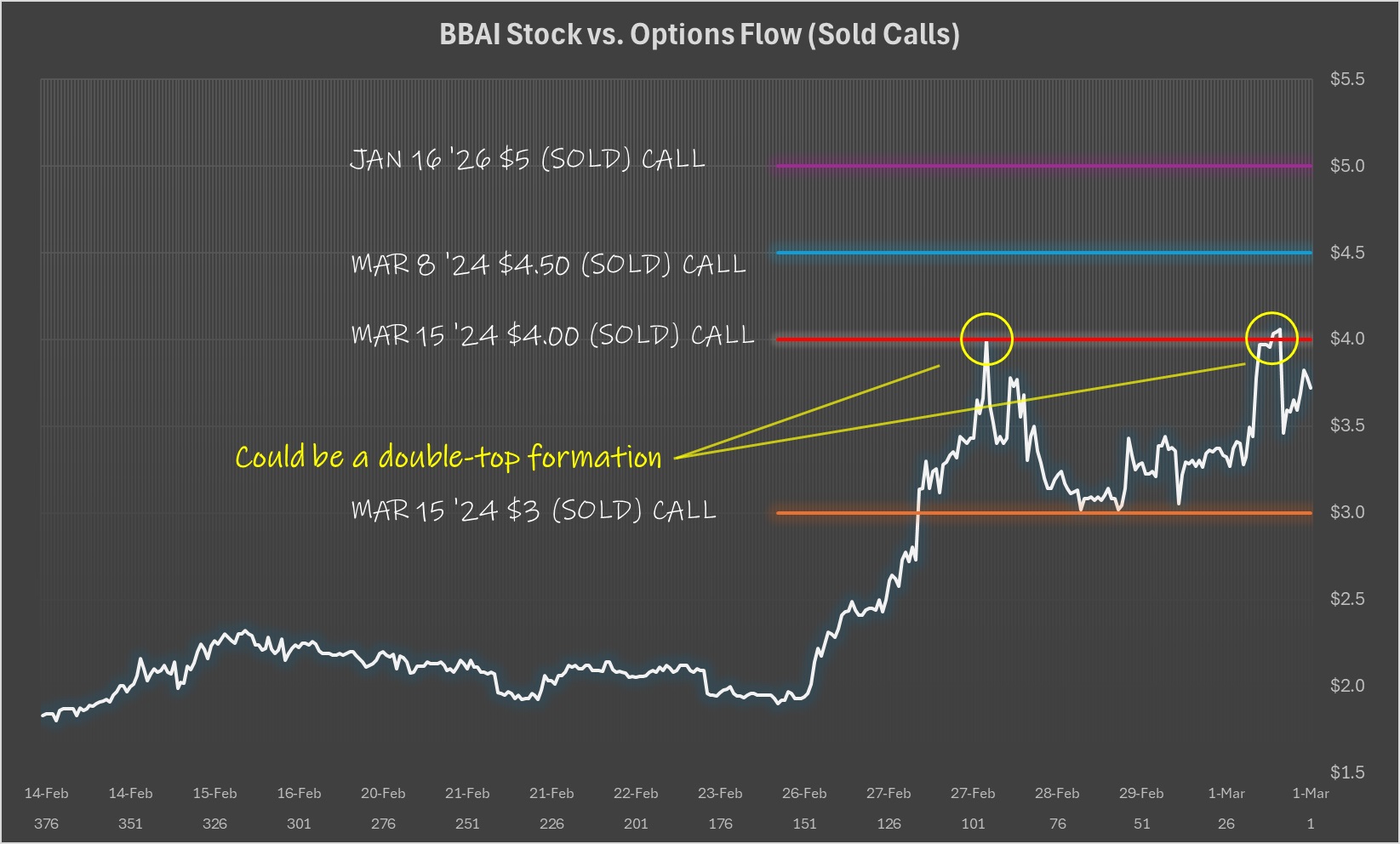

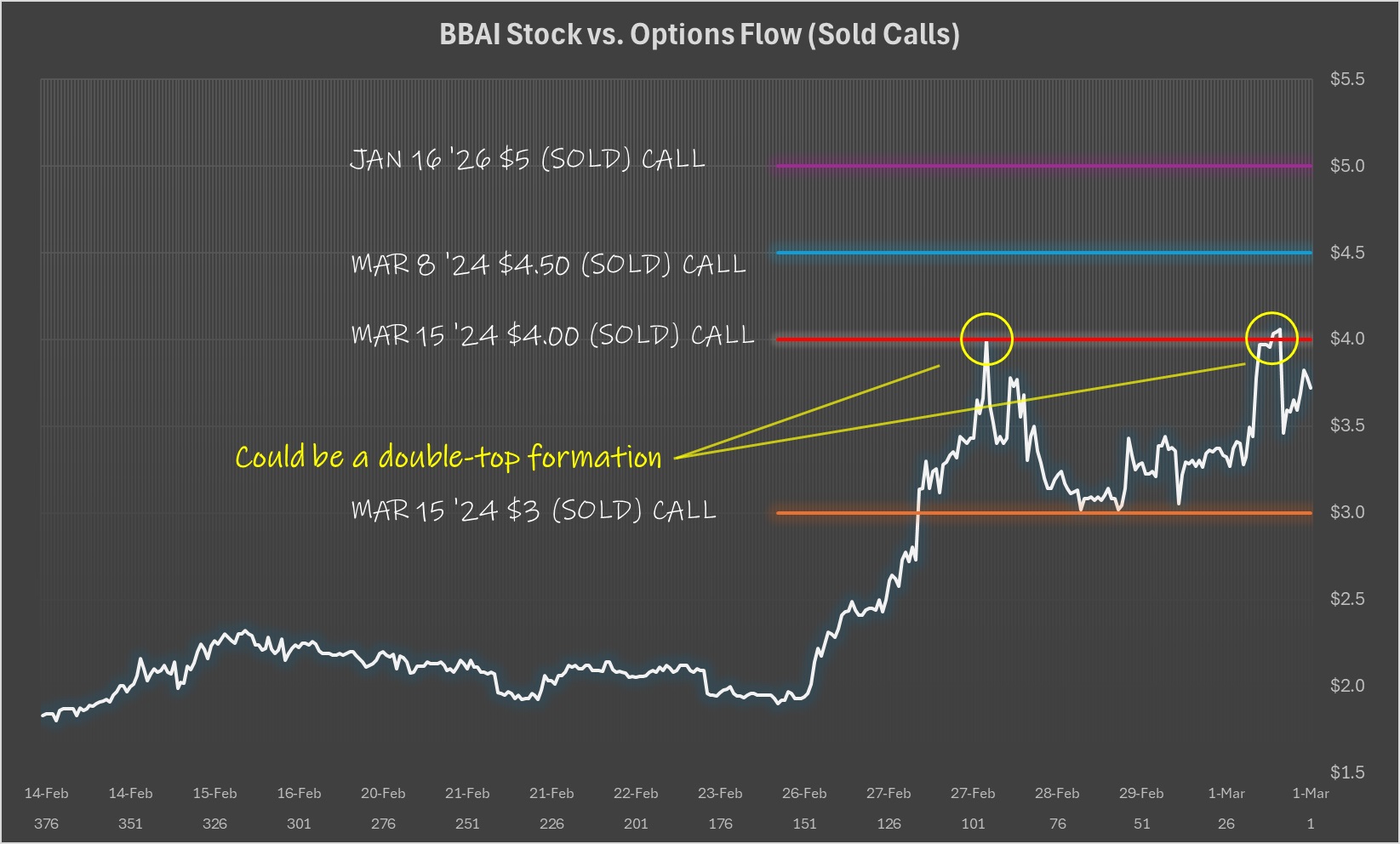

Risk Assessment and Potential Downsides

While the outlook is positive, it's crucial to acknowledge potential risks associated with investing in BBAI stock:

- Market Volatility: The stock market is inherently volatile, and BBAI stock is susceptible to fluctuations.

- Competitive Threats: The defense technology sector is competitive, and new players could emerge, impacting BBAI's market share.

- Geopolitical Factors: Global events and geopolitical instability can influence government spending on defense, potentially impacting BBAI's revenue.

Understanding these risks is essential for any investor considering a position in BBAI stock. A balanced assessment of both the opportunities and risks is crucial before making any investment decision.

The Impact of Increased Defense Spending on BBAI Stock

The correlation between increased defense spending and BBAI's growth potential is significant.

Correlation Between Defense Budget and BBAI Growth

The US and other global governments are significantly increasing their defense budgets. This increased investment directly translates into opportunities for companies like BigBear.ai, which provide critical technologies and services to the defense sector. Higher defense budgets generally mean increased contract awards and opportunities for revenue growth for BBAI. (Include specific data or projections if available, citing the source).

Long-Term Outlook and Investment Strategy

The long-term outlook for BigBear.ai is promising, given the continuous need for advanced technologies within the defense industry. Potential investment strategies could include:

- Long-term hold: Investing with a long-term horizon, anticipating sustained growth in the defense sector.

- Strategic diversification: Incorporating BBAI into a diversified investment portfolio to mitigate overall risk.

- Consult a Financial Advisor: Seeking professional advice is crucial before making any investment decisions.

Careful consideration of risk tolerance and investment goals is crucial when forming an investment strategy around BBAI stock.

Conclusion

This analysis of BigBear.ai (BBAI) stock highlights its strong position within the burgeoning defense technology sector, fueled by substantial government investment. While inherent risks exist, the "buy" rating for BBAI stock appears justifiable considering its technological advantages, promising financial projections, and the overall growth trajectory of the defense industry. Considering the current landscape and the potential for future growth, BigBear.ai (BBAI) stock remains a compelling investment opportunity. Conduct thorough research and consult a financial advisor before making any investment decisions related to BigBear.ai (BBAI) stock.

Featured Posts

-

Mission Patrimoine 2025 Plouzane Et Clisson Patrimoine Breton Sauvegarde

May 21, 2025

Mission Patrimoine 2025 Plouzane Et Clisson Patrimoine Breton Sauvegarde

May 21, 2025 -

Aston Villas Rashford Shines In Fa Cup Rout Of Preston

May 21, 2025

Aston Villas Rashford Shines In Fa Cup Rout Of Preston

May 21, 2025 -

Storing Bij Abn Amro Waarom Kan Ik Niet Online Betalen

May 21, 2025

Storing Bij Abn Amro Waarom Kan Ik Niet Online Betalen

May 21, 2025 -

The Goldbergs Enduring Appeal Why We Still Love This Family Sitcom

May 21, 2025

The Goldbergs Enduring Appeal Why We Still Love This Family Sitcom

May 21, 2025 -

Learn About Bangladesh Facts News And More On Bangladeshinfo Com

May 21, 2025

Learn About Bangladesh Facts News And More On Bangladeshinfo Com

May 21, 2025