BigBear.ai (BBAI) Stock Crash: Analyzing The 17.87% Drop

Table of Contents

Analyzing the Immediate Triggers of the BBAI Stock Crash

The sudden 17.87% plunge in BBAI's stock price wasn't without warning signs. Several factors likely converged to trigger this significant market reaction. Pinpointing the exact cause requires examining the events immediately preceding the crash.

-

Negative Earnings Report or Revised Guidance: A disappointing earnings report, often including missed revenue projections or a lowered earnings-per-share (EPS) guidance, is a classic catalyst for a stock price decline. Did BigBear.ai release such a report before the crash? Analyzing their official financial statements is crucial. (Link to financial report if available).

-

Unexpected Loss of a Major Contract: Government contracts often represent a substantial portion of revenue for companies like BigBear.ai. The unexpected loss of a major contract, particularly one previously anticipated, could drastically impact investor confidence and lead to a sell-off. Specific details about any lost contracts would need to be analyzed.

-

Wider Market Downturn Impacting Tech Stocks: The broader market environment plays a crucial role. A general downturn in the tech sector, perhaps driven by rising interest rates or concerns about inflation, could disproportionately affect a growth stock like BBAI. Correlation with broader market indices should be examined.

-

Analyst Downgrades or Negative Sentiment Reports: Negative analyst reports or downgrades can significantly influence investor sentiment. Did major financial institutions issue negative assessments of BBAI's prospects before the crash? The dissemination of such reports could directly influence trading activity.

-

Impact of Broader Economic Factors (Inflation, Interest Rates): Macroeconomic factors, like inflation and interest rate hikes, can negatively impact investor confidence in growth stocks, particularly those with high valuations. These factors should be considered in the context of the overall market climate.

Evaluating the Underlying Factors Contributing to the BBAI Stock Volatility

Beyond the immediate triggers, several underlying factors likely contributed to BBAI's stock volatility and vulnerability to a sharp decline.

-

Competition within the AI and Data Analytics Market: The AI and data analytics sector is intensely competitive. BigBear.ai faces stiff competition from established players and emerging startups, potentially impacting their market share and profitability.

-

BBAI's Growth Trajectory and its Sustainability: Investors carefully evaluate a company's growth potential. Any concerns about the sustainability of BBAI's growth trajectory, perhaps based on slowing revenue growth or increased competition, could lead to reduced investor confidence.

-

Investor Sentiment and Overall Market Confidence in the Company: Investor sentiment is crucial. Negative news, even if not directly impacting the company's financials, can impact investor confidence, resulting in increased selling pressure.

-

Risks Associated with Government Contracts or Specific Industry Reliance: BBAI's reliance on government contracts introduces a degree of risk. Delays in payments, changes in government policy, or loss of contracts can significantly impact their financial performance.

-

Debt Levels and Financial Stability of the Company: High debt levels can make a company more vulnerable during economic downturns. Examining BBAI's balance sheet and debt-to-equity ratio is crucial for understanding their financial health.

Assessing the Impact of the Crash on BBAI's Long-Term Prospects

The 17.87% crash has significant implications for BigBear.ai's future.

-

Effect on the Company's Ability to Secure Funding or Attract Talent: A sharp stock price decline can make it harder to raise capital or attract top talent, potentially hindering future growth and innovation.

-

Impact on Mergers and Acquisitions Strategies: A lower stock price could impact BBAI's ability to make strategic acquisitions, limiting its growth opportunities.

-

Changes in the Company's Business Model or Strategic Focus in Response to the Crash: The crash may force BBAI to reassess its strategy, potentially leading to changes in its business model or focus.

-

Potential for a Recovery or Further Decline in the Stock Price: Predicting the future stock price is impossible, but analyzing the underlying factors can provide insights into potential scenarios.

-

Long-Term Implications for Investors Holding BBAI Stock: The crash presents a crucial decision point for investors—hold, sell, or buy more BBAI stock.

Strategies for Investors Following the BBAI Stock Crash

The BBAI stock crash requires careful consideration for investors.

-

Hold, Sell, or Buy More BBAI Stock – Pros and Cons of Each Strategy: Each strategy carries risks and rewards. Holding requires belief in a long-term recovery; selling minimizes losses but risks missing potential rebound; buying more is a high-risk, high-reward strategy.

-

Diversification Strategies to Mitigate Risk: Diversification across different asset classes is crucial to mitigate risk. Over-reliance on a single stock, especially a volatile one, is not advisable.

-

Importance of Conducting Thorough Due Diligence Before Making Investment Decisions: Before making any investment decision, thorough research and understanding of the company's financials and market position are crucial.

-

Monitoring Relevant News and Financial Reports: Stay informed about BBAI's performance and the broader market trends.

-

Seeking Advice from a Qualified Financial Advisor: Consult with a qualified financial advisor to assess your risk tolerance and make informed decisions.

Conclusion

The 17.87% drop in BigBear.ai (BBAI) stock highlights the risks associated with investing in growth stocks within a volatile market. Understanding the interplay between immediate triggers like negative earnings reports and underlying factors such as competition and market sentiment is crucial for interpreting the situation. The impact on BBAI's long-term prospects is still unfolding, but careful analysis suggests both potential for recovery and the possibility of further decline. The strategies outlined above provide a framework for navigating this complex scenario. The 17.87% drop in BBAI stock serves as a potent reminder of the need for diligent research and risk management in any investment decision involving BigBear.ai (BBAI) or similar AI-focused companies. Conduct thorough due diligence before making any investment choices related to BBAI.

Featured Posts

-

Saisonende Bundesliga Abstieg Fuer Bochum Und Holstein Kiel Leipzig Ohne Champions League

May 21, 2025

Saisonende Bundesliga Abstieg Fuer Bochum Und Holstein Kiel Leipzig Ohne Champions League

May 21, 2025 -

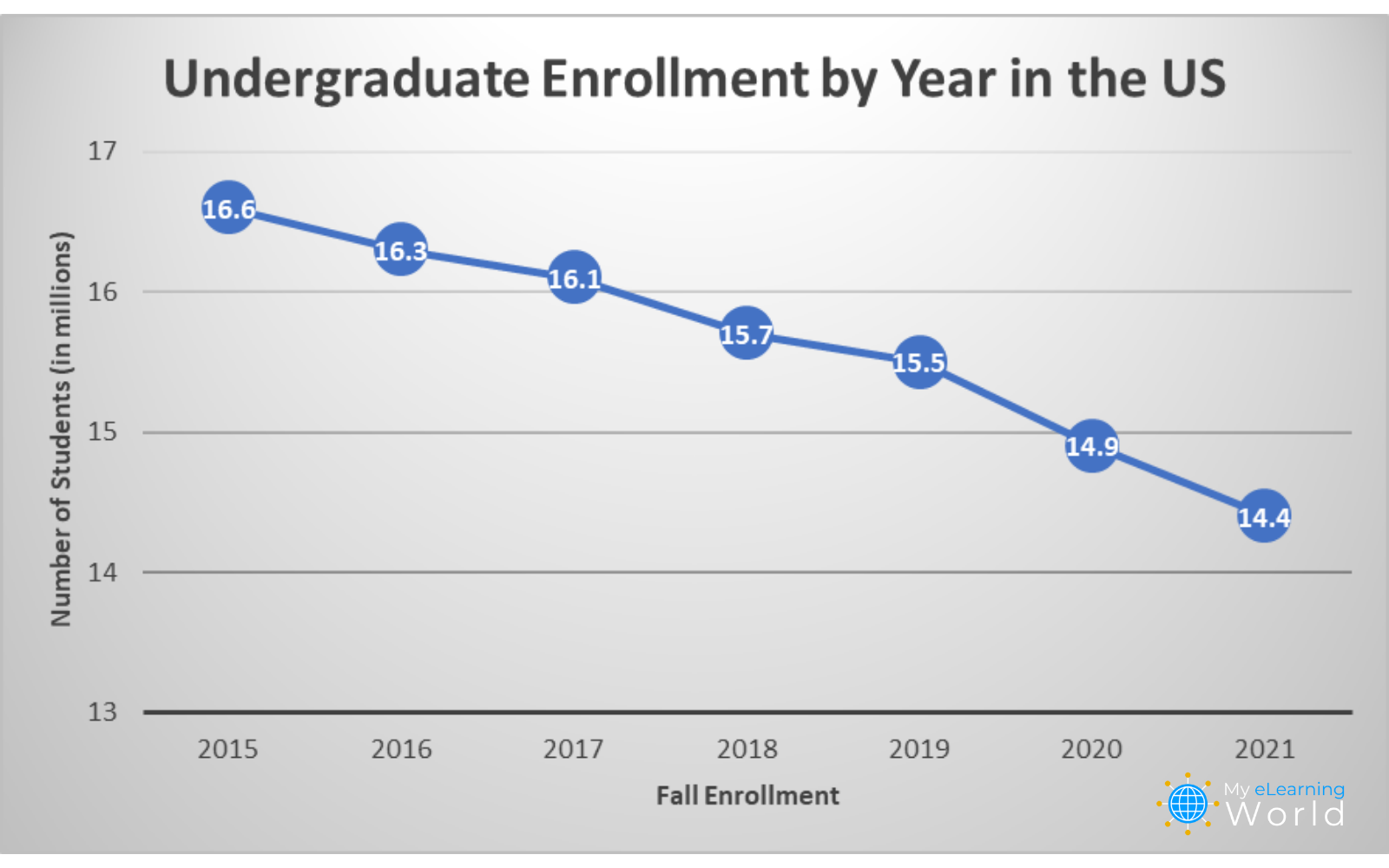

College Enrollment Decline A Deep Dive Into The Economic Consequences For Towns

May 21, 2025

College Enrollment Decline A Deep Dive Into The Economic Consequences For Towns

May 21, 2025 -

Une Nouvelle Navette Gratuite Test Entre La Haye Fouassiere Et Haute Goulaine

May 21, 2025

Une Nouvelle Navette Gratuite Test Entre La Haye Fouassiere Et Haute Goulaine

May 21, 2025 -

Decision Delayed Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 21, 2025

Decision Delayed Ex Tory Councillors Wifes Racial Hatred Tweet Appeal

May 21, 2025 -

Bundesliga Abstieg Bochum Und Holstein Kiel Verlieren Die Klasse Leipzig Entgeht Der Champions League

May 21, 2025

Bundesliga Abstieg Bochum Und Holstein Kiel Verlieren Die Klasse Leipzig Entgeht Der Champions League

May 21, 2025