BigBear.ai (BBAI) Stock Decline In 2025: Understanding The Factors

Table of Contents

Macroeconomic Factors Impacting BBAI Stock Performance

Broader macroeconomic trends significantly influence BBAI stock performance. Factors like interest rate hikes, inflation, and recessionary fears can dramatically impact investor confidence and the overall market.

- Correlation between overall market performance and BBAI's stock price: BBAI stock, like most equities, is subject to the ebb and flow of the overall market. A downturn in the broader market will likely negatively affect BBAI, even if the company's fundamentals remain strong.

- Impact of investor sentiment and risk aversion on tech stocks, including BBAI: During periods of economic uncertainty, investors tend to become more risk-averse, often leading to a sell-off in growth stocks, including those in the tech sector like BBAI. Increased risk aversion translates to reduced investment in potentially volatile sectors.

- Analysis of potential economic downturns and their effect on government spending (a key factor for BBAI): BigBear.ai heavily relies on government contracts. A recession could lead to reduced government spending, directly impacting BBAI's revenue streams and profitability. Decreased government budgets translate to fewer contracts awarded.

Company-Specific Challenges Affecting BBAI Stock Price

Internal challenges at BigBear.ai can also negatively influence its stock price. These issues require careful consideration.

- Competitive landscape analysis – how is BBAI performing against competitors?: The AI and government contracting sectors are fiercely competitive. BBAI's ability to maintain a competitive edge regarding innovation, pricing, and client acquisition directly impacts its stock price. Failure to compete effectively could lead to market share erosion and decreased profitability.

- Financial performance – revenue growth, profitability, debt levels, etc.: Consistent revenue growth, profitability, and manageable debt levels are essential for a healthy stock price. Any negative trends in these areas can signal underlying problems and trigger a decline in BBAI stock.

- Execution risks – challenges in delivering projects, meeting deadlines, etc.: Failure to deliver projects on time and within budget can damage BBAI's reputation and erode investor confidence. This is especially critical in the government contracting realm, where reliability and performance are paramount.

- Management changes or strategic shifts: Significant changes in management or strategic direction can create uncertainty among investors, potentially causing stock price volatility. Unclear or poorly executed strategic shifts may lead to negative market reaction.

Sector-Specific Headwinds Facing the AI and Government Contracting Industry

Industry-wide headwinds further challenge BBAI and similar companies.

- Regulatory changes affecting AI development or government contracts: Changes in regulations concerning AI development and government contracting can significantly impact BBAI's operations and profitability. New regulations may increase compliance costs or limit market opportunities.

- Shifting government priorities or budget constraints: Changes in government priorities and budget allocations can directly affect demand for BBAI's services. A shift in focus away from AI-related projects could impact the company’s future contracts.

- Technological disruptions within the AI sector: Rapid technological advancements could render BBAI's current offerings obsolete, necessitating significant investment in research and development to stay competitive. This could strain resources and affect short-term profits.

- Increased competition for talent in the AI field: Attracting and retaining top talent in the highly competitive AI industry is vital. A shortage of skilled professionals can hinder BBAI's growth and innovation.

Investor Sentiment and Market Speculation Surrounding BBAI

Investor sentiment and market speculation can significantly influence BBAI's stock price volatility.

- Impact of news articles, analyst ratings, and social media sentiment on BBAI's stock price: Positive or negative news coverage, analyst ratings, and social media sentiment can all impact investor perception and influence trading decisions, causing price swings.

- Short-selling activity and its influence on BBAI's stock: Short-selling, where investors bet against a stock's price, can amplify downward pressure on BBAI's stock price, especially during periods of uncertainty.

- Analysis of potential market manipulation or misinformation: The possibility of market manipulation or the spread of misinformation regarding BBAI should always be considered as a factor influencing the stock price.

Conclusion: Understanding and Navigating BBAI Stock's Future

Several factors – macroeconomic conditions, company-specific challenges, industry headwinds, and investor sentiment – could contribute to a hypothetical decline in BBAI stock in 2025. Thorough research and risk assessment are crucial before investing in BBAI or any other stock. To make informed decisions regarding your BBAI stock portfolio, it's vital to stay updated on BBAI stock performance by regularly monitoring news, financial reports, and analyst opinions. Continue your BBAI stock research and monitor the BBAI stock market trends to mitigate risk. Remember, understanding these factors is key to navigating the complexities of the BBAI stock market and making sound investment decisions.

Featured Posts

-

Aldhkae Alastnaey Yuhyy Aghatha Krysty Hl Stuktb Rwayat Jdydt

May 20, 2025

Aldhkae Alastnaey Yuhyy Aghatha Krysty Hl Stuktb Rwayat Jdydt

May 20, 2025 -

Understanding Your Updated Hmrc Tax Code Impact Of Savings

May 20, 2025

Understanding Your Updated Hmrc Tax Code Impact Of Savings

May 20, 2025 -

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025

Dzhenifr Lorns Maychinstvoto Za Vtori Pt

May 20, 2025 -

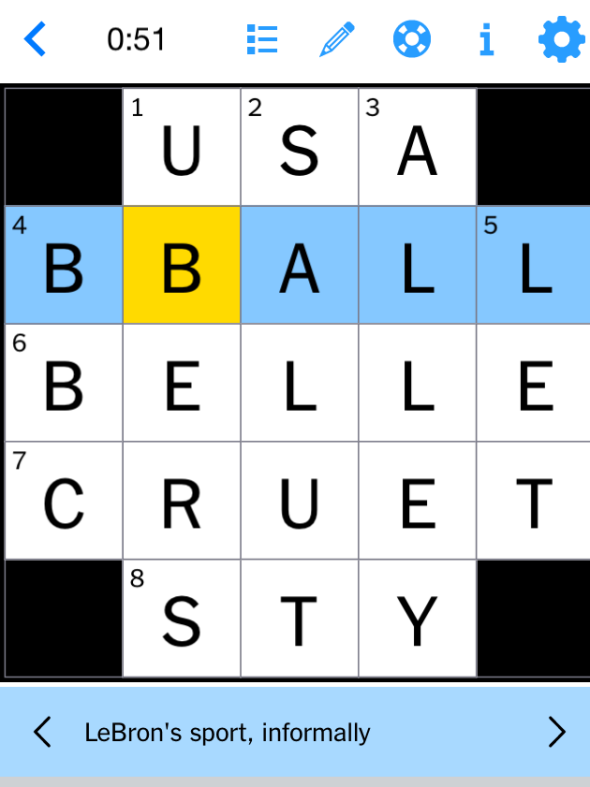

May 9 Nyt Mini Crossword Puzzle Answers

May 20, 2025

May 9 Nyt Mini Crossword Puzzle Answers

May 20, 2025 -

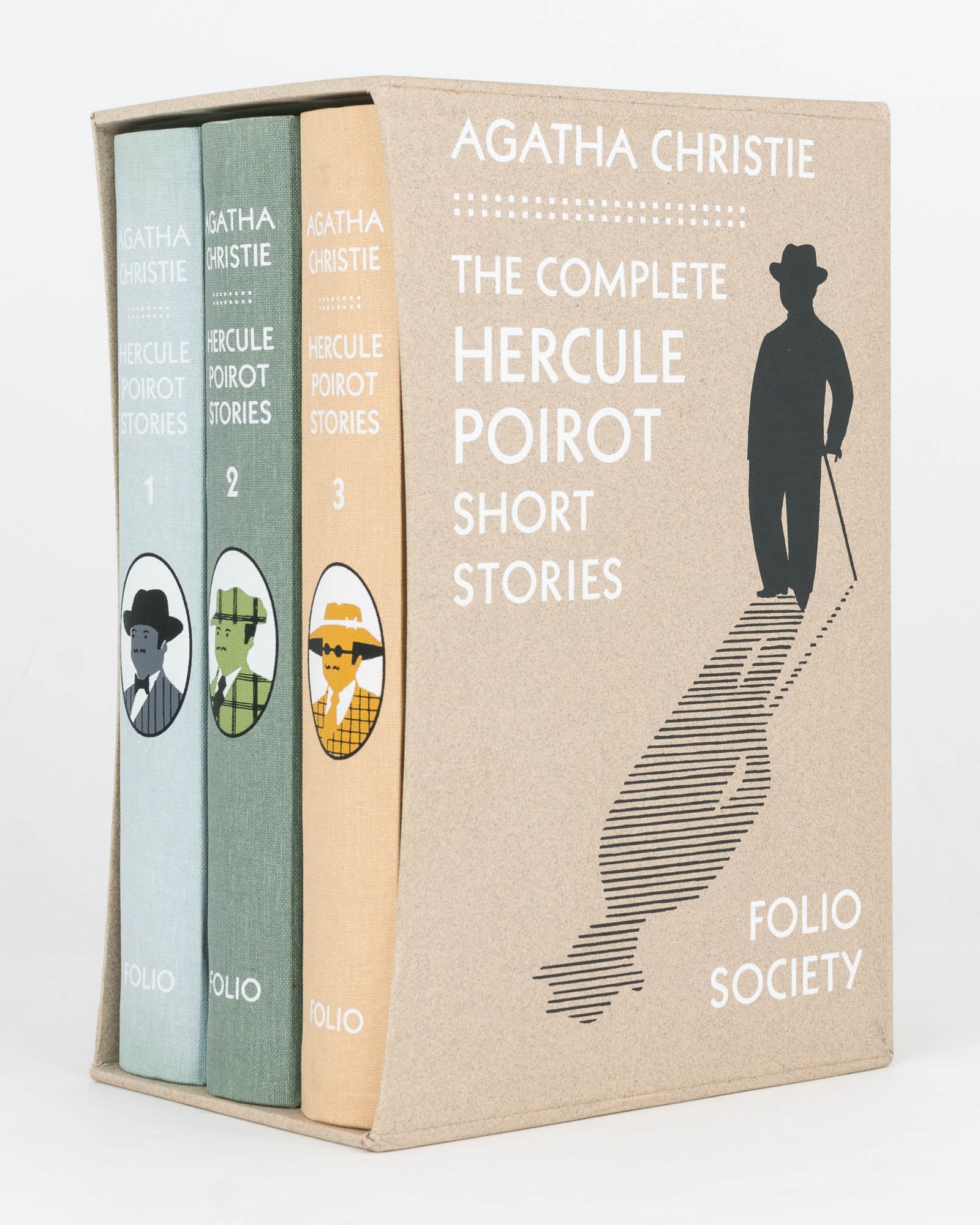

The Evolution Of Hercule Poirot In Agatha Christies Novels

May 20, 2025

The Evolution Of Hercule Poirot In Agatha Christies Novels

May 20, 2025