BigBear.ai (BBAI) Stock: Is It Worth The Investment? A Thorough Analysis

Table of Contents

BigBear.ai's Business Model and Financial Performance

BigBear.ai (BBAI) is a leading provider of AI-powered solutions, focusing on advanced analytics and data science. Its primary target markets include government (particularly defense), and commercial sectors. The company leverages cutting-edge technologies, including machine learning, artificial intelligence, and advanced data analytics, to provide mission-critical solutions. A BigBear.ai investment hinges on the understanding of its financial health and future prospects.

Revenue Streams and Growth Potential

BigBear.ai's revenue streams are diversified, a key element to consider for any BBAI investment. This diversification reduces the impact of reliance on a single source.

- Government Contracts: A significant portion of BBAI's revenue comes from contracts with government agencies, particularly in the defense and intelligence sectors.

- Commercial Partnerships: BBAI is increasingly focused on expanding its commercial partnerships, targeting sectors like cybersecurity and financial services.

The growth trajectory of BBAI is vital when considering BBAI stock. While past performance doesn't guarantee future results, analyzing historical trends provides valuable insight. Analyzing revenue growth rate, profit margins, and debt levels is crucial. Access to recent financial reports is necessary to accurately assess this aspect of a BigBear.ai investment.

Competitive Landscape and Market Share

BigBear.ai operates in a highly competitive market, with established players and emerging startups vying for market share. A thorough understanding of BBAI's competitive positioning is critical for a prudent BBAI investment.

- Key Competitors: BBAI competes with larger technology companies offering similar AI and data analytics solutions, as well as smaller specialized firms. A direct comparison of BBAI's capabilities, market penetration, and pricing strategies against its competitors is necessary.

- Competitive Advantages: BBAI's competitive advantages include its specialized expertise in mission-critical applications, its strong government relationships, and its commitment to continuous technological innovation.

Recent Financial Reports and News

Regularly reviewing BigBear.ai's financial reports is essential when considering a BigBear.ai investment. Recent quarterly and annual reports provide insights into key financial metrics such as revenue growth, profitability, and cash flow. Significant news and announcements impacting the stock price should be closely monitored.

Risk Assessment for BigBear.ai Investment

Investing in BBAI stock, or any BigBear.ai investment, involves inherent risks. A comprehensive risk assessment is crucial before making any investment decisions.

Market Risks and Industry Volatility

The technology sector, particularly the AI market, is known for its volatility. Economic downturns can significantly impact BBAI's performance, particularly its government contract revenue streams.

- Market Volatility: The inherent volatility of the stock market, coupled with the cyclical nature of government spending, creates significant risk for BBAI stock.

- Competition: Intense competition from established players and emerging startups can put pressure on BBAI's pricing and profitability.

Financial Risks and Debt Levels

Analyzing BBAI's financial health, including its debt-to-equity ratio, cash flow, and potential for future funding needs, is crucial.

- Debt Levels: High levels of debt can increase financial risk and potentially limit BBAI's ability to invest in future growth opportunities.

- Cash Flow: A strong and positive cash flow is essential for the sustainability and growth of the company.

Geopolitical Risks and Government Contracts

BBAI's significant reliance on government contracts exposes it to geopolitical risks. Changes in government priorities or international relations can significantly impact revenue streams.

- Government Budget Changes: Shifts in government spending priorities can directly affect the volume of contracts awarded to BBAI.

- Geopolitical Instability: International conflicts or political instability can disrupt operations and impact contract awards.

Growth Potential and Future Outlook for BBAI Stock

Despite the risks, BBAI's growth potential is substantial, making a BigBear.ai investment appealing to some. Several factors contribute to this potential.

Technological Innovation and Advancements

BBAI's continued investment in research and development is crucial to its long-term success. Technological advancements in AI and data analytics provide significant opportunities for growth and market expansion.

- AI Innovation: BBAI's commitment to developing cutting-edge AI solutions positions it for significant growth in various sectors.

- New Applications: Exploring new applications of its AI technology in emerging markets presents significant growth opportunities.

Expansion Plans and Market Penetration

BBAI's strategic expansion plans into new markets and its efforts to increase market share will play a significant role in its future performance.

- New Market Entry: Expanding into new commercial markets can diversify revenue streams and reduce reliance on government contracts.

- Market Share Growth: Increasing market share within existing markets can lead to significant revenue growth.

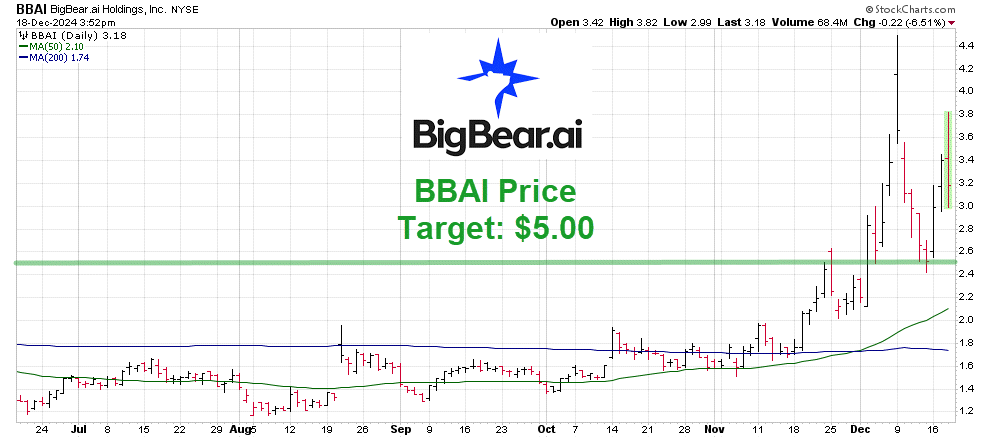

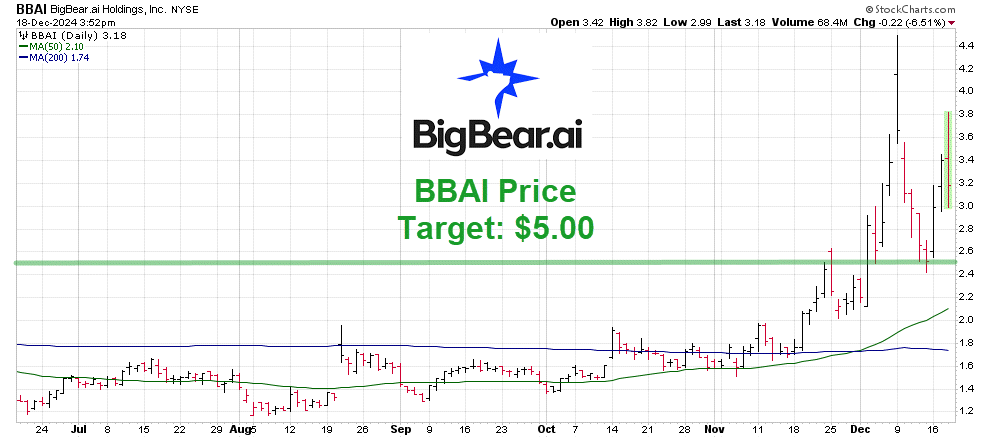

Analyst Predictions and Price Targets

Financial analysts offer a range of opinions and price targets for BBAI stock. It's crucial to review these predictions but remember that they're not guarantees of future performance.

Conclusion: Is BigBear.ai (BBAI) Stock Right for You?

Investing in BigBear.ai (BBAI) stock presents both significant opportunities and substantial risks. While the company's technological capabilities and diversified revenue streams are positive factors, the volatility of the AI market, reliance on government contracts, and financial risks need careful consideration. Whether a BigBear.ai investment is right for you depends on your individual risk tolerance and investment goals.

Therefore, while BBAI shows promise, it is not a guaranteed investment. Before investing in BBAI stock or exploring other BigBear.ai investment options, conduct thorough due diligence, consult with a financial advisor, and understand your own risk profile. Informed decision-making is paramount when investing in volatile growth stocks like BBAI. Remember, this analysis is for informational purposes only and does not constitute financial advice.

Featured Posts

-

Philippines China Tensions Rise Over Typhon Missile System Deployment

May 20, 2025

Philippines China Tensions Rise Over Typhon Missile System Deployment

May 20, 2025 -

Actualizacion Sobre La Salud De Michael Schumacher Una Noticia Que Emocono

May 20, 2025

Actualizacion Sobre La Salud De Michael Schumacher Una Noticia Que Emocono

May 20, 2025 -

James Cronin Highfields New Head Coach

May 20, 2025

James Cronin Highfields New Head Coach

May 20, 2025 -

The Us Missile Launcher And The Growing China Us Tensions

May 20, 2025

The Us Missile Launcher And The Growing China Us Tensions

May 20, 2025 -

Ivoire Tech Forum 2025 La Plateforme Internationale Pour La Transformation Numerique En Cote D Ivoire

May 20, 2025

Ivoire Tech Forum 2025 La Plateforme Internationale Pour La Transformation Numerique En Cote D Ivoire

May 20, 2025