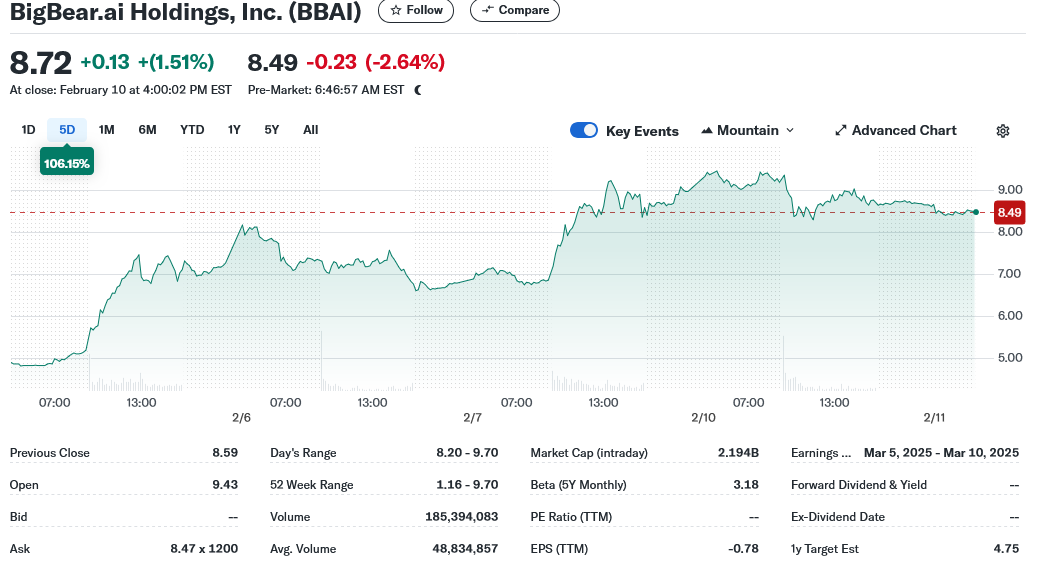

BigBear.ai (BBAI) Stock Performance In 2025: A Comprehensive Review

BigBear.ai (BBAI) Current Market Position and Financial Performance

Understanding BigBear.ai's current financial standing is crucial to predicting its future performance. Analyzing BBAI financials, including revenue, earnings, and market capitalization, allows us to gauge its strength and stability within the competitive AI market. Let's examine key aspects of its current market position:

-

Recent Quarterly and Annual Reports: A thorough review of BBAI's recent financial reports reveals its revenue growth, profitability margins, and overall financial health. Analyzing these reports provides critical insight into the company’s operational efficiency and its ability to generate sustainable profits. Examining trends in revenue growth is especially important, helping us determine the company's potential for future expansion.

-

Key Performance Indicators (KPIs) and Industry Benchmarks: Comparing BBAI's KPIs – such as revenue growth, earnings per share (EPS), and return on equity (ROE) – to industry benchmarks paints a clear picture of its competitive positioning. This allows us to assess its relative success against other players in the AI sector. Lagging behind benchmarks may indicate challenges that could impact future BBAI stock predictions.

-

Competitive Landscape and Market Positioning: BigBear.ai operates in a fiercely competitive AI market. Analyzing its market share, its competitive advantages, and the strategies employed by its competitors—such as Palantir, C3.ai, and others—is crucial. Identifying BBAI’s unique selling propositions (USPs) and potential market niches will provide crucial insights into its future growth prospects.

-

Significant Partnerships and Contracts: Strategic alliances and major contracts can significantly impact BBAI's revenue streams and future growth trajectory. Identifying any key partnerships or government contracts secured will allow for a more accurate forecast of future earnings and BBAI stock valuation. Large contracts can represent significant growth opportunities.

Factors Influencing BBAI Stock Performance in 2025

Numerous factors can influence BBAI stock performance in 2025. These include the overall growth potential of the AI industry, technological advancements impacting BigBear.ai's products and services, regulatory changes, and general macroeconomic conditions.

-

AI Market Growth Potential: The AI market is expected to experience significant growth in the coming years. Assessing this potential growth and determining BigBear.ai's ability to capitalize on these trends is critical for predicting future BBAI stock prices. A larger market share in a rapidly growing market naturally leads to higher valuations.

-

Impact of New Technologies: Rapid advancements in AI technologies, such as machine learning and deep learning, will influence BigBear.ai's competitive positioning. The company's capacity to adapt and innovate, developing and integrating new technologies, is paramount to its future success and BBAI stock valuation. Failure to adapt could negatively affect BBAI's growth prospects.

-

Regulatory Changes and their Impact: Government regulations and policies related to AI and data privacy will have a significant effect on the AI industry, and BigBear.ai's operations are no exception. Keeping abreast of regulatory changes is crucial for accurately projecting BBAI’s future performance. Stricter regulations could impact profitability and slow down BBAI stock price growth.

-

Macroeconomic Factors: Inflation, interest rates, and overall economic health will influence investor sentiment and market conditions, which in turn influence BBAI stock performance. A strong economy generally leads to positive investor sentiment and higher stock valuations. Conversely, economic downturns tend to impact stock markets negatively.

BBAI Stock Price Prediction and Investment Strategies

Predicting BBAI's stock price in 2025 involves a degree of speculation. However, considering the factors discussed above, we can construct potential scenarios. Remember that these are estimations, and actual outcomes may differ significantly.

-

Potential Price Targets: Based on different growth scenarios (optimistic, neutral, pessimistic), we can develop potential price targets for BBAI stock in 2025. These targets should be presented alongside the assumptions and limitations of each scenario.

-

Risk Assessment and Mitigation: Investment in BBAI stock, like any stock, carries inherent risks. These risks should be clearly identified and analyzed, along with possible mitigation strategies. This is crucial for responsible investing and managing potential financial losses.

-

Investment Strategies for Different Risk Tolerances: Depending on the individual investor's risk tolerance (conservative, moderate, aggressive), different investment strategies should be suggested, such as buy, hold, or sell. Risk tolerance directly influences how much one should invest in BBAI stock.

-

Disclaimer Regarding Speculative Nature of Predictions: It is essential to clearly state that any stock price prediction is inherently speculative and not a guaranteed outcome. Investors should always conduct their own thorough research and consider seeking professional financial advice.

Conclusion

Predicting BigBear.ai (BBAI) stock performance in 2025 requires a careful analysis of its current financial position, the evolving AI landscape, and various macroeconomic factors. While the company shows promise within the rapidly expanding AI market, it faces competition and inherent risks. Our analysis suggests a cautiously optimistic outlook, but investors should proceed with caution, always performing thorough due diligence. Remember, the information provided here is for educational purposes only and is not financial advice. Stay informed on BBAI stock predictions and learn more about BigBear.ai’s investment potential by conducting your own comprehensive research and seeking advice from qualified financial professionals before making any investment decisions.

Tv Host Lorraine Kelly Squirming After David Walliams Remark

Tv Host Lorraine Kelly Squirming After David Walliams Remark

Analyzing Trumps Aerospace Agreements Substance Vs Spectacle

Analyzing Trumps Aerospace Agreements Substance Vs Spectacle

Ferrari Risks Alienating Leclerc By Prioritizing Hamiltons Comfort

Ferrari Risks Alienating Leclerc By Prioritizing Hamiltons Comfort

Us Credit Downgrade Live Updates On Dow Futures And Dollar

Us Credit Downgrade Live Updates On Dow Futures And Dollar

Side Hustle Income Tax The Impact Of Hmrcs New Us Inspired Enforcement Strategy

Side Hustle Income Tax The Impact Of Hmrcs New Us Inspired Enforcement Strategy