BigBear.ai Holdings (BBAI) 2025 Stock Performance: A Comprehensive Review

Table of Contents

BigBear.ai's Current Market Position and Competitive Landscape

BigBear.ai operates in the rapidly expanding market of artificial intelligence and data analytics solutions, focusing on national security and commercial applications. Understanding its current position and the competitive landscape is critical to any BBAI stock forecast.

Analyzing BBAI's Strengths

BigBear.ai possesses several key strengths:

- Advanced AI Capabilities: BBAI leverages cutting-edge AI technologies, including machine learning, deep learning, and natural language processing, to deliver sophisticated solutions. Their expertise in these areas is a significant competitive advantage.

- Strong Government Partnerships: BigBear.ai has secured numerous contracts with government agencies, demonstrating the effectiveness and demand for their services in national security applications. This provides a stable revenue stream and enhances their reputation within the sector. (See recent press releases on their website for specific examples)

- Data Analytics Expertise: Their capabilities extend beyond basic AI, incorporating strong data analytics to transform raw data into actionable insights. This allows for more effective decision-making by their clients.

- Strategic Partnerships: Collaborations with other technology companies expand their reach and capabilities. These partnerships provide access to new technologies and markets. (Links to relevant partnership announcements should be added here)

Assessing BBAI's Competitors

The AI and data analytics market is competitive. Key competitors include larger established firms like Palantir Technologies and smaller, specialized AI companies.

- Competitive Differentiation: While facing competition from larger players, BBAI differentiates itself through its specialization in niche markets like national security and its focus on providing highly customized solutions.

- Pricing Strategies: BBAI's pricing strategy likely reflects the specialized nature of its solutions and its focus on high-value clients, such as government agencies.

- Market Share Analysis: Currently, BBAI holds a relatively smaller market share compared to established giants. However, its focus on specific high-growth sectors presents significant opportunities for expansion.

Market Growth Potential for AI Solutions

The AI industry is experiencing exponential growth, projected to reach [Insert market size prediction with source citation] by 2025. This presents significant potential for BBAI:

- Increased Demand: Growing government and commercial interest in AI-driven solutions promises a large addressable market for BBAI's services.

- Technological Advancements: Continuous advancements in AI technologies will allow BBAI to improve its existing solutions and create new, more valuable offerings.

- Expansion into New Markets: BBAI's future growth might depend on successful expansion into new sectors, broadening its client base and revenue streams.

Financial Performance and Future Projections for BBAI

Analyzing BBAI's financial performance and projecting its future trajectory is crucial for a meaningful BBAI stock forecast.

Review of BBAI's Financial Health

Reviewing BBAI's recent financial statements (10-K filings, quarterly reports) is vital:

- Revenue Growth: Analyze the trend of revenue growth over the past few years. Look for consistent growth or signs of stagnation.

- Profitability: Evaluate the company's profitability (gross margin, net income) and its ability to generate consistent profits.

- Debt Levels: Assess the company's debt levels and its ability to manage its debt effectively. High debt levels can pose a risk to the company's financial health.

Growth Factors and Potential Challenges

Several factors could influence BBAI's future growth:

- New Contracts and Product Launches: Securing significant new contracts, especially with government agencies, and launching successful new products can drive revenue and boost investor confidence.

- Economic Downturn: Economic downturns can significantly impact technology spending, potentially reducing demand for BBAI's solutions.

- Intense Competition: The competitive landscape continues to evolve, with new entrants and increased competition from established players.

Predicting BBAI's Stock Price in 2025

Predicting the stock price of any company, including BBAI, is inherently speculative. However, considering the factors outlined above:

- Best-Case Scenario: Significant growth in key markets, successful product launches, and strong financial performance could lead to a substantial increase in BBAI's stock price.

- Worst-Case Scenario: Economic downturn, increased competition, and failure to secure new contracts could lead to a decrease in the stock price.

- Most Likely Scenario: A moderate growth trajectory, driven by consistent progress in key markets and ongoing innovation, seems most likely. This assumes a generally stable economic environment.

Factors Influencing BBAI Stock Performance (Beyond Company-Specific Factors)

External factors significantly impact BBAI's stock performance.

Macroeconomic Conditions

Broader economic conditions affect investor sentiment and investment in the tech sector:

- Inflation and Interest Rates: High inflation and rising interest rates can reduce investor appetite for riskier investments, potentially impacting BBAI's stock price.

- Recession Risk: A recessionary environment typically leads to reduced technology spending, negatively affecting BBAI's growth prospects.

Geopolitical Events

Global events can create uncertainty and impact BBAI's performance:

- International Conflicts: Geopolitical instability can disrupt global markets and impact investor confidence, influencing BBAI's stock price.

- Trade Wars and Sanctions: Trade disputes and sanctions can affect BBAI’s access to markets and supply chains.

Regulatory Changes

Government regulations on AI and data privacy are crucial:

- Data Privacy Regulations: Compliance with regulations like GDPR and CCPA is crucial and impacts operational costs.

- AI Ethics and Governance: Emerging regulations focusing on the ethical use of AI could create both opportunities and challenges for BBAI.

Conclusion

This analysis of BigBear.ai Holdings (BBAI) suggests its 2025 stock performance will depend on a complex interplay of internal factors (company performance, innovation, market share) and external factors (macroeconomic conditions, geopolitical events, regulatory changes). While predicting the precise stock price is impossible, understanding these factors provides a framework for informed investment decisions.

While this BigBear.ai (BBAI) stock analysis offers valuable insights, further research and close monitoring of BBAI's progress are strongly recommended before making any investment decisions. Conduct thorough due diligence before investing in BBAI or any other stock. Remember, this is not financial advice.

Featured Posts

-

The Power Of Music Exploring The Sound Perimeter Of Connection

May 21, 2025

The Power Of Music Exploring The Sound Perimeter Of Connection

May 21, 2025 -

Kaellman Ja Hoskonen Loppu Puola Uralle

May 21, 2025

Kaellman Ja Hoskonen Loppu Puola Uralle

May 21, 2025 -

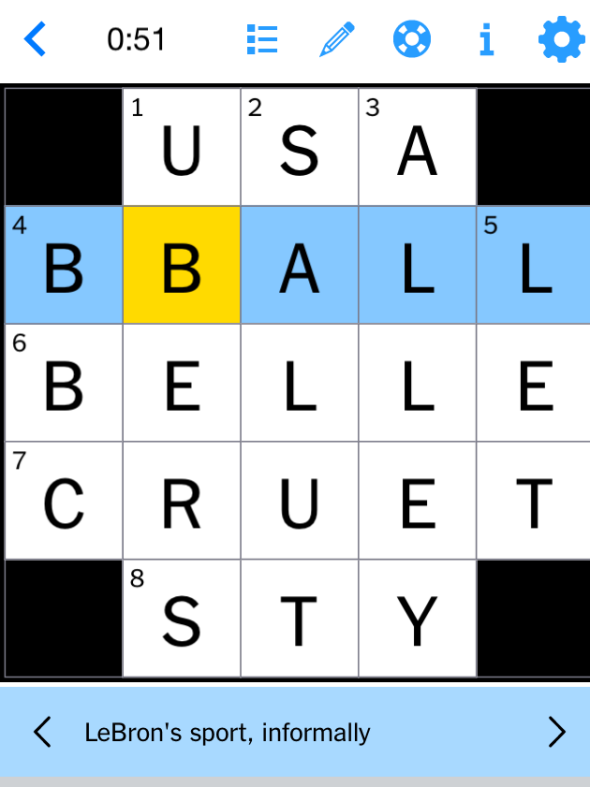

Marvel Avengers Crossword Clue Nyt Mini Crossword Answers For May 1st

May 21, 2025

Marvel Avengers Crossword Clue Nyt Mini Crossword Answers For May 1st

May 21, 2025 -

Abn Amro Huizenmarktverwachting 2024 Stijgende Prijzen Ondanks Risicos

May 21, 2025

Abn Amro Huizenmarktverwachting 2024 Stijgende Prijzen Ondanks Risicos

May 21, 2025 -

Solving The Mystery Recent Red Light Sightings In France

May 21, 2025

Solving The Mystery Recent Red Light Sightings In France

May 21, 2025