BigBear.ai Holdings (BBAI) Stock Plunge In 2025: Reasons And Analysis

Table of Contents

Macroeconomic Factors Contributing to the BBAI Stock Decline

Several significant macroeconomic headwinds contributed to the BBAI stock decline in 2025. These broader economic forces significantly impacted investor sentiment and market performance, affecting even fundamentally strong companies like BigBear.ai.

Impact of Rising Interest Rates

The aggressive interest rate hikes implemented by central banks globally in 2025 played a crucial role in the BBAI stock plunge.

- Increased borrowing costs: Higher interest rates increased the cost of borrowing for businesses, impacting profitability and hindering growth prospects for companies like BBAI.

- Reduced investor appetite for risk: Investors shifted their focus from high-growth, high-risk tech stocks, like BBAI, towards safer, more conservative investments offering higher yields in the fixed-income market.

- Impact on company valuations: Increased discount rates used in valuation models led to a compression of valuations for growth stocks, resulting in lower stock prices.

Global Economic Uncertainty

Widespread economic uncertainty, fueled by fears of a recession and persistent inflation, further exacerbated the situation.

- Investor flight to safety: Investors sought refuge in safe-haven assets like government bonds, reducing the capital available for riskier investments in the technology sector.

- Decreased market liquidity: Reduced investor participation led to lower trading volumes and decreased market liquidity, making it challenging for investors to buy or sell BBAI stock at desired prices.

- Impact on overall market sentiment: The prevailing negative sentiment in the broader market negatively affected the performance of even well-performing companies like BBAI.

Geopolitical Instability

Geopolitical instability, including [insert specific examples of geopolitical events from 2025, e.g., escalating trade tensions, regional conflicts], further dampened investor confidence and contributed to the BBAI stock price fall.

- Examples of geopolitical events: [Provide specific examples and their impact, e.g., sanctions impacting supply chains, increased uncertainty leading to decreased investment].

- Impact on investor confidence: The uncertainty created by these events led to risk aversion among investors, triggering sell-offs in riskier assets like BBAI stock.

- Sector-specific risks: Geopolitical events can disproportionately impact specific sectors. [Explain how geopolitical events might particularly impact the AI and data analytics sector and BBAI's business].

Company-Specific Factors Affecting BBAI Stock Performance

Beyond macroeconomic factors, several company-specific issues contributed to the BBAI stock performance decline in 2025. Understanding these internal factors is crucial for a comprehensive analysis.

Missed Earnings Expectations

BBAI's failure to meet projected earnings in [specify quarter/year] triggered a significant sell-off.

- Specific financial reports: [Cite specific financial reports highlighting the missed earnings expectations].

- Reasons for missed expectations: [Explain the reasons behind the missed expectations, e.g., delays in project implementations, increased competition, unexpected expenses].

- Investor reaction: The market reacted negatively to the missed earnings, leading to a sharp drop in BBAI's stock price.

Changes in Management or Strategy

Potential changes in leadership or a shift in business strategy could have eroded investor confidence.

- Key personnel changes: [Mention any significant changes in key personnel and their potential impact on the company's performance].

- Shifts in strategic direction: [Discuss any major shifts in the company's strategic direction and their potential implications for the future].

- Market response: The market often reacts negatively to uncertainty caused by changes in management or strategy, impacting stock prices.

Competition and Market Saturation

Increased competition within the AI and data analytics sector might have put pressure on BBAI's market share and profitability.

- Key competitors: [Identify key competitors and their market strategies].

- Market share analysis: [Discuss the competitive landscape and BBAI's market share].

- Competitive pressures on BBAI: [Analyze how competitive pressures affected BBAI's pricing, profitability, and overall performance].

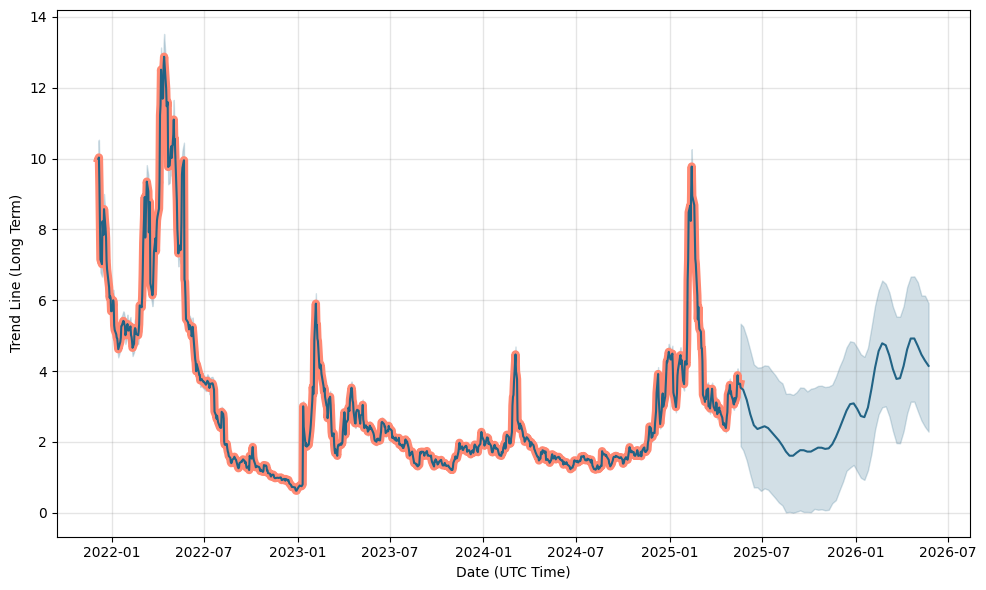

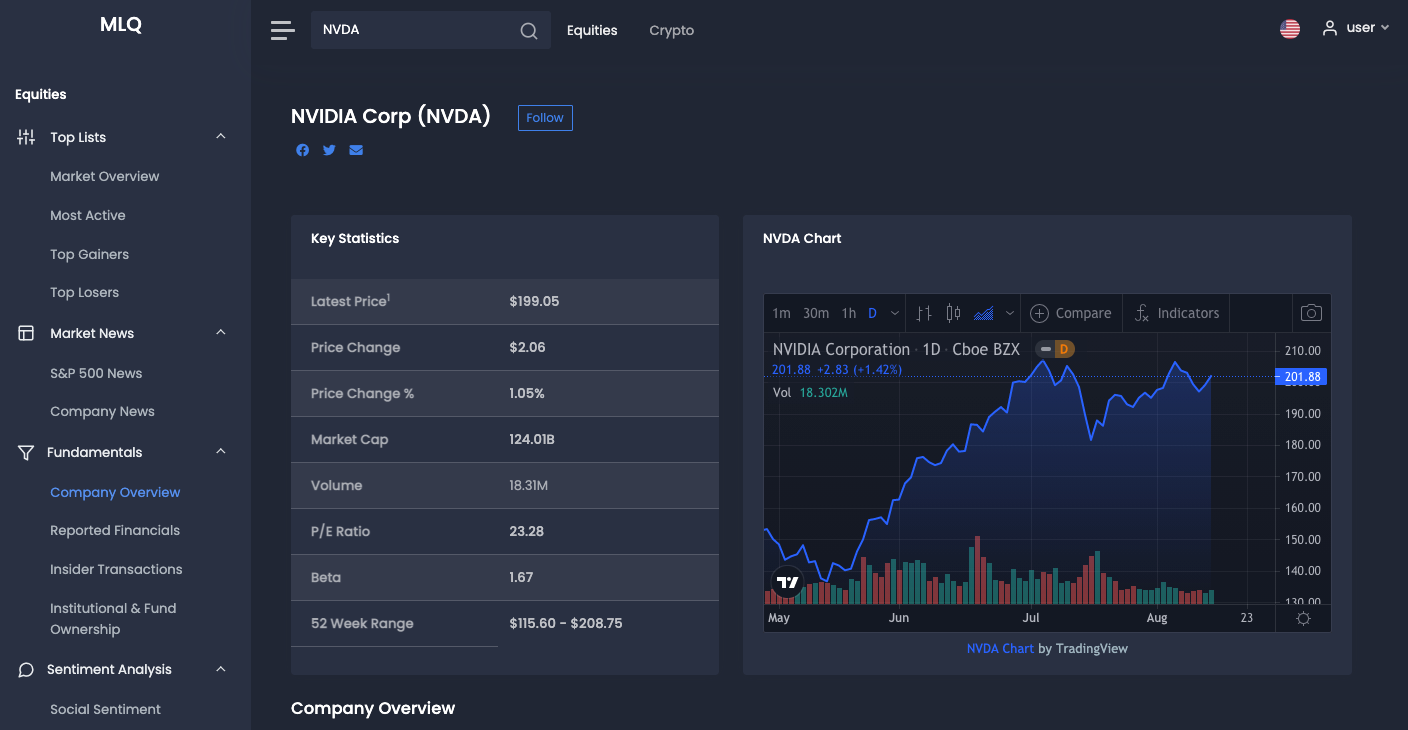

Technical Analysis of the BBAI Stock Plunge

A technical analysis of BBAI's stock chart reveals several patterns and indicators that preceded the dramatic price drop.

Chart Patterns and Indicators

The stock price exhibited classic bearish patterns, including [mention specific chart patterns like head and shoulders, double top, etc.].

- Specific chart patterns observed: [Describe the observed chart patterns and their typical interpretations].

- Corresponding technical indicators: [Mention specific technical indicators, such as RSI, MACD, or moving averages, that confirmed the bearish signals].

- Interpretation of signals: [Explain how the combination of chart patterns and technical indicators suggested an impending price decline].

Volume and Trading Activity

High trading volume accompanied the price drop, indicating significant selling pressure.

- High volume sell-offs: [Discuss the unusually high trading volume during the period of the price decline].

- Unusual trading activity: [Mention any unusual trading activity that might have contributed to the price drop, like short-selling pressure].

- Interpretation of volume changes: [Explain how the high trading volume reinforced the bearish signals from the chart patterns and technical indicators].

Support and Resistance Levels

The breaching of key support levels further accelerated the price decline.

- Key support and resistance levels: [Identify the crucial support and resistance levels on the chart].

- Significance of breaches: [Explain the significance of the support level breaches in confirming the bearish trend].

- Implications for future price movement: [Discuss the implications of the broken support levels for potential future price movements].

Conclusion: Navigating the Future of BigBear.ai Holdings (BBAI) Stock

The BigBear.ai Holdings (BBAI) stock plunge in 2025 was a result of a confluence of macroeconomic headwinds, company-specific challenges, and bearish technical signals. Understanding these factors is crucial for informed investment decisions. The future outlook for BBAI remains uncertain, contingent upon the company's ability to address its internal challenges and navigate the broader economic environment. While potential for recovery exists, significant risks remain.

Understanding the reasons behind the BigBear.ai Holdings (BBAI) stock plunge is crucial for informed investment decisions. Conduct thorough research, analyze the latest financial reports, and consider consulting with a financial advisor before making any investment decisions related to BBAI stock or engaging in BBAI stock analysis. Remember to carefully assess the BBAI investment outlook in the context of your broader investment strategy.

Featured Posts

-

Jennifer Lawrence Rodila Drugo Dijete Detalji O Rodenju

May 20, 2025

Jennifer Lawrence Rodila Drugo Dijete Detalji O Rodenju

May 20, 2025 -

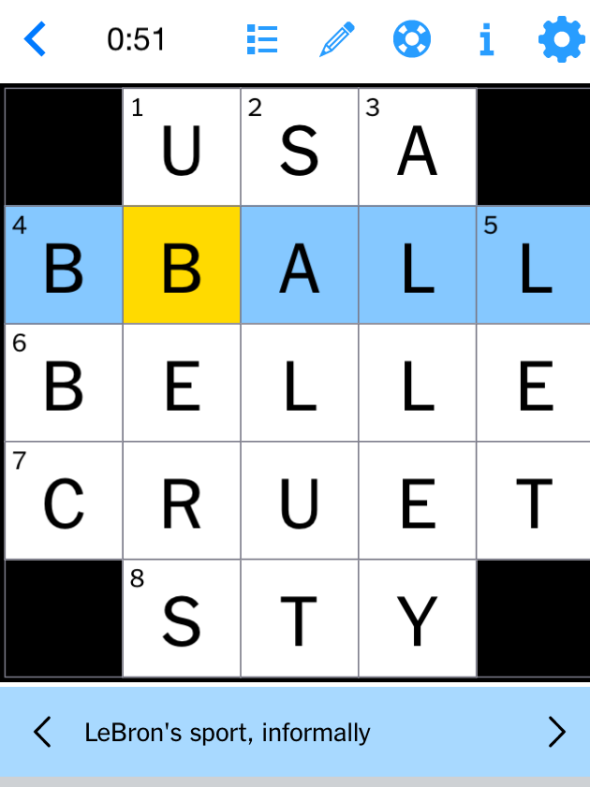

Nyt Mini Crossword Clues And Answers March 18 2025

May 20, 2025

Nyt Mini Crossword Clues And Answers March 18 2025

May 20, 2025 -

Seger I Malta Jacob Friis Inleder Med Bortaseger

May 20, 2025

Seger I Malta Jacob Friis Inleder Med Bortaseger

May 20, 2025 -

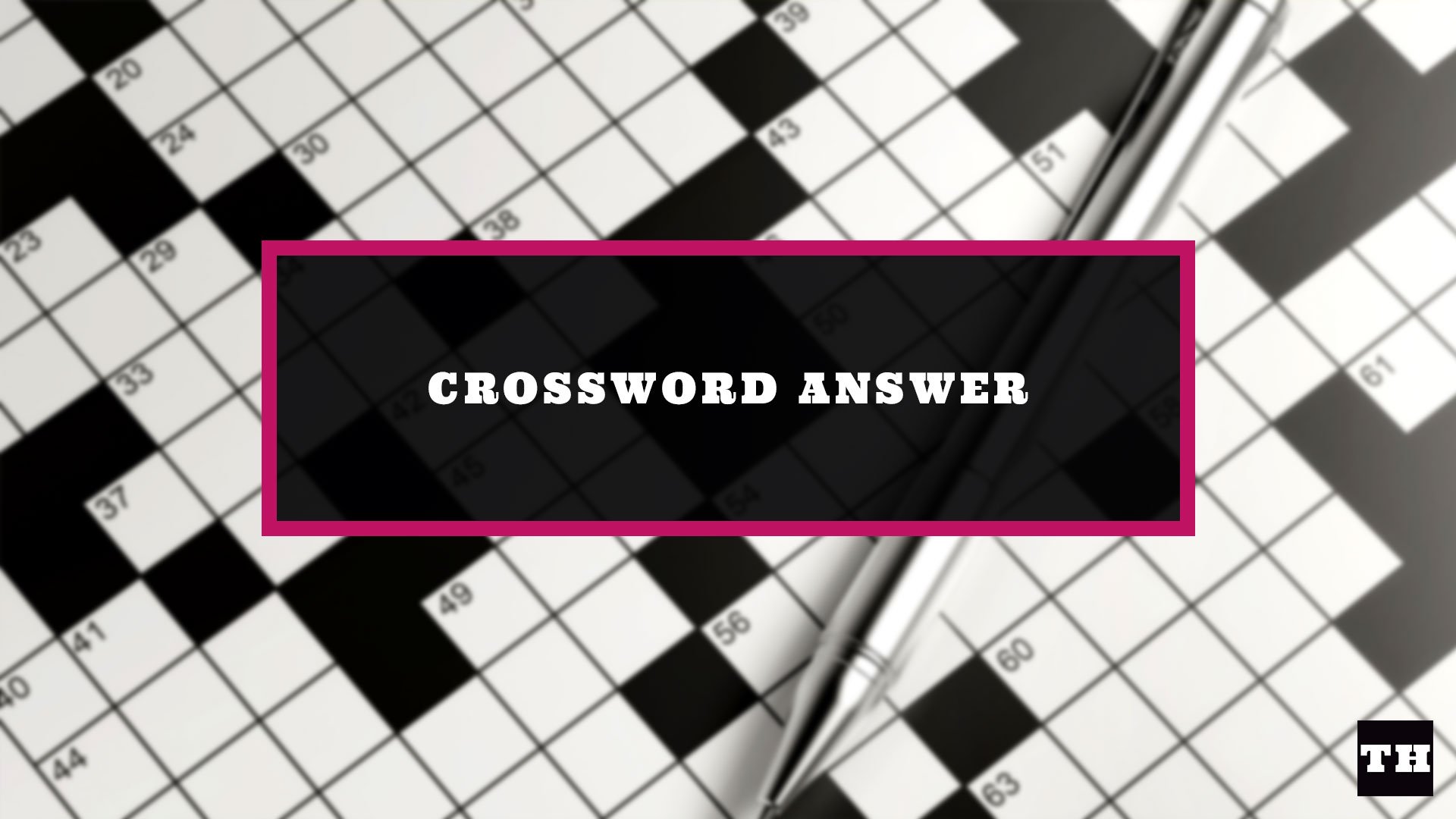

1 Reason To Buy This Ai Quantum Computing Stock Now

May 20, 2025

1 Reason To Buy This Ai Quantum Computing Stock Now

May 20, 2025 -

March 27 2024 Nyt Mini Crossword Full Solutions

May 20, 2025

March 27 2024 Nyt Mini Crossword Full Solutions

May 20, 2025