BigBear.ai Holdings, Inc.: Securities Lawsuit Filed

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai

The lawsuit against BigBear.ai Holdings, Inc. alleges securities fraud, misrepresentation, and material omissions. The complaint, filed in [Court Name], centers on the claims of [Plaintiff Name(s)], who allege that BigBear.ai made misleading statements regarding [Specific area of alleged misrepresentation, e.g., financial performance, contract wins, technological capabilities]. These alleged misrepresentations, the plaintiffs argue, artificially inflated the price of BigBear.ai stock.

- Plaintiffs' Claims: The plaintiff(s) claim that BigBear.ai knowingly misled investors about [specific details of misleading information], resulting in significant financial losses when the truth emerged.

- Key Allegations: The lawsuit details specific instances of alleged misrepresentation and omission, focusing on the period between [Start Date] and [End Date]. The complaint points to specific press releases, investor presentations, and financial filings as evidence of the alleged wrongdoing.

- Securities Involved: The lawsuit involves [Type of Securities, e.g., common stock] of BigBear.ai Holdings, Inc.

- Court Filing: The complaint was filed in the [Court Name] and can be accessed via [Link to Court Document, if available]. News articles covering the lawsuit can be found at [Link to News Article(s), if available].

Potential Impact on BigBear.ai and its Stock Price

The securities lawsuit against BigBear.ai carries significant potential consequences for the company and its investors. The impact on BigBear.ai's stock price could be substantial, both in the short-term and long-term.

- Stock Price Volatility: The uncertainty surrounding the lawsuit is likely to lead to increased volatility in BigBear.ai's stock price. Investor confidence may be shaken, potentially leading to a decline in the stock's value.

- Financial Burden: Defending against the lawsuit will incur substantial legal fees for BigBear.ai. Any potential settlement or judgment could also impose a significant financial burden on the company, impacting its future operations and profitability.

- Reputational Damage: A securities lawsuit, regardless of its outcome, can severely damage a company's reputation and credibility. This reputational damage could negatively affect future business opportunities, partnerships, and investor relations.

- Class Action Potential: There's a possibility that the lawsuit could expand into a class action, involving a larger number of plaintiffs and potentially increasing the financial exposure for BigBear.ai.

Advice for BigBear.ai Investors

The securities lawsuit against BigBear.ai presents a complex situation for investors. Understanding your rights and options is critical.

- Consult Financial Advisors: Investors are strongly advised to consult with their financial advisors to discuss their investment strategy in light of the lawsuit. This is especially important for those holding a significant amount of BigBear.ai stock.

- Class Action Participation: If the lawsuit becomes a class action, investors may be able to participate. Information on joining a class action will usually be publicized through legal notices and the court’s website.

- Seek Legal Counsel: Investors who believe they have suffered losses due to the alleged misrepresentations should consider seeking legal counsel to explore their options.

- Risk Management: This lawsuit highlights the inherent risks associated with stock market investments. Diversification and a well-defined investment strategy are crucial to mitigate such risks.

- Stay Informed: Staying updated on the developments in the lawsuit is vital. Regularly check reputable news sources and the court's website for updates.

Understanding Your Rights as a BigBear.ai Shareholder

As a shareholder in BigBear.ai, you have certain rights, including the right to be informed accurately about the company's financial performance and to participate in legal proceedings related to potential corporate wrongdoing. However, navigating these rights can be complex, making it essential to seek professional legal advice if you believe your interests have been harmed.

Conclusion

This article summarized the key details of the securities lawsuit filed against BigBear.ai Holdings, Inc., including the allegations, potential impact on the company and its stock price, and advice for affected investors. The situation highlights the importance of careful due diligence and risk management in investment decisions.

Staying informed about the developments in this BigBear.ai lawsuit is crucial for all investors. If you are a BigBear.ai shareholder, consult with a financial advisor and explore all available options to protect your investment. Understanding the intricacies of this BigBear.ai securities lawsuit is the first step towards making informed decisions about your investment portfolio. Remember to seek professional legal counsel to understand your rights and options.

Featured Posts

-

Ankuendigung Endgueltige Gestaltung Durch Architektin Vor Ort Bestimmt

May 20, 2025

Ankuendigung Endgueltige Gestaltung Durch Architektin Vor Ort Bestimmt

May 20, 2025 -

Festival Da Cunha Isabelle Nogueira Apresenta Evento Em Manaus Com Imersao Na Cultura Amazonica

May 20, 2025

Festival Da Cunha Isabelle Nogueira Apresenta Evento Em Manaus Com Imersao Na Cultura Amazonica

May 20, 2025 -

Canada Post Facing Financial Crisis A Proposal To Eliminate Door To Door Delivery

May 20, 2025

Canada Post Facing Financial Crisis A Proposal To Eliminate Door To Door Delivery

May 20, 2025 -

Rising Sea Levels Rising Credit Risk How Climate Change Impacts Home Loans

May 20, 2025

Rising Sea Levels Rising Credit Risk How Climate Change Impacts Home Loans

May 20, 2025 -

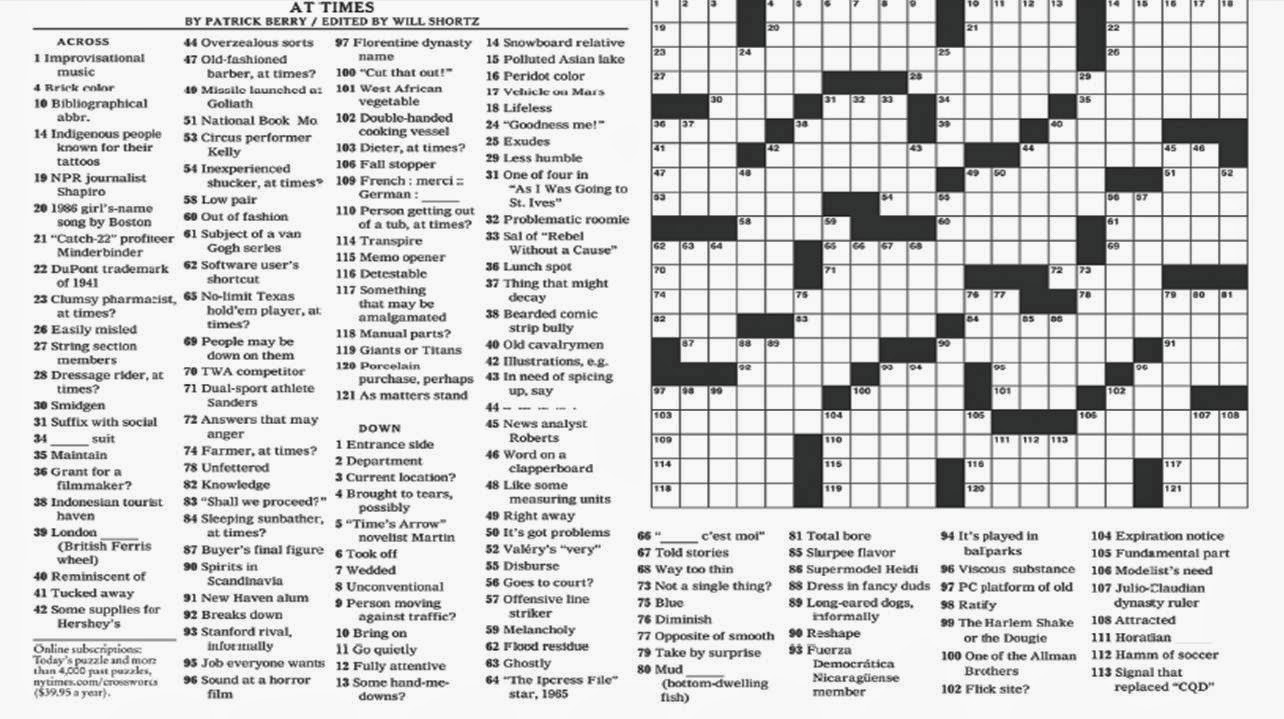

All The Answers Nyt Mini Crossword May 9th

May 20, 2025

All The Answers Nyt Mini Crossword May 9th

May 20, 2025