BigBear.ai Stock: Is It A Smart Investment In 2024?

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai (BBAI) provides AI-powered solutions, primarily targeting government and commercial clients. Their services range from advanced analytics and data science to cybersecurity and mission support. This focus on high-value, complex projects positions them in a niche market segment. However, this also presents challenges.

The competitive landscape is fiercely contested, with established tech giants and nimble startups vying for market share. Key BigBear.ai competitors include companies like Palantir Technologies and various specialized AI consulting firms. BigBear.ai's competitive advantages lie in their:

-

Strengths:

- Specialized expertise: Deep understanding of government and defense needs.

- Strong client relationships: Long-standing partnerships built on trust and proven results.

- Proprietary technology: Unique AI algorithms and data processing capabilities. Examples include their successful application of AI in national security projects and disaster response.

-

Weaknesses:

- Market saturation: Facing intense competition from larger, more established players with greater resources.

- Financial stability: Past financial performance needs improvement to build long-term investor confidence. This is a key consideration for any BBAI stock investment.

- Dependence on government contracts: Revenue streams might be susceptible to changes in government spending.

Financial Performance and Future Projections

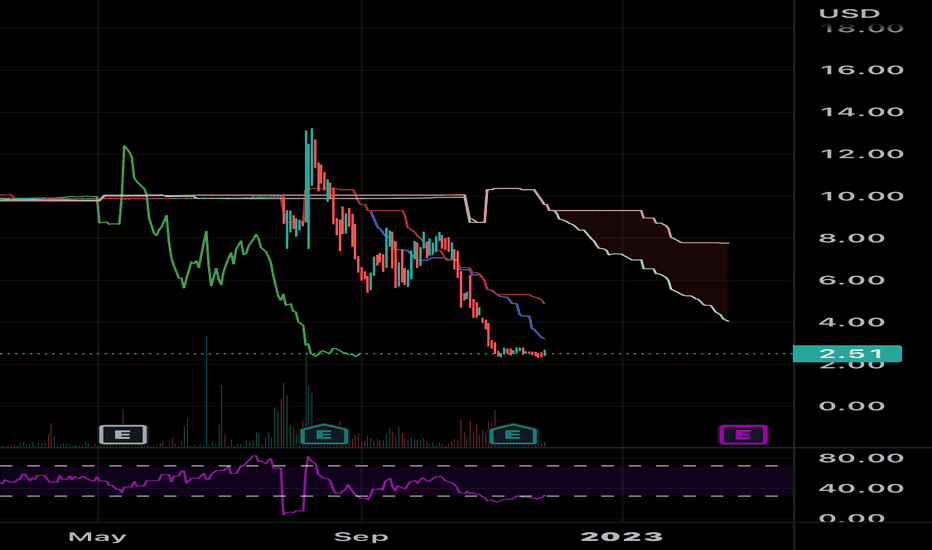

Analyzing BBAI stock requires a careful look at its financial performance. While recent revenue figures may show fluctuations, the company’s growth trajectory needs to be evaluated alongside industry trends and competitor performance. Key financial metrics to watch include revenue growth, earnings per share (EPS), and debt levels. (Note: Actual charts and graphs would be included here if this were a published article).

- Key Financial Metrics and Trends: (Specific data would be inserted here, sourced from reliable financial reporting). Examining these trends over several quarters will offer a better understanding of the company's financial health.

- Growth Potential and Anticipated Challenges: BigBear.ai's future growth hinges on securing new contracts, particularly in the expanding commercial AI sector. Successful expansion into new markets and demonstrating continued technological innovation are crucial for positive future projections.

- Debt Levels and their Impact on Profitability: High debt levels could significantly impact profitability and investor confidence. Analyzing the company's debt-to-equity ratio and interest coverage ratio is vital for any serious AI investment.

Risk Assessment and Potential Rewards

Investing in BBAI stock, like any AI investment, carries inherent risks:

- Market Risk Factors Influencing BBAI Stock Price: Overall market volatility, changes in investor sentiment towards the AI sector, and macroeconomic factors can all impact the BBAI stock price significantly.

- Technological Risks and their Impact: Rapid technological advancements could render BigBear.ai's current technology obsolete, impacting their competitiveness and potentially affecting return on investment (ROI).

- Potential for Significant Returns versus Potential for Losses: BigBear.ai's high-growth potential presents the opportunity for significant returns; however, the inherent risks outlined above could lead to substantial losses. This must be weighed against the risk tolerance of the individual investor.

Expert Opinions and Analyst Ratings

To gain a comprehensive perspective on BigBear.ai stock, it's crucial to consult expert opinions. Analyst ratings from reputable financial institutions provide valuable insights into the potential of the BBAI stock forecast. (Note: Specific analyst ratings and quotes would be included here).

- Summary of Positive and Negative Expert Opinions: A range of opinions often exists, highlighting the nuances of evaluating the company’s future prospects.

- Consolidated Analyst Ratings: A summary of buy, sell, or hold recommendations would provide a general consensus (assuming data is available).

- Diversity of Opinions and Reasons Behind Different Ratings: Understanding the reasoning behind differing opinions is crucial for informed decision-making.

Conclusion: Is BigBear.ai Stock Right for You in 2024?

BigBear.ai stock (BBAI) presents a compelling yet complex investment proposition in 2024. While its specialized AI solutions and strong client relationships offer potential rewards, the competitive landscape and financial stability concerns necessitate careful consideration. The high-growth potential is undeniable, but the risks are substantial.

Remember, before investing in any AI stock, including BigBear.ai stock, thorough due diligence is paramount. This article is for informational purposes only and should not be considered financial advice. Conduct your own research, consult with a financial advisor, and ensure BigBear.ai stock aligns with your risk tolerance and overall investment portfolio strategy. Consider diversifying your investments to mitigate potential losses. Researching "BBAI stock" and BigBear.ai stock analysis from multiple sources is recommended before making any investment decisions.

Featured Posts

-

The Decamerons Lou Gala A Deep Dive Into Her Success

May 20, 2025

The Decamerons Lou Gala A Deep Dive Into Her Success

May 20, 2025 -

Analyzing The D Wave Quantum Qbts Stock Decrease On Monday

May 20, 2025

Analyzing The D Wave Quantum Qbts Stock Decrease On Monday

May 20, 2025 -

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025

Philippines Rejects Chinese Demands Missile System Remains

May 20, 2025 -

Tragedia Na Tijuca Incendio Em Escola Deixa Comunidade Em Choque

May 20, 2025

Tragedia Na Tijuca Incendio Em Escola Deixa Comunidade Em Choque

May 20, 2025 -

Improved Wireless Headphones A Look At The Top Performers

May 20, 2025

Improved Wireless Headphones A Look At The Top Performers

May 20, 2025