BigBear.ai Stock Plunges After Disappointing Q1 Earnings

Table of Contents

Q1 Earnings Miss Expectations: Revenue and Profitability

BigBear.ai's Q1 2024 earnings report revealed a substantial shortfall in revenue compared to analyst predictions. The company missed its projected revenue targets, leading to concerns about its financial health and growth prospects. Several contributing factors played a role in this disappointing performance:

- Contract Delays: Several key contracts experienced unforeseen delays, impacting the revenue stream for the quarter. This highlights challenges in securing and delivering projects within the projected timeframe.

- Scaling Challenges: The company's efforts to scale its operations to meet increasing demand appear to have encountered hurdles, resulting in lower-than-anticipated revenue generation.

- Increased Competition: The competitive landscape in the AI solutions market remains fierce, with established players and new entrants vying for market share.

The impact on profitability was equally concerning. BigBear.ai reported a net loss, and the adjusted EBITDA also fell significantly short of expectations. Here's a summary of the key financial figures:

- Revenue: [Insert actual revenue figure] (vs. Analyst estimate of [Insert analyst estimate])

- Net Loss: [Insert actual net loss figure]

- Adjusted EBITDA: [Insert actual adjusted EBITDA figure]

- Comparison to Q1 2023: [Insert comparison data, highlighting the difference between Q1 2024 and Q1 2023 performance]

These figures paint a concerning picture of BigBear.ai's Q1 financial performance, clearly contributing to the subsequent BigBear.ai stock price drop.

Lowered Guidance for Future Quarters: Investor Concerns

Adding to the negative sentiment, BigBear.ai lowered its revenue guidance for the remainder of the year. This revised outlook fueled further concerns among investors, leading to significant sell-offs. The company attributed the lowered guidance to several factors:

- Macroeconomic Headwinds: The challenging macroeconomic environment, with potential recessionary pressures, impacted customer spending and contract negotiations.

- Competitive Pressures: The intense competition in the AI sector continues to put pressure on pricing and profitability.

- Internal Operational Challenges: The company acknowledged ongoing challenges related to scaling its operations and managing project timelines effectively.

The lowered guidance significantly impacted investor sentiment. The market interpreted this as a sign of weakened long-term growth prospects for BigBear.ai, resulting in a further decline in the BigBear.ai stock price. Analyst forecasts for the remainder of the year were also revised downwards, contributing to the negative outlook.

Market Reaction and Stock Price Volatility: Immediate Impact and Long-Term Implications

The immediate impact of the Q1 earnings report on BigBear.ai's stock price was dramatic. The stock experienced a significant drop in value, reflecting investor concerns about the company's financial performance and future outlook. Trading volume surged as investors reacted to the news, indicating significant market volatility.

- Stock Price Drop: [Insert percentage or specific figure of stock price drop]

- Trading Volume: [Insert data on increased trading volume]

- Analyst Ratings: Many analysts downgraded their ratings for BigBear.ai stock following the earnings announcement.

- Media Coverage: Financial news outlets widely reported on the disappointing earnings and the subsequent stock price decline.

The long-term implications for BigBear.ai's stock price remain uncertain. Investor confidence has been shaken, and the company faces the challenge of regaining trust and demonstrating a path to sustainable growth. The volatility in the BigBear.ai stock price is likely to persist until the company delivers improved financial results and a clearer roadmap for future success.

BigBear.ai's Response and Future Strategy: Addressing Investor Concerns

BigBear.ai has acknowledged the shortcomings in its Q1 performance and the need for a strategic response. The company outlined several measures aimed at addressing the issues and improving future performance, including:

- Streamlining Operations: Efforts are underway to optimize internal processes and improve operational efficiency.

- Strengthening Sales and Marketing: Increased focus on sales and marketing activities to accelerate revenue growth.

- Strategic Partnerships: Exploration of strategic partnerships to expand market reach and access new opportunities.

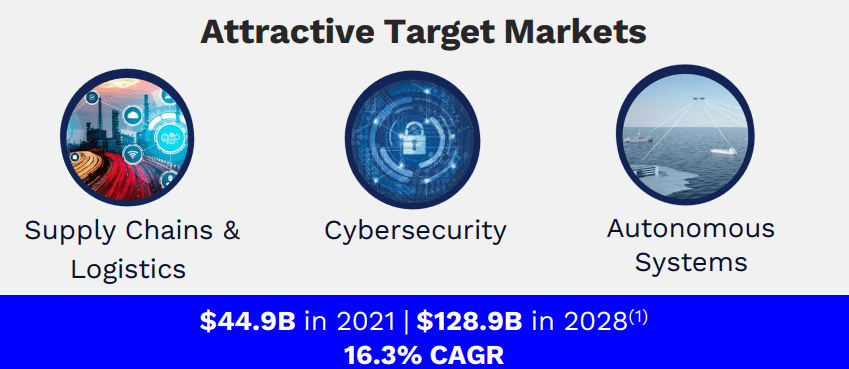

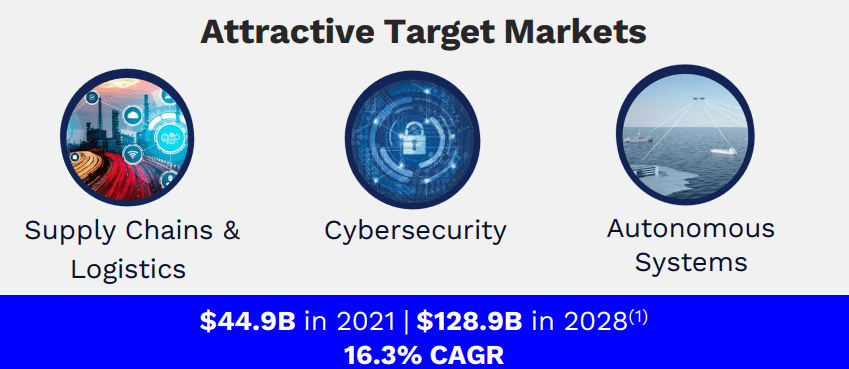

The company's long-term strategic plan focuses on leveraging its AI capabilities to deliver innovative solutions and capture a larger share of the growing AI market. The success of this strategy will be crucial in determining BigBear.ai's future prospects and restoring investor confidence.

Conclusion: Analyzing the BigBear.ai Stock Plunge and Future Outlook

The BigBear.ai stock plunge following its disappointing Q1 earnings report underscores the significant impact of missed expectations and lowered guidance on investor sentiment. The combination of lower-than-anticipated revenue, reduced profitability, and a revised, less optimistic outlook for the rest of the year contributed to a dramatic drop in the BigBear.ai stock price and increased market volatility. While the company has outlined a plan to address the challenges, its success in implementing these strategies and achieving sustainable growth will be critical in determining the long-term performance of BigBear.ai stock. Stay tuned for further updates on BigBear.ai's stock performance and future earnings reports to make informed investment decisions about BigBear.ai stock. For more in-depth financial news and analysis, you can consult reputable sources like [insert links to relevant financial news websites].

Featured Posts

-

Canada Post Facing Financial Crisis A Proposal To Eliminate Door To Door Delivery

May 20, 2025

Canada Post Facing Financial Crisis A Proposal To Eliminate Door To Door Delivery

May 20, 2025 -

Exploring The Agatha Christie Echoes In M Night Shyamalans The Village

May 20, 2025

Exploring The Agatha Christie Echoes In M Night Shyamalans The Village

May 20, 2025 -

Trumps Bill A Pyrrhic Victory For Ai Companies

May 20, 2025

Trumps Bill A Pyrrhic Victory For Ai Companies

May 20, 2025 -

Poslednie Novosti O Mikhaele Shumakhere Drug Rasskazal O Tyazheloy Situatsii

May 20, 2025

Poslednie Novosti O Mikhaele Shumakhere Drug Rasskazal O Tyazheloy Situatsii

May 20, 2025 -

Benjamin Kaellman Huippuvire Huuhkajien Riveihin

May 20, 2025

Benjamin Kaellman Huippuvire Huuhkajien Riveihin

May 20, 2025