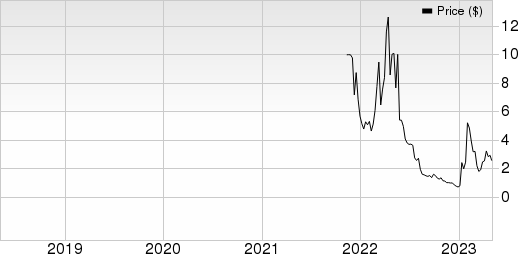

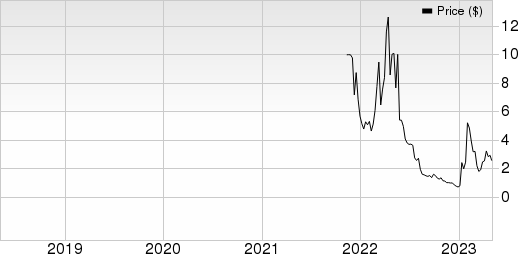

BigBear.ai's (BBAI) 17.87% Plunge: Revenue Miss And Leadership Instability

Table of Contents

BBAI Revenue Miss: Falling Short of Expectations

BigBear.ai's recent financial report revealed a significant shortfall in revenue, triggering the initial BBAI stock price drop. The company missed its projected revenue targets, raising serious questions about its financial performance and future prospects. This BBAI revenue miss wasn't a minor discrepancy; it was a substantial deviation from analyst expectations, impacting investor confidence significantly.

-

Specific Revenue Figures: While precise figures require reference to the official financial report, reports indicated a considerable gap between actual revenue and the projected figures. This discrepancy needs to be analyzed in conjunction with the company's guidance and market conditions.

-

Key Factors Contributing to the Miss: Several factors likely contributed to the BBAI revenue shortfall. These could include delays in securing crucial government contracts, increased competition in the data analytics market, and perhaps unforeseen challenges in integrating recent acquisitions. Further investigation is needed to pinpoint the exact causes.

-

Impact on Future Projections: The revenue miss casts a shadow over BigBear.ai's future financial projections. Investors will be closely scrutinizing the company's revised guidance and strategic plans to gauge its ability to recover and regain momentum. This uncertainty is a major factor influencing the BBAI stock price.

Leadership Instability at BigBear.ai: Impact on Investor Confidence

Adding to the concerns surrounding the BBAI revenue shortfall is the recent leadership instability within the company. Changes at the top often trigger uncertainty and negatively impact investor confidence. This is especially true when coupled with poor financial performance. The lack of clear direction and potential internal conflicts can further erode investor trust.

-

Timeline of Leadership Changes: A detailed timeline of recent leadership changes, including CEO transitions, board member departures, and any other significant shifts in management, needs to be examined to fully understand the scope of the instability.

-

Potential Reasons for Leadership Changes: The reasons behind these leadership changes need careful consideration. Were they voluntary departures, forced resignations, or a strategic restructuring? Understanding the underlying cause is crucial for assessing the long-term impact.

-

Impact on Company Morale and Future Planning: Leadership changes, especially abrupt ones, can significantly affect employee morale and long-term strategic planning. This uncertainty adds to the volatility impacting BBAI stock.

-

Investor Sentiment Following Leadership Changes: Investor sentiment following leadership changes is overwhelmingly negative, contributing to the sell-off and the ongoing BBAI stock price decline.

Market Reaction and Future Outlook for BBAI Stock

The market's immediate reaction to the revenue miss and leadership instability was swift and negative, resulting in the significant BBAI stock plunge. Investors reacted by selling off their shares, causing the dramatic 17.87% drop. This market analysis highlights the severity of the situation and the uncertainty surrounding BBAI's future.

-

Short-Term and Long-Term Predictions: Short-term predictions for BBAI stock are largely negative, but long-term prospects depend heavily on the company's ability to address the revenue shortfall and stabilize its leadership.

-

Potential Catalysts for a Price Recovery: Potential catalysts for recovery include securing new contracts, demonstrating improved financial performance, appointing a strong new CEO, and improving transparency and communication with investors.

-

Risks and Opportunities for Investors: The current situation presents significant risks for investors, but there might be opportunities for those willing to take on considerable risk and believe in BigBear.ai's long-term potential. Careful research is paramount before making any investment decisions.

Conclusion: Navigating the BigBear.ai (BBAI) Stock Dip

BigBear.ai's (BBAI) 17.87% stock price plunge is a direct consequence of a significant revenue miss and leadership instability. This combination has eroded investor confidence and created considerable uncertainty regarding the company's future. Understanding these factors is crucial for navigating the current volatility. While the short-term outlook remains challenging, the long-term potential of BBAI stock depends on the company’s ability to effectively address the identified issues and regain investor trust. Thorough research and a carefully considered investment strategy are essential before making any decisions regarding BBAI stock. Continue your research and make calculated moves in the BBAI market to minimize risks.

Featured Posts

-

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Toy Alloy

May 20, 2025

I Periptosi Giakoymaki Mia Analysi Tis Ypotimisis Toy Alloy

May 20, 2025 -

Analyzing The Us Missile System Implications For Relations With China

May 20, 2025

Analyzing The Us Missile System Implications For Relations With China

May 20, 2025 -

Uk Luxury Brands Struggle With Eu Export Growth Post Brexit

May 20, 2025

Uk Luxury Brands Struggle With Eu Export Growth Post Brexit

May 20, 2025 -

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025

Preparing For A Wintry Mix Of Rain And Snow

May 20, 2025 -

March 31 2024 Nyt Mini Crossword Answers

May 20, 2025

March 31 2024 Nyt Mini Crossword Answers

May 20, 2025