BigBear.ai's Q1 Earnings Miss Expectations, Leading To Stock Decline

Table of Contents

BigBear.ai Q1 Earnings Report: A Detailed Breakdown

BigBear.ai's Q1 2024 earnings report revealed a concerning picture, falling significantly short of analyst expectations across key metrics. This section breaks down the crucial elements of the report, providing a comprehensive analysis of the revenue miss and profitability concerns.

Revenue Miss

BigBear.ai reported Q1 revenue of $XX million, considerably lower than the anticipated $YY million. This represents a [percentage]% decrease compared to the previous quarter and a [percentage]% decline year-over-year. The company attributed the shortfall to several factors:

- Contract Delays: Several significant contracts experienced unexpected delays, pushing revenue recognition into later quarters.

- Lower-than-anticipated Demand: Demand for certain BigBear.ai products and services proved weaker than initially projected.

- Increased Competition: Intensified competition within the market contributed to the revenue shortfall.

This significant revenue underperformance directly impacted the overall financial health of the company and played a key role in the subsequent stock price decline. The company's quarterly revenue significantly underperformed the forecast, raising concerns about the accuracy of future revenue projections.

Profitability Concerns

The Q1 earnings report also highlighted serious profitability issues. BigBear.ai's gross profit margin fell to [percentage]%, significantly lower than the [percentage]% reported in Q4 2023. Operating income was a negative $ZZ million, and the company reported a net loss of $WW million, leading to a negative earnings per share (EPS). Contributing factors included:

- Increased Operating Expenses: Higher-than-expected operating costs negatively impacted the bottom line.

- Higher R&D Costs: Investments in research and development, while crucial for long-term growth, put a strain on short-term profitability.

- Inefficiencies in Operations: Internal inefficiencies may have contributed to higher operating costs.

The lack of profitability adds further pressure on BBAI stock, prompting investors to question the company's ability to generate sustainable profits in the near future. The low profit margin significantly impacted investor confidence.

Guidance for Future Quarters

BigBear.ai provided revised guidance for the remainder of 2024, tempering expectations for future growth. The company projected full-year revenue of $XXX million, significantly lower than previous forecasts. Profit margin projections remain cautious, with the company anticipating continued pressure on profitability in the coming quarters. However, the company pointed to potential catalysts for future growth, including:

- Expected Contract Finalizations: The completion of delayed contracts is expected to boost revenue in subsequent quarters.

- New Product Launches: New product offerings are anticipated to contribute to revenue growth in the long term.

- Strategic Partnerships: BigBear.ai highlighted the potential for increased revenue through strategic partnerships.

The cautious guidance further fueled investor concerns, contributing to the negative market reaction following the earnings release. Investors will be closely monitoring the company's ability to meet these revised expectations.

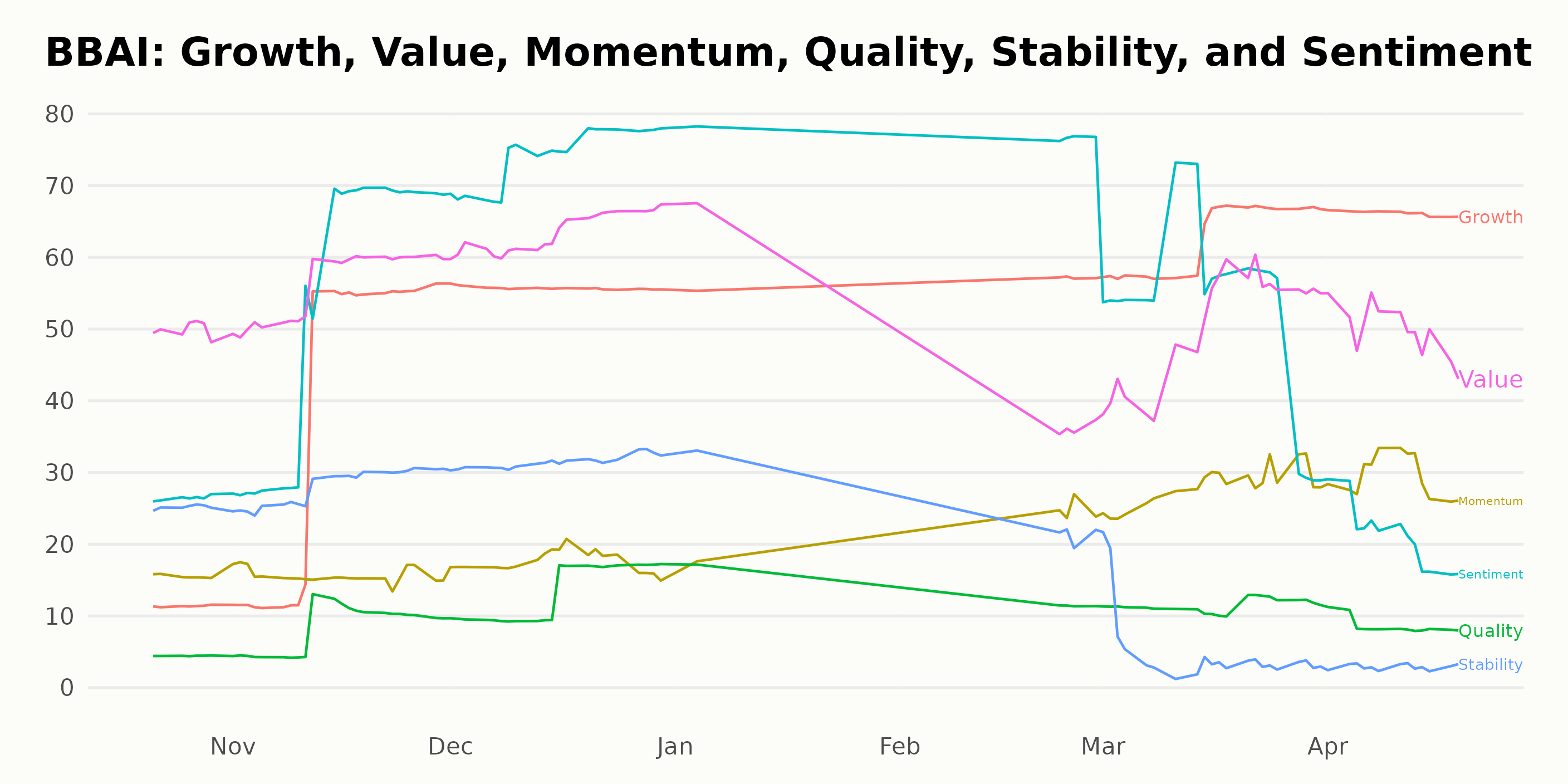

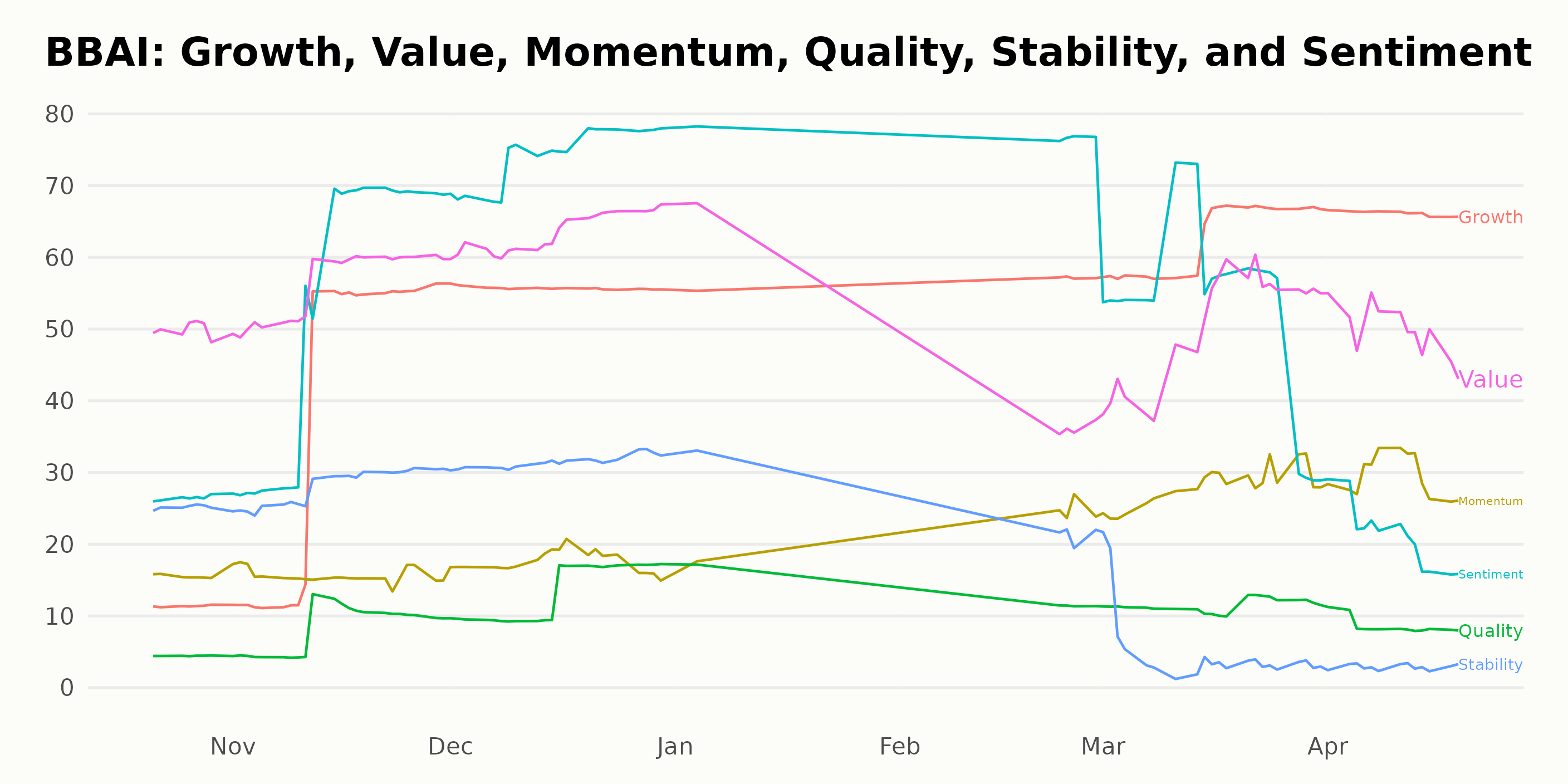

Market Reaction and Investor Sentiment

The release of BigBear.ai's Q1 earnings report triggered a swift and significant negative reaction in the market.

Stock Price Decline

Following the earnings announcement, BBAI stock experienced a sharp decline, falling [percentage]% to $[price] per share. Trading volume surged, indicating heightened investor activity as many rushed to sell their shares. The immediate sell-offs clearly reflect the negative sentiment surrounding the company's performance. For many investors, the earnings report indicated the stock presents a sell opportunity.

Analyst Reactions

Financial analysts reacted negatively to the Q1 results, with many downgrading their price targets and ratings for BBAI stock. Several analysts issued "sell" recommendations, citing concerns about the company's ability to meet future expectations. Some analysts, however, expressed cautious optimism, highlighting the potential for a turnaround based on the company's strategic initiatives and future product launches. These mixed reactions reflect the uncertainty surrounding BigBear.ai's future prospects. Analyst opinions on BBAI are sharply divided, further increasing uncertainty.

Potential Long-Term Implications for BigBear.ai

The disappointing Q1 results could have significant long-term implications for BigBear.ai, requiring strategic adjustments and a careful assessment of its competitive position.

Strategic Adjustments

In response to the Q1 earnings miss, BigBear.ai is likely to undertake several strategic adjustments to improve its financial performance and regain investor confidence. This might include:

- Cost-Cutting Measures: Implementing cost-cutting initiatives to improve profitability.

- Restructuring Plans: Restructuring operations to enhance efficiency and reduce redundancies.

- Refined Business Strategy: Revising its business strategy to focus on higher-growth areas.

- Accelerated Product Development: Prioritizing the development and launch of new products.

These strategic adjustments will be crucial in determining BigBear.ai's ability to recover from this setback and achieve long-term growth. Effective implementation and execution of these changes are vital for the company's future success.

Competitive Landscape

BigBear.ai operates in a highly competitive landscape, and the Q1 earnings miss could weaken its competitive standing. The company will need to focus on strengthening its competitive advantage to overcome the challenges presented by its competitors. Key aspects to consider include:

- Market Share: Protecting and potentially increasing its market share.

- Competitive Differentiation: Highlighting its unique value proposition to stand out from competitors.

- Technological Innovation: Continuing to invest in technological innovation to maintain a competitive edge.

BigBear.ai's ability to navigate this competitive environment will be a key determinant of its long-term success. The company’s future market share will strongly indicate its overall success following these challenges.

Conclusion: Analyzing the Future of BigBear.ai Stock

BigBear.ai's Q1 earnings miss, characterized by a significant revenue shortfall and profitability concerns, resulted in a substantial stock decline. The company's revised guidance and cautious outlook for the remainder of the year further fueled investor uncertainty. While the company has outlined strategic adjustments to address these challenges, its ability to execute these plans effectively and overcome the competitive landscape will determine its long-term success. While BigBear.ai’s Q1 earnings miss presents challenges, further research is crucial for investors considering its future. Analyze the company's strategic responses and the competitive landscape before making any investment decisions regarding BigBear.ai stock. Careful consideration of the company's strategic initiatives and its position within the competitive landscape is essential before making any investment decisions related to BBAI stock.

Featured Posts

-

Vc Adas

May 21, 2025

Vc Adas

May 21, 2025 -

The New Mexico Gop Arson Attack And Allegations Of Censorship By Abc Cbs And Nbc

May 21, 2025

The New Mexico Gop Arson Attack And Allegations Of Censorship By Abc Cbs And Nbc

May 21, 2025 -

Mild Temperatures Little Rain Chance Your Weekend Weather Outlook

May 21, 2025

Mild Temperatures Little Rain Chance Your Weekend Weather Outlook

May 21, 2025 -

Low Rock Show Vapors Of Morphine Plays Northcote

May 21, 2025

Low Rock Show Vapors Of Morphine Plays Northcote

May 21, 2025 -

Baggelis Giakoymakis Analyontas Tin Katastrofi Tis Anthropinis Aksias

May 21, 2025

Baggelis Giakoymakis Analyontas Tin Katastrofi Tis Anthropinis Aksias

May 21, 2025