Billionaires' Secret Weapon: The ETF Predicted To Soar 110% In 2025

Table of Contents

Understanding the Predicted ETF's Potential

What Makes This ETF Unique?

This specific ETF stands out due to its innovative investment strategy. Unlike many passively managed ETFs, this one employs a sophisticated, actively managed approach, focusing on:

- Artificial Intelligence (AI)-Driven Stock Selection: The ETF leverages cutting-edge AI algorithms to identify high-growth potential stocks across diverse sectors.

- Global Diversification: The portfolio includes companies from various developed and emerging markets, mitigating risk and capitalizing on global growth opportunities.

- Focus on Disruptive Technologies: The ETF prioritizes companies at the forefront of technological innovation, such as renewable energy, biotechnology, and artificial intelligence itself.

The 110% return prediction for 2025 isn't pulled out of thin air. It’s based on:

- Robust Market Analysis: Extensive research and modeling predict significant growth in the sectors this ETF targets.

- Expert Opinions: Leading financial analysts have voiced optimism about the ETF's potential, citing its unique strategy and favorable market conditions.

- Historical Performance of Similar Strategies: While past performance isn't indicative of future results, analysis of similar investment strategies shows comparable high-growth potential.

Compared to other growth ETFs, this one distinguishes itself through its blend of active management, AI-driven stock picking, and targeted focus on rapidly expanding technology sectors.

Analyzing the Risk Factors

While the potential rewards are significant, it's crucial to acknowledge the inherent risks involved in any investment, especially those aiming for high growth. These include:

- Market Volatility: The stock market is inherently unpredictable. Even well-researched ETFs can experience short-term declines.

- Sector-Specific Risks: Over-reliance on specific sectors (like technology) can increase vulnerability to sector-specific downturns.

- Active Management Fees: Active management comes with higher fees compared to passively managed ETFs.

Thorough due diligence is paramount. Understand your own risk tolerance and ensure this ETF aligns with your broader investment portfolio diversification strategy. Remember, never invest more than you can afford to lose.

The Billionaire Connection: Why Are They Investing?

Sophisticated Investment Strategies

Billionaires often employ complex, high-risk, high-reward strategies. They aren't afraid to invest in areas with significant growth potential, even if it means accepting higher levels of risk. This ETF aligns perfectly with this strategy.

Access to Exclusive Information?

While we can't confirm access to insider information (which would be illegal), it's plausible that billionaires have access to market intelligence and trends not yet available to the public. This could inform their investment decisions and contribute to their success.

Long-Term Vision

Billionaires typically adopt a long-term investment horizon. They're less concerned with short-term market fluctuations and more focused on the long-term growth potential of their investments. The 110% prediction reflects this long-term perspective.

How to Access This High-Growth ETF

Finding the Right Brokerage Account

Many reputable online brokerage accounts offer access to a wide range of ETFs, including this one. Research different platforms to find one that suits your needs and offers competitive fees.

Understanding Investment Fees and Expenses

Before investing, carefully review the ETF's prospectus to understand its expense ratio, management fees, and any other associated costs. These fees can impact your overall returns.

Step-by-Step Investment Guide

- Research: Thoroughly understand the ETF's investment strategy, risks, and potential rewards.

- Open an Account: Choose a brokerage account and complete the necessary paperwork.

- Fund Your Account: Deposit the funds you wish to invest.

- Place Your Order: Search for the ETF's ticker symbol and place your order through your brokerage platform.

Conclusion

This ETF presents a potentially lucrative investment opportunity with the potential for significant returns. The unique investment strategy, coupled with the apparent interest from billionaire investors, makes it an intriguing prospect. However, remember that a 110% return is a prediction, not a guarantee. Past performance is not indicative of future results, and investing always involves risk. Don't miss out on the billionaires' secret weapon: Start your research on this high-growth ETF today! (Disclaimer: This article is for informational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any investment decisions.)

Featured Posts

-

Confidential Dossier Informs Cardinals Choice For Next Pope

May 08, 2025

Confidential Dossier Informs Cardinals Choice For Next Pope

May 08, 2025 -

Dwp Benefit Stoppage 355 000 Affected 3 Month Notice Given

May 08, 2025

Dwp Benefit Stoppage 355 000 Affected 3 Month Notice Given

May 08, 2025 -

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025

Dwp Letter Missing Potential 6 828 Benefit Loss

May 08, 2025 -

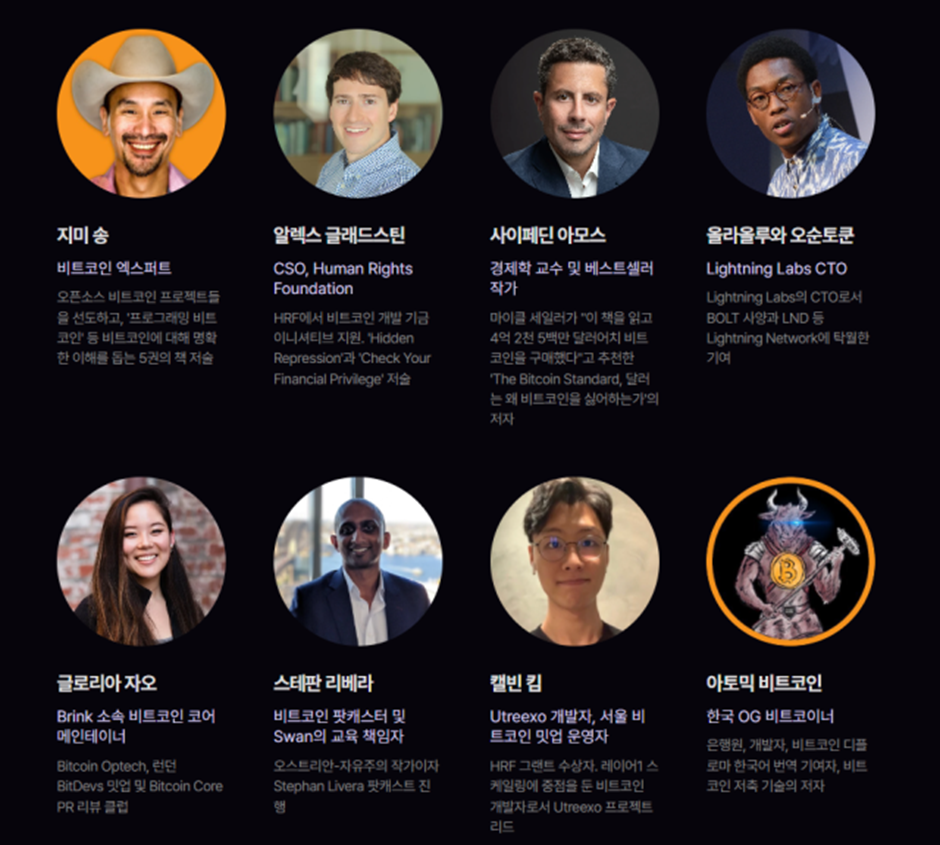

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025

Bitcoin Seoul 2025 Asias Largest Bitcoin Conference

May 08, 2025 -

Ubers Antitrust Lawsuit Against Door Dash Examining The Food Delivery Market Competition

May 08, 2025

Ubers Antitrust Lawsuit Against Door Dash Examining The Food Delivery Market Competition

May 08, 2025