Bitcoin At A Critical Juncture: Key Price Levels To Watch

Table of Contents

Understanding Bitcoin's Historical Price Performance

Bitcoin's journey has been marked by dramatic swings, with periods of explosive growth (bull markets) followed by sharp corrections (bear markets). Analyzing past Bitcoin price levels is essential for predicting future trends. By examining historical support and resistance levels, we can identify potential areas of price consolidation or breakout.

<img src="bitcoin-historical-price-chart.png" alt="Bitcoin Historical Price Chart showing key support and resistance levels, all-time highs and lows.">

- Significant All-Time Highs and Lows: Bitcoin's all-time high (ATH) provides a crucial psychological benchmark, often acting as a strong resistance level. Conversely, previous all-time lows (ATL) can serve as potential support.

- Price Consolidation Periods: Identifying periods where the price traded within a specific range (consolidation) helps determine potential breakout levels.

- Macroeconomic Events: Global events like the 2020 COVID-19 pandemic or shifts in regulatory landscapes have significantly impacted Bitcoin's price, influencing support and resistance levels.

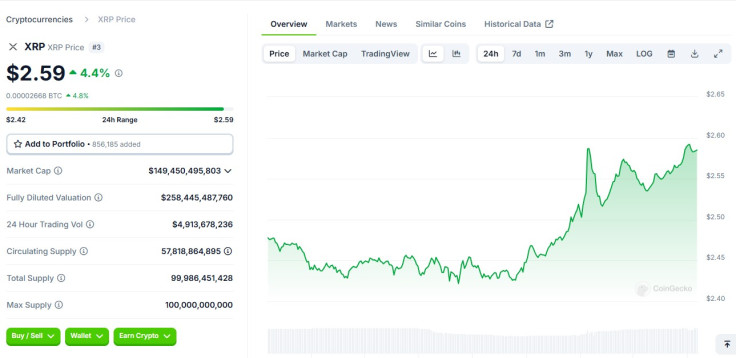

Analyzing Current Bitcoin Support Levels

Currently, several key support levels for Bitcoin can be identified using technical indicators like moving averages (MAs) and Fibonacci retracements. These levels represent areas where buying pressure is expected to be strong enough to prevent a further price decline.

- 200-Day Moving Average (MA): This long-term MA often acts as a significant support level. A break below this could signal a more substantial bearish trend.

- Fibonacci Retracement Levels: These levels, based on Fibonacci sequences, identify potential support areas after a price rally.

- Psychological Levels: Round numbers like $20,000 or $30,000 can act as significant support or resistance due to psychological factors influencing traders.

A break below these crucial support levels could trigger further selling pressure, leading to a more significant price correction. This scenario necessitates careful risk management and a reassessment of investment strategies.

<img src="bitcoin-current-support-levels.png" alt="Chart illustrating current Bitcoin support levels based on moving averages and Fibonacci retracements.">

Identifying Potential Bitcoin Resistance Levels

Conversely, resistance levels represent price areas where selling pressure is expected to outweigh buying pressure, potentially halting an upward price movement. Identifying these levels is crucial for setting profit targets and managing risk.

- Previous Highs: Past price highs often act as strong resistance levels. Overcoming these resistance levels often requires strong bullish momentum.

- Trendline Resistance: Drawing trendlines connecting price highs can help identify potential resistance zones.

- Psychological Levels: Similar to support, round numbers can act as significant resistance barriers.

A successful breakout above these resistance levels could signal a renewed bullish trend, potentially leading to further price appreciation. However, failing to break through these levels could lead to price consolidation or even a reversal.

<img src="bitcoin-resistance-levels.png" alt="Chart showing potential Bitcoin resistance levels based on previous highs and trendlines.">

The Role of Market Sentiment in Bitcoin Price Prediction

Market sentiment plays a vital role in influencing Bitcoin price levels. News events, social media trends, and regulatory announcements can significantly impact investor confidence and, consequently, price movements.

- Fundamental Analysis: Combining technical analysis with fundamental analysis (assessing the underlying value and adoption of Bitcoin) provides a more holistic view.

- News Impact: Major cryptocurrency news, regulatory changes, or adoption by large institutions can dramatically influence Bitcoin's price.

- Whale Activity and Institutional Investment: Large transactions by "whales" (high-net-worth investors) and increased institutional investment can significantly influence price movements.

Sentiment analysis tools can help gauge market confidence by analyzing social media discussions, news articles, and other sources. This information, coupled with technical analysis, provides a more comprehensive picture of the market.

Interpreting On-Chain Metrics for Bitcoin Price Analysis

On-chain metrics, such as transaction volume, mining hash rate, and the number of active addresses, provide valuable insights into Bitcoin's underlying network activity and can be used to predict future price trends.

- Transaction Volume: High transaction volume often suggests increased demand and potential price appreciation.

- Mining Hash Rate: A higher hash rate indicates a more secure and robust network, often positively correlating with price.

- Active Addresses: The number of active addresses participating in the Bitcoin network reflects network adoption and can be an indicator of future price movements.

Reliable sources for on-chain data include Glassnode, CoinMetrics, and Blockchain.com. Analyzing these metrics alongside technical and fundamental analysis enhances predictive accuracy.

Conclusion: Monitoring Bitcoin Price Levels for Informed Decisions

Understanding and consistently monitoring key Bitcoin price levels is crucial for informed investment decisions. We've explored historical performance, current support and resistance levels, and the significance of market sentiment and on-chain metrics. Remember that a balanced approach, combining technical and fundamental analysis, is essential for navigating the complexities of the cryptocurrency market.

To make well-informed investment decisions, stay updated on crucial Bitcoin price levels, conduct thorough research, and consider seeking advice from qualified financial professionals. Further reading on Bitcoin price analysis techniques and effective trading strategies is highly recommended. Stay informed and make smart choices in the dynamic world of Bitcoin investing.

Featured Posts

-

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Outperforms Bitcoin And Other Crypto Assets

May 08, 2025

Sec Acknowledges Grayscale Xrp Etf Filing Xrp Price Outperforms Bitcoin And Other Crypto Assets

May 08, 2025 -

School Timetable Adjustments For Psl In Lahore

May 08, 2025

School Timetable Adjustments For Psl In Lahore

May 08, 2025 -

5 Minute Minecraft Superman Preview From Thailand Theater

May 08, 2025

5 Minute Minecraft Superman Preview From Thailand Theater

May 08, 2025 -

Breaking Bread With Scholars Navigating The Dynamics Of Academic Networking

May 08, 2025

Breaking Bread With Scholars Navigating The Dynamics Of Academic Networking

May 08, 2025 -

Digital Identity In Europe The Upcoming European Digital Identity Wallet

May 08, 2025

Digital Identity In Europe The Upcoming European Digital Identity Wallet

May 08, 2025