Bitcoin Breaks 10-Week High, Approaches US$100,000 Milestone

Table of Contents

Factors Contributing to Bitcoin's Price Increase

Several intertwined factors are fueling Bitcoin's impressive price increase and its approach to the psychological barrier of US$100,000. These range from institutional investment and regulatory clarity to broader macroeconomic trends.

Institutional Investment: The Big Players Enter the Game

The growing acceptance of Bitcoin by institutional investors is a significant driver of its recent price appreciation. Large-scale investments are injecting significant capital into the Bitcoin market, pushing prices higher.

- Increased Grayscale Bitcoin Trust holdings: Grayscale, a leading digital currency asset manager, continues to accumulate a substantial amount of Bitcoin, indicating strong institutional confidence.

- MicroStrategy's continued Bitcoin acquisitions: MicroStrategy, a business intelligence company, has become a prominent example of corporate Bitcoin adoption, consistently adding to its Bitcoin reserves.

- Other major corporations investing in Bitcoin: A growing number of publicly traded companies are adding Bitcoin to their balance sheets, viewing it as a strategic asset and a hedge against inflation. This institutional Bitcoin investment is significantly impacting the market. The potential approval of a Bitcoin ETF could further amplify this trend.

The increasing participation of institutional investors signals a shift towards the mainstream acceptance of Bitcoin as a legitimate asset class, furthering its price appreciation. The rise of institutional Bitcoin investment is a powerful testament to its growing credibility in the financial world.

Regulatory Clarity and Positive Sentiment: A More Favorable Landscape

Positive regulatory developments and improving market sentiment are playing a crucial role in the Bitcoin surge. A more favorable regulatory environment reduces uncertainty and encourages greater participation.

- Positive statements from regulators: While regulatory frameworks are still evolving, certain jurisdictions are showing increasing signs of acceptance, leading to reduced regulatory uncertainty.

- Growing acceptance of Bitcoin as a legitimate asset: The narrative surrounding Bitcoin is becoming increasingly positive, with more financial institutions and analysts acknowledging its potential as a store of value and a diversification tool.

- Reduced regulatory uncertainty in key markets: Greater clarity regarding Bitcoin's legal status in important markets is boosting investor confidence and encouraging further investment.

The combination of positive regulatory sentiment and growing acceptance is fostering a more favorable environment for Bitcoin, significantly contributing to its price increase and bolstering the Bitcoin 100k narrative.

Macroeconomic Factors: A Safe Haven in Uncertain Times

Global macroeconomic conditions are also influencing Bitcoin's price. Concerns about inflation and uncertainty in traditional markets are driving investors towards Bitcoin as a potential hedge and safe haven.

- Inflation concerns driving investors to Bitcoin as a hedge: With inflation rates rising in many parts of the world, investors are seeking assets that can potentially protect their purchasing power. Bitcoin, with its limited supply, is seen by some as a hedge against inflation.

- Uncertainty in traditional markets: Geopolitical instability and economic uncertainty in traditional markets are pushing investors to seek alternative assets, with Bitcoin being a prime candidate.

- Decreased confidence in fiat currencies: Concerns about the long-term stability of fiat currencies are contributing to the increased demand for Bitcoin as a decentralized and digitally scarce asset.

These macroeconomic factors, combined with the growing perception of Bitcoin as a Bitcoin safe haven, are significantly impacting the Bitcoin price and contributing to its current bullish run. The interplay between Bitcoin inflation hedge properties and macroeconomic instability continues to fuel its price increase.

Technical Analysis and Future Price Predictions

Technical analysis provides further insights into Bitcoin's potential trajectory. Several indicators suggest the possibility of continued price appreciation, although predicting the future of Bitcoin is inherently challenging.

Chart Patterns and Indicators: Reading the Tea Leaves

Technical indicators point towards potential further gains. Analyzing chart patterns and various technical indicators can give a better understanding of potential short to medium-term price movements.

- Support and resistance levels: The price has broken through significant resistance levels, suggesting further upside potential.

- Moving averages: Moving averages are showing a clear bullish trend, supporting the upward price momentum.

- Relative Strength Index (RSI): The RSI may indicate whether the market is overbought or oversold, offering clues about potential corrections or further rallies.

Bitcoin technical analysis, while not foolproof, provides valuable insights into potential price movements. Analyzing Bitcoin chart patterns is a key component of understanding the market's dynamics.

Expert Opinions and Market Forecasts: A Range of Views

While predicting the precise future price of Bitcoin is impossible, expert opinions and market forecasts offer a range of potential scenarios.

- Consensus among analysts: Many analysts are bullish on Bitcoin's long-term prospects, with some suggesting a continued upward trend.

- Range of price targets: Forecasts vary widely, with some analysts predicting prices well above US$100,000, while others suggest potential corrections.

- Potential for further gains or corrections: The Bitcoin market is inherently volatile, and price corrections are a normal part of its cycle.

Analyzing Bitcoin analyst predictions and carefully considering Bitcoin price forecast is crucial for informed decision-making. Understanding the Bitcoin market outlook requires a comprehensive approach considering various viewpoints.

Risks and Challenges Facing Bitcoin's Ascent

Despite the current bullish momentum, several risks and challenges could impact Bitcoin's continued ascent.

Volatility and Price Corrections: The Inherent Risk

Bitcoin's inherent volatility is a significant risk factor. Sharp price corrections are a possibility and should be anticipated.

- Historical price fluctuations: Bitcoin's history is marked by significant price swings, highlighting its volatility.

- Factors that could trigger a price decline: Negative news, regulatory changes, or macroeconomic shifts could trigger a price decline.

- Risk management strategies for Bitcoin investors: Diversification and responsible risk management are crucial for navigating the volatility of the Bitcoin market.

Understanding Bitcoin volatility and implementing effective Bitcoin risk management strategies are essential for investors. Preparing for Bitcoin price correction is a crucial part of a prudent investment strategy.

Regulatory Uncertainty and Potential Bans: A Looming Threat

Regulatory uncertainty and the potential for bans in certain jurisdictions remain significant risks.

- Ongoing debates about Bitcoin regulation: Governments worldwide are grappling with how to regulate cryptocurrencies, creating uncertainty.

- Potential for stricter regulations or outright bans in certain jurisdictions: Increased regulatory scrutiny or outright bans could negatively impact Bitcoin's price.

- Impact of regulatory uncertainty on Bitcoin's price: Uncertainty about future regulations can create volatility and dampen investor confidence.

The potential for Bitcoin regulation risks and the threat of a Bitcoin ban in certain regions remain significant factors to consider. Monitoring regulatory uncertainty Bitcoin is vital for navigating the market effectively.

Conclusion: Bitcoin's Ascent Towards US$100,000 – What's Next?

Bitcoin's recent surge to a 10-week high, driven by a confluence of institutional investment, regulatory clarity, macroeconomic factors, and positive market sentiment, has propelled it closer to the US$100,000 milestone. While the potential for further gains exists, investors must acknowledge the inherent volatility and risks associated with Bitcoin. Regulatory uncertainty and potential price corrections remain significant challenges. To navigate this dynamic market successfully, staying informed is crucial. Learn more about Bitcoin, understand the factors influencing its price, and always invest wisely in Bitcoin. Track the Bitcoin price and make informed decisions based on thorough research. The future of Bitcoin remains an exciting and evolving landscape, demanding careful consideration and a well-informed approach.

Featured Posts

-

New Platform For Donating Cavs Tickets Easy And Secure

May 07, 2025

New Platform For Donating Cavs Tickets Easy And Secure

May 07, 2025 -

Karate Kid Legends A New Generation Forges Its Legacy

May 07, 2025

Karate Kid Legends A New Generation Forges Its Legacy

May 07, 2025 -

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

May 07, 2025

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

May 07, 2025 -

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025

How The Pope Is Elected A Guide To The Conclave Process

May 07, 2025 -

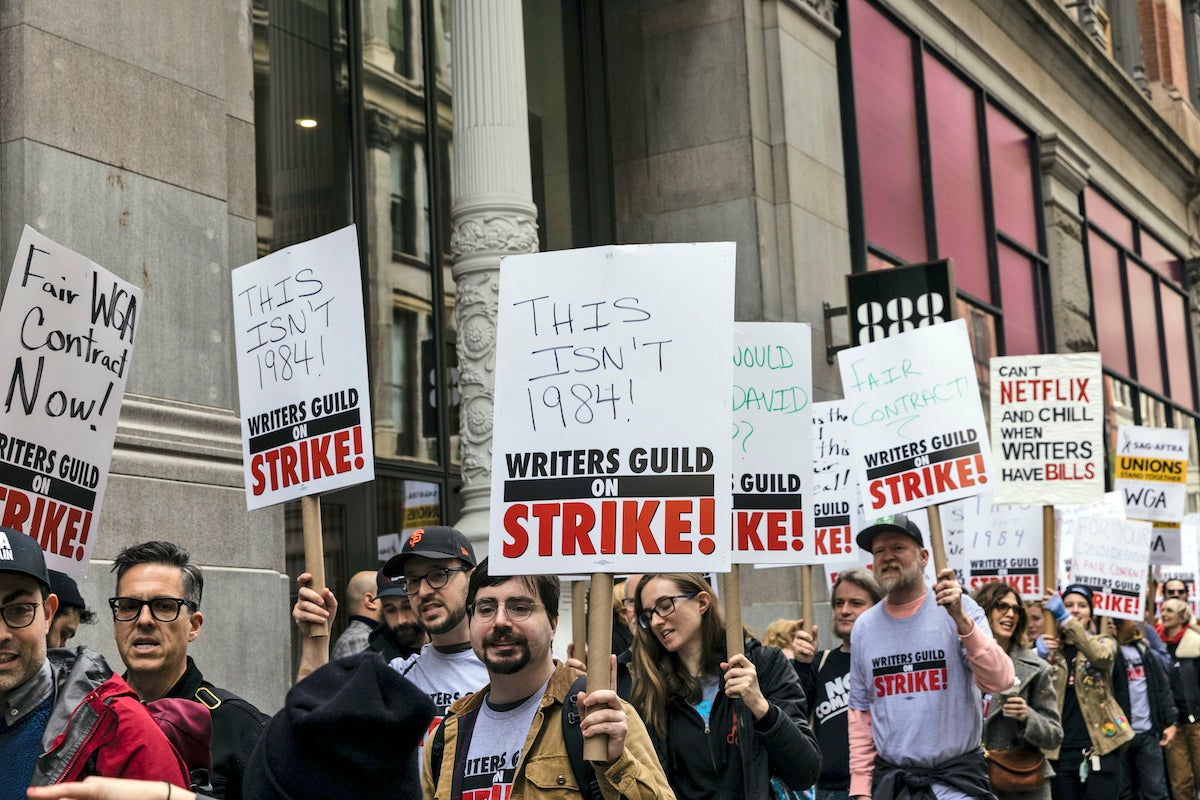

Actors And Writers Strike The Impact On Hollywood Productions

May 07, 2025

Actors And Writers Strike The Impact On Hollywood Productions

May 07, 2025